U.S. Faucet Market Size, Share & COVID-19 Impact Analysis, By Type (Pull Out, Pull Down, Bar, Motion Detection, Separate Spray, and Others), By Material Type (Brass, Stainless Steel, Chrome, Plastics, and Others), By Install Type (Wall Mounted and Deck Mounted), By Functionality (Manually Operated, Touchless, and Hybrid), By Application (Bathroom and Kitchen), By End-user (Commercial/Industrial and Residential), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

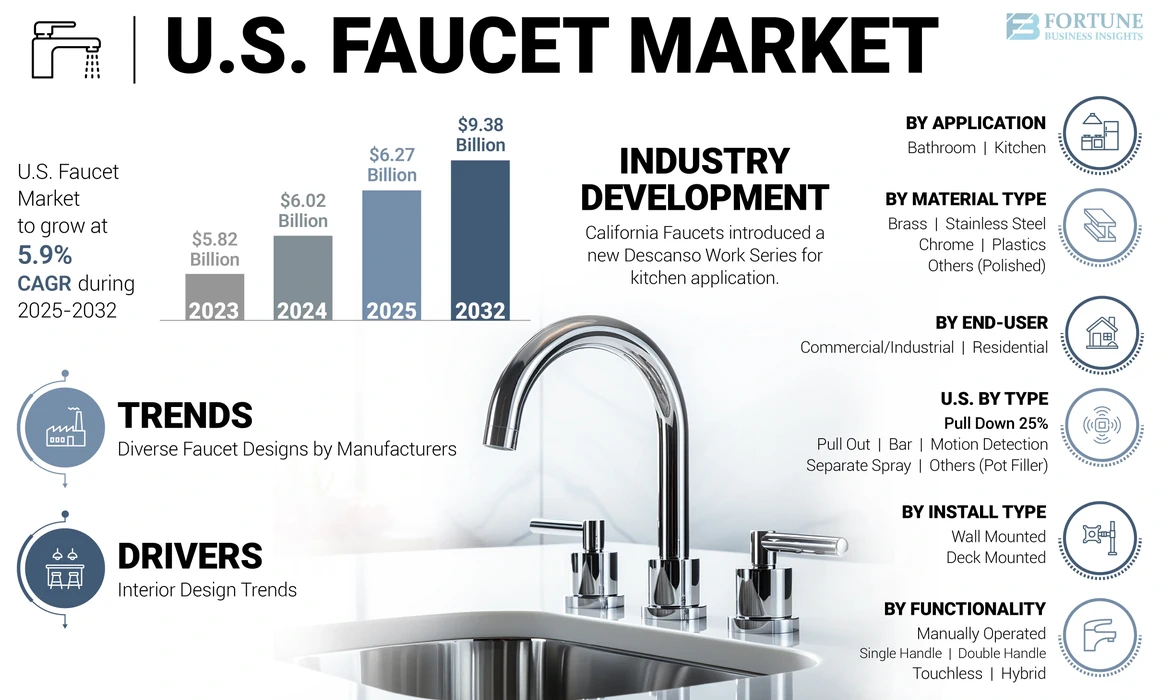

The U.S. faucet market size was valued at USD 6.02 billion in 2024. The market is projected to grow from USD 6.27 billion in 2025 to USD 9.38 billion by 2032, exhibiting a CAGR of 5.9% during the forecast period.

A faucet is a plumbing fixture used to control the flow of water, designed to regulate the release of water from plumbing systems. It finds application in residential, commercial, and industrial spaces.

A thriving construction industry, marked by increased housing projects and infrastructure development, directly impacts the demand for such products. Additionally, investment for the expansion of residential and commercial construction spending in the U.S. is one of the important factors for market growth. For instance, according to the U.S. Census Bureau, residential construction investment increased by 59% from May 2020 to May 2022. Additionally, rising aesthetic preferences and interior design trends influence the choice of materials and finishes for such systems. The variety of available finishes allows consumers to align their system choices with the broader design theme of their homes. For instance, April 2022 marked Gerber Plumbing Fixtures' expansion of the Satin Black finish, offering nearly 50 new items for luxurious bathrooms and kitchen designs.

COVID-19 IMPACT

COVID-19 Pandemic Negatively Impacted Market Growth Due to Complete Closure of Manufacturing Facilities

The pandemic triggered widespread disruptions in U.S. supply chains. Factories and manufacturing facilities faced closures or reduced capacities, and transportation of goods was hampered. These challenges directly affected the production and distribution of these products, potentially leading to delays, shortages of inventory, and increased manufacturing costs. The construction and real estate sectors experienced fluctuations during the pandemic. This uncertainty in the construction industry directly impacted the demand for construction-related products, including products used in new projects or renovations. All the above-aforementioned factors restricted the U.S. faucet market growth.

Various manufacturers are providing products through numerous distribution channels, such as online and offline. The acceleration of online shopping led companies to enhance their e-commerce capabilities. Manufacturers and retailers invested in user-friendly online platforms, digital marketing, and improved customer service to reach consumers who were increasingly turning to online channels.

However, post COVID-19 impact with heightened awareness of health and hygiene, some companies pivoted their product lines to include items related to health and wellness. This includes products with touch-free technology or products emphasizing water conservation. For instance, In January 2022, Moen introduced smart faucets with hands-free operation, allowing users to control temperature and flow through gestures. All such factors are expected to contribute positively to market growth during the forecast period.

U.S. Faucet Market Trends

Diverse Faucet Designs by Manufacturers to Fuel Market Growth

Manufacturers are expanding their product lines to include a wide range of styles, finishes, and configurations. Design diversity in the market is driven by the recognition that consumers have diverse tastes and preferences when it comes to home aesthetics. This includes modern and minimalist designs with clean lines, as well as classic or traditional styles that evoke a timeless appeal. Also, major players are introducing new technological advancements in such products with special designs, including metal and polished materials, to attract more consumer demand. For instance, in 2022, Blanco unveiled new functional accessories and finishes, including the addition of Satin Gold and Black to their metal selection. All such factors are the key trends for the market.

Download Free sample to learn more about this report.

U.S. Faucet Market Growth Factors

Interior Design Trends to Propel Expansion of Market Landscape

Faucets are crucial design elements in kitchens and bathrooms. Changing interior design trends, such as a shift toward modern or vintage aesthetics, drive demand for specific system styles, finishes, and designs. They play a crucial role in enhancing the overall aesthetic appeal of kitchens and bathrooms. Interior design trends are often influenced by popular culture, including architectural movements, lifestyle changes, and media representations. For instance, design elements featured in home improvement shows or social media platforms can quickly become popular, impacting consumer preferences for these products. Several manufacturers must stay attuned to the ever-evolving world of design to meet consumer expectations and offer products that align with contemporary styles and preferences. All such factors drive market growth.

RESTRAINING FACTORS

Stringent Regulations to Halt Growth of the Market

Compliance with water efficiency sensor regulations is a significant challenge for manufacturers. Governmental bodies, at both federal and state levels, often introduce and enforce standards aimed at reducing water consumption. Manufacturers must invest in research and development to design products that meet these regulations. This can result in increased production costs as well as potential constraints on design flexibility. Striking a balance between regulatory compliance and delivering products that meet consumer preferences becomes crucial for success in the market.

U.S. Faucet Market Segmentation Analysis

By Type Analysis

360° Rotation, Touchless Technology, and Ease of Installation Propel Pull Out Segment's Market Expansion

Based on type, the market is classified into pull out, pull down, bar, motion detection, separate spray, and others.

As per our analysis, in the year 2024, the pull out segment dominated the market in terms of revenue share and is projected to grow with the highest share during the forecast period due to various features associated with these products, such as the ability to rotate in 3600, having touch & touchless technology, and easy to install & maintain.

Bar, pull down type, motion detection, and separate spray segments are projected to grow with potential growth due to being commonly used in kitchen areas for rinsing and cleaning dishes. Along with this, they found applications in cafes, restaurants, and quick-service restaurants. Additionally, growing demand from bathroom and kitchen applications contributes positively to the U.S. faucet market share.

To know how our report can help streamline your business, Speak to Analyst

By Material Type Analysis

Stainless Steel Faucets Witness High Growth Due to Corrosion Resistance and Robustness

Based on material type, the market is segmented into brass, stainless steel, chrome, plastics, and others.

According to our analysis, in 2024, the stainless steel segment dominated the market in terms of revenue market share and is projected to experience high growth during the forecast period. This growth can be attributed to features such as durability, resistance to corrosion, robustness, and aesthetic appeal. Stainless steel faucets are widely used in both bathroom and kitchen applications.

Brass, plastic, polished, and chrome products are projected to experience significant growth during the forecast period due to features such as reflective surfaces, cost-effectiveness, and suitability for both traditional and modern kitchen designs. Additionally, they are available in various customizable sizes, which further fuels market growth.

By Install Type Analysis

Wall-Mounted Faucets Projected for Strong Growth, Offering Clean Appearance and Easy Installation

Based on install type, the market is classified into wall mounted and deck mounted.

In 2024, the wall-mounted segment dominated the market in terms of revenue share and is anticipated to experience the highest growth during the forecast period. This is attributed to its installation on the wall rather than the sink or countertop. Additionally, it offers features such as a clean and aesthetic appearance, along with ease of installation.

The deck-mounted segment is projected to experience significant growth due to its availability in various customizable sizes, finishes, and styles. Additionally, it is widely used in both commercial and bathroom aesthetics. It is suitable for both new construction and renovation projects. Regular cleaning and occasional checks for leaks or loose parts are recommended to ensure proper functionality. All these factors contribute to the growth of the market.

By Functionality Analysis

Manual Faucets Maintain Market Lead with Touchless and Hybrid Options in Pursuit

Based on functionality, the market is segmented into manually operated, touchless, and hybrid.

In 2024, the manually operated segment dominated the market in terms of revenue market share, followed by touchless and hybrid options. This is due to the rising demand from both residential and commercial sectors.

Touchless products are anticipated to experience significant growth, driven by their enabled sensors and applications in both commercial and residential settings. This technology utilizes sensors to detect motion and activate water flow, typically powered by batteries or electric sources. Hybrid products, combining both manual operation and touchless technology, are expected to grow moderately during the forecast period, benefiting from the increasing adoption of touchless systems alongside traditional manual options.

By Application Analysis

Bathroom Segment Primed for Growth with Focus on Residential and Commercial Sectors

Based on application, the market is segmented into bathroom and kitchen.

In 2024, the bathroom segment dominated the market in terms of revenue share and is projected to experience the highest growth during the forecast period, driven by increasing government investments in the expansion of residential and commercial sectors.

The kitchen segment is anticipated to grow moderately, owing to increased investment in residential and commercial restaurants, which enhances the demand for such systems to control water flow. Additionally, the market's growth is attributed to factors such as growing urbanization, rising customer preference for functional kitchens, and increasing renovation activities across the U.S. geography to boost the market growth.

By End-user Analysis

Residential Construction and Renovation Activities Propel Residential Segment Forward

Based on End-user, the market is segmented into commercial/industrial, and residential.

In 2024, the residential segment dominated the market in terms of revenue market share and is anticipated to maintain its dominance during the forecast period, owing to growing investments in residential construction and renovation activities.

Additionally, consumer preferences for aesthetically and stylish products are changing to enhance the overall look of kitchens and bathrooms across commercial restaurants, cafes, coffee studios, the manufacturing sector, and kitchen premises. Along with this, the industrial sector should be designed for easy maintenance. Quick and accessible components allow for efficient repairs or replacements, minimizing downtime in industrial processes.

COUNTRY INSIGHTS

The market in the U.S. is growing due to various factors, such as urbanization, renovation activities, and increasing construction-related activities across the country driving market growth. Increasing residential and construction-related activities across both residential and non-residential sectors enhance the demand for such products in the commercial sector. These factors have contributed positively to the growth of the market. Additionally, government spending on new residential and commercial buildings across the U.S. is increasing, which further boosts the demand for such products in the bar, kitchen, and bathroom sectors.

Key Industry Players

Key Players Embrace Strategic Initiatives to Enhance Market Presence and Product Offerings

Key players such as Fortune Brands Innovations, Geberit, Globe Union Industrial Corp, and Delta Faucet Company, among others, are engaged in adopting acquisitions, business expansions, collaborations, and product launches as core strategies to improve their product portfolios and expand into diversified geographic locations.

For instance, in November 2023, Zurn Elkay Water Solutions, a supplier of Elkay, launched an extension of its Crosstown Series products into the market. These products are made of stainless steel material and are more suitable for residential spaces. They are available in two sizes, 5” and 6”, and feature long-lasting, robust, and high-performance characteristics. Such factors drive market growth.

LIST OF TOP U.S. FAUCET COMPANIES:

- Geberit (Chicago Faucets) (Switzerland)

- Fortune Brands Innovations (Moen Incorporated) (U.S.)

- Globe Union Industrial Corp (Gerber Plumbing Fixtures) (Taiwan)

- Lixil Corporation (American Standards Brands) (Japan)

- Masco Corporation (Delta Faucets Company) (U.S.)

- California Faucets (U.S.)

- Jaclo (U.S.)

- Kohler Co. (U.S.)

- Pfister Faucets (U.S.)

- Sloan Valve Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: California Faucets introduced a new Descanso Work Series for kitchen applications. It is wall-mounted and features polished material, cost-effectiveness, and double-handle products. It finds wide usage in both residential and commercial spaces.

- May 2023: Fortune Brands acquired Emtek & Schaub to enhance its product portfolio in hardware and plumbing products. The acquisition was completed for approximately USD 800 million.

- December 2022: Lixil Corporation acquired Basco, a U.S.-based company specializing in plumbing fixtures and sanitation products. The primary aim of this acquisition was to expand the product portfolio for bathroom and kitchen applications.

- July 2022: California Faucets introduced a new bath collection product for bathroom applications. It features double-handle technology and an attractive design.

- January 2022: Moen Incorporated introduced smart technology with hands-free operation, enabling users to control temperature and flow through gestures.

REPORT COVERAGE

The report methodology covers a detailed depth analysis of the type, material type, install type, functionality, application, and end-user. It provides information about leading players in such product and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Material Type

By Install Type

By Functionality

By Application

By End-user

|

Frequently Asked Questions

The market is projected to reach USD 9.38 billion by 2032.

In 2024, the market was valued at USD 6.02 billion.

The market is projected to grow at a CAGR of 5.9% during the forecast period.

The pull out segment is expected to lead the market.

The wall mounted segment is expected to lead the market.

An increasing investment in new residential and commercial buildings is the key factor for the market growth.

Masco Corporation, Kohler Co., Lixil Corporation, Delta Faucets Company, Fortune Brands Inc. and others are major players in the market.

By application, the bathroom segment is expected to dominate the market during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us