Transplantation Market Size, Share & Industry Analysis, By Product Type (Tissue Products, Immunosuppressive Drugs, and Preservation Solutions), By Application (Organ Transplantation and Tissue Transplantation), By End-user (Hospitals, Transplantation Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

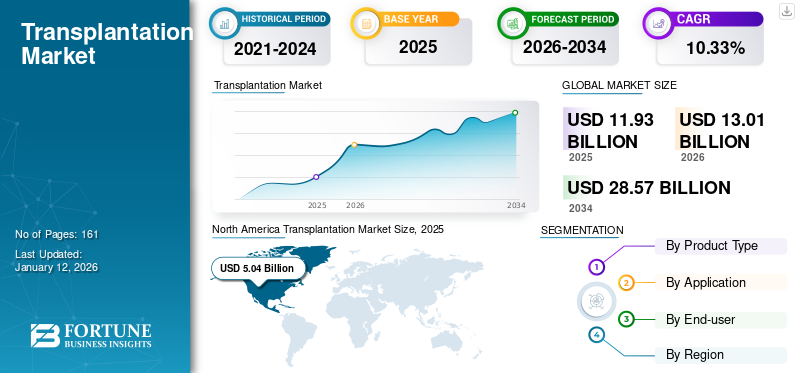

The global transplantation market size was valued at USD 11.93 billion in 2025 and is projected to grow from USD 13.01 billion in 2026 to USD 28.57 billion by 2034, exhibiting a CAGR of 10.33% during the forecast period. North America dominated the transplantation market with a market share of 42.29% in 2025. Moreover, the U.S. transplantation market is projected to grow significantly, reaching an estimated value of USD 8.54 billion by 2032, driven by an increasing number of organ donations in the country.

Transplantation is a surgical procedure of taking an organ or living tissue and implanting it in another part of the body or another body. The rising demand for these procedures and the launches of novel products to prevent the failure of these procedures is one of the foremost factors contributing to transplantation market growth. Organ failure cases usually occur due to various factors, including severe trauma, blood loss, poisoning, drug abuse, leukemia, sepsis, and other acute diseases.

This has led to a vast global demand for tissue and organ transplantation, including organs such as kidneys, liver, heart, and lungs.

- For instance, according to statistics published by the Health Resource & Services Administration in February 2024, around 103,223 males, females, and children are on the U.S. national waiting list for organ transplants. Such strong demand for organ transplant procedures in key countries is anticipated to drive market growth during the forecast period.

In addition, various non-government and government groups are helping to disseminate awareness regarding the importance of organ donation.

- For instance, the Organ Receiving and Giving Awareness Network (ORGAN) India was formed with a mission to spread awareness of organ donation and transplantation among the people of India. The organization is also spreading awareness via all media platforms, such as social media, campaigns, films, animations, radio, television, and blogs.

- Similarly, in the U.K., the government agency National Health Service (NHS) carries out regular public awareness drives to educate and encourage individuals to register for organ donations. Such programs are expected to surge market growth.

The COVID-19 outbreak affected the global market due to a decline in transplant procedures globally. The strict guidelines of the pandemic led to reduced patient visits to healthcare professionals for these kinds of procedures. Furthermore, the pandemic also negatively impacted the product sales of prominent players in the market at the end of 2020. The market returned to the pre-pandemic level with a rise in patient visits to hospital settings and an increase in awareness about organ donation at the end of 2022.

The ease of COVID-19 regulations and increased patient visits to hospitals for transplantation are expected to surge the market growth. The strategic research initiatives by companies with launches of new products helped the market return to its pre-pandemic scenario in 2024 and are slated to contribute to stable market growth during 2025-2032.

Transplantation Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 11.93 billion

- 2026 Market Size: USD 13.01 billion

- 2034 Forecast Market Size: USD 28.57 billion

- CAGR: 10.33% from 2026–2034

Market Share:

- North America dominated the transplantation market with a 42.29% share in 2025, driven by increasing organ donations and the presence of advanced healthcare infrastructure and reimbursement policies. The U.S. transplantation market alone is projected to reach USD 8.54 billion by 2032, fueled by rising awareness, government support, and innovative products that prevent transplant failures.

- By product type, immunosuppressive drugs held the largest market share in 2026 due to their critical role in preventing organ rejection, along with growing adoption supported by government recommendations.

Key Country Highlights:

- Japan: Demand is driven by technological advancements in tissue products and immunosuppressive drugs combined with increasing organ transplant procedures aligned with strict regulatory and environmental guidelines.

- United States: Growth is supported by the substantial increase in organ transplantation procedures, favorable reimbursement policies, and strategic collaborations promoting organ donation awareness.

- China: The large patient population suffering from chronic diseases, alongside expanding healthcare infrastructure and increasing government initiatives to improve organ donation rates, are key growth drivers.

- Europe: Growth is attributed to robust government awareness programs, increasing transplant procedures, and multi-stakeholder collaborations aimed at increasing organ donation rates.

Transplantation Market Trends

Collaborations between Public and Private Players to Boost Organ Donation and Transplants Contribute to Market Growth

The market has witnessed numerous strategic collaborations over the years. The increasing incidence of organ failure has led to an extreme necessity for these procedures. Therefore, many players are continuously focusing on building their product portfolio and are also focused on increasing the number of these procedures through collaborations. For instance, the Transplant Therapeutics Consortium (TTC) has collaborated with the transplant community, including stakeholders such as industry, academia, professional societies, and regulatory agencies. The TTC is managed and supported by the Critical Path Institute (C-Path). It is co-founded by the American Society of Transplantation (AST) and the American Society of Transplant Surgeons (ASTS).

Furthermore,the Sectoral Coordination of Transplants, Seville-Huelva, Spain, signed a public-private collaboration agreement with several hospitals in Seville, Spain, in 2012. The agreement aims to support the process of organ and tissue donation in the Intensive Care Unit (ICU) setting without transferring to the potential donor, thus guaranteeing that the organ donor can participate in this process. In addition, it added to a training program for the ICU and OR staff of the private sector.

Similarly, in March 2023, an agreement was made between The Pan American Health Organization (PAHO) and the Ministry of Health of the Government of Spain to boost the organ donation and transplants sector within the U.S.

Such initiatives are anticipated to significantly bolster the market's growth rate throughout the projected period.

Download Free sample to learn more about this report.

Transplantation Market Growth Factors

Increase in Demand for Transplantation Procedures Boosts Market Expansion

The overall growth of the market is likely to be driven by a significant increase in transplantation procedures worldwide, resulting in a high demand for organs. The increasing prevalence of chronic illnesses such as cancer, kidney failure, COPD, and lupus often leads to extensive damage to tissues and organs. The surge in organ failures stands out as a vital driver for market expansion owing to a rise in transplant procedures.

- For instance, according to data from the U.S. Health Resources & Services Administration and Organ Donation Statistics, in 2023, more than 46,000 organ transplant procedures were performed in the U.S.

Furthermore, the increase in awareness programs for organ and tissue donation in emerging and developed nations, including the U.S. and the U.K., is propelling the market growth. These countries have developed healthcare infrastructure and are implementing favorable reimbursement policies.

- For instance, the National Organ and Tissue Transplant Organization (NOTTO) is a national-level organization set up under the Directorate General of Health Services, Ministry of Health, and Family Welfare. It conducts coordination and networking activities to procure and distribute the Organs and Tissues Donation and Transplantation registry in India.

Technological Advancements in Tissue Products Augment Market Growth

One of the distinguishing factors expected to push market growth is the development of technologically advanced tissue products. Some emerging technologies in tissue products include autologous stem cell transplant, which has become convenient due to the advent of induced Pluripotent Stem Cells (iPSC). Scientists are trying to develop organs from human-induced pluripotent stem cells.

Furthermore, novel technologies, such as three-dimensional (3D) bioprinting, decellularization and recellularization, and interspecies organogenesis, are being utilized to overcome immunologic hurdles. Prominent players are focusing on launching novel tissue products in the market.

- For instance, in June 2023, 3D BioFibR launched a bio-ink additive named μCollaFibR and CollaFibR 3D scaffold, a new collagen fiber product used for the bioprinting of tissue and organ models.

RESTRAINING FACTORS

Prolonged Waiting Period for Transplantation Procedures Act as a Barrier to Market Expansion

There is a growing demand for organ and tissue transplant procedures. However, one of the substantial hindrances to market growth is the extensive wait times for these procedures, especially in emerging countries.

- For instance, as per the statistics published by Donate Life America, more than 100,000 people are waiting for organ transplants in the U.S., and every 8 minutes, one person is added to the waiting list.

- However, fewer organ donations eventually increase the waiting time for these procedures. According to the National Kidney Foundation, the average waiting time for kidney transplantation can be 3-5 years. The long waiting time and unmet demand for these procedures are anticipated to restrict the market growth.

In addition, in developing countries, most people are unaware of the options for these procedures, and there is an abundance of inadequate reimbursement policies. According to an article published by Kidney 360 in December 2021, the median waiting time for a deceased donor kidney transplant is three years in Brazil.

Transplantation Market Segmentation Analysis

By Product Type Analysis

Immunosuppressive Drugs Segment Held the Largest Market Share Due to Various Benefits

The global market can be segmented based on product type into tissue products, immunosuppressive drugs, and preservation solutions.

