U.S. Bedsheets Market Size, Share & COVID-19 Impact Analysis, By Type (Cotton Bed Sheets, Silk Bed Sheets, Synthetic Bed Sheets, Linen Bed Sheets, and Others), By Price Range (Under 50 USD, USD 50 to USD 100, Between USD 100 and USD 200, and Above USD 200), By Application (Residential and Commercial), By Sales Channel (Supermarket/Hypermarket, Specialty Store, and Online), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

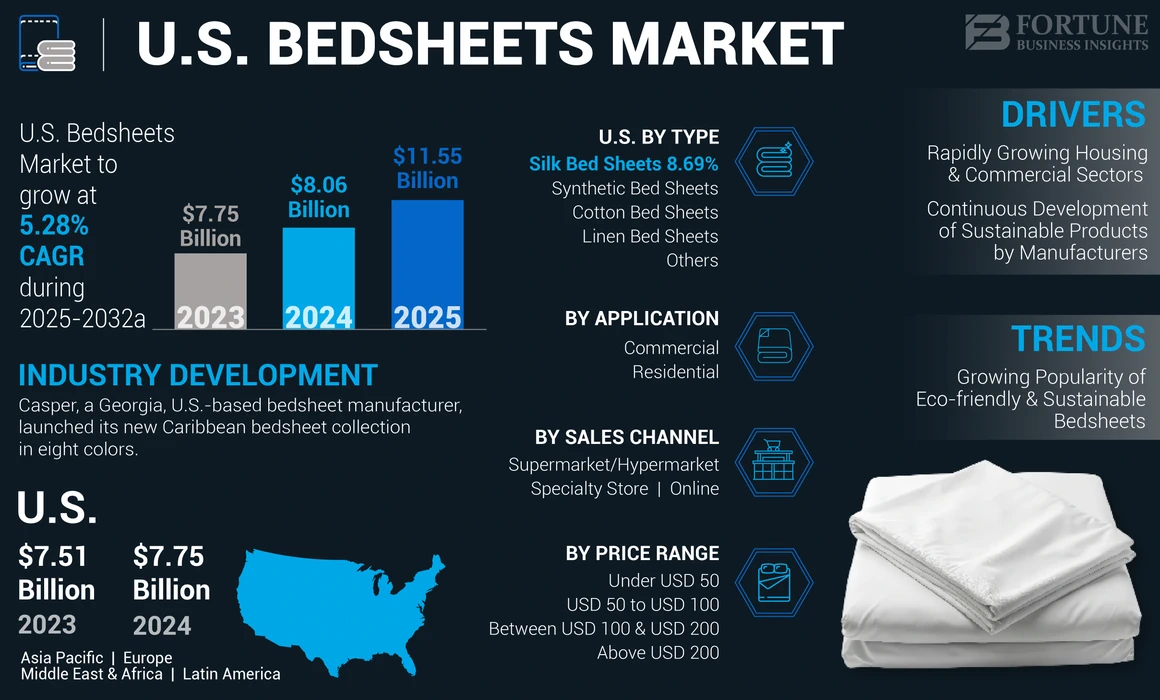

The U.S. bedsheets market size was valued at USD 7.75 billion in 2024. The market is projected to grow from USD 8.06 billion in 2025 to USD 11.55 billion by 2032, exhibiting a CAGR of 5.28% during the forecast period.

A bedsheet is a piece of cloth that is placed above a mattress. Bed sheets are available in various colors and sizes in the U.S. market. The rapidly growing residential and hospitality sectors drive the U.S. bedsheets market. The growing fabric technology and the availability of a wide range of eco-friendly and sustainable bed sheets are trending in the U.S. market.

COVID-19 IMPACT

Closure of Manufacturing Facilities and Lockdown Restrictions during the COVID-19 Impacted Product Demand

The COVID-19 pandemic significantly disrupted almost all sectors, as demand and exports sharply plummeted across the U.S. The slowdown in economic growth in the U.S. arose due to the closure of manufacturing facilities, trade restrictions, and the shutdown of retail stores in 2020. Changes in economic conditions and inflationary trends in the prices of raw materials adversely affected product prices in the U.S. Moreover, changing prices of raw materials, such as cotton and polyester, due to decreased production, global supply chain disruptions, and the broader inflationary environment related to ongoing macroeconomic conditions, have further impacted the demand for home bedding products, such as bed sheets.

The pandemic significantly impacted this market due to changes in market dynamics. The supply chain suffered from production, logistics, and distribution challenges due to lack of transportation and trade restrictions during the pandemic. Post-COVID-19, several players focused on launching innovative products to meet the increased demand for bed sheets across the U.S. in order to grow their sales. Growing fabric technology and the availability of multiple colors of sheets have surged bed sheets demand post-pandemic.

