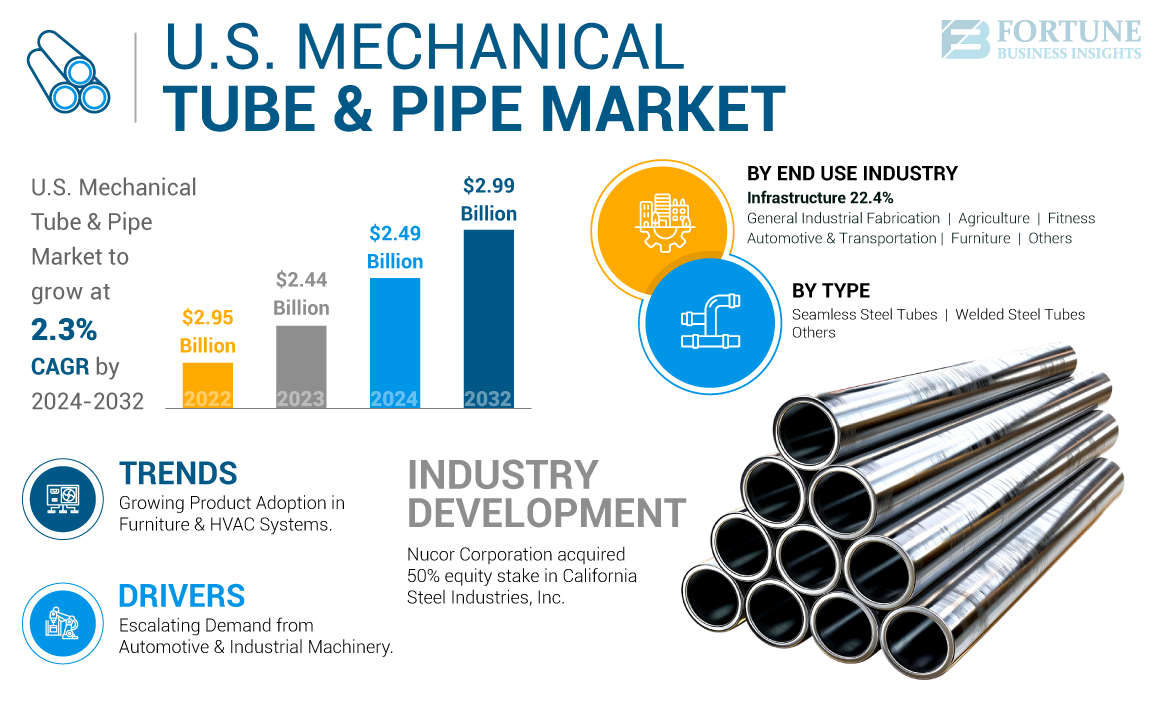

U.S. Mechanical Tube & Pipe Market Size, Share & Industry Analysis, By Type (Welded Steel Tubes, Seamless Steel Tubes, and Others), and By End Use Industry (General Industrial Fabrication, Infrastructure, Automotive & Transportation, Agriculture, Furniture, Fitness, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The U.S. mechanical tube & pipe market size was valued at USD 2.44 billion in 2023 and is projected to grow from USD 2.49 billion in 2024 to USD 2.99 billion by 2032, exhibiting a CAGR of 2.3% during the forecast period.

Mechanical tube & pipe solutions are used for the functioning of other equipment or machineries in various industries. The products are used for mechanical and light gauge structural applications. These products offer excellent corrosion resistance, strength, durability, workability, and stable mechanical properties. The most common types of mechanical tubes are Hot Rolled/Finished Seamless Tubes (HRS), Cold Drawn Seamless Tubes (CDS), and Hot Rolled or Cold Rolled Electric Weld Tubing (HREW/CREW). The product finds application in industries such as chemical, textile machinery, dairy and food processing, fertilizer, pesticide, modern architecture, construction industry, agriculture, pharmaceutical, water treatment facilities, oil and gas processing, synthetic fiber processing, desalination, pulp & paper, refinery & petrochemicals, shipbuilding, and power generation. The growing demand for mechanical & tube pipe the aforementioned applications is primarily driving the market size.

