U.S. Generator Sales Market Size, Share & Industry Analysis, By Power Rating (Below 75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA), By Fuel Type (Diesel, Gas, Others), By Application (Continuous Load, Peak Load, Standby Load), By End-User (Mining, Oil & Gas, Construction, Residential, Marine, Manufacturing, Pharmaceuticals, Commercial, Telecom, Others) and Forecast, 2025-2032

KEY MARKET INSIGHTS

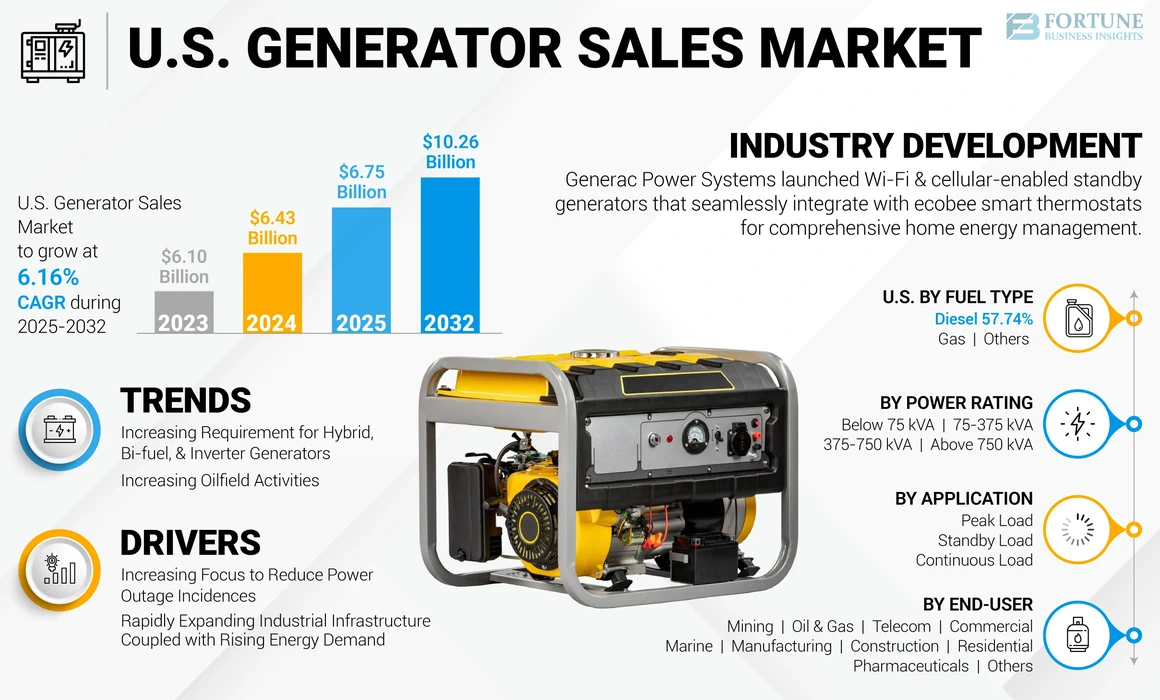

The U.S. generator sales market size was valued at USD 6.43 billion in 2024. The market is projected to be worth USD 6.75 billion in 2025 and reach USD 10.26 billion by 2032, exhibiting a CAGR of 6.16% during the forecast period.

The remarkable development in generator technologies have led to significant growth in the market. Rapid industrialization and urbanization have surged the demand for constant electric supply, making power backups a vital element of development. The increasing utilization of generators and the growing technological advancements have further increased the demand for generators. The requirement for uninterrupted, unbroken peak power demand has made generators crucial equipment in industry, commerce sector, and residential. The U.S. has been one of the major participants in the global generator sales market and is expected to witness significant growth during the forecast period.

The COVID-19 pandemic had a detrimental impact on the generator industry. It suffered significant losses due to stringent rules, such as nationwide lockdowns. It created hindrances in initiating new end-user projects due to the unavailability of necessary capital in heavy-duty processes, such as exploration and production of hydrocarbons, mining of new assets, construction activities, and new commercial infrastructures, among others, which affected the market growth adversely. The disruptions in shipment channels affected the import of generators to the U.S., China, and India are significant countries manufacturing and deploying diesel generators due to immense investment potential in Asia Pacific.

On the contrary, these countries underwent various regional and national levels of shutdown of industrial operations to contain the spread of the virus. As a result, the import of generators to the U.S. has been affected, thereby impacting the entire market in the country.