U.S. Bedsheets Market Trends

Growing Popularity of Eco-friendly and Sustainable Bedsheets is Propelling Market Growth

The popularity of natural and eco-friendly products is growing significantly due to the increasing awareness of sustainability and environmentally friendly options. Several prominent players are focusing on launching organic and natural products to cater to the increasing demand from eco-conscious consumers. For instance, in April 2023, Brooklinen, a New York-based direct-to-consumer (DTC) home essentials brand, introduced its first home bedding products, including bed sheets made from organic cotton. The new collection is Oeko-Tex certified for chemical safety and Global Organic Textile Standard (GOTS) certified. Furthermore, organic and eco-friendly sheets are developed without harmful chemicals and synthetic fibers, reducing the chances of skin irritation and allergic responses while creating less friction and increasing comfort. These factors are expected to further fuel their demand in the coming years.

Download Free sample to learn more about this report.

DRIVING FACTORS

Rapidly Growing Housing and Commercial Sectors to Trigger Product Demand

The rapidly growing housing and commercial sectors, including hotels, motels, and resorts, are driving bedsheet sales across the U.S. For instance, according to the American Hotel and Lodging Association (AHLA), a Washington, D.C.-based hotel association representing various industry segments across the country, the U.S. hotel industry is expected to achieve nearly 1.3 billion occupied hotel room nights in 2023, surpassing the total from 2019 (1.14 billion). Moreover, the increasing demand for the product from hospitals is also boosting the market's growth.

Continuous Development of Sustainable Products by Manufacturers to Drive Market Growth

The growing awareness of sustainability and the increasing popularity of environmentally friendly products have significantly driven the development of sustainable and organic bed sheets, leading to market growth. These bedsheets are crafted from materials such as organic cotton, organic latex, eucalyptus, bamboo, organic hemp, and linen. Additionally, they adhere to environmental standards, are easy to recycle, and possess antibacterial properties. Furthermore, brands such as Made Trade, Under the Canopy, West Elm, and Delilah Home Goods offer sustainable bed sheets in the U.S. market.

RESTRAINING FACTORS

Fluctuating Raw Material Prices and Supply Chain Disruptions to Hamper Market Growth

Unfavorable climate conditions, changing consumer preferences, and limited supplies of raw materials such as cotton, jute, linen, and others have significantly impacted cotton prices. Since cotton is one of the major raw materials used in fabric production for bed sheets, these rising prices are expected to restrain the U.S. bedsheets market growth.

Raw materials, particularly cotton, have a significant impact on the textile industry, including the production of bed sheets, and they contribute to increased production costs. Furthermore, rising competition and the influx of counterfeit products into the market have been restraining market growth in the country.

For instance, according to the 2021 annual report of Sleep Number Corporation, a leading U.S.-based manufacturer of comforter and bedding products, the company has faced significant manufacturing disruptions due to the shortage of raw materials, which, in turn, has disrupted the supply chain and restricted market growth in the U.S.

SEGMENTATION

By Type Analysis

Cotton Bed Sheets Segment Dominates Due to its Significant Demand and Moisture-Resistant Properties

Based on type, the market is further divided into cotton bed sheets, silk bed sheets, synthetic bed sheets, linen bed sheets, and others. The cotton bed sheet segment holds the major U.S. bedsheets market share due to the rising consumer preference for cotton owing to its features, such as natural and versatile material with moisture-resistant properties. Moreover, individuals with skin sensitivities highly prefer cotton bed sheets as they are naturally hypoallergenic, and skin irritation or itchiness-free. Cotton bed sheets are available in several brands, colors, and sizes in various offline and online stores in the U.S.

To know how our report can help streamline your business, Speak to Analyst

By Price Range Analysis

Bedsheets Priced Between USD 100 and USD 200 to Boost Growth Due to its Augmenting Demand

Based on price range, the market is segmented into under 50 USD, USD 50 to USD 100, between USD 100 and USD 200, and above USD 200. Between USD 100 and USD 200, the segment holds a major U.S. market share. Several industry participants emphasize providing products between this price range to increase traffic toward their business and generate revenue streams. Prominent market players across the U.S., including BEDGEAR, Avocado Mattress, LLC, Brooklinen, Sleep Number Corporation, and Tempur-Pedic North America, LLC, offer bed sheets between USD 100 and USD 200. Products in this price range are available in various materials, including Pima cotton, organic cotton, and high-quality bamboo blends, offering durability, softness, and breathability.

By Application Analysis

Residential Segment Boosts Market Value Owing to Rising Demand for Bedsheets

Based on application, the market is divided into residential and commercial. The residential segment dominates the market due to the rise in consumer spending on home décor and their demand for bed sheets in various materials, designs, colors, and patterns. These products are increasingly used to give an aesthetic look to the bedroom, which supports segmental growth. In addition, the growing number of housing units in the U.S. resulted in increasing product launches for residential end-use.