The outbreak of the COVID-19 pandemic created several challenges for the tube & pipe industry in 2020 as the supply chains were disrupted due to trade restrictions, and its consumption declined due to government-imposed lockdowns. With the nationwide lockdown, several industry players reported struggling to keep their operations running. Fewer options to choose from, higher material prices, and delayed project cycles were among the few challenges several stakeholders faced in operating the tube & pipe industry. Based on our analysis, the U.S. market exhibited a decline of 27.8% in 2020 as compared to 2019.

U.S. Mechanical Tube & Pipe Market Trends

Rising Adoption of Mechanical Tubes & Pipes in HVAC Systems, Furniture, and Fitness to Boost Market Growth

The rising adoption of mechanical tube & pipe in the HVAC systems, furniture, and fitness applications will offer lucrative opportunities for the market to grow positively. HVAC systems mainly consist of heating, ventilation, and air conditioning. In the HVAC system, mechanical steel pipes are mainly utilized to ensure appropriate fluid transmission and flow from one point to another. The transfer and movement of these fluids in a well-organized pipe system are designed to offer comfortable ventilation in industrial environments such as malls, showrooms, theaters, or even residential. Furniture tubes made from galvanized steel have a high demand in the U.S. This is due to their various characteristics such as uniformity in shape, smooth surface, highly durable, corrosion-free, and high load-bearing capacity. Increasing interior design, mainly in the commercial spaces and increasing high demand for furniture from newly constructed houses, has increased mechanical steel pipes consumption. Moreover, the rapid growth of the sports industry and increasing consciousness amongst the people pertaining to health fitness has resulted in the adoption of steel pipes due to advantageous properties such as light and durability.

Download Free sample to learn more about this report.

U.S. Mechanical Tube & Pipe Market Growth Factors

Surging Demand from Automotive and Industrial Machinery to Support Market Growth

Mechanical tubes and pipes find various applications in the automotive industry due to their exceptional strength, toughness, and machinability. Such tubes and pipes are mainly used as condensation pipes, automobile axle tubes, automobile shock absorbers, automobile exhaust pipes, control shaft tube stack pipes, and others. According to the Association of European Automobile Manufacturers (ACEA), in 2023, the U.S. accounted for nearly 12% of the global automotive production. The presence of such a massive automotive production hub and the wide adoption of mechanical tubes in automotive production are set to fuel the market growth during the forecast period.

In addition, machinery manufacturing is one of the largest and most competitive sectors of the American manufacturing economy. According to the International Trade Administration, the U.S. is among the top five suppliers of capital equipment, where domestic manufacturers hold over half of the nation’s demand. The U.S. stands as a manufacturing hub globally, and thus, the overall manufacturing industry contributed USD 2.3 trillion to the nation’s GDP, which is nearly 11% of the total U.S. GDP. The presence of a massive manufacturing hub and machinery manufacturing is a significant part of the overall industry, which fuels the demand for mechanical tube & pipe products in the region.

RESTRAINING FACTOR

Unfavorable Demographic Factors and Huge Dependency on Foreign Countries May Create Impediments for Market Growth

Though the U.S. steel industry is less carbon intensive than other leading steel producers, its domestic production capacity is not enough to meet its domestic demand. In addition, other demographic factors are fueling the domestic production cost, including rising labor costs, pressure from government bodies to adopt advanced technologies to reduce carbon emissions, and high inflation. Such factors are creating several impediments for mechanical tube & pipe companies.

As a result, the U.S. steel mill import products account for 20 to 25% of the nation’s total demand. Moreover, when it comes to mechanical tubes and pipes, the import penetration rate increases to nearly 60%. Such a huge reliance on foreign countries may reduce the bargaining power of the U.S. government and may create challenges in the future.

