U.S. Automotive HVAC Market Size, Share & Industry Analysis, By Type (Automatic and Manual), By Vehicle Type (Passenger Vehicle (Hatchback, Sedan, and SUV) and Commercial Vehicle (Light Commercial Vehicle and Heavy Commercial Vehicle)), By Component (Compressor, Condenser, Evaporator, Receiver Dryer, Expansion Valve, and Others), By Distribution Channel (OEM and Aftermarket), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

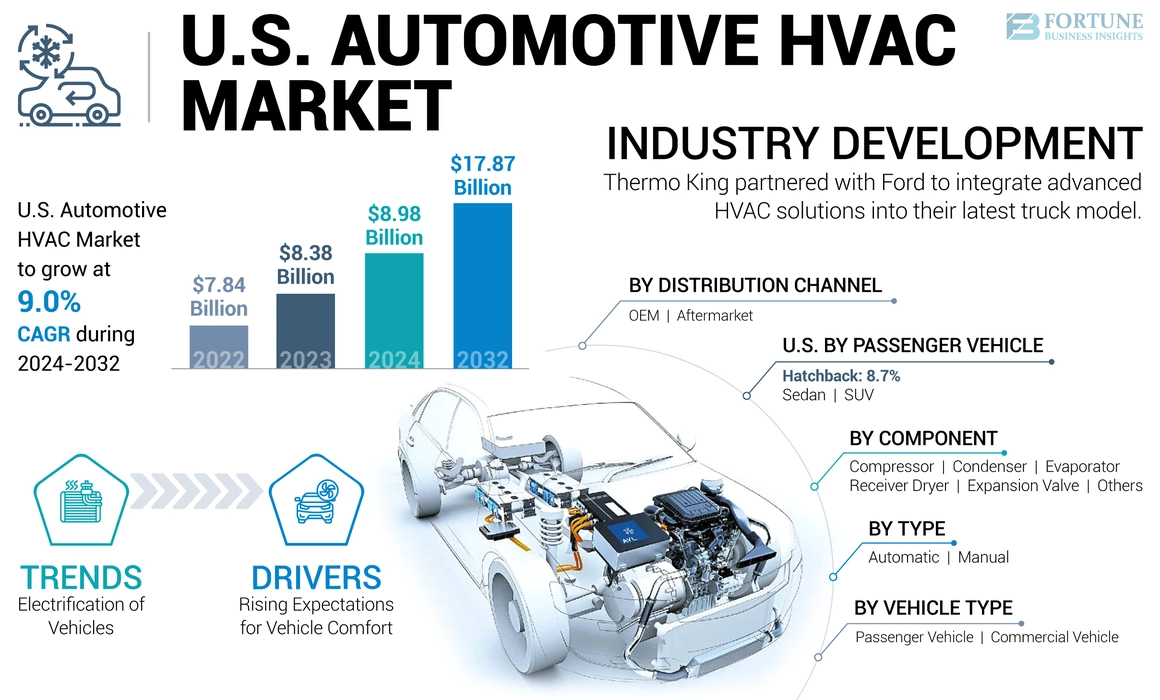

The U.S. automotive HVAC market size was valued at USD 8.38 billion in 2023 and is projected to grow from USD 8.98 billion in 2024 to USD 17.87 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period. The U.S. Automotive HVAC Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 17.87 Billion By 2032

The U.S. automotive HVAC market is propelled by expanding domestic automotive production, coupled with increasing consumer demand for enhanced in-vehicle comfort. Americans are increasingly prioritizing advanced climate control systems that not only regulate temperature but also improve overall cabin air quality.

The rising popularity of luxury vehicles and high-end SUVs has further accelerated the adoption of sophisticated HVAC technologies. Consumers are seeking more advanced climate control features that offer precise temperature management, air purification, and personalized comfort settings. Technological innovations such as smart climate zones, advanced air filtration systems, and energy-efficient cooling and heating mechanisms are becoming increasingly important to U.S. car buyers.