U.S. Generator Sales Market Trends

Increasing Requirement for Hybrid, Bi-fuel, & Inverter Generators is a Vital Trend

Hybrid generators are a combination of traditional generator sets with another controllable electric source, such as a fuel cell. This integration allows for fuel-efficient, noise-reduced, and environment-friendly power supply sources. On the other hand, bi-fuel generators utilize both natural gas and diesel, offering enhanced reliability. Inverter generators use advanced electronic circuits and high-tech magnets to invert the current type from input to output. Several manufacturers are adopting bi-fuel generators to address the carbon emissions and high operational costs. This shift presents an opportunity for players in the U.S. market for generator sales.

For instance, the U.S. Department of Energy, in April 2021, announced its support for President Biden's goal of net-zero carbon emissions by 2050. The increased consumer conscience and obligation toward sustainable development gives rise to the growth in hybrid and bi-fuel generators. This growth is expected to create significant opportunities in the market for generator sales in the U.S.

Increasing Oilfield Activities to Promote Market Growth

Businesses are extending their reach, engaging in E&P activities in increasingly harsh and unconventional areas. Successful offshore operators have established technology, infrastructure, and operational capabilities that are extremely valuable to blue growth sectors. Therefore, the development of new oil and gas reserves, especially in deep sea and ultra-deep sea regions, is a growing demand for advanced generators and serves as an opportunity for the global market.

For instance, the Energy Information Agency (EIA) projected crude oil production to increase by 190,000 bpd to 12.63 million bpd in 2024-2025. EIA also projected that consumption of oil and other liquid fuels increased by 100,000 barrels per day to 20.4 million barrels per day in 2023. In 2022, the U.S. crude oil production reached 11.9 million. This has led the U.S. to quickly invest in the exploration and production of natural gas and crude oil from onshore and offshore locations. Utilizing generators as a power source in oilfields and mining activities for all operations makes it a vital component in the sector. The growing energy production in the country indirectly affects the market growth of generator sales in the country.

Download Free sample to learn more about this report.

U.S. Generator Sales Market Growth Factors

Increasing Focus to Reduce Power Outage Incidences to Promote Market Growth

Abrupt grid problems, faults in transmission & distribution lines, weather problems, and other factors affect the power supply across the U.S. Regulatory bodies are adopting measures to reduce the power cut durations to enable continual operations. Unexpected power outages have significantly increased consumers' demand for reliable backup power sources in residential and commercial sectors propelling the generator sales market in the U.S. Additionally, the ability to remain operational across industrial infrastructures without grid power sources has led users to adopt numerous measures to fight blackout conditions.

For instance, in December 2022, a severe winter storm caused a widespread power outage in the U.S. and Canada. Approximately, 1.5 million people were left without power across several states as the powerful Arctic winter storm swept through the region. Winter weather alerts were issued across vast parts of both countries, spanning from coast-to-coast. The storm brought destructive winds and freezing temperatures, posing risks of frostbite. In November 2022, a plane crash into power lines in Maryland, U.S., resulted in extensive power outages throughout the state. The electricity cut-off affected over 90,000 houses, which accounted for nearly one-quarter of the entire country facing the outage.

Rapidly Expanding Industrial Infrastructure Coupled with Rising Energy Demand to Bolster Market Growth

The exponential increase in the power demand and the building of new power generation, transmission, and distribution stations to serve the growing needs are projected to augment the industry's pace. Additionally, mounting expenditure in construction, manufacturing, mining, commercial, and many other end-user sectors have led various public and private authorities to increase their efforts to meet consumer demand during peak hours. For instance, in 2021, the U.S. Census Bureau announced that the total spending on public construction increased by about USD 76 billion in March 2021 compared to last year. The same report indicated that residential construction accounted for the significant additions around USD 138 billion, whereas other constructions were reduced significantly.

The growing setup of new public safety infrastructures is also projected to boost energy requirements across various verticals, propelling the need for continuous and backup power products. For instance, in September 2021, the U.S. Energy Information Administration (EIA) anticipated that the industrial sector, including construction, agriculture, mining, manufacturing, and refining, would likely account for the dominating share of U.S. energy consumption.

RESTRAINING FACTORS

Rising Adoption of Clean Energy Technologies and Rigorous Emission Norms is a Major Restraining Factor

The government has implemented targets to utilize green energy technologies to reduce dependency on fossil fuels. The U.S.'s adherence to exceeding the required objectives is likely to hinder the market pace. Furthermore, stringent norms introduced by numerous administrations to cut the usage and emission of harmful substances from different sources may obstruct the industry's size. For instance, in December 2022, the U.S. Energy Information Administration announced that U.S. battery storage capacity will increase significantly by 2050. Developers and power plant owners have planned to suggestively increase utility-scale battery storage capacity in the U.S. in the coming three years, reaching 30.0 (G.W.) by the end of 2025.

Moreover, as per the Environmental Protection Agency's (EPA) first national emissions standards for new stationary diesel engines under New Source Performance Standards (NSPS), NSPS requires all new diesel engines to meet generally applicable off-highway or off-way emissions standards. It requires that it be certified as compliant. EPA's diesel engines generally comply with mobile vessel emissions standards that require particulate matter and nitrogen oxide emissions to be reduced by more than 90%.