U.S. Mechanical Tube & Pipe Market Segmentation Analysis

By Type Analysis

Welded Steel Tubes Segment Accounted for Dominant Share due to its High Demand from End-users

Based on type, the market is segmented into welded steel tubes, seamless steel tubes, and others.

The welded steel tubes segment dominated the market and is poised to remain the primary choice among end-users mainly due to its exceptional mechanical properties and low price compared to other types. Mechanical tubes offer exceptional yield strength over standard steel pipes, making them suitable for applications that require more tensile strength, hardness, and machinability. This type of tube is primarily used in the automotive industry, food and beverage industry, marine industry, pharmaceutical industry, and various other mechanical engineering applications.

On the other hand, seamless steel tubes are identified as another important type in the U.S. market and has gained significant attention by end-users. The mechanical tube & pipe demand is anticipated on the back of its heightened usage in various applications. These include heavy equipment and machinery, oil and gas control lines, chemical injection lines, below-sea safety valves, fluid and gas transfer, and others. Efficacy to offer more corrosion resistivity and high pressure handling capability, makes this product type an ideal choice for hydraulic applications and fluid and gas transfer lines. Its exceptional unique properties and rising adoption in high performance applications will drive segment growth significantly during the forecast period.

By End Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Parts Segment had the Largest Share owing to Significant Product Usage in these Parts

Based on end use industry, the market is categorized into general industrial fabrication, infrastructure, automotive & transportation, agriculture, furniture, fitness, and others.

The general industrial fabrication segment held the largest U.S. mechanical tube & pipe market share in 2023. The huge demand is anticipated due to the high adoption of mechanical tubes and pipes in a wide array of application areas in general industrial fabrication. It is widely used in making industrial equipment such as conveyor systems, material handling equipment, machine frames, and others, which drives the mechanical tube & pipe demand.

In the automotive and transportation segment, mechanical tube & pipes are used for various applications including heavy-duty truck frame components, landing gear and rear guards, trailer side rails, exhaust systems, and RV frame components. Moreover, steel pipes prevent instances of broken tubing in exhaust pipes as they are subjected to high heat levels. All these factors contribute to the rapid adoption of steel pipes and tubes in the automotive industry, thereby driving the segment growth at a considerable pace.

In the agriculture industry, steel tubing is used as an alternative to rollover protection structures, handle/lever, moveable and stable irrigation systems, valves, fittings, automation equipment, filters, emitters, farm gates, and other irrigation applications. The demand for expeditious crop yield leads to the usage of advanced machinery, which will drive the consumption of steel tubes & pipes moderately till 2032.

The furniture segment is projected to exhibit substantial growth supported by the rise in consumer lifestyle for aesthetic home & office demands, further increasing renovation activities. The mechanical tube & pipe products are used for making tables, legs of chairs, and beds. These benefiting properties of steel pipes, including withstanding load and impact and long-lasting life, supporting the segment’s growth consistently.

The increase in fitness equipment as a result of the health and fitness trend has become a lifestyle. The extensive size and gauge options and the ability to attain tight tolerance are benefits of steel that further increase the product demand

COUNTRY INSIGHTS

The U.S. mechanical tube & pipe market stood at USD 2.44 billion in 2023. In terms of volume and value, the U.S. is witnessing moderate product demand due to a strong presence of end-use industries. The oil & gas industry is expected to be gaining rejuvenation due to upcoming fuel demand, which drives the consumption of the product in the country. Furthermore, several end-use industries such as furniture, fitness, and agriculture are expanding due to the growing demand from consumers for home décor products, gym and fitness equipment, and farming machineries and tools. The demand for these products will boost the U.S. mechanical tube & pipe market growth.

In addition, the improving lifestyle of consumers supported by high disposable income is also positively affecting the market. The lifestyle improvement is surging the demand for modern home architecture and interior, thereby creating mechanical tube & pipe demand. The country has witnessed a high shift toward the trend for healthy lifestyle, which has propelled gym & fitness equipment demand in gyms and household use. All the factors altogether are driving the regional market growth.