Automotive HVAC, also known as heating, ventilation, and air conditioning, is a technology in the vehicle that manages and controls the internal climate of the vehicle cabin. In general, it maintains passenger comfort by efficiently managing temperature and air quality. The refrigerant is converted from liquid to gas and vice versa while absorbing heat. The main components include compressors, condensers, evaporators, and blowers, which collectively deliver conditioned air for passengers and achieve optimal thermal comfort.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Expectations for Vehicle Comfort Leads to Substantial Market Growth

Consumers' expectations of comfort and convenience in this automotive landscape have increased. The need for sophisticated climate control systems has increased, with vehicles morphing from modes of transportation to living spaces. Modern consumers care for the comfort and functionality of the vehicle while traveling. The change in consumer habits can be noticed by the increasing demand for dual-zone and tri-zone climate control systems, where passengers can individually select their comfort level. This makes long journeys bearable by accommodating the preferences of their occupants.

Market Restraints

Increasing Cost and Complexity of Advanced HVAC Systems to Act as a Major Restraint

This push for advanced HVAC systems in vehicles has greatly led to complexity in their designs and functionalities. In recent times, manufacturers have integrated smart climate control and advanced filtration systems that improve air quality. These innovations, which enhance comfort and convenience, require a big investment in research and development.

Manufacturing costs rise due to higher complexity production processes for intricate components and advanced technology in the automotive HVAC. Integration of these high-tech systems can also add to maintenance costs during the life cycle of the vehicle, raising consumers' ownership costs.

Market Opportunities

Growing Economic Growth, Vehicle Production and Ownership in the U.S. Offer Market Expansion Opportunity

The recovering U.S. economy continues to spur growth, with disposable incomes growing enough to enable more and more consumers to buy cars. Such trends are particularly prevalent in the young population, which emphasizes personal mobility. As more people own cars, there is a resultant demand for good HVACs, which improve comfort during travel. Urbanization is the other factor driving vehicle ownership. With the increasing population moving to cities where public transportation may not be available or convenient, personal vehicles become a necessity for everyday commuting and transportation. In this regard, the need for passenger vehicles with advanced air conditioning systems that can cater to various climate conditions increases. Generally, the growth of automotive production and ownership in the U.S. is based on economic growth, urbanization trends, and changes in consumer preferences, providing a great opportunity for the automotive HVAC market. Manufacturers are looking at ways to fulfill growing needs for comfort and efficiency through various vehicle segments. With this growth, manufacturers can capture the opportunity by innovating their HVAC solutions to increase passenger comfort and reduce harmful emissions from vehicles.

Market Challenges

Regulatory Requirements and Emission Standards Challenge Market Development

There are complex regulations aimed at reducing environmental impact, ensuring consumer safety, and enhancing friendly and energy-efficient automotive HVAC systems in the automotive industry. These regulations, therefore, influence the overall production, including the design and operation of automotive HVAC systems. There are two major regulatory bodies, the Environmental Protection Agency and the National Highway Traffic Safety Administration, and the manufacturers of automotive HVAC systems must adhere to strict standards. Emission standards that primarily concern pollutants and greenhouse gases from passenger and commercial vehicles are one major regulatory pressure. These have been tightened to reduce climate change and provide better air quality.

U.S. AUTOMOTIVE HVAC MARKET TRENDS

Electrification of Vehicles is a Major Market Trend

A key trend changing the automotive sector landscape is the electrification of vehicles. In the HVAC sector, this trend is crucial to the industry as hybrid vehicles and EVs are increasingly being introduced in the market. As these vehicles become more available, so does the demand for specially-purpose-built HVAC systems for these vehicles. EVs purely operate on electric power and do not produce waste heat from combustion in the engines, unlike conventional ICE vehicles. This lack of thermal output from the engine calls for advanced heating solutions, as when cold weather sets in, passengers may require more and more battery life if one does not keep an efficient eye on things.

Consequently, manufacturers are keenly interested in developing high-tech HVAC technologies that offer optimized energy usage and a comfortable cabin climate. Also, most current EVs have adopted combined integrated thermal management systems through the integration of HVAC functionality and battery temperature regulation. Thermal loads are managed through different vehicle systems by the manufacturers for overall improved energy efficiency and performance. Optimized performance and long battery life accompany better cabin temperature controls.