U.S. Generator Sales Market Segmentation Analysis

By Power Rating Analysis

Above 750 kVA Segment to Hold Largest Share Fueled by Utilization in Large-Scale Industries

Based on power rating, the market is segmented into below 75 kVA, 75-375 kVA, 375-750 kVA, and above 750 kVA.

The above 750 kVA segment holds the maximum share due to the indispensable need for emergency and continuous power situations across heavy-duty applications. These units are widely used to provide power in reliable operations demanding continuous and standby or emergency loads. The generator units are primarily designed to be integrated with heavy-duty end-user industries such as the oil-gas sector, mining, power plants, construction, manufacturing facilities, and others.

Generators with power ratings below 75 kVA are widely used in low-load applications such as residential, commercial, medical, railways, and others. These are designed compactly and lightweight to operate silently and efficiently and provide optimum solutions for standby and continuous loads. They are widely adopted owing to the rapidly increasing number of residential users to power household appliances.

75-375 kVA generators are designed for easy integration in industry verticals such as data centers, commercial structures, manufacturing plants, hospitals, and others. The products also offer competitive initial and operating costs with aesthetic benefits for standby, peak shaving, and continuous load operations.

Generators rated between 375 to 750 kVA are majorly installed in oil gas, mining, construction, commercial, and many other industry verticals. These units are designed to serve continuous load operations in different locations for unlimited hours each year.

By Fuel Type Analysis

Extensive Use of Diesel Fuel Generators to Drive Segmental Growth

The market can be split based on fuel type into diesel, gas, and others. Currently, the maximum share of generators use diesel as the fuel type, making it the largest segment. Diesel generators are commonly used as backup units for emergency power supply in large establishments, homes, and small offices.

A gas generator is a machinery that converts the chemical energy in gas to electrical energy. Gas is generally used to power emergency and portable generators and is the most affordable and effective fuel among non-renewable resources. Increasing natural gas consumption and exploration is projected to add to the segment landscape.

Generators using other fuel types, include gasoline, fuel oil, biofuel, wood gas, and others. These fuels generally are not used due to their low efficiency and availability. Increasing environmental consciousness and shift toward cleaner energy are expected to drive the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Continuous Load Segment to Maintain a Higher Share Due to Use in Heavy-Duty Operations

Based on application, the market is divided into continuous load, peak load, and standby load. The continuous load segment, widely installed at mining, agriculture, oil & gas, and telecom towers, conduct high-load operations and are unreachable to the grid. This segment accounts for the maximum U.S. generator sales market share due to the setup of heavy-duty applications across industries. They usually operate at about 70% of the rated capacity and majorly function in capacities near and above 300 kVA with no overload requirements.

Peak shaving load or prime power generators are majorly integrated into industry verticals with varying load operations, such as manufacturing, power plants, data centers, and many others. The units are of two main types based on the running time, including indefinite and limited duration operations with loads generally greater than 400 kVA outputs. Expanding manufacturing capabilities, incorporating new production plants, and investments in completing new projects in the oil & gas and mining sectors are some factors that augment the segment size.

Standby generators are among the most widely used units integrated into residential, commercial, and pharmaceuticals. They are also designed to accommodate a public utility source with output loads ranging from a few kVA to 1000 kVA.

By End-User Analysis

Residential Segment to Hold Largest Share Due to Increasing Requirement

Based on end-user, the market is divided into mining, oil & gas, construction, residential, marine, manufacturing, pharmaceuticals, commercial, telecom, and others.

The residential segment generally opts for low power ratings and can be primarily used as a standby or backup power source to tackle load shedding and power outage situations. The residential segment accounts for the maximum market share due to the increased requirement for consistent home power backups to accommodate the rising remote working trend.

The oil & gas industry requires standby and peak load units to operate heavy equipment for continuous pumping even without main power. Furthermore, offshore operations located in mid-sea sites rely extensively on continuous load generators to deliver a reliable ability to conduct tasks without interruption. Standby power and peak load products are vital in onshore operations, whereas deep-sea procedures require continuous power, backup power, and prime power units for various functions. The growing investments in the oil & gas industry, the discovery of new reserves, and the abundant presence of bulk reservoirs will drive the segment growth.

Mining operations widely integrate continuous load generators owing to the unavailability of regular electric power in remote locations with no grid connection. Additionally, prime power or peak load generators handle varying loads at high capacities and standby load units to manage power outages. Significant expansion plans across current assets coupled with the rising exploitation of new mineral reserves are set to shape the segment landscape.

