U.S. Allergic Conjunctivitis Market Size, Share & Industry Analysis, By Drug Class (Antihistamines & Mast Cell Stabilizers, Corticosteroids, and Others), By Disease Type (Severe Allergic Conjunctivitis and Mild Allergic Conjunctivitis), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

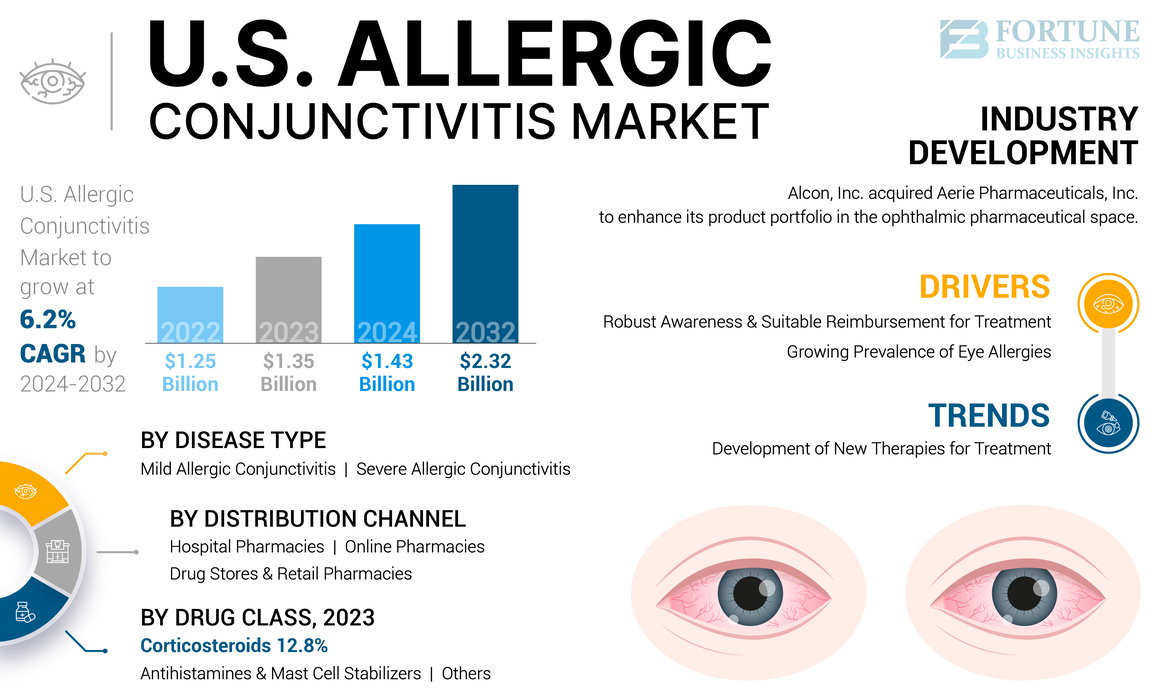

The U.S. allergic conjunctivitis market size was USD 1.35 billion in 2023. The market is expected to grow from USD 1.43 billion in 2024 to USD 2.32 billion by 2032, exhibiting a CAGR of 6.2% during the forecast period.

Allergic conjunctivitis is an IgE-mediated hypersensitivity reaction. It is the most frequent ocular allergy and affects the ocular surface for the duration of aeroallergen exposure. The common allergens that induce conjunctivitis include tree, grass pollen, house dust mites, animal/pest dander, and mold spores. Furthermore, the rising number of cases and the presence of advanced healthcare facilities with different treatment options in the U.S. is driving the growth of the market.

Moreover, rising healthcare expenditure in the country and increasing government and private awareness programs for allergy and anaphylaxis detection and management are expected to drive market growth. Also, the presence of key market players with robust product offerings, treatment options, and rising research initiatives between the companies to offer convenient treatment methods for the disease is boosting the U.S. allergic conjunctivitis market growth.

