U.S. Joint Spacer Systems Market Size, Share & Industry Analysis, By Procedure Type (Knee, Hip, and Shoulder), By End-user (Hospitals and Ambulatory Surgical Centers), By Region (Northeast, Midwest, South, and West), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

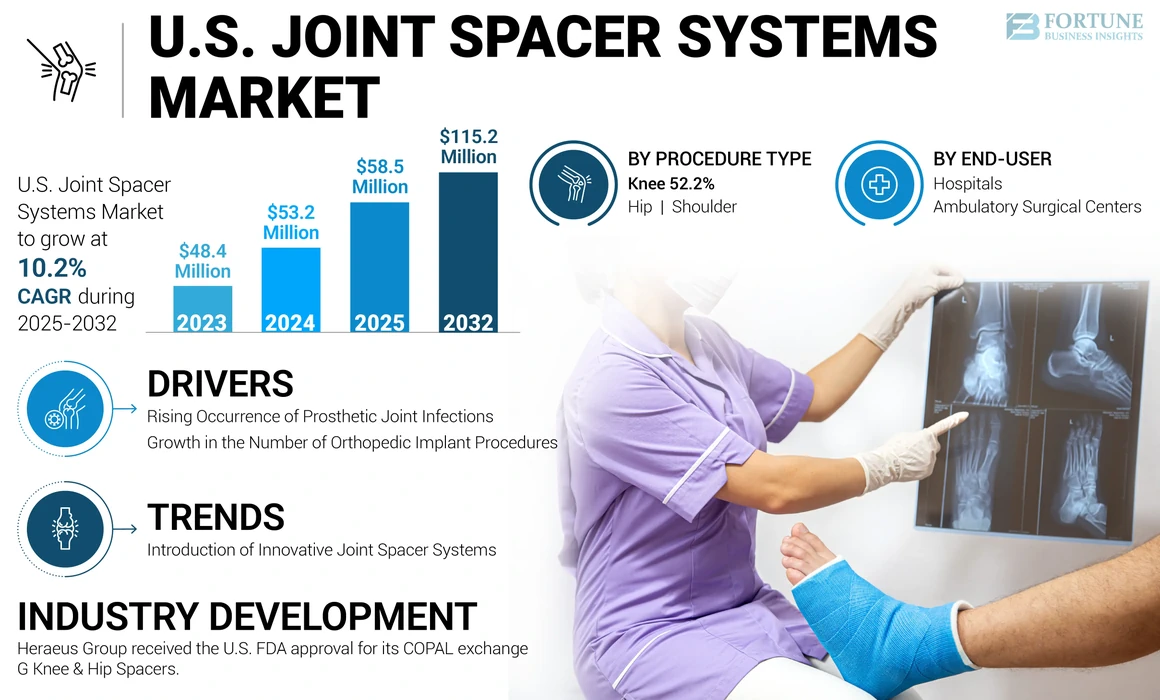

The U.S. joint spacer systems market size was valued at USD 53.2 million in 2024. The market is projected to grow from USD 58.5 million in 2025 to USD 115.2 million by 2032, exhibiting a CAGR of 10.2% during the forecast period.

The joint spacer system consists of articulating or preformed spacers that are infused with antibiotics, which are offered in various sizes and are composed of bone cement. These devices facilitate temporary joint mobility maintenance, leading to improved functionality and enhanced patient satisfaction.

These antibiotic joint spacers are temporary intra-articular devices intended primarily for the control of predominantly post-arthroplasty joint and bone infections via sustained, topical antibiotic release while also ensuring adequate joint function. These spacers play a crucial role in surgical procedures aimed at addressing prosthetic joint infections (PJI) through the two-stage revision approach.

The expansion of the market in the U.S. is driven by rising cases of prosthetic joint infections and the increasing number of orthopedic implant procedures nationwide. Moreover, the market players are focusing on launching innovative products, which is expected to further propel the market growth throughout the forecast period.

The COVID-19 pandemic adversely affected the joint spacer systems market in 2020 due to the decrease in the number of patients undergoing procedures such as joint arthroplasty. Postponements of orthopedic procedures declined the number of hospital admissions due to health concerns, and strict guidelines from healthcare associations regulating orthopedic practices were among the factors contributing to the decline in two-stage revisions.

However, the patient numbers suffering from prosthetic joint infections begun to increase as a result of the relaxation of regulations imposed by the governments in different countries until 2021. Therefore, in 2021, the demand for preformed spacer systems was positively affected by the resumption of services.

U.S. Joint Spacer Systems Market Trends

Introduction of Innovative Joint Spacer Systems

The demand for joint spacer products in the U.S. market was increased by various advantages associated with these products. For example, it offers a highly effective range of activity against around 90% of clinically relevant bacteria and considerably reduces the occurrence of surgical site infections in patients at higher risk for primary arthroplasty.

Before 2015, Tecres S.p.A. was the sole company operating in the market, and its products were distributed in the U.S. through Exactech, Inc. However, after 2015, there has been a notable increase in the launches of these systems, which has significantly boosted the market growth in the past few years.

The growing incidence of prosthetic joint infections, along with an increasing number of orthopedic implantations, has prompted market players to prioritize the development and introduction of preformed joint spacers aimed at enhancing treatment for prosthetic joint infections.

- For example, in November 2019, OsteoRemedies LLC unveiled the REMEDY Stemmed Knee Spacer for commercial release during the 2019 American Association of Hip and Knee Surgeons (AAHKS) conference.

Moreover, the implementation of novel manufacturing methods, such as custom-made 3D printing and the development of preformed joint spacers to enhance patient outcomes, are anticipated to drive the adoption of technologically advanced orthopedic implants.

Download Free sample to learn more about this report.

U.S. Joint Spacer Systems Market Growth Factors

Rising Occurrence of Prosthetic Joint Infections to Drive the Demand for Joint Spacer Systems

In recent years, orthopedic implantation procedures for the hip, knee, and shoulder have been on the rise in the U.S. With the increasing number of these procedures, there is an anticipated increase in the number of peri-prosthetic joint infections across the nation.

- For instance, as per the data provided by the National Center for Biotechnology Information in October 2023, the incidence of prosthetic joint infection usually varies from 1.0% to 2.0% of the total joint arthroplasty cases. It can occur anytime from 4 weeks to 2 years following the initial arthroplasty procedure.

- Likewise, as reported in a research study by the National Center for Biotechnology Information in March 2019, the incidence of prosthetic joint infection generally falls between 0.5% to 1.0% for hip and shoulder replacements and 0.5% to 2.0% for knee replacements.

In the U.S., two stages of revision are standard procedures for treating PJI, which has increased in recent years with increasing cases of prosthetic joint infection. Therefore, the demand for joint spacers is projected to rise over the forecast period due to a growing number of two-stage revision procedures.

Furthermore, the market players are prioritizing the introduction of innovative products, which is expected to bolster the demand for these systems throughout the study duration.

Thus, the U.S. joint spacer systems market growth is expected to be driven by this increasing focus of the companies on the introduction of joint spacers and the increasing incidence of prosthetic joint infections.

Growth in the Number of Orthopedic Implant Procedures to Boost the Market Growth

Another factor driving demand for orthopedic implants is a rapidly increasing incidence of orthopedic injuries in the U.S. The rate of PJI, which in turn increases the demand for joint spacers to treat it in the U.S., has also increased as a result of the increasing number of implantations.

- For example, the American Academy of Orthopedic Surgeons study projected that by 2030, there will be 1.28 million total knee replacements and 635,000 total hip replacement procedures carried out in the U.S. The demand for these spacer systems is expected to increase over the forecast period as a result of this rise in knee & hip implantations.

Moreover, the adoption of technologically advanced orthopedic implants is likely to be improved by the companies’ increased focus on developing advanced technologies for preformed joint spacers with a view to achieving better patient outcomes. In addition, the adoption of implants for orthopedic procedures has increased due to fewer adverse reactions related to post-implantation in patients.

Furthermore, an increasing aging population with a higher prevalence of joint-related issues, such as osteoarthritis, rheumatoid arthritis, and other joint disorders, is one of the factors responsible for the increasing demand for these joint spacer systems.

- For instance, as per the data provided by the American College of Rheumatology in February 2024, approximately 790,000 knee replacements and 544,000 hip replacements are performed every year in the U.S. This number is increasing as the population ages.

Thus, the growth of the U.S. joint spacers market is expected to be driven by the introduction of advanced spacer technology coupled with an increasing number of prosthetic joint infections.

RESTRAINING FACTORS

Existence of Alternatives and Adverse Effects of Preformed Spacer Systems May Restrict Market Growth

The growth of the market is expected to be limited by various factors, including the presence of alternatives, such as surgeon-made spacers, and the side effects associated with the preformed spacer systems.

Preformed joint spacers are the newly launched product compared to surgeon-made spacers, which are used in the two-stage revision arthroplasty. Moreover, surgeon-based spacers have better accessibility throughout the U.S. and are of considerable benefit in terms of mobility, pain, bone loss, success, or reinfection rates as opposed to preformed spacers. These advantages of surgeon-based spacers are expected to constrain the adoption of preformed spacer systems in the U.S. market.

In addition, there are several complications associated with spacer systems, which limits their adoption in joint replacement procedures.

- For instance, as per the data provided by MDPI in August 2023, there are various spacer-related complications, such as spacer dislocation, acetabular component dislodgement, peri-prosthetic fracture, prosthetic dislocation, femoral component loosening, and hematoma requiring reoperation.

In addition, future demand for preformed joint spacers may be hindered by several adverse effects, including lower antibiotic dosage/elution, restrictions on the antibiotic types, limited sizing options, increased dislocation rate, and higher cost compared to surgeon-made spacers.

Therefore, the presence of better alternatives and drawbacks of preformed joint spacers are poised to limit the overall market growth during the forecast period.

U.S. Joint Spacer Systems Market Segmentation Analysis

By Procedure Type Analysis

Knee Segment Led Due to the Growing Incidence of Prosthetic Joint Infections During Implantation Procedures

Based on procedure type, the U.S. joint spacer systems market is segregated into knee, hip, and shoulder.

The knee segment accounted for the maximum portion of the U.S. joint spacer system market share in 2024 and is projected to record significant growth throughout the forecast period. The segment’s growth is primarily due to the growing incidence of prosthetic joint infections in total knee replacement procedures across the U.S.

Furthermore, some of the factors driving the segmental growth are the availability of a large number of bone spacer products for knee surgery and the increasing demand for preformed joint spacers to treat prosthetic knee infections.

- For instance, as per the data provided by the Cleveland Clinic in July 2023, one of the most common types of arthroplasties is knee replacement. Over 850,000 knee replacements are performed annually by surgeons in the U.S.

In 2024, the hip segment accounted for a significant market share and is expected to record promising growth during the forecast period. Growing demand for the treatment of prosthetic joint infections, coupled with growing two-stage revision hip procedures, has led to a strong market share in this segment. In addition, segment growth is anticipated to be stimulated in the forecast period by the launch of advanced hip joint spacers with two antibiotic properties in the market.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospitals Segment Dominated Due to Enhanced Medical Equipment

In terms of end-user, the market is divided into hospitals and ambulatory surgical centers.

The hospitals segment held the largest U.S. joint spacer systems market share in 2024 and is projected to grow at a considerable CAGR during the forecast period. Some of the factors contributing to the growth of this segment are the presence of technologically advanced equipment in hospitals, together with an increase in hospital visits by patients undergoing two-stage revision procedures for the treatment of peri-prosthetic joint infection.

On the other hand, the ambulatory surgical centers segment is anticipated to grow at the highest CAGR during the forecast period. The segmental growth is majorly due to the increasing patient shift toward receiving treatment at ambulatory surgery centers. Moreover, the growth of this segment is expected to be driven by an increasing number of ambulatory surgical centers, together with a rise in the number of hip and knee surgeries carried out at ASCs.

- For example, nearly 22,427 hip and knee replacements were performed in the ASCs in 2022, with an increase of 57% compared to total procedures conducted in 2021, as reported by the American Joint Replacement Registry's annual report for 2022.

REGIONAL INSIGHTS

On the basis of region, the U.S. market for joint spacer systems is divided into Northeast, Midwest, South, and West.

High Concentration of Hospitals in The Southern Region is Fueling the Demand for these Devices

The South region held the maximum share in 2024 and is anticipated to grow at a significant CAGR during 2025-2032. The availability of advanced healthcare facilities and the presence of a large number of hospitals in this region have contributed to its growth.

Similarly, the growth of the market is driven by the presence of one of the market players providing joint space systems in the region.

- For example, OsteoRemedies, LLC, one of the key players operating in the U.S. market, is located in Tennessee, a state in the South region. In view of the growing number of total joint replacement operations in the South Region, this company's presence is expected to increase the distribution of spacers.

One of the key factors contributing to the regional growth is the high number of revision procedures carried out in this region.

The Midwest region is slated to experience a significant CAGR during the forecast period. The opening of new orthopedic hospitals and orthopedic clinics in the Midwest region is one of the factors driving the market growth.

- For instance, in February 2023, the Orthopedic Institute announced that it had purchased land for a new clinic in South Dakota, a state in the Midwest region of the U.S.

Moreover, the Northeast and West regions of the U.S. are anticipated to grow at a considerable CAGR during 2025-2032.

Key Industry Players

Broader Range of Joint Spacer Systems Offerings by Market Players to Stimulate Market Expansion

The market is highly consolidated in nature, with the presence of only three key players such as Tecres S.p.A., OsteoRemedies, LLC, and Heraeus Group.

Tecres S.p.A. is the major player operating in the U.S. market. It is the first company to offer preformed spacers in the market, including InterSpace Knee, InterSpace Hip, and InterSpace Shoulder. These joint spacers have been on the market for many years and have continued to perform well even after the introduction of new products. Its strong portfolio of preformed spacer systems, strong presence in the U.S. market, and established distribution network make it the largest shareholder.

Other players operating in the joint spacer systems market include OsteoRemedies, LLC, and Heraeus Group. Their continued focus on the development of new products with advanced features is one of the driving factors for their growth. Furthermore, their market shares are projected to increase over the forecast period as a result of increased focus on the launch of new joint spacers.

List of Top U.S. Joint Spacer Systems Companies:

- Tecres S.p.A. (Italy)

- OsteoRemedies, LLC (U.S.)

- Heraeus Group (Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2021: Heraeus Group acquired Norwood Medical, a premier full-service provider of advanced outsourced medical manufacturing solutions in three key markets, including orthopedics, minimally-invasive procedures, and robotic-assisted surgery. This acquisition increased the manufacturing of orthopedic medical devices, which includes a joint spacer.

- October 2019: Heraeus Group received the U.S. FDA approval for its COPAL exchange G Knee & Hip Spacers.

- November 2018: OsteoRemedies, LLC received U.S. FDA clearance for its Dual-Antibiotic Spacer and Bone Cement with Vancomycin and Gentamycin.

- November 2018: OsteoRemedies, LLC introduced the REMEDY SPECTRUM GV Hip Spacer System and SPECTRUM GV Bone Cement to offer a wide range of treatment options with

REPORT COVERAGE

The U.S. joint spacer systems market forecast provides detailed market analysis and focuses on key insights such as key industry developments in the market and average pricing of joint spacer systems by key players. In addition, it provides information on the number of orthopedic implant procedures and the number of infected orthopedic implant procedures for hip, knee, and shoulder in terms of volume in the U.S. market. Furthermore, it provides an analysis of different segments and profiles of the major market players. The market report also includes an overview of technological advancements in joint spacer systems.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 10.2% from 2025-2032 |

|

Segmentation |

By Procedure Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 53.2 million in 2024 and is projected to reach USD 115.2 million by 2032.

The market is expected to exhibit a CAGR of 10.2% during the forecast period.

By procedure type, the knee segment led the market in 2024.

The growing prosthetic joint infection cases, an increasing number of orthopedic implantation procedures, and the introduction of these devices by key players in the U.S. market are expected to strongly drive market growth.

Tecres S.p.A. and OsteoRemedies, LLC are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us