TV Distribution Model Market Size, Share & Industry Analysis, By Technology Type (Cable TV, Satellite TV/DTH, and Internet Protocol TV (IPTV)), By Subscription Type (Monthly and Annual), By End-use (Commercial and Personal), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

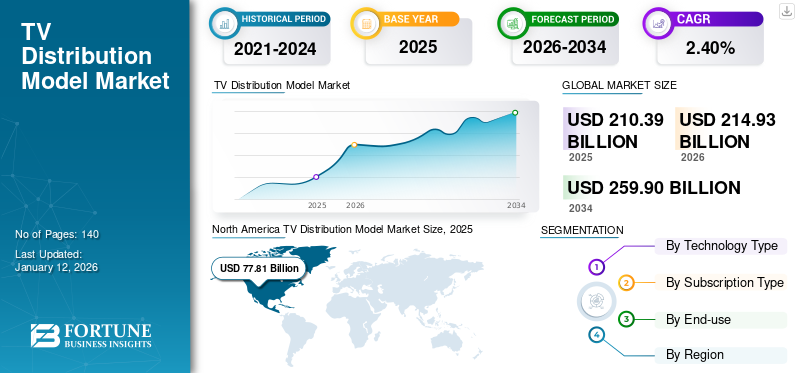

The global TV distribution model market size was valued at USD 210.39 billion in 2025. The market is projected to grow from USD 214.93 billion in 2026 to USD 259.9 billion by 2034, exhibiting a CAGR of 2.40% during the forecast period. North America dominated the global market with a share of 36.98% in 2025.

A TV distribution model is a system that consists of various types of TV models, such as cable TV, satellite TV, IPTV, and so on. Community antenna installations or domestic television cable networks are also known as TV distribution models.

The market’s growth is expected to be driven by several government initiatives, increased high-quality content, and the ability to reach rural and remote areas. Moreover, the introduction of native IP broadcasting standards is further fostering the market’s growth. The market is also undergoing significant changes driven by technological innovation, shifting consumer preferences, and competitive dynamics. Satellite TV/DTH and IPTV platforms are reshaping the industry landscape, challenging traditional TV providers and creating both opportunities and challenges for content creators, advertisers, and regulators.

The TV distribution model market growth was significantly impacted by the COVID-19 pandemic. With people staying at home, there was a notable increase in the demand for streaming services. This accelerated the ongoing trend of cordless platforms and caused the shift away from traditional TV. Market leaders started investing their funds and expanding their production capabilities to leverage advanced TV distribution models. Overall, the pandemic acted as a catalyst for existing trends in TV distribution, accelerating the shift toward digital platforms. It also prompted adaptations in production, distribution, and consumption habits across the industry.

IMPACT OF GENERATIVE AI

Advanced Content Creation Capabilities of Generative AI for TV Distribution Models Fuel Market Growth

The distribution models for TV are being revolutionized by generative AI, and this has a significant influence on the development of algorithms, machine learning, and GPUs. A common method of broadening viewing choices is to combine satellite TV with cable. Satellite TV usually provides a diverse selection of channels, which can include international and specialty channels, while cable allows access to local channels and often offers a higher internet speed.

Autonomous content creation in the form of scripts or images is possible with Generative AI. This could lead to a huge increase in the number of available satellite TV channels catering to specific interests and different audiences. These channels could use AI-produced content to provide programming slots, experiment with new formats, or create entirely new genres of shows. The combination of generative AI and TV distribution models presents a chance to spark a transformation in TV communications by allowing for quicker, more precise simulations. This can lead to the unlocking of new capabilities across various domains.

TV Distribution Model Market Trends

Market Transformation Due to Emergence of 5G Broadcasting Will Become Key Trend

The trend refers to the impact of 5G technology on the TV industry, including satellite TV/DTH, IPTV, and cable TV, which has led to changes in content delivery, user experience, and market dynamics. With the emergence of 5G broadcasting, vendors are exploring hybrid delivery models that combine their services with 5G networks. This enables faster and more efficient content delivery to consumers, enhancing their viewing experience. Also, companies are integrating 5G technology to offer enhanced streaming services, including higher-resolution video, interactive features, and personalized content recommendations, thereby meeting evolving consumer demands.

Furthermore, companies in the TV industry are working together with other business models to incorporate 5G technology into their range of products. The integration of 5G can enhance the services offered by TV providers by enabling more interactive features, including real-time streaming, on-demand content, and more engaging interactive advertisements. The lower latency of 5G enhances the delivery of live content, such as sports events, news broadcasts, and other time-sensitive programs.

Download Free sample to learn more about this report.