Other end-user industries that install generator sets for various operations include agriculture, water & wastewater treatment facilities, railways, data centers, and many more. These verticals use generator sets across the peak, continuous, and backup stages to increase the operational lifespan of projects, mitigate maintenance needs, noise reduction features, and many others.

COUNTRY INSIGHTS

The market of generator sales has been analyzed across the U.S. The country holds a dominant position in the North American market, primarily due to its large market size. Encouraging government initiatives aimed at ensuring energy security and providing electricity access to rural areas combined with rapid development in residential, commercial, and industrial sectors are expected to drive market growth. The U.S. market has witnessed significant growth, particularly in the diesel and natural gas generator market. The growth can be attributed to substantial increase in hydrocarbon and mineral production capacities, which provide fuel and raw materials for the fabrication of various goods.

The peak and standby load have witnessed considerable growth in their installation owing to the increasing setup of distance powering projects and growing measures to combat the power outage situations in the country. Additionally, continuous industrial expansions associated with the setup of new public and private substructures across different verticals, such as mining, manufacturing, marine, and pharmaceuticals, are anticipated to augment the market's growth.

Key Industry Players

Generac Power Systems, American Honda Motor Corp., and Caterpillar Inc. to Lead with Increase in Production

The competitive landscape in the country comprises only a handful of key players. Many have increased investments in developing reliable generator sets for various end-user segments and power ratings. Most of the research is being conducted to improve the performance, life, efficiency, and ease of deployment. It can be considered that Generac Power Systems, American Honda Motor Corp., and Caterpillar Inc. are prominent generator manufacturing companies and are investing in increasing their sales throughout the country. They are expected to remain the market leaders in the future.

LIST OF TOP U.S. GENERATOR SALES COMPANIES:

- Generac Power Systems (U.S.)

- American Honda Motor Corp. (U.S.)

- Caterpillar Inc. (U.S.)

- Cummins Inc. (U.S.)

- Ingersoll Rand (U.S.)

- John Deere (U.S.)

- Briggs and Stratton (U.S.)

- HiPower Systems (U.S.)

- Kohler – SDMO (France)

- Wacker Neuson (Germany)

KEY INDUSTRY DEVELOPMENTS:

- July 2023- Briggs & Stratton Energy Solutions acquired SimpliPhi Power, which is a California-based energy storage systems manufacturer. With this acquisition, Briggs & Stratton Energy Solutions can market a series of standby generators along with scalable, intelligent energy storage products under the Briggs & Stratton brand.

- February 2023- Caterpillar Inc. launched Cat XQ330, a mobile diesel generator set that meets U.S. EPA Tier 4 Final emission standards, powered by a Cat C9.3B diesel engine. The generator is equipped with the EMCP 4.4 digital control panel and programmable logic controller functionality, which improves reliability and flexibility to accommodate changes in application requirements.

- January 2023 - Generac Power Systems, Inc. announced its complete line of Wi-Fi, cellular-supported standby generators, which will quickly integrate with the latest version of ecobee smart thermostats, making a center in the home for energy management. By assimilating Generac home generators with ecobee thermostats, energy management at home will be combined in one place, an easy-to-use interface. Homeowners can rapidly and effortlessly use their generators in a power outage.

- June 2022 - Honda unveiled Honda EU3200i, the latest generator in the Honda Super Quiet E.U. Series portfolio. The high-output Honda EU3200i supplies relatively more power and greater convenience than the older version, the Honda EU3000i generator in a compressed, portable package, and space-saving.

- May 2021 - Cummins Inc. launched the C1300N6 and C1000N6B NFPA 110 Type 10 capable natural gas generator sets for standby and peak power applications. Its characteristics include ease of installation and commissioning, a 10-second start with CSA22.2, and UL2200 listings. They are equipped with Cummins PowerCommand 3.3 controller, circuit breaker options, and a skid-mounted radiator. Weather-protective enclosures consisting of aluminum or galvanneal are provided to protect against high sound attenuation.

REPORT COVERAGE

The research report offers an in-depth analysis of the market and focuses on its key aspects. Also, the research report provides vital insights into the latest generator sales industry developments and scrutinizes technologies being adopted rapidly across North America. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.16% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power Rating

|

|

By Fuel Type

|

|

|

By Application

|

|

|

By End-User

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market size was USD 6.75 billion in 2025 and is projected to reach USD 10.26 billion by 2032.

The market will likely grow at a CAGR of 6.16% during the forecast period (2025-2032).

The diesel segment holds the largest market share in revenue.

Increasing focus on reducing power outages is the key factor driving the market.

Generac Power Systems, American Honda Motor Corp., Rolls Royce plc, and Caterpillar Inc. are key participants in this market.

Utilizing generators as a power source in oilfields and mining activities for all operations makes it a vital component in the sector. The growing energy production in the country is indirectly affecting the market in the country.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us