U.S. Earplugs Market Size, Share & Industry Analysis, By Material Type (Silicone, Wax, and Foam), By End-User (Personal Use and Commercial/Industrial), and Country Forecast, 2025– 2032

U.S. Earplugs Market Size

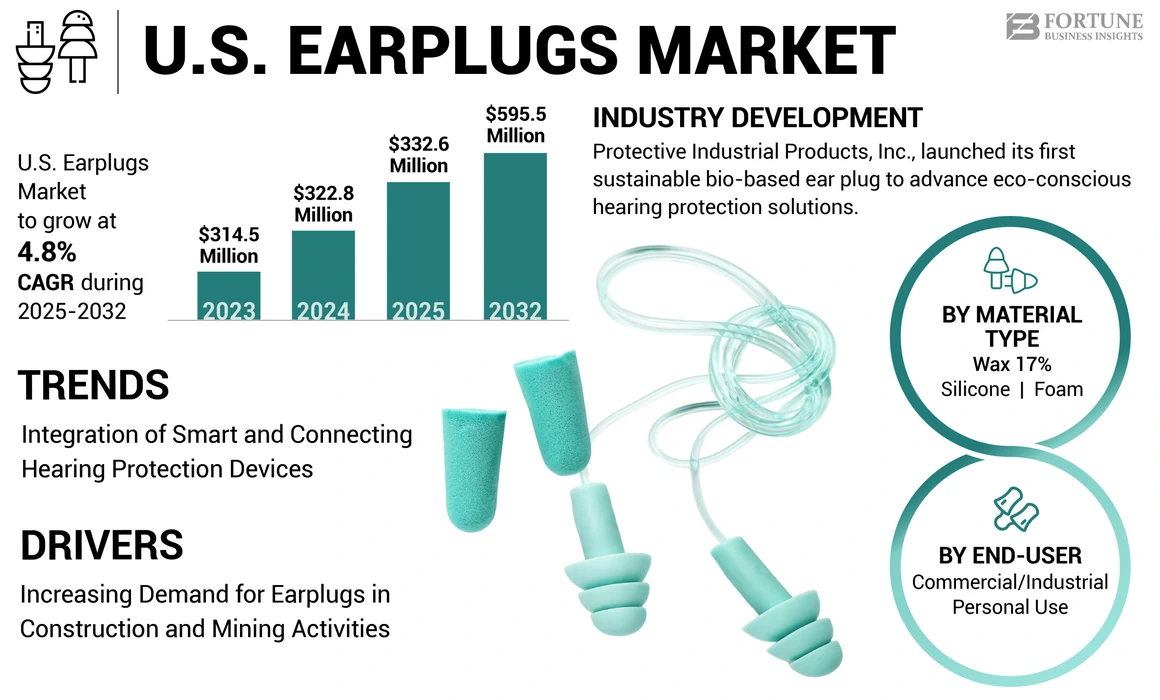

The U.S. earplugs market size was valued at USD 322.8 million in 2024. The market is projected to grow from USD 332.6 million in 2025 to USD 595.5 million by 2032, exhibiting a CAGR of 4.8% during the forecast period.

An earplug is a small device designed to be injected into the ear canal to guard the ears from foreign objects, loud noises, or water. They are usually prepared of silicone, wax, and foam and come in numerous forms and sizes to fit diverse ear canal sizes comfortably. Earplugs are often used in environments where exposure to loud noise can potentially damage hearing, such as concerts, construction sites, or while operating noisy machinery.

They are also used for swimming to prevent water from entering the ear canal, reducing the risk of infections. Additionally, some people use these to help them sleep by blocking out ambient noise. They are made of three material types: silicon, wax, and foam. As per the requirement of the end-user, these can be available in variations such as flanged and custom molded for any material type and are also sold by the suppliers.

Additionally, there is an increasing demand for custom-molded earplugs that are mainly used by musicians, swimmers, motorcycle riders, hunters, and shooters to prevent hearing loss caused by prolonged exposure to loud sounds. They are made in a laboratory with the help of molds taken by experienced and trained audiologists. They can acquire any unusually shaped ear and can provide 25 to 30 dB of noise reduction. They are also able to lower the noise by inserting filters for more care and attention.

The outbreak of the COVID-19 pandemic has negatively affected the growth of the market due to halted production and supply-chain disruption. The U.S., Germany, Italy, the U.K., and China significantly reduced market share due to prolonged lockdowns all over the world, including major end-users. The disruption of supply chains and production in the U.S., was a result of preventive measures taken by different industries to control the spread of coronavirus, resulting in reduced demand for earplugs within that country.

IMPACT OF HEARING PROTECTION FIT-TEST SYSTEM

A Hearing Protection Fit-Test System is a tool or apparatus used to assess the effectiveness of Hearing Protection Devices (HPDs) worn by individuals in noisy environments. These systems are designed to measure the level of noise attenuation provided by the HPDs and ensure they are correctly fitted to the wearer's ears. The fit-test process typically involves placing microphones inside the ear canal, either directly or using specialized earplugs or earmuffs equipped with microphones.

These microphones measure the sound levels inside the ear both with and without the hearing protection device in place. By comparing these measurements, the system can determine the amount of noise reduction achieved by the HPD and assess its effectiveness in protecting the wearer's hearing.

Companies are majorly involved in manufacturing these hearing protection fit test systems as they offer several advantages in various settings where noise exposure is a concern.

- For instance, Honeywell provides their VeriPRO™ Fit Testing System, consisting of a process which is in three-part that ensures the efficiency of a worker’s ear plug fit in each ear over a range of frequencies. The safety manager can then view this information in individual reports.

Nowadays, this system plays a crucial role in safeguarding workers' hearing health, promoting regulatory compliance, and fostering a safer and more productive work environment.

U.S. Earplugs Market Trends

Integration of Smart and Connecting Hearing Protection Devices to Boost the Demand of the Market

The smart & connected earplugs are mainly used to build communication and protect against hearing damage, along with providing real-time warnings to enhance the situational awareness of the workers in noisy and challenging environments.

- For instance, according to the World Health Organization (WHO) Report 2024, by 2050, nearly 2.5 billion people are expected to suffer from hearing loss. A minimum of 700 million people will need hearing aids and Hearing Protection Devices (HPD) rehabilitation.

The growing integration of smart and connecting technology helps to mute the high impulse noise across mining and military sectors to improve the ambient sound necessary for situational awareness. This factor brings advancements in technology and increases investments in research and development activities by the market's key players to develop smart HPDs, which helps boost sound quality. Hence, all these factors contribute to the U.S. earplugs market growth.

Download Free sample to learn more about this report.

U.S. Earplugs Market Growth Factors

Increasing Demand in Construction and Mining Activities to Bolster Market Growth

Mining and construction industries use noisy equipment, machinery, and tools, such as jackhammers and diggers, to perform underground construction activities, including underground coal transport, wall mining, blasting, shaft sinking, roof bolting, and others. Approximately 61% of all workers in the mining industry have been exposed to hazardous noise levels at work, which can cause hearing damage to employees.

The construction and mining industries use machinery and equipment that makes noise above 75 dB and ranges up to 120 dB. It results in workers' hearing loss and can cause Noise-Induced Hearing Loss (NIHL) in a short time. These are portable, lightweight, and easy to use, making them comfortable and convenient for workers to use for a longer time. They can be worn under safety helmets, safety glasses, and other protection equipment used across these industries, further driving the U.S. earplugs market share.

RESTRAINING FACTORS

Availability of Substitutes in the Industry to Hamper Market Growth

The need for Hearing Protection Devices (HPD) made with specific materials and features differs from the typical industry standards. Many substitutes are available for earplugs to protect the hearing ability of the user or worker and reduce the Noise Reduction Rating (NRR). Furthermore, various alternative Hearing Protection Devices (HPD) cannot be used for sleep, explosives, workplaces, music concerts, swimming, or other purposes. However, the performance of each alternative is different. Hence, the presence of a large number of substitutes for the earplugs restricts the market growth.

U.S. Earplugs Market Segmentation Analysis

By Material Type Analysis

Silicon Material to Dominate the Market Due to Its Reusable Feature

Based on material type, the market is classified into silicone, wax, and foam.

As per the analysis, the silicone segment holds the largest market share in the U.S. These are reusable and can be cleaned and stored for multiple uses. They offer a comfortable fit and are often favored by individuals who find foam earplugs uncomfortable or need a more durable option. Silicone is also suitable for swimming as it creates a watertight seal in the ear canal, preventing water from entering and reducing the risk of ear infections.

Moreover, the foam segment is anticipated to gain a major CAGR during the forecast period, followed by silicon. These are highly effective at reducing noise levels due to their ability to expand and conform to the shape of the ear canal, creating a tight seal. This allows them to provide a high level of noise reduction, making them popular choices for individuals seeking strong noise attenuation.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Commercial/Industrial to Lead the Market Due To Safeguarding Workers' Hearing Health

Based on end-user, the market is divided into personal use and commercial/industrial.