- In May 2023, Harrow, Inc. announced approval for ophthalmic medicines, MAXIDEX (dexamethasone ophthalmic suspension) 0.1%, ILEVRO (nepafenac ophthalmic suspension) 0.3%, and NEVANAC (nepafenac ophthalmic suspension) 0.1% by the U.S. FDA. These medicines are now commercially available under the Harrow umbrella.

The COVID-19 pandemic negatively impacted the U.S. market. The decline in patient visits to the hospitals during the pandemic due to restrictions led to a decrease in the number of prescriptions for the treatment. Moreover, the pandemic negatively impacted the sales of these products in the country. Additionally, the rising number of seasonal allergy cases, ocular allergy, the presence of high-end healthcare facilities, and expenditures in the U.S. normalized the market over 2021-2023. It is expected to attain robust growth during 2024-2032.

U.S. Allergic Conjunctivitis Market Trends

Development of New Therapies for Treatment is Prominent Trend

In recent years, one of the significant U.S. allergic conjunctivitis market trends is the increasing development of drug delivery systems for conjunctivitis treatment.

Currently, various topical eye drops are available for the treatment, although this dosage form has several drawbacks. It includes low bioavailability, inadequate penetration of the drug into ocular tissues, short residence time on the eye surface due to tear turnover, the need for frequent applications, and reliance on patient adherence to the treatment regimen.

To address these challenges, many research and development activities are taking place by the key players to offer robust products for the treatment of the disease is a prominent trend.

- For instance, in October 2021, Ocular Therapeutix, Inc. announced the approval of a Supplemental New Drug Application (sNDA) by the U.S. Food and Drug Administration (FDA) to broaden the DEXTENZA (dexamethasone ophthalmic insert) label to add an indication for the treatment of ocular itching associated with this condition.

Such clinical trials and regulatory approvals for new and advanced delivery options are expected to become a prominent trend in the market.

Download Free sample to learn more about this report.

U.S. Allergic Conjunctivitis Market Growth Factors

Growing Prevalence of Eye Allergies to Boost Market Growth

The primary factor driving the expansion of the U.S. market is the rising prevalence of eye allergies and anaphylaxis. It is an inflammation of the conjunctiva caused by allergens and irritants, such as pollen, dust, and mold. It is common in people with other allergic conditions such as hay fever, asthma, or eczema.

- According to the U.S. Department of Health & Human Services, National Health Interview Survey in 2021, 25.7% of adults in the U.S. had a seasonal allergy. Seasonal allergic conjunctivitis is also known as hay fever, which is caused by pollens, an airborne allergen dispersed from flowering plants, trees, grass, and weeds that leads to red, watery, or itchy eyes.

Thus, the growing number of cases of allergy and conjunctivitis associated with it eventually enhances product adoption in the market.

Robust Awareness and Suitable Reimbursement for Treatment to Boost Market Growth

Another critical driver of the market is the rising awareness amongst the patient population regarding disease treatment through various campaigns and programs initiated by key government bodies of the country. The growing awareness enhances product adoption in the market.

- For instance, in April 2024, the Asthma and Allergy Foundation of America (AAFA) designated May as National Asthma and Allergy Awareness Month. The foundation works on educating and researching about the factors leading to allergies and treatment to manage the conditions.

Additionally, an increase in government support by offering reimbursement coverage on new drug delivery systems launched by key players to reduce the economic burden of treatment is expected to propel the growth of the market.

RESTRAINING FACTORS

Adverse Events Associated with Medications May Hinder Market Growth

In recent years, the rising prevalence of allergic conjunctivitis has increased the demand for medication to treat them. However, the market has faced challenges, such as the presence of adverse drug reactions associated with the drugs available in the market, which can lead to their reduced adoption.