TV Distribution Model Market Growth Factors

Delivering High-Quality Content Through Satellite Communications & Internet Connectivity to Drive Market Growth

The market is driven by increasing demand for high-quality and premium content. Consumers are seeking access to premium program content, including sports events, movies, and original content. This type of content is offered by vendors through their extensive channel lineup. For instance, major vendors, such as DirecTV and Dish Network continue to invest in securing exclusive rights to popular content, such as live sports leagues and blockbuster movies to attract subscribers. Additionally, in response to growing demand, vendors are increasingly focusing on developing advanced set-top boxes and dish receivers that are capable of delivering high-definition and even 4K content to consumers' homes.

Companies worldwide are launching new satellites, enabling enhanced internet coverage and capacity. This, in turn, increases the availability of high-speed internet, thereby enhancing on-demand viewing and offering high-quality content without buffering issues across IPTV and satellite TV models. For instance,

- In January 2023, OneWeb confirmed the deployment of 40 satellites, with SpaceX bringing the OneWeb constellation to 542 satellites, which is over 80% of the satellite fleet currently in orbit. OneWeb and its partners, through their ‘Countdown to Global Connectivity’ campaign, aim to provide internet connectivity to a greater number of underserved and unserved remote and rural businesses and communities.

Similarly, companies are actively investing in next-generation technologies to stay competitive in this evolving landscape. In April 2024, SES acquired Intelsat, a Broadcast and Digital Terrestrial Television Distribution (DTT) provider, to create a stronger multi-orbit operator with greater internet coverage. This will help the company stay competitive in the satellite communications industry.

RESTRAINING FACTORS

Regulatory Challenges to Create Barriers Impacting Market’s Competitive Landscape

Regulatory challenges in the global market refer to legal and governmental obstacles that impact the operation and growth of TV services. These challenges can include spectrum allocation, licensing requirements, content regulations, and geopolitical considerations. Regulatory frameworks vary globally, impacting content distribution channels, licensing agreements, and market entry for satellite, cable, and IPTV providers. Governments regulate the allocation of spectrum frequencies for satellite communication, which can affect the availability and quality of satellite TV services. For instance,

- In 2021, the U.S. Federal Communications Commission (FCC) conducted auctions for C-Band spectrum, impacting vendors' access to these frequencies. The C-band spectrum is vital for TV broadcasts, particularly for satellite distribution of television signals.

TV Distribution Model Market Segmentation Analysis

By Technology Type Analysis

Growing Consumer Demand for Satellite TV-based Services Boosted Market Growth

Based on technology type, the market is segmented into cable TV, satellite TV/DTH, and Internet protocol TV (IPTV).

In terms of market share, the satellite TV/DTH segment dominated the market size of 40.99% in 2026. To further diversify the service offerings, satellite TV providers are actively promoting the use of bonus features, new networks, and more advanced channels. Thus, growth of this segment has been mainly driven by growing consumer demand for these services.

The Internet Protocol TV (IPTV) segment is anticipated to register the highest CAGR during the forecast period. The growth is due to the high level of functionality that IPTV offers, for instance, its ability to broadcast pre-recorded or live shows on a network already in place, as opposed to conventional cable TV.

To know how our report can help streamline your business, Speak to Analyst

By Subscription Type Analysis

Cost-Savings and Predictive Capabilities Boosted Demand for Annual Subscriptions

Based on subscription type, the market is segmented into monthly and annual.

In terms of market share, the annual segment dominated the TV distribution model market share of 53.56% in 2026. This subscription type is particularly attractive due to its predictability and potential cost savings for consumers. For TV distribution platforms, annual subscriptions provide a steady revenue stream and better financial forecasting. Moreover, annual subscriptions often come with a discount compared to monthly plans. This upfront payment can save consumers money over time.

The monthly segment is anticipated to register the highest CAGR during the forecast period. Consumers can subscribe and unsubscribe monthly, providing flexibility in managing expenses and content choices. Additionally, monthly pricing makes it easier for consumers to create budgets for entertainment expenses.

By End-use Analysis

Personal Segment Dominated Market Due to Diverse Viewing Entertainment Preferences

Based on end-use, the market is categorized into commercial and personal.

In terms of market share, in 2026, the personal segment dominated the market of 55% as television remains the main form of family entertainment, serving multiple members with different viewing preferences. In addition, this segment often involves regular television watching, such as morning news and evening prime-time programs that are well suited to satellite TV's programming patterns.

The commercial segment is expected to register the highest CAGR during the forecast period. Commercial use of the TV distribution model encompasses the installation of TV sets in local businesses, malls, and TV and home theater stores. The latest trend in satellite TV and IPTV is Omnichannel, which allows access to business-related information through these services. New advances, such as HD content, personalized content, and video-on-demand aim to enhance the customers’ viewing experience. Manufacturers and suppliers are devising innovative strategies to drive the demand for TV services, including content and service bundles.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America TV Distribution Model Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 77.81 billion in 2025 and USD 78.79 billion in 2026. In this region, the increased use of television and the Internet has contributed to a substantial increase in the regional market revenues. For instance, according to an industry analyst, by November 2023, over 18% of American TV households had at least one TV set capable of receiving free broadcast programming. In addition, the growth of the North American TV distribution model market has been stimulated by the increasing focus of satellite TV service providers on the adoption of integrated broadband broadcasting systems. The U.S. market is projected to reach USD 51.95 billion by 2026.