The immunosuppressive drugs segment held a dominant transplantation market share 43.18% in 2026. This is due to the benefits these drugs offer, lowering the body's ability to reject a transplanted organ. Moreover, the increasing adoption of these drugs amongst patients after transplantation, coupled with the increasing government recommendations regarding drugs for organ transplantations stimulates the segment’s growth.

The tissue products segment held a substantial market share due in 2024 to increased R&D initiatives by various medical devices companies leading to product launches. In addition, the rising trauma and injury cases significantly propel the segment’s expansion.

- For instance, in November 2021, Thermo Fisher Scientific announced the launch of two transplant diagnostics portfolios for better characterization of samples and to bring speed and confidence to the transplant laboratory. Such advancements in transplant laboratories boost market expansion.

- For instance, in June 2022, Arthrex Inc. funded and granted support to a soft tissue injury research project. The project was conducted in collaboration between the Orthopedic Research and Education Foundation (OREF) and the Orthopedic Trauma Association (OTA).

The preservation solutions segment is expected to grow significantly during the forecast period due to increasing technological advancements in these products, making them more cost-effective and offering several logistical advantages and features.

By Application Analysis

Rising Number of Tissue Transplantation Procedures to Escalate Segment Growth

In terms of application, the market is divided into organ transplantation and tissue transplantation. The tissue transplantation segment captured a higher market share in revenue in 2024 as the replacement of skin, cornea, bones, heart valves, tendons, nerves, and veins is among the most commonly performed procedures globally. The tissue transplantation segment with a share of 63.88% in 2026. The increase in the number of tissue transplantation procedures, such as corneal transplants, also augments the expansion of the segment in the global market. According to the 2022 Eye Banking Statistical Report published by the Eye Bank Association of America, 79,126 tissues were distributed for keratoplasty. Furthermore, the U.S. eye banks contributed 20,577 ocular tissues to support the research and training purposes.

The organ transplantation segment is estimated to hold a significant position in the market during the forecast period due to the rising number of transplant procedures owing to the increased prevalence of various chronic diseases such as cancer, kidney failure, chronic obstructive pulmonary disease (COPD), and lupus.

- For instance, the United Network for Organ Sharing reported in February 2022 that approximately 31,238 heart transplants were conducted in the last ten years in the U.S. and 513 pediatric heart transplants were conducted in 2021.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Large Number of Procedures in Hospitals to Boost Segment’s Growth

Based on end-user, the market is segmented into hospitals, transplantation centers, and others. The hospitals segment dominates the market with a share of 60.06% in 2026 and is likely to grow as hospitals are primary care centers for treatment of these procedures. Furthermore, favorable health reimbursements for these procedures and a rise in equipped hospitals are vital factors contributing to the hospitals segment growth.

The transplantation centers segment held a noticeable position in 2024. The rise in these specialized institutions in developed and developing regions is anticipated to contribute to the segment growth. According to Donor Alliance Inc., there are more than 250 transplant centers in the U.S.

The others segment is expected to witness limited growth prospects during the forecast period due to the fewer procedures conducted in these institutions.

REGIONAL INSIGHTS

On the basis of region, the global market is segregated into Europe, Asia Pacific, Latin America, the Middle East & Africa, and North America.

North America

North America Transplantation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America’s market size was valued at USD 5.04 billion in 2025, and is estimated to dominate the global market during the forecast period. The region is expected to maintain its dominance due to the substantial demand for novel tissue transplantation products and organ transplants. Other factors that bolstered the growth of the market are satisfactory reimbursement plans and the fast adoption of three-dimensional (3D) bioprinting across the region. Furthermore, the presence of prominent companies in the U.S. and the regulatory approvals for innovative items are some common contributing factors to market growth in North America. In July 2021, Astellas Pharma Inc. received the U.S. Food and Drug Administration (FDA) approval for its supplemental New Drug Application (sNDA) for PROGRAF (tacrolimus). It prevents organ rejection in adult and pediatric lung transplant recipients. The U.S. market is valued at USD 5.05 billion by 2026.

- In September 2023, United Therapeutics Corporation announced the xenotransplantation of an UHeart xenoheart into a living person and carried on a study of the UThymoKidne xenokidney. This program helps address the shortage of transplantable organs for patients with end-stage chronic diseases.

Europe

Europe was the second-largest market in 2024. The growth can be attributed to the increase in transplant procedures and the vital initiatives by various governments to raise awareness about organ donations in the region. As per an article published by the Nature Reviews Nephrology in 2021, a group of prominent European stakeholders is collaborating within a Thematic Network, presented with an outline of challenges to increase the rates of these procedures. It has proposed 12 critical areas along with specific measures that should be considered to promote the conduction of these procedures. The UK market is valued at USD 0.5 billion by 2026, while the Germany market is valued at USD 0.82 billion by 2026.