Impact of COVID-19

The COVID-19 pandemic led to a huge disruption to the global supply chains, therefore affecting the raw materials and components required in the automotive HVAC systems. Lockdowns and border restrictions delayed shipments and led to higher lead times for manufacturers. Automotive plants had to either halt production or decrease production capacity due to the reduction in the overall output of HVAC systems. It reduced the rate of production with higher costs due to the scarce sourcing of necessary components among manufacturers. Additionally, appropriate filtering of airborne bacteria and viruses, including COVID-19, was needed as a part of comfort and safety measures in the vehicle while the number of cases increased.

The pandemic brought forth fluctuations in vehicle demand. In 2020, the total sales of passenger cars recorded a decrease of over 14% compared to 2019. This had a negative impact on the HVAC market since not as many vehicles are sold and produced. However, the economies are now opening, and consumer confidence slowly began coming back into the system; vehicle sales and production bounced back.

SEGMENTATION ANALYSIS

By Type

Automatic is the Leading Type Owing to Growing Consumer Demand for Comfort

On the basis of type, the market has been divided into automatic and manual.

The automatic segment held the largest U.S automotive HVAC market share, owing to the consumer demand for comfort, convenience, and technology, as well as advancements in transmission design and performance. Additionally, the increasing adoption of semi-autonomous and autonomous vehicles, which rely on automatic transmissions, will also contribute to this growth trend.

The manual segment is estimated to grow at the highest CAGR over the forecast period. This shift is driven by increasing consumer preference for ease of use and convenience, particularly among younger generations. Manual automatic vehicles, also known as dual-clutch transmissions, offer a seamless driving experience with the ability to shift gears automatically, eliminating the need for a traditional clutch pedal. Manufacturers, such as Volkswagen, Ford, and Hyundai are expanding their offerings of manual automatic vehicles, catering to this growing demand.

By Vehicle Type

Increased Demand for SUVs to Propel Growth of Passenger Vehicles Segment

Based on vehicle type, the market has included passenger vehicle and commercial vehicle.

The growth of the passenger vehicle segment is directly proportional to the demand for vehicle sales in the U.S. market. According to industry trends, the U.S. passenger vehicle segment is expected to witness significant growth in terms of market share. This is primarily driven by factors such as increased demand for SUVs and crossovers, the growing popularity of electric vehicles, and a shift toward smaller and more fuel-efficient vehicles. As consumers become increasingly environmentally conscious and demand for autonomous vehicles grows, the passenger vehicle segment is poised to experience a surge in popularity, with manufacturers investing heavily in research and development to meet these evolving demands. As a result, market share is expected to grow, with key players such as Toyota, Ford, and General Motors leading the charge.

To know how our report can help streamline your business, Speak to Analyst

The commercial vehicle segment also contributes to the boost in growth of the automotive HVAC market. This is driven by increasing demand for e-commerce and online shopping, which has led to a surge in deliveries and transportation needs. Additionally, the growing popularity of ride-hailing and food-delivery services has also contributed to the growth of the commercial vehicle market. Furthermore, the rise of autonomous vehicles and electric trucks is expected to boost the segment further as companies invest in innovative technologies to reduce emissions and improve efficiency.

By Component

Condensers Dominate Market Share Due to Its Essential Function in HVAC Systems

Based on component, the market is categorized into compressor, condenser, evaporator, receiver dryer, expansion valve, and others.

The condenser segment leads the automotive HVAC market primarily because of its vital role in air conditioning systems. Condensers dissipate heat that has been gathered from the cabin air. Furthermore, advancements in condenser technology are anticipated to enhance the efficiency of HVAC systems, further fueling the growth of this segment.

The evaporator segment also commands a notable share of the market. Evaporators function by absorbing heat, which cools the air within the vehicle cabin. Innovations in evaporator technology are likely to drive the demand for more sophisticated HVAC systems.

By Distribution Channel

Development of Advanced HVAC Systems for Passenger Vehicles Boosted OEM Segment Growth

Based on distribution channel, the market has included OEM and aftermarket.