- For instance, the common adverse reactions reported by FDA for PATADAY (olopatadine hydrochloride ophthalmic solution), 0.2% such as blurred vision, burning or stinging, conjunctivitis, dry eye, foreign body sensation, hyperemia, hypersensitivity, keratitis, lid edema, pain and ocular pruritus, asthenia, back pain, flu syndrome, headache, increased cough, infection, nausea, rhinitis, sinusitis, and taste perversion were reported with the drug.

Such side effects associated with the medication are affecting consumers' trust and limiting the adoption of products and the growth of the market.

U.S. Allergic Conjunctivitis Market Segmentation Analysis

By Drug Class Analysis

Increasing Demand for Antihistamines & Mast Cell Stabilizers to Boost Segment’s Growth

The market segmentation based on drug class is divided into antihistamines & mast cell stabilizers, corticosteroids, and others.

The antihistamines & mast cell stabilizers segment dominated the U.S. market in the drug class segment. The segment is anticipated to grow at a significant CAGR during the forecast period. The substantial share of the segment is due to the increasing demand for antihistamines & mast cell stabilizers to control the allergic reaction in the patient, as the clinical signs and symptoms of allergic conjunctivitis are mediated by the release of histamine by mast cells.

Moreover, major players in the U.S. market are focusing on increasing the availability of the drug over-the-counter. Such scenarios boost the growth of the segment.

- For instance, in March 2022, AbbVie Inc. announced the Over-the-Counter (OTC) availability of LASTACAFT (alcaftadine ophthalmic solution 0.25%). It is used for eye allergy itch relief and offers relief in minutes that lasts 16 hours.

The corticosteroids segment holds a substantial share of the market. The substantial share of the segment is augmented due to the presence of key players in the market with product offerings such as corticosteroids for the treatment.

The others segment holds a notable share of the market. The growth of the segment is attributed to the rising research and development activities amongst the key players to launch advanced drugs for disease treatment. Also, increasing demand for immunotherapies and biologics for allergy treatment is expected to boost the growth of the segment in the market.

To know how our report can help streamline your business, Speak to Analyst

By Disease Type Analysis

Rising Prevalence of Severe Symptoms of Allergic Conjunctivitis Lead to Propel Segment Growth

Based on disease type, the market is bifurcated into severe allergic conjunctivitis and mild allergic conjunctivitis.

The severe allergic conjunctivitis segment held the dominant U.S. allergic conjunctivitis market share in 2023. The dominant share of the segment is due to the rising prevalence of eye allergy cases in the country.

Additionally, the presence of well-established players with generic and branded product offerings for severe symptoms boosted the segment’s growth.

- For instance, in March 2024, according to the U.S. Centers for Disease Prevention and Control (CDC) Climate and Health Program, up to 30.0% of the general population and 70.0% of allergic rhinitis patients experience allergic conjunctivitis in the U.S.

The mild segment accounted for a substantial share in 2023 owing to the high prevalence of seasonal allergies and milder symptoms. Also, the presence of over-the-counter medications for mild conditions makes it convenient for patients seeking treatment.

By Distribution Channel Analysis

Shift of Patients to Hospitals for Treatment to Aid Hospital Pharmacies Segmental Growth

Based on distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

The hospital pharmacies held a dominant share of the U.S. market in 2023. The growth of the segment is attributed to the high flow of patients suffering from allergic conjunctivitis in hospitals and adequate reimbursement policies awarded by hospitals in the country. Such scenarios boost the adoption of drugs from hospital pharmacies and propel the growth of the segment in the market.

The drug stores & retail pharmacies segment held a substantial share of the market. The growth of the segment is due to the presence of a majority of drugs for treatment at these channels. Also, the increasing regulatory approvals and collaboration among the key players and the retail channels to launch drugs over-the-counter for patient use is expected to drive the segment’s market growth.

- For instance, in February 2021, Alcon, Inc. announced that Pataday Once Daily Relief Extra Strength (olopatadine hydrochloride ophthalmic solution 0.7%) is available in-store and online at U.S. retailers. Such approvals and availability of drugs at these channels boost the growth of the segment.

