Home / Healthcare / Pharmaceutical / U.S. Opioid Use Disorder (OUD) Market

U.S. Opioid Use Disorder (OUD) Market Size, Share & Industry Analysis, By Drug Class (Buprenorphine, Methadone, and Naltrexone), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Stores, and Online Pharmacies), and Country Forecast, 2024-2032

Report Format: PDF | Published Date: Sep, 2024 | Report ID: FBI108778 | Status : PublishedThe U.S. opioid use disorder (OUD) market size was worth USD 2.36 billion in 2023 and is projected to grow at a CAGR of 9.9% during the forecast period.

Opioid use disorder is a chronic medical condition characterized by the compulsive use of opioids despite adverse consequences, often leading to physical and psychological dependence on these powerful pain-relieving substances.

The U.S. has seen a significant upsurge in the prevalence of opioid overdose and large number of cases of opioid use disorder, which is anticipated to increase the demand for the opioid dependence treatment. For instance, according to the Centers for Disease Control and Prevention (CDC), in the U.S., an estimated 2.7 million people in the age group of 12 or above reported having an opioid dependence in 2021.

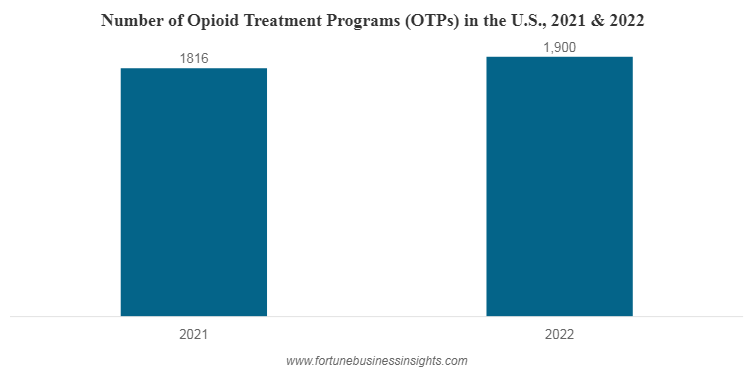

Furthermore, the growing number of opioid treatment programs coupled with increasing visits to this healthcare facility has increased the adoption of prescription opioids drugs for opioid dependence treatment.

In 2020, the world experienced an outbreak of COVID-19, which hampered the number of patient visits to healthcare facilities to treat opioid dependence. This resulted in the decline of the U.S. market in 2020.

LATEST TRENDS

Increased Consideration of Buprenorphine Patches as a Treatment Mode

In recent years, the market has witnessed an advancement in the route of administration of drugs for the treatment of the disorder. Buprenorphine patches as a treatment mode have various advantages, such as easing the mode of drug delivery and reducing pain, and can be self-administered. Furthermore, market players are introducing these advanced drugs in the market.

- For instance, in April 2020, Amneal Pharmaceuticals, Inc. launched a generic version of Butrans (buprenorphine) transdermal patches following Abbreviated New Drug Application (ANDA) approval by the FDA.

DRIVING FACTORS

Growing Government Initiatives and Support from NGOs to Overcome Opioid Dependence to Boost the Market Growth

The growing prevalence of opioid dependence has stimulated the government and NGOs to create awareness regarding the treatment of the disease to reduce cases. Furthermore, the introduction of reimbursement for opioid dependence treatment encouraged the patient population to undergo treatment. Such encouragement through reimbursement policy is expected to support the U.S. opioid use disorder (OUD) market growth.

- For instance, in January 2020, a bundled Medicare payment became available to hospitals to support the comprehensive treatment of opioid use disorders. The Medicare policy covers U.S. Food and Drug Administration (FDA)-approved opioid agonist and antagonist medication-assisted treatment (MAT) medications.

In the U.S., there were an increase in the number of opioid treatment programs. There were 1,900 and 1,816 opioid treatment programs in 2022 and 2021, respectively.

RESTRAINING FACTORS

Adverse Effects Associated with Therapies to Limit the Market Growth

Despite the increased treatment of opioid dependence disorders in the country, the growing concern regarding the risk associated with the drugs might hinder its adoption in the market. The side effects associated with the use of drugs include vomiting, diarrhea, respiratory depression, bone/joint pain, bladder pain, dental problems, muscle aches, abdominal cramps, and constipation.

