U.S. Epinephrine for Anaphylaxis Treatment Market Size, Share & Industry Analysis, By Product Type (Autoinjectors, Prefilled Syringes, and Others), By Type (Branded and Generics), By Distribution Channel (Hospitals Pharmacies and Online & Retail Pharmacies), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

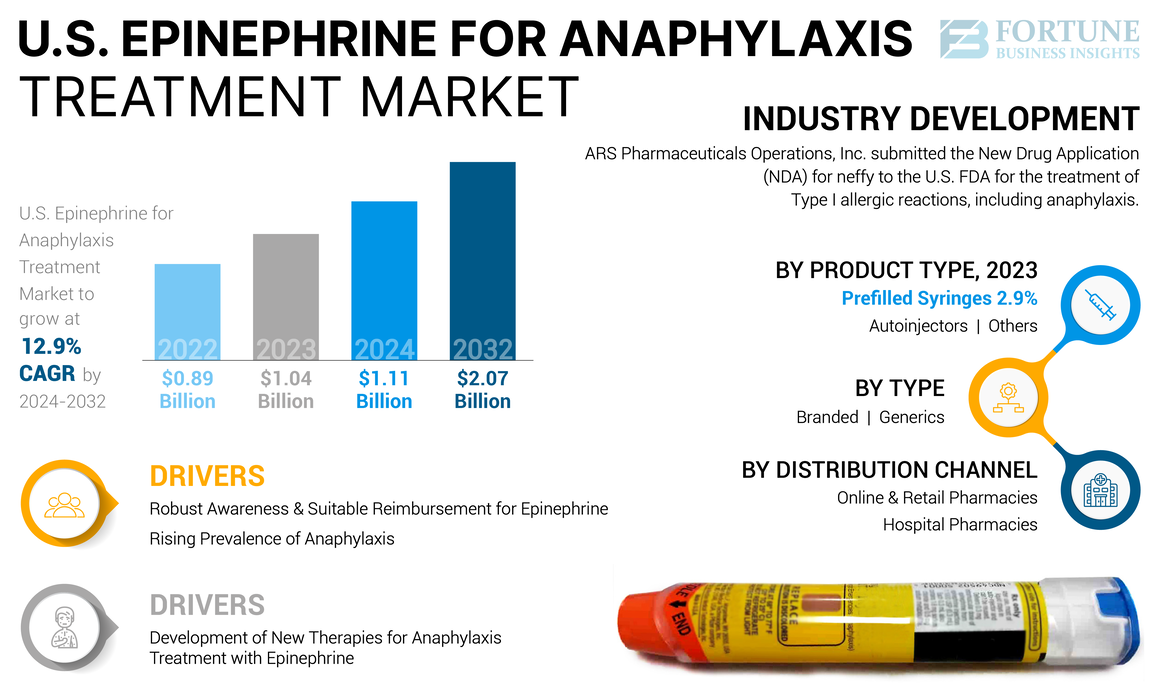

The U.S. epinephrine for anaphylaxis treatment market size was USD 1.04 billion in 2023. The market is expected to grow from USD 1.11 billion in 2024 to USD 2.07 billion by 2032, exhibiting a CAGR of 12.9% during the forecast period.

Anaphylaxis is an acute, life-threatening allergic reaction that occurs rapidly after exposure to an allergen, such as peanuts, food, insect stings, medication, or latex. The symptoms include difficulty in breathing, swelling of the throat, hives, hypotension, and loss of consciousness. Immediate treatment of these conditions with epinephrine products is necessary to counteract these symptoms. Without prompt treatment, anaphylaxis can lead to shock, cardiac arrests, or even death of the patient. Thus, to avoid these conditions, epinephrine acts as an emergency treatment option for anaphylaxis and is expected to boost the growth of the market.

Furthermore, the rising number of allergy and anaphylaxis cases in the U.S. is driving the growth of the market.

- According to the Asthma and Allergy Foundation of America, more than 100.0 million people in the U.S. experience various types of allergies each year. Nearly 1 in 3 adults and more than 1 in 4 children have a seasonal allergy, eczema, or food allergy. Thus, the rising number of allergies leads to the increased demand for epinephrine, boosting the market growth.

Moreover, rising healthcare expenditure in the country and increasing government and private awareness programs for anaphylaxis detection and management to drive market growth. Also, the presence of key players in the market with technologically advanced product offerings and rising research initiatives between the companies to offer convenient treatment methods for anaphylaxis is boosting the U.S. epinephrine for anaphylaxis treatment market growth.

- For instance, in August 2024, ARS Pharmaceuticals Operations, Inc. announced the U.S. Food and Drug Administration (FDA) approval of neffy (epinephrine nasal spray) 2 mg for treatment of Type I Allergic Reactions, including anaphylaxis in adults and children. Such approvals and launches promote the growth of the market in the U.S.

The U.S. market for epinephrine for anaphylaxis treatment was negatively impacted during the COVID-19 pandemic. The sudden rise in COVID-19 patients resulted in a decrease in the number of patient visits for anaphylaxis conditions. Also, a decrease in the number of hospital admissions during the pandemic led to a reduction in the number of prescriptions for anaphylaxis treatment.

Moreover, the COVID-19 pandemic negatively impacted the sales of these products in the U.S. The number of patient visits and company revenue returned to its pre-pandemic growth levels in 2021, and it was normalized completely in 2022 and 2023. It is expected to attain robust growth during 2024-2032.

U.S. Epinephrine for Anaphylaxis Treatment Market Trends

Development of New Therapies for Anaphylaxis Treatment with Epinephrine is Prominent Trend

In recent years, one of the significant U.S. epinephrine for anaphylaxis treatment market trends is the increasing development of drug delivery systems for anaphylaxis treatment.

Although to fulfill the growing demand for quick and accurate treatment of anaphylaxis, there is a shift in the focus of researchers and market players on launching new delivery systems for epinephrine for quick and easy use.

However, currently, epinephrine prefilled syringes and autoinjectors are available in the U.S., but fear of needles and inaccurate release of dose may deplete the patients' conditions. Thus, to overcome such problems, there are rising initiatives by the key players to launch needle-free, portable, easy-to-use formulations for the emergency treatment of anaphylaxis in the U.S.

- For instance, in July 2024, Aquestive Therapeutics, Inc. announced positive topline pharmacokinetic data from the self-administration study of Anaphylm (epinephrine) Sublingual Film. If approved by the United States Food and Drug Administration (FDA), Anaphylm will be the first and only non-invasive, orally delivered epinephrine for the treatment of severe life-threatening allergic reactions, including anaphylaxis.

Such clinical trials and regulatory approvals for the new and advanced delivery options for epinephrine are expected to become a prominent trend in the market.

Download Free sample to learn more about this report.

U.S. Epinephrine for Anaphylaxis Treatment Market Growth Factors

Rising Prevalence of Anaphylaxis to Propel Market Growth

The primary factor driving the U.S. epinephrine for anaphylaxis treatment market growth is the rising prevalence of anaphylaxis and allergy. The extensive increase in the number of allergy cases that eventually lead to anaphylactic shock raises the demand for accurate and quick-onset treatment to decrease the need for hospitalizations.

- According to the Asthma and Allergy Foundation of America, a study was published in the Journal of Allergy and Clinical Immunology (JACI). It was found that anaphylaxis, a life-threatening allergic reaction, is common in the U.S. and occurs in about one in 50 Americans and probably closer to one in 20.

Furthermore, an upsurge in chronic diseases such as cardiovascular diseases also increases the symptoms of anaphylaxis, and the rising prevalence of Cardiovascular Disease (CVD) in the U.S. is also increasing the number of anaphylaxis cases in the region. Such conditions require epinephrine treatment to reduce the chronic symptoms associated with the diseases and thus drive the growth of the epinephrine for anaphylaxis treatment market.

Robust Awareness and Suitable Reimbursement for Epinephrine to Boost Market Growth

Many governments and organizations, both public and private, are striving to spread awareness about allergies and anaphylaxis among the population. These initiatives educate people on how to detect the early signs of anaphylaxis and how to manage the conditions by using epinephrine injectors.

- For instance, the KeepSmilin4Abbie Foundation helps to detect the early signs of anaphylaxis to enable early intervention to save millions of people from sudden death due to anaphylaxis. Such programs and foundations are anticipated to augment the overall growth in the epinephrine for anaphylaxis treatment market.

Additionally, an increase in government support by offering reimbursement coverage on epinephrine to reduce the economic burden of anaphylaxis is expected to propel the growth of the market.

RESTRAINING FACTORS

Product Recalls and Device Failure for Epinephrine Injectors May Hinder Growth Prospects

In recent years, the rising demand for epinephrine for anaphylaxis treatment has increased the product launches to fulfill the demand. However, the market has faced challenges, such as product recall of devices due to manufacturing defects and inadequate dosage delivery. Some adverse events were reported for the devices that can lead to their reduced adoption.

- For instance, in March 2022, DMK Pharmaceuticals, formerly known as Adamis Pharmaceuticals Corporation, voluntarily recalled certain lots of SYMJEPI (epinephrine) Injections of 0.15 mg (0.15 mg/0.3 mL) and 0.3 mg (0.3 mg/0.3 mL) Prefilled Single-Dose Syringes due to potential clogging of the needle preventing the dispensing of epinephrine. Such product launches hampered consumer trust and product adoption in the market.

Such product recalls and warnings associated with epinephrine injectors are affecting consumers' trust and limiting the adoption of products and the growth of the epinephrine for anaphylaxis treatment market in the U.S.

U.S. Epinephrine for Anaphylaxis Treatment Market Segmentation Analysis

By Product Type Analysis

Increasing Anaphylaxis Prevalence Leads to Growth of Autoinjectors

The market segmentation based on product type is divided into autoinjectors, prefilled syringes, and others.

The autoinjectors segment dominated the U.S. market in the product type segment. The segment is growing at a significant CAGR during the forecast period. The high share of the segment is due to the benefits associated with the epinephrine autoinjectors for immediate treatment of anaphylaxis reactions. It is user-friendly and rapidly delivers medication at the correct dose, which decreases the risk of dosing errors.

Moreover, major players in the U.S. market are focusing on manufacturing epinephrine autoinjector pens for anaphylaxis treatment. Such scenarios boost the growth of the segment in the market.

- For instance, in November 2018, Teva Pharmaceutical Industries Ltd. released limited doses of the FDA-approved generic version of EpiPen 1 Autoinjector, 0.3 mg, in the U.S. market.

The prefilled syringes segment held a substantial share of the market due to the rising number of emergency hospitalizations associated with anaphylaxis and an increasing number of prescriptions of epinephrine for anaphylaxis treatment in the U.S. Additionally, the rising number of patients in the emergency department leading to the increased demand for accurate and measured doses of epinephrine, offer convenience to healthcare professionals.

- For instance, according to the Drug Usage Statistics, the U.S., 2013 – 2022, estimated that the number of patients in the U.S. on epinephrine treatment was 992,912 in 2022. Such a large number of patients is expected to propel the growth of the segment.

The others segment held a minimum share of the market. The growth of the segment is attributed to rising research and development activities amongst the key players in the market to launch advanced drug delivery options for epinephrine in the emergency treatment of anaphylaxis.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Generic Autoinjectors Hold Leading Position Due to their Rising Approvals

Based on type, the market is bifurcated into branded and generics.

The generics segment held the dominant U.S. epinephrine for anaphylaxis treatment market share in 2023. The dominant share of the segment is due to the patent expiration of branded drugs in the market. Moreover, increasing demand for cost-effective treatment for anaphylaxis is also propelling the demand for generic medications in the country. Additionally, the presence of well-established generic players in the market, along with regulatory approvals and product launches, boosted the segment’s growth.

The increasing collaboration between regulatory bodies and pharma companies to manufacture safe and effective generics is expected to propel the growth of the segment.

- For instance, the U.S. Food and Drugs Administration (FDA) under the Generic Drug Program in 2022 is actively engaged in collaboration with regulatory authorities around the world to harmonize standards for the development of safe, effective, high-quality generic medicines.

The branded segment holds a considerable share of the market and is expected to grow during the forecast period. The growth of the segment is due to the rising demand for effective treatment for anaphylaxis after the onset of the reaction, and the increasing number of patients with allergies in the U.S. Additionally, strong research and development expenditure leading toward the expansion of the patented products for anaphylaxis treatment in the country is expected to propel the growth of the segment.

By Distribution Channel Analysis

Strong Preference to Online & Retail Pharmacies for Epinephrine Injectors to Aid Segmental Growth

Based on distribution channel, the market is segmented into online & retail pharmacies and hospital pharmacies.

The online & retail pharmacies held a dominant share of the U.S. market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth of the segment is due to the presence of a majority of prescription drugs in these channels, as well as ease of availability, support services, and convenience to the patients. Additionally, increasing collaboration activities among online and retail pharmacies and manufacturing companies are bolstering the growth of the segment in the market.

- For instance, in July 2019, Walgreens collaborated with Kaléo to announce the availability of AUVI-Q (epinephrine injection, USP) 0.1 mg autoinjector in Walgreens stores across the country. As part of this partnership, Walgreens became the first national retail pharmacy to carry the full range of AUVI-Q autoinjectors, which also includes the 0.3 mg and 0.15 mg doses.

The hospital pharmacies segment held a substantial share of the U.S. market in 2023. The growth of the segment is due to the rising number of hospitalizations in the emergency department for anaphylaxis treatment. Moreover, the high flow of patients suffering from anaphylaxis in hospitals and adequate reimbursement policies awarded by hospitals in the country are boosting the growth of the segment.

Additionally, the increasing number of prescriptions of epinephrine prescribed by medical professionals is boosting the growth of facilities such as hospital pharmacies in the U.S. market.

- For instance, according to ClinCalc LLC, Drug Usage Statistics, U.S, in 2022, the estimated number of prescriptions for epinephrine prescribed in the U.S. is 1,458,094. Such a large number of prescriptions boosted the growth of the segment.

KEY INDUSTRY PLAYERS

Presence of Strong Generic Product Portfolio by Teva Pharmaceutical Industries Ltd. to Expand their Market Position

The competitive landscape of the market reflects a consolidated structure. Teva Pharmaceutical Industries Ltd. held a significant position in the U.S. market in 2023 due to its established brand presence and the strong availability of generic products in the market. Moreover, the strategic activities of key players propel the market expansion.

Viatris Inc., Amneal Pharmaceuticals LLC, ALK-Abelló A/S, Kaleo, and ARS Pharmaceuticals Operations, Inc. are also some of the other key players in terms of market share. The rising focus of the companies on the introduction of innovative products with specific strategic initiatives and gaining approvals are anticipated to boost their presence in the U.S. market during the forecast period.

LIST OF TOP U.S. EPINEPHRINE FOR ANAPHYLAXIS TREATMENT COMPANIES:

- Viatris Inc., (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Adamis Pharmaceuticals LLC. (Canada)

- Amneal Pharmaceuticals LLC (U.S.)

- DMK Pharmaceuticals (U.S.)

- ALK-Abelló A/S (Denmark)

- ARS Pharmaceuticals Operations, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: ARS Pharmaceuticals Operations, Inc. submitted the New Drug Application (NDA) for neffy (epinephrine nasal spray) to the U.S. FDA for the treatment of Type I allergic reactions, including anaphylaxis.

- March 2023: American Regent launched sulfite-free Epinephrine Injection, USP, used as an emergency treatment for allergic reactions (Type I), including anaphylaxis.

- May 2020: DMK Pharmaceuticals and USWM, LLC., agreed to grant commercial rights to USWM, LLC., for the distribution and commercialization of the SYMJEPI epinephrine injection.

- November 2018: Teva Pharmaceutical Industries Ltd. released limited doses of the FDA-approved generic version of EpiPen 1 Autoinjector, 0.3 mg, in the U.S. market.

REPORT COVERAGE

The report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. In addition to this, it comprises the value, volume, size, and share of the segment. Also, the report provides information related to anaphylaxis prevalence and technological advancements, key industry developments and new product launches. Furthermore, the impact of COVID-19 pandemic, as well as a detailed company profile and the industry overview are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) and Volume (Million Units) |

|

Growth Rate |

CAGR of 12.9% from 2024-2032 |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 1.04 billion in 2023 and is projected to record a valuation of USD 2.07 billion by 2032.

The market is expected to exhibit a CAGR of 12.9% during the forecast period of 2024-2032.

Based on product type, the autoinjectors segment is projected to lead the market.

The increasing prevalence of anaphylaxis and a rise in awareness are expected to drive the market growth.

The development of new therapies for anaphylaxis treatment is the key trend in the market.

Viatris Inc. and Teva Pharmaceutical Industries Ltd. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us