The commercial/industrial segment is expected to grow with the highest CAGR during the forecast period. The industrial utilization of earplugs in the U.S. is crucial in safeguarding workers' hearing health and preventing noise-induced hearing loss in noisy occupational environments.

The personal use segment holds a major market share due to its excessive usage in sleeping, concerts and events, workouts, studying and concentration, motorcycling and motorsports, and water activities.

COUNTRY INSIGHTS

Based on geography, the market is studied across the West, South, Middle West, and Northeast.

The earplugs market in the U.S. has been experiencing balanced growth. The growth is driven by the growing awareness about the risks of noise-induced hearing loss in various sectors, such as manufacturing, construction, entertainment, and healthcare, leading to an increased demand for hearing protection.

Additionally, stringent occupational safety regulations mandating the use of hearing protection equipment in noisy work environments have boosted the demand among workers in industries such as construction, manufacturing, and aviation, further contributing to the earplugs market growth in the U.S.

Moreover, the South region in the U.S. is anticipated to depict a substantial CAGR market share. The growth is attributed to the wide presence of various industries, such as manufacturing, construction, and oil and gas, which often have high noise exposure levels. As a result, there is a greater demand for these hearing devices to protect hearing among workers in these industries. This industrial presence drives sales in the region.

KEY INDUSTRY PLAYERS

Manufacturers Focus on Providing Various Earplugs Drives Market Growth

The market is identified as a highly competitive market with the presence of multiple players operating at a global level and certain regional levels where the domestic players have a substantial stay in the market share. Companies such as 3M Global, Honeywell International Inc., Loop BV, Kardex Group, EARGASM, and Lucid Hearing Holding Company, LLC cover a significant market share in the U.S. These companies are known for providing various electronic and non-electronic earplugs.

- For instance, 3M offers PELTOR™ Electronic Earplug and EEP-100 that are only used for industrial purposes.

- In 2018, Lucid Hearing Holding Company, LLC acquired Etymotic Research, which enhanced its portfolio with the addition of earplugs.

List of Top U.S. Earplugs Companies:

- 3M Global (U.S.)

- Honeywell International Inc. (U.S.)

- Loop BV (Belgium)

- UVEX SAFETY GROUP (Germany)

- Radians, Inc. (U.S.)

- Alpine Hearing Protection (U.S.)

- Moldex-Metric, Inc. (U.S.)

- EARGASM (U.S.)

- Lucid Hearing Holding Company, LLC. (ETYMOTIC) (U.S.)

- Liberty Safety (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Protective Industrial Products, Inc., a key provider of Personal Protective Equipment (PPE), launched its first sustainable bio-based ear plug to advance eco-conscious hearing protection solutions.

- February 2023: Logitech, a Swiss keyboard, mouse, and computer accessory provider, launched Logitech G Fits, its first pair of gaming-grade wireless earbuds that combines lightform molding technology for perfect fit and professional-grade LIGHTSPEED wireless connectivity. These wireless earbuds deliver gaming-grade audio performance when connected to PlayStations, PCs, Macs, and mobile devices.

- May 2023: EARPEACE, a high-fidelity earplug manufacturer, partnered with NEXX Helmets to develop a co-branded hearing protection product line for motorcycle riders to ensure safety. The helmet, in combination with earplugs, helps to protect the rider from noise-induced hearing loss (NIHL) by providing hearing protection.

- March 2021: Honeywell International Inc. launched a new earplug dispenser named “Honeywell HL400 Antimicrobial-Protected Dispenser” that has been sanitized with an antibacterial addictive ingredient to fulfill the operation safety needs of the employees.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.8% from 2025 to 2032 |

|

Unit |

Value (USD Million) and Volume (Thousand Units) |

|

Segmentation |

By Material Type

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the U.S. earplugs market is projected to reach USD 595.5 million by 2032.

In 2024, the market was valued at USD 322.8 million.

The market is projected to grow at a CAGR of 4.8% during the forecast period.

The end-user segment is expected to lead the market.

Increasing demand in construction and mining activities to bolster the market growth

3M Global, Honeywell International Inc., Loop BV, UVEX SAFETY GROUP, Radians, Inc., Alpine Hearing Protection, Moldex-Metric, Inc, EARGASM, Lucid Hearing Holding Company, LLC. (ETYMOTIC), and Liberty Safety are some of the leading companies in the market.

The South region in the U.S. market holds the highest market share.

The silicon material type segment dominates the market due to its reusable feature.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us