Asia Pacific

Asia Pacific is estimated to grow at the highest rate during the forecast period. The growing use of the TV distribution model in the region is due to the diversification of content. The market in Asia Pacific has been greatly influenced by satellite TV, providing a variety of channels to suit different languages and interests of the citizens. Economic growth in many countries across the region has led to an expansion of the middle class with increasing disposable income. As a result, more households can afford satellite TV subscriptions and the associated equipment. This growing middle-class demographic represents a significant market for satellite TV operators, fueling the expansion of their services. The Japan market is projected to reach USD 10.96 billion by 2026, the China market is projected to reach USD 16.14 billion by 2026, and the India market is projected to reach USD 7.71 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to register the second-highest growth rate in the market during the forecast period. The growth is expected to be driven by rising demand for consumer electronics, increasing urbanization, and changing lifestyles due to increased disposable income.

Europe

Europe is expected to register a significant growth rate in the market during the forecast period. The demand for TV distribution models has increased significantly as a result of the proliferation of digital transformation initiatives and an increasing number of connected devices. The market is receiving significant contributions from several innovative companies and projects. For instance, in December 2023, Eutelsat commenced its operations at additional capacity to provide broadband Internet access and direct-to-home (DTH) satellite television broadcasting in western and central Europe. Services are being delivered at 33 degrees East via the EUROBIRD 2 satellite, previously known as HOT BIRD. The UK market is projected to reach USD 5.71 billion by 2026, and the Germany market is projected to reach USD 6.79 billion by 2026.

South America

South America is poised for significant growth during the forecast period. This growth is attributed to increasing IT spending, surge in 5G technology, and supportive government laws for communication services in Brazil and Argentina.

KEY INDUSTRY PLAYERS

Market Players to Focus On Various Business Growth Strategies to Increase Their Operations

Some of the key companies involved in the market are focusing on offering advanced TV distribution models by providing users with easy API integration, improved customer services, cost savings, and more. These market players are buying out local and small-scale firms to increase their business reach. Moreover, they are also implementing various business growth strategies, such as investments, mergers & acquisitions, and partnerships to stay ahead of the market competition.

List of Top TV Distribution Model Companies:

- DIRECTV, LLC. (U.S.)

- DISH Network L.L.C. (U.S.)

- COMCAST CORPORATION (U.S.)

- Verizon Communications Inc. (U.S)

- Bharti Airtel Limited (India)

- Tata Play Ltd. (India)

- Foxtel (Australia)

- Charter Communications, Inc. (U.S.)

- Altice USA, Inc. (U.S.)

- Fetch TV Pty Ltd (Australia)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: DISH TV and Hughes Network Systems launched their bundled service to enhance customer value. By combining DISH TV's satellite television with HughesNet's satellite internet services, customers can get improved entertainment and connectivity solutions.

- April 2024: DirecTV signed agreements with Scripps Networks and Cineverse to add seven new channels, including Court TV and Scripps News, to its streaming lineup. This expansion also included over 4,000 hours of on-demand programming from Cineverse.

- March 2024: Star Sports collaborated with Tata Play and Airtel Digital TV to enhance the IPL viewing experience. This partnership aimed to offer viewers an enriched experience with innovative features and interactive content during the tournament.

- October 2023: Foxtel launched Hubbl Glass, powered by Comcast technology, to enhance viewer experience with personalized content recommendations and seamless navigation. This strategic collaboration aimed to optimize content discovery and engagement, leveraging cutting-edge technology for superior user satisfaction.

- September 2022: FETV launched on Optimum, expanding its reach to Optimum subscribers. The addition enhanced Optimum's programming lineup, providing viewers with access to FETV's diverse range of classic television shows and content.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, technology types, subscription types and end-users. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 2.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology Type

By Subscription Type

By End-use

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach a valuation of USD 259.9 billion by 2034.

In 2025, the market value stood at USD 210.39 billion.

The market is projected to record t a CAGR of 2.40% during the forecast period.

In 2025, based on end-use, the personal segment led the market.

Delivering high-quality & premium content to television services vendors through satellite communications & internet connectivity will drive the market growth.

DIRECTV, LLC., DISH Network L.L.C., COMCAST CORPORATION, Verizon Communications Inc., Bharti Airtel Limited, Tata Play Ltd., Foxtel, Charter Communications, Inc., Altice USA, Inc., and Fetch TV Pty Ltd are the top companies in the market.

North America dominated the global market with a share of 36.98% in 2025.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us