Commercial segment in bedsheets is also projected to witness significant growth due to expanding end-use industries, namely hospitals, hotel and spa industry, and others.

By Sales Channel Analysis

Supermarket/Hypermarket Segment Lead the Market due to the Wide Availability of Products and Offers

Based on sales channel, the market is classified into supermarket/hypermarket, specialty store, and online. The supermarket/hypermarket segment holds a significant share in the market. Supermarkets and hypermarkets, such as Walmart, Target, and Costco, focus on offering a wide range of bedsheets and provide discounts during special occasions, weekends, and holidays, making them appealing shopping destinations. Several brands also concentrate on launching their products through supermarket and hypermarket chains and acquisitions to expand their reach and consumer base.

The online segment is expected to grow considerably in the coming years due to the convenience and ease of shopping anywhere, anytime. This segment includes online retailers such as Amazon, Anthropologie, Bed Threads, and Boll & Branch, which offer a wide range of bedsheets. Moreover, online stores often provide detailed product descriptions and customer reviews to help customers make informed decisions before purchasing sheets.

KEY INDUSTRY PLAYERS

Key Players Focus on Expanding Production Capacities to Support Product Consumption

Key players, including Tempur Sealy, Purple Innovation LLC, Sleep Number Corporation, and others, are focused on strengthening their product portfolios to meet consumer demand for bedsheets. Furthermore, several prominent players are emphasizing sustainability and reducing their carbon footprint to gain a competitive edge in the market. For instance, in April 2021, Avocado Mattress LLC was announced to be the only mattress company to achieve 100% carbon neutrality, as stated by its Founder Mark Abrials. The company entered into several strategic partnerships to become 100% carbon neutral, thereby gaining a competitive edge in the market amid the rising consumer demand for sustainable products.

LIST OF KEY COMPANIES PROFILED:

- Avocado Mattress LLC (U.S.)

- Tempur Sealy International (U.S.)

- Boll & Branch (U.S.)

- Casper (U.S.)

- Brooklinen (U.S.)

- GhostBed (U.S.)

- Bedgear (U.S.)

- Sleep Number Corporation (U.S.)

- Buffy (U.S.)

- Serta Simmons Bedding LLC (U.S.)

- MyPillow (U.S.)

- Parachute Home Inc. (U.S.)

- Cozy Earth (U.S.)

- LUXOME (U.S.)

- Frette (Italy)

- L.L Bean Inc. (U.S.)

- John Matouk & Co. Inc. (U.S.)

- Hotel Luxury Collection (U.S.)

- Mellanni (U.S.)

- Malouf (U.S.)

- Purple Innovation LLC (U.S.)

- Beaumont & Brown (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Casper, a Georgia, U.S.-based bedsheet manufacturer, launched its new Caribbean bedsheet collection in eight colors.

- April 2023: Sleep Country Canada, a Canadian bedding retailer, announced the acquisition of ownership of the Canadian assets of Casper Sleep Inc. Sleep Country Canada had acquired the assets of Casper Sleep Inc’s Canadian operations for USD 20.6 million.

- August 2022: Mellanni, a New Jersey, U.S.-based bedding and accessories brand, launched its new 100% flax linen sheets set on Amazon, a U.S.-based e-commerce company.

- February 2022: Pure Parima, a New Jersey, U.S.-based bedding company, launched a new midnight color 100% Egyptian cotton sheets. The company focuses on adding new products to its portfolio.

- July 2021: Brooklyn Bedding, a U.S.-based bedding manufacturer, announced the launch of the deep pocket bamboo cotton sheets collection in its online shop and retail stores. These sheets are made from rayon fibers derived from bamboo that help maintain an ideal body temperature throughout the night.

REPORT COVERAGE

The market research report provides a detailed market analysis, market overview, and focuses on crucial aspects, such as key companies, product types, and distribution channel areas. Besides this, the report offers insights into the current market trends and highlights key industry developments. In addition to the aforementioned factors, the report outlines several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.28% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Price Range

|

|

|

By Application

|

|

|

By Sales Channel

|

Frequently Asked Questions

Fortune Business Insights states that the market size was valued at USD 7.29 billion in 2022 and is projected to reach USD 10.29 billion by 2030.

The U.S. market is estimated to record a CAGR of 4.61% during 2023-2030.

By type, the cotton bed sheets segment holds a major market share during the forecast period.

The growing number of sustainable products is the primary factor driving the market's growth.

Sleep Number Corporation, Tempur Sealy International, Purple Innovation LLC, Serta Simmons Bedding, and others are the major players in the U.S. market.

The rising popularity of eco-friendly and sustainable bed sheets propels market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us