U.S. Natural Stone & Marble Market Size, Share & Industry Analysis, By Type (Granite, Limestone, Marble, Sandstone, Slate, and Others), By Application (Building & Construction, Monumental, and Specialty), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

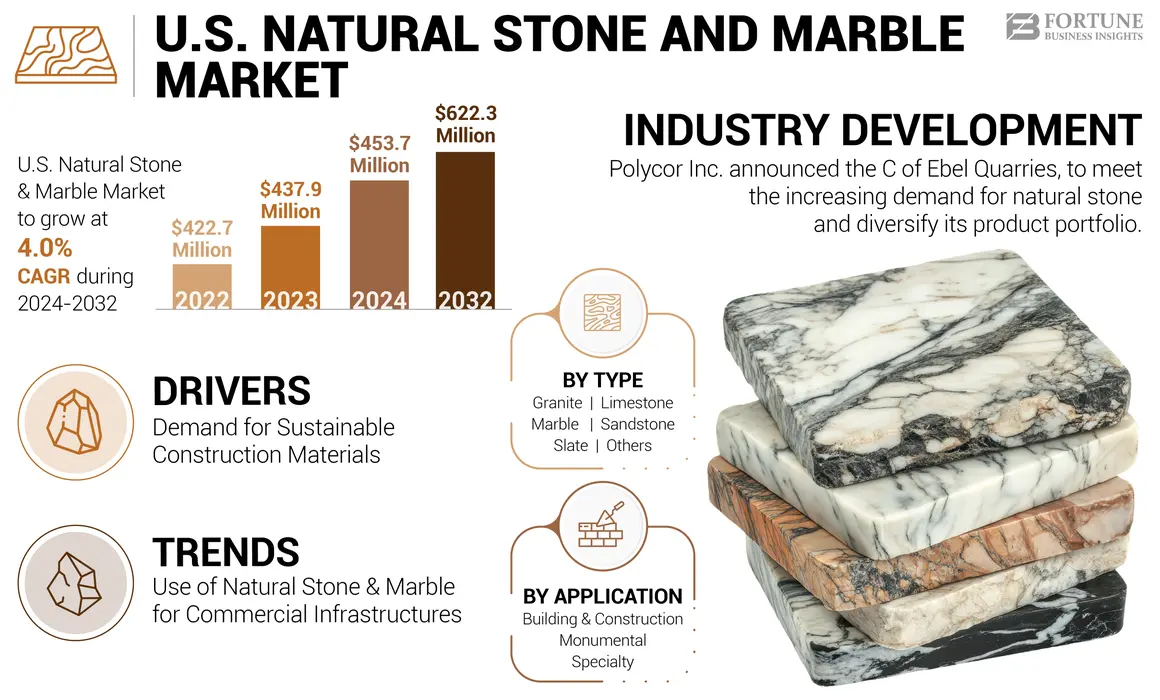

The U.S. natural stone & marble market size was valued at USD 437.9 million in 2023. The market is projected to grow from USD 453.7 million in 2024 to USD 622.3 million by 2032, exhibiting a CAGR of 4.0% during the forecast period.

Natural stones are mineral material found naturally in the environment that is mined for different construction and decorative applications. It is renowned for its strength, enduring elegance, and adaptability. The market growth is primarily due to the increasing consumption of natural stones and marbles for aesthetic and architectural applications. The growing investments and initiatives of the U.S. government to support green buildings and sustainable architecture are driving the market growth. The versatility of natural stone that suits internal and external designs, its sturdy and durable nature, and its aesthetic appeal are some factors influencing market growth.

The U.S. natural stone industry experienced a slowdown during the COVID-19 pandemic owing to the restrictions imposed by the government. The U.S. announced lockdowns, which restricted the infrastructure development activities by limiting the supply of construction materials. Similarly, restrictions on transportation also created a hurdle to the construction and renovation activities.

U.S. Natural Stone & Marble Market Trends

Increasing Use of Natural Stone & Marble for Commercial Infrastructures to Influence Market Growth

The use of these stones & marbles in commercial applications is increasing owing to their versatile decorative and functional properties. Natural stones are being used in various projects besides countertops. They are used in entryways, flooring, and statement pieces that enhance the commercial space's visual appeal, further boosting the demand for natural stone & marble in the U.S.

For instance, Natural Stones Projects is a service for architects and designers to fabricate and supply natural stone for high-end residential and commercial applications. Natural Stone Projects was selected to supply four types of stones to Mulberry’s novel design idea for their global stores. This project used natural stones such as Cornish Slate, English Ironstone, Honed Finish and Mahogany Stone, and Printemps Green Marble.

Download Free sample to learn more about this report.

U.S. Natural Stone & Marble Market Growth Factors

Rising Demand for Sustainable Construction Materials to Boost Market Growth

In recent years, there has been significant demand for sustainable materials across all sectors, including construction. Sustainable infrastructure design focuses on increasing the efficiency of resources, including water, energy, and other materials, while limiting its effect on human health and the environment during the structure’s life cycle.

Natural stone has been the building material of choice, based on aesthetics and durability, for centuries. In today’s eco-conscious world, its popularity is also driven by the fact that it’s the most sustainable building material. Increasing popularity of limestone, sandstone, marble, granite, travertine, or slate in architecture, construction, conservation & restoration, interior design, and landscaping are driving their adoption.