Such side effects associated with the drugs used in the management of opioid dependence are restricting the population from deploying these drugs as a treatment option.

SEGMENTATION

By Drug Class Analysis

Based on drug class, the U.S. market is trifurcated into methadone, buprenorphine, and naltrexone.

The buprenorphine segment held the largest share and is expected to grow at the highest CAGR during the analysis period. This is due to the growing number of opioid treatment programs coupled the introduction of buprenorphine by the market players.

- For instance, In May 2020, Hikma Pharmaceuticals PLC launched Buprenorphine Hydrochloride Injection, 0.3mg/mL, the generic version of Buprenex1 in the U.S. Such launch of buprenorphine is expected to boost the segment growth during the forecast period.

By Route of Administration Analysis

Based on the route of administration, the U.S. opioid use disorder (OUD) market is bifurcated into oral and parenteral.

In 2022, the parenteral segment held the largest share of the market. The segmental expansion can be attributed to the market players' continuously growing strategies to research and develop new drugs with an aim to receive FDA approval for drugs for the treatment of opioid dependence.

- For instance, in June 2023, Braeburn Inc. received approval from the U.S. FDA for BRIXADI (buprenorphine) extended-release injection for subcutaneous use (CIII) for the treatment of opioid use disorder.

By Distribution Channel Analysis

Based on distribution channel, the U.S. market is segmented into hospital pharmacies, retail pharmacies & stores, and online pharmacies.

The hospital pharmacies held the largest share in 2022 due to the surging patient pool for opioid use disorder and the dependency of the patient population on hospitals and opioid treatment programs for the administration of drugs. Moreover, the expansion of opioid treatment program clinics and strict regulations to provide methadone only to the opioid treatment programs in the U.S. is expected to propel segmental share during the forecast period.

- For instance, as per the National Survey of Substance Abuse Treatment Services (N-SSATS), in 2020, there were 311,531 clients who received methadone in opioid treatment program facilities.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, the market records the presence of emerging and established companies operating in the market. Key industry players, such as Indivior PLC, Alkermes, and Orexo AB, have a significant U.S. opioid use disorder (OUD) market share. The prominent presence of these companies' market is attributed to its portfolio's strong sales in buprenorphine and naltrexone. Orexo AB is engaged in the continuous development of more effective drugs for treating opioid disorders. Indivior PLC has more buprenorphine product offerings in its portfolio, which is the dominant segment in the market.

Some other companies with a considerable presence in the market include Hikma Pharmaceuticals PLC, Titan Pharmaceuticals, Inc., BioDelivery Sciences International Inc., and other small and medium-sized players. These companies are deploying strategic moves, such as the introduction of various products to strengthen their product portfolio for attracting more market revenue. Furthermore, the growing focus of these companies on increasing partnerships with other players to increase awareness regarding opioid dependence is expected to propel their company’s revenue in the long run.

LIST OF KEY COMPANIES PROFILED:

- Indivior PLC (U.S.)

- Alkermes (Ireland)

- Orexo AB (Sweden)

- Titan Pharmaceuticals, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- BioDelivery Sciences International Inc. (U.S.)

- Viatris Inc. (Mylan N.V.) (U.S.)

- Braeburn Inc. (U.S.)

- Camurus (Sweden)

- Lannett (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 - The New York State Office of Addiction Services and Supports (OASAS) and the New York State Department of Health (DOH) introduced the Buprenorphine Assistance Pilot Program to assist with the cost of buprenorphine for the opioid dependence treatment

- June 2020 – Titan Pharmaceuticals, Inc. entered a partnership with Indegene to form a multichannel digital marketing program across the U.S. The partnership would help grow their competence in providing solutions for patients addicted to opioid.

REPORT COVERAGE

The market report provides a detailed analysis of the market. It focuses on key aspects, such pipeline analysis of key products and statistics of opioid dependence in the U.S. In addition, it includes key industry developments, new product launches, