Home / Healthcare / Medical Device / U.S. Drug Delivery Systems Market

U.S. Drug Delivery Systems Market Size, Share & Industry Analysis, By Type (Inhalation, Transdermal, Injectable, and Others), By Device Type (Conventional and Advanced), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Country Forecast, 2024-2032

Report Format: PDF | Published Date: Sep, 2024 | Report ID: FBI107910 | Status : PublishedThe U.S. drug delivery systems market size was worth USD 16.28 billion in 2023 and is projected to grow at a CAGR of 4.6% during the forecast period.

The rising prevalence of various chronic diseases, such as diabetes, Chronic Obstructive Pulmonary Disease (COPD), asthma, and others, in the country, is one of the predominant factors propelling the demand for drug delivery systems. Further, introducing technologically advanced products to enable safe and efficient drug administration also supports market growth.

- According to the Centers for Disease Control and Prevention 2023 statistics, an estimated 25.0 million people in the U.S. had asthma in 2021. The rising prevalence of such disorders is likely to raise the adoption of drug delivery systems in the country.

The U.S. drug delivery systems market witnessed substantial growth during the COVID-19 pandemic due to an increase in immunization programs in the country. Such programs raised the demand for these devices. This increased the focus of manufacturers on increasing the manufacturing capacities to cater to this demand.

LATEST TRENDS

Rising Collaborations among Pharmaceutical and Medical Device Manufacturers to Propel Industry Expansion

Market players are continuously integrating new and innovative technologies into existing products to increase the efficiency of drug delivery systems. Moreover, pharmaceutical companies are collaborating with device manufacturers for launching technologically advanced products.

Such initiatives and launches are anticipated to increase patient engagement and aid proper disease management.

- For instance, in March 2022, Sanofi partnered with Enable Injections, a drug delivery company, to advance the development of subcutaneous drug delivery devices for Sarclisa.

DRIVING FACTORS

Shifting Preference toward Self-Administering Drugs among Patients to Impel Market Growth

In the current scenario, patients are refraining from visiting clinics to administer drugs. Rather, they are shifting their preference toward safe and convenient self-administering drug delivery systems. Self-administering drug delivery devices improve patient compliance, especially among the geriatric population, and reduce the frequency of hospital and clinic visits, making the process cost-effective.

The rising launch of self-administering injectable drug delivery systems by players to cater to the growing product demand among patients is fueling the U.S. market growth.

- For instance, in February 2023, AstraZeneca received the U.S. FDA approval for a single-use, pre-filled pen, Tezspire. The launch was focused on self-administration in patients suffering from severe asthma.

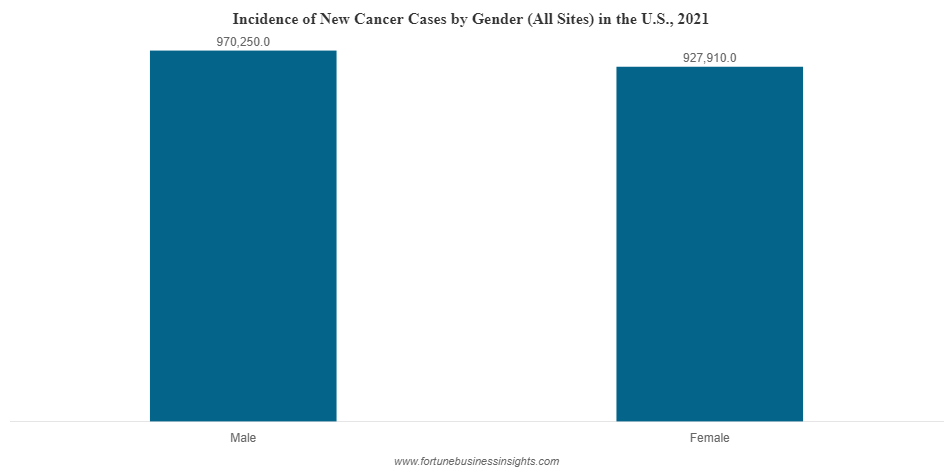

The estimated new cancer cases in males were higher than in females in the U.S. Among males, prostate cancer accounted for 26% of the new cases, whereas in females, breast cancer was the leading cancer and accounted for 30% of all the new cases.

RESTRAINING FACTORS

Increase in Product Recalls May Impede the Market Growth

Despite the integration of advanced technology and the launch of new products to cater to the surging demand in the country, the frequency of product recalls due to manufacturing defects or contaminations is likely to hinder the U.S. drug delivery systems market growth.

- For instance, in March 2022, Adamis Pharmaceuticals Corporation voluntarily recalled a few lots of Symjepi (epinephrine pre-filled injections) from the consumer level. The batch lots of the recalled product included 21101Y, 21041W, 21081W, and 21102W. The batches were recalled owing to the potential clogging of the epinephrine pre-filled injections dispensing needle.

SEGMENTATION

By Type Analysis

Based on type, the market is segmented into inhalation, transdermal, injectable, and others. The injectable segment held the largest share in 2022 and is projected to dominate the market in the upcoming years. The rise in the number of vaccination campaigns and the launch of advanced wearable injections in the country favors market growth. Another factor supporting the segment growth is an increase in the manufacturing capacity of injections by key players to meet the rising demand.

- For instance, in March 2023, Genixus expanded its manufacturing capacity for KinetiX, a ready-to-administer syringe, by establishing a new manufacturing facility in Concord, California. Through this, the company aimed to expand its portfolio and meet the rising demand for these syringes.

By Device Type Analysis

Based on device type, the market is categorized into conventional and advanced. The conventional segment accounted for the largest share due to easy availability and low cost. Also, shifting manufacturers’ focus to increase the efficiency of these systems by integrating novel technologies is another factor responsible for the increased adoption of these cost-effective devices. Furthermore, increasing approvals and launches of these products for various applications are driving the growth of the market.

- For instance, in October 2022, Hikma Pharmaceuticals PLC launched the pre-filled succinylcholine chloride syringe. Succinylcholine chloride is used as anesthesia in hospitals and for muscle relaxation during surgery

By Distribution Channel Analysis

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and others.

The hospital pharmacies segment accounted for the largest share in 2022. These pharmacies are an indispensable part of hospitals. The growing number of hospital visits, increasing number of hospital admissions, rising surgeries, and the growing number of hospitals are a few factors augmenting the demand for drug delivery devices from hospital pharmacies.

The retail pharmacies segment is expected to grow at a significant CAGR during the forecast period. The increase in the availability of drug delivery systems from retail pharmacies and the rise in the number of retail pharmacy outlets are set to promote the segment growth. Also, the rising government initiatives to strengthen the pharmacy sectors in the country contribute to the U.S. market growth.

- For instance, in June 2023, Walmart announced plans to establish more than 80 specialty pharmacies across 11 states in the U.S.

KEY INDUSTRY PLAYERS

The market is fragmented with the presence of various players. BD, West Pharmaceutical Services Inc., and Baxter are a few key players holding a significant U.S. drug delivery systems market share. The introduction of new products in the market, strategic mergers and acquisitions performed by the companies to expand their geographical reach, and product portfolio are a few factors contributing to their revenue growth.

- For instance, in August 2022, Baxter received the approval of the U.S. FDA for Novum IQ Syringe Infusion Pump.

Other companies, such as Medtronic, Ypsomed, Kindeva Drug Delivery, and others, also operate in the market. The increasing focus of these players on increasing manufacturing capacities and the launch of new products is anticipated to increase their market share.

LIST OF KEY COMPANIES PROFILED:

- BD (U.S.)

- Baxter (U.S.)

- Medtronic (Ireland)

- Hikma Pharmaceuticals PLC (U.K.)

- Teva Pharmaceuticals USA Inc. (U.S.)

- Teikoku Pharma USA, Inc. (U.S.)

- Sanofi (France)

KEY INDUSTRY DEVELOPMENTS:

- April 2023- CSL received the FDA approval for an immunoglobulin pre-filled syringe, Hizentra to treat patients living with Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Primary Immunodeficiency (PI). The injection is ready to use and provides convenience in drug delivery

- April 2023- Medtronic received the U.S. FDA approval for Minimed 780G system integrated with Guardian 4 sensor, an insulin pump with meal detection technology.

- March 2023 – Pfizer received the FDA clearance for Zavzpret, a calcitonin gene-related peptide receptor antagonist nasal spray indicated for the treatment of acute migraine in adults.

REPORT COVERAGE

The market research report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements, the prevalence of chronic diseases in the U.S, new product launches, key industry developments such as mergers, partnerships, & acquisitions, and the impact of COVID-19 on the market. Additionally, the report will provide key market tends, impact of COVID-19, and others. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 4.6% from 2024 to 2032 |

Unit |

Value (USD Billion) |

Segmentation |

By Type

|

By Device Type

|

|

By Distribution Channel

|

Frequently Asked Questions

How much is the U.S. drug delivery systems market worth?

Fortune Business Insights says that the U.S. market was worth USD 16.28 billion in 2023.

At what CAGR is the U.S. drug delivery systems market projected to grow during the forecast period (2024-2032)?

The market is expected to exhibit a CAGR of 4.6% during the forecast period (2024-2032).

Which is the leading segment in the market by type?

By type, the injectable segment held a leading share in the market.

Who are the top players in the market?

BD, West Pharmaceutical Services Inc., and Baxter, among others are the major players in the market.

- USA

- 2023

- 2019-2022

- 70