KEY INDUSTRY PLAYERS

Key Industry Players Adopt Growth Strategies to Improve Market Positions

The key players in the U.S. mechanical tube & pipe market are Nucor Corporation, Zekelman Industries, TimkenSteel, Cleveland-Cliffs Inc., Bull Moose Tube, and Tenaris S.A. The companies have adopted strategies such as acquisitions, increasing investments, capacity improvement, and new product developments for gaining a competitive advantage. For example, in January 2020, Tenaris S.A. announced the completion of acquiring a U.S. based steel pipe manufacturer IPSCO Tubulars, Inc. from PAO TMK. The acquisition price was estimated based on a debt-free, cash-free basis while the final amount was paid in cash, followed by contractual adjustments, amounting to USD 1,067 million.

LIST OF TOP U.S. MECHANICAL TUBE & PIPE COMPANIES:

- Nucor Corporation (U.S.)

- Tenaris S.A. (Luxembourg)

- Cleveland-Cliffs Inc. (U.S.)

- U.S. Steel Corporation (U.S.)

- Atkore (U.S.)

- Valmont Tubing (U.S.)

- Vallourec (France)

- Bull Moose Tube (U.S.)

- Metallus Inc. (TimkenSteel)

- Zekelman Industries (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2022 – Nucor Corporation completed the acquisition of 50% equity ownership interest in California Steel Industries, Inc. CSI’s product capabilities include electric resistance welded pipe, pickled and oiled, hot rolled, and galvanized sheet steels, as well as cold rolled with annual capacity accounting approximately 2,000 kilotons.

- January 2022 – Tenaris is boosting production at its welded mill in Hickman, Arkansas, amid its ongoing manufacturing growth across the U.S. The mill increased manufacturing activity, producing a range of welded OCTG, including proprietary Wedge Series 400 connections to support the growing customer demand in the U.S.

- June 2021 – Bull Moose Tube Company, a Caparo Bull Moose subsidiary, announced plans to build a 350 kilotons per year HSS and Sprinkler pipe mill. The mill would be built on Steel Dynamics’ new Sinton, Texas flat-rolled campus. With this capacity expansion, the company would be able to meet the growing demand from Southwest, West Coast, and Mexico markets and across the entire business model.

- April 2021 – TimkenSteel Corporation announced that it had signed a purchase agreement with Daido Steel (Shanghai) Co., Ltd. ("Daido") with the intent to sell its TimkenSteel (Shanghai) Corporation Limited ("TSS") subsidiary in China for approximately USD 7 million in cash. With this arrangement, Daido would move from a valued supplier to a key authorized distributor of TimkenSteel products in China.

- January 2020 – Tenaris S.A. announced the completion of its acquisition of IPSCO Tubulars, Inc., a U.S. manufacturer of steel pipe, from PAO TMK. The acquisition was in line with the company’s strategic approach to enhance its market presence in the U.S. market.

REPORT COVERAGE

The report offers an in-depth market analysis of the value chain and emphasizes key aspects including key companies, types and end use industries. Moreover, the report provides insights on major market trends while highlighting major industry developments. In addition to the above mentioned factors, the report covers different factors which have contributed significantly to the market growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 2.3% over 2024 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By End Use Industry

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market worth was USD 2.44 billion in 2023 and is projected to reach USD 2.99 billion by 2032.

Growing at a CAGR of 2.3%, the market will exhibit steady growth during the forecast period (2024-2032).

By type, the welded steel tubes segment is expected to be the leading segment.

The surging demand from automotive and industrial machinery is a key factor slated to support market growth.

Nucor Corporation, Cleveland-Cliffs Inc., U.S. Steel Corporation, and Vallourec are the top players in the market.

The robust product demand in the HVAC systems, furniture, and fitness will drive the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us