The online pharmacies segment held a notable share of the market. The growth of the segment is due to the presence of a majority of prescription drugs in these channels, as well as ease of availability, support services, and convenience to the patients. Also, rising usage of technology and e-commerce platforms in the U.S. boost the growth of the segment.

KEY INDUSTRY PLAYERS

Robust Product Portfolio with Strong Regulatory Approvals by Alcon Inc. to Maintain their Position

The competitive landscape of the market reflects a fragmented structure. Alcon, Inc. held a significant position in the U.S. market in 2023 due to its robust product portfolio, with an emphasis on obtaining regulatory approvals to launch its key products over-the-counter. Furthermore, Bausch + Lomb and AbbVie Inc. held a substantial share of the market revenue due to the robust product offerings in the eye care business and strong strategic initiatives by the company.

Other prominent players include Teva Pharmaceutical Industries Ltd., Harrow, Inc., Ocular Therapeutix, Inc., and others. The rising focus of the companies on the introduction of innovative and generic products with specific strategic initiatives and gaining approvals are anticipated to boost their presence in the U.S. market during the forecast period.

- For instance, in December 2022, Harrow, Inc. acquired exclusive U.S. commercial rights for five ophthalmic products of Novartis AG after signing a binding agreement. These products include Ilevro, Vigamox, Maxidex, Nevanac, and Triesence. Such factors affect the company’s presence in the market.

List of Top U.S. Allergic Conjunctivitis Companies:

- Teva Pharmaceutical Industries Ltd. (Israel)

- AbbVie Inc. (U.S.)

- Alcon Inc. (Switzerland)

- Bausch + Lomb (Canada)

- Sun Pharmaceutical Industries Ltd. (India)

- Harrow, Inc. (U.S.)

- Ocular Therapeutix, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Harrow, Inc. acquired Santen Pharmaceutical Co., Ltd’s U.S. and Canadian commercial rights of FLAREX, NATACYN, VERKAZIA, and ZERVIATE.

- November 2022: Alcon, Inc. acquired Aerie Pharmaceuticals, Inc. to enhance its product portfolio in the ophthalmic pharmaceutical space with commercial products and a development pipeline.

- March 2022: AbbVie Inc. announced the over-the-counter availability of LASTACAFT (alcaftadine ophthalmic solution 0.25%). It is used for eye allergy itch relief and offers relief in minutes that lasts 16 hours.

- September 2020: Bausch + Lomb announced the U.S. Food and Drugs Administration approval for Alaway Preservative Free (ketotifen fumarate 0.035%) antihistamine eye drops, a temporary relief for allergy sufferers with itchy eyes.

- February 2020: Alcon, Inc. announced the approval of Pataday Once Daily Relief (olopatadine hydrochloride ophthalmic solution 0.2%) and Pataday Twice Daily Relief (olopatadine hydrochloride ophthalmic solution 0.1%) by U.S. Food and Drugs Administration for sale over the counter (OTC) in the U.S. Pataday is used for eye allergy itch relief.

REPORT COVERAGE

The report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. In addition to this, the market report provides information related to the prevalence of allergic conjunctivitis and pipeline analysis of the new drug developed by the market players. Furthermore, the U.S. market analysis also focuses on key industry developments and new product launches in the market by key companies. In addition, the impact of COVID-19, as well as a detailed company profile and the industry overview during the pandemic, are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.2% from 2024-2032 |

|

Segmentation |

By Drug Class

|

|

By Disease Type

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 1.35 billion in 2023 and is projected to record a valuation of USD 2.32 billion by 2032.

The market is expected to exhibit a CAGR of 6.2% during the forecast period of 2024-2032.

The antihistamines & mast cell stabilizers segment is projected to lead the market.

The contributing factors, such as the increasing prevalence of eye allergies and a rise in awareness and reimbursement policies, are expected to drive the market growth.

The development of new therapies for allergic conjunctivitis is the key trend in the market.

Alcon Inc. and Bausch + Lomb are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us