The OEM segment accounted for a dominating market share in 2023. This growth is attributed to increasing demand for passenger vehicles, particularly in the Electric Vehicle (EV) segment, where OEMs are focusing on developing advanced HVAC systems that provide optimal temperature control and air quality. As a result, leading U.S. OEMs, such as General Motors, Ford, and FCA, are investing heavily in R&D to develop innovative HVAC systems that meet evolving customer needs and regulatory requirements. This growth is expected to be driven by increasing adoption of premium features, such as dual-zone climate control and advanced air purification systems, which will enhance the driving experience and boost customer satisfaction.

The aftermarket segment is expected to grow at the highest compound annual growth rate during the forecast period. This growth is driven by increasing average vehicle age, leading to a higher demand for replacement parts and repairs. Additionally, the rise of luxury vehicles and advanced technologies in HVAC systems has created a need for high-performance aftermarket components that can match the quality of original equipment.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies are Emphasizing on Development of HVAC Systems for EVs to Cater the Changing Consumer Demand

The U.S. automotive HVAC market is dominated by many global market players such as Denso, Mahle, Valeo, and Marelli. These market players are emphasizing the development of more efficient and eco-friendly automotive HVAC systems. Moreover, they are developing HVAC systems for EVs to support the surging demand for electric mobility. These initiatives are anticipated to foster the U.S. automotive HVAC market growth over the analysis period.

List of Key Automotive HVAC Companies Profiled:

- Mahle Group (Germany)

- Detroit Thermal System LLC (U.S.)

- Valeo (France)

- Denso Corporation (Japan)

- Marelli (Japan)

- Hanon System (South Korea)

- Behr-Hella Thermocontrol (BHTC) (Germany)

Key Industry Developments

- October 2023: Thermo King, a subsidiary of Ingersoll Rand, announced a partnership with Ford to integrate advanced HVAC solutions into their latest truck models. This collaboration aims to provide enhanced temperature control and comfort for drivers and passengers, especially in challenging weather conditions, while also focusing on energy efficiency.

- June 2023: Hanon Systems launched a new line of eco-friendly HVAC systems designed to increase efficiency in electric vehicles. These systems utilize sustainable materials and innovative technologies to reduce energy consumption while maintaining optimal climate control for passengers.

- February 2023: Magna International completed its acquisition of Veoneer, a move that significantly enhanced its HVAC product line. This acquisition enables Magna to incorporate advanced driver assistance features into its HVAC systems, making them more adaptable to the growing demand for smart vehicle technologies.

- September 2022: BorgWarner entered a strategic partnership with Jaguar Land Rover to co-develop more efficient HVAC solutions. This collaboration focuses on integrating cutting-edge technologies that enhance both energy efficiency and vehicle performance, aligning with the increasing shift toward electrification in the automotive industry.

- April 2022: Continental AG launched a new HVAC system tailored for electric vehicles, emphasizing advanced climate control technologies. This innovative system is designed to optimize energy use, ensuring that electric vehicles can maintain passenger comfort without compromising battery life.

- March 2021: Valeo announced its acquisition of FTE Automotive Group, a move designed to bolster its presence in the HVAC component market. This acquisition allows Valeo to integrate advanced technologies and expand its product offerings, particularly in the realm of thermal management solutions.

- January 2021: Denso Corporation partnered with Toyota Motor Corporation to enhance thermal management systems specifically for electric vehicles. This collaboration aims to leverage Denso’s expertise in HVAC technology to improve energy efficiency and passenger comfort in Toyota’s upcoming electric models.

Report Coverage

The U.S. automotive HVAC market research report analyzes the market in-depth and highlights crucial aspects such as prominent companies, market segmentation, competitive landscape, vehicle type, and technology adoption. Besides this, the report provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 9.0% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Vehicle Type

By Component

By Distribution Channel

|

Frequently Asked Questions

The market was valued at USD 8.38 billion in 2023 and is projected to reach USD 17.87 billion by 2032.

The market is projected to grow at a CAGR of 9.0% over the forecast period.

The OEM segment holds the leading position in the market.

Increasing demand for passenger vehicles, particularly in the Electric Vehicle (EV) segment, fuels market growth.

Denso, Mahle, Detroit, and Valeo are some of the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us