Asia Pacific

Asia Pacific witnessed significant growth in 2024 as the cases of organ failure are considerably high in the region due to the rising prevalence of chronic diseases among the geriatric population. The Japan market is valued at USD 0.55 billion by 2026, the China market is valued at USD 0.87 billion by 2026, and the India market is valued at USD 0.55 billion by 2026.

Latin America is also expected to gain momentum during the forecast period. Many organ donation and transplantations in Mexico and Brazil could provide lucrative opportunities for leading market players. According to an article published by Serviços e Informações do Brasil in 2022, 12,000 organ transplants were performed in Brazil in 2021. The country is second in the world ranking, behind the U.S.

The Middle East & Africa is expected to witness decent growth during the projected period due to the rising government programs to increase awareness amongst the individuals of emerging countries across the region.

List of Key Companies in Transplantation Market

Strong Portfolio and Sales of Zimmer Biomet, Astellas Pharma, and BioLife Solutions to Strengthen their Market Position

Based on the competitive landscape, the market is fragmented into several national and international players for tissue products, immunosuppressive drugs, and preservation solutions. However, to gain a larger market share, companies are focusing on new product launches and strategic acquisitions. In the tissue products segment, Zimmer Biomet stands out as the market leader, primarily due to its extensive portfolio of soft tissue products such as the 'DeNovo NT Graft' and the 'DermaSpan Acellular Dermal Matrix.' These products are widely used in knee, hip, ankle, and shoulder surgeries.

In the immunosuppressive drugs segment, Astellas dominates the market with its highly successful PROGRAF (tacrolimus) product. Furthermore, Veloxis Pharmaceuticals, Inc. has a promising pipeline of drugs in its portfolio, which is expected to contribute to its growth in the market.

In terms of preservation solutions, BioLife Solutions is one of the key market players due to its robust cell processing segment, including biopreservation media products. Furthermore, emerging companies, such as MTF Biologics, Dr. Franz Köhler Chemie GmbH, and Paragonix Technologies, are slowly gaining a significant market share owing to the technologically advanced product offerings.

LIST OF KEY COMPANIES PROFILED:

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Arthrex, Inc. (U.S.)

- Veloxis Pharmaceuticals, Inc. (Asahi Kasei Corporation) (U.S.)

- BioLife Solutions (U.S.)

- TransMedics (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Zimmer Biomet (U.S.)

- Astellas Pharma Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: TransMedics announced the acquisition of Bridge to Life Ltd. for the technologies Ex-Vivo Organ Support System ("EVOSS") and LifeCradle Heart Preservation Transport System with an aim to expand its product offerings and indications for organ transplants.

- March 2023: LiveOnNY collaborated with MediGO and launched a real-time organ tracking technology to keep track of organ donation and transplantation ecosystem.

- July 2022: Carl Zeiss Meditec partnered with Precise Bio to develop and commercialize fabricated corneal tissue for patients requiring endothelial keratoplasty and natural lenticular transplants to treat keratoconus and vision correction.

- March 2022: Zimmer Biomet entered a multi-year agreement with Biocomposites to exclusively distribute Genex Bone Graft Substitute with its new mixing system and delivery options in the U.S.

- January 2022: Novartis AG collaborated with Alnylam, intending to explore targeted therapy to restore liver function. Alnylam’s siRNA technology is intended to promote the regrowth of functional liver cells and is an alternative for liver failure patients.

- January 2022: BioLife Solutions extended collaboration with Seattle Children's Therapeutics to optimize biopreservation and closed-system manufacturing by integrating Sexton's AF-500 cell processing tools.

- October 2021: TransMedics signed a manufacturing agreement with Dalton Pharma Services for its OCS Liver System.

REPORT COVERAGE

The report includes a detailed market overview that include market forecast for the segments of product type, application, end-user, and region. The analysis emphasizes crucial aspects such as dynamics of the market, key industry developments, mergers, acquisitions, partnerships, new product launches, an overview of technological advancements, regulatory scenarios, number of organ transplants, key industry trends, major market players, and COVID-19 pandemic impact on the global market. Besides this, the report includes insights into the market trends and industry dynamics. In addition, it offers numerous factors and market statistics contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.33% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 11.93 billion in 2025.

In 2025, the North America market size stood at USD 5.04 billion.

Growing at a CAGR of 10.33%, the market is expected to exhibit steady growth over the forecast period (2026-2034).

By application, the tissue transplantation segment led the market in 2026.

The rise in demand for procedures, technological advancements in tissue products, and favorable government initiatives are driving market growth.

Astellas Pharma, BioLife Solutions, and Zimmer Biomet are some of the major market players.

North America is poised to dominate by holding the largest share during the forecast period.

New product launches, rising government initiatives to increase organ donations, and a rise in these procedures globally drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us