Natural stone & marble are extremely strong and durable, making them a sustainable choice. Due to its eco-friendly and sustainable nature, residential and commercial buildings employ natural stone in various application areas, including flooring, interior design, and countertops. Natural stone recycles the heat from the sun and helps reduce energy costs. Moreover, it also helps manage the allergens and pollutants in the air and does not contain harmful chemicals or toxins, resulting in driving market growth in the coming years.

RESTRAINING FACTORS

Introduction of Artificial Stones to Hinder Market Growth

Artificial concrete blocks and ceramic tiles are alternatives to natural stone. Though the demand for marble and natural stone is on the rise, ceramic tiles and artificial concrete blocks are in huge demand compared to natural stones. Besides, these building materials are relatively cost-effective, which makes them the obvious choice for consumers, thus affecting the U.S. natural stone & marble market growth.

Moreover, the development of technology and modern equipment allows the creation of artificial stones of different sizes, colors, and designs. Growing demand from the construction and interior sectors is foreseen to push demand for artificial stones.

U.S. Natural Stone & Marble Market Segmentation Analysis

By Type Analysis

Limestone Segment Dominated the Market Owing to its Exceptional Properties

Based on type, the market is segmented into granite, limestone, marble, sandstone, slate, and others.

The limestone segment accounted significant U.S. natural stone & marble market share in 2023 and is likely to maintain its dominance during the forecast period. Limestone inherently possess insulating characteristics that aid in temperature control and decrease the use of energy. As a result, it can decrease the expenses associated with heating and cooling. Limestone construction material offers efficient thermal inertia, which absorbs and gradually disburses heat.

Marble is expected to be the fastest-growing segment. Marble possesses incredible strength and exceptional aesthetics and hence, is employed in art, architecture, and construction. Marble is majorly used in regions with high temperatures. It can act as a natural air conditioning system as it remains cool at higher temperatures. Marble also provides benefits such as protection from weather erosion, water leaks, and chemical corrosion.

By Application Analysis

Building & Construction Segment to Lead the Market Due to Growing Commercial and Residential Construction

Based on application, the market is segmented into building & construction, monumental, and specialty.

The building & construction segment is expected to dominate the U.S. market share during the forecast period. Growing commercial and residential construction across the U.S. is a major factor supporting the growth of the segment. According to the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, residential remodeling in the major metro cities of the U.S. grew rapidly in 2023. This growth was associated with surging home prices, increasing sales of residential spaces and high earnings.

In the monumental segment, natural stones and marble are mainly employed in constructing monuments, statues, and other artifacts due to low maintenance and minimal upkeep.

KEY INDUSTRY PLAYERS

Key Market Players are Taking-Up Variety of Strategies to Cement Their Positions

In terms of the competitive landscape, the market depicts the presence of established and emerging companies. The key players include Southland Stone USA, Inc., USA Marble LLC, Natural Stones USA, and A&G Marble. Industry players compete mainly based on product prices and application characteristics. In addition, companies are emphasizing product innovation, social marketing, acquisition, and collaborations to maintain competitive edge.

List of Top U.S. Natural Stone & Marble Companies:

- Southland Stone USA, Inc. (U.S.)

- Superior Granite and Marble (U.S.)

- USA Marble LLC (U.S.)

- A&G Marble Inc (U.S.)

- Levantina y Asociados de Minerales, S.A (Spain)

- Natural Stones USA (U.S.)

- Polycor Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 -Polycor Inc. completed the acquisition of ROCAMAT, which is an important player in the global building stone production sector and a leading producer of natural stone in France. ROCOMAT has four transformation plants and operates 30 limestone quarries across France. This acquisition would create new growth opportunities for the Polycor group in France.

- February 2023: Polycor Inc. announced the acquisition of Ebel Quarries, which is a limestone fabricator and quarrier based in Ontario. The acquisition would help the company to cater increasing demand for natural stone and diversify its product portfolio.

- May 2022: Birch Hill Equity Partners and Investissement Québec acquired Polycor Inc. in partnership with the company’s management from TorQuest Partners and its co-investors, PNC Mezzanine Capital and Wynnchurch Capital. The transaction, which was closed on April 29, 2022, support the continued growth of Polycor in Québec and across its global operations.

- October 2019– Polycor Inc. continues to show strong growth with the acquisition of one of the leading quarries and fabricators of Indiana limestone, Elliott Stone Company Inc. The acquisition expanded Polycor's product portfolio of natural stone building products for the hardscapes and masonry sector.

REPORT COVERAGE

The market research report examines key factors such as companies, products, and applications. It also covers market trends and highlights noteworthy industry advancements. The study provides different variables that have contributed to the market growth in recent years. It includes the industry's historical data, latest market dynamics, opportunities, and revenue growth estimates at the country, regional, and global levels.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.0% from 2024 to 2032 |

|

Unit |

Value (USD Million) Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says the market stood at USD 437.9 million in 2023.

The market is expected to exhibit a CAGR of 4.0% during the forecast period.

By type, limestone segment led the market in 2023.

Southland Stone USA, Inc., USA Marble LLC, Natural Stones USA, and A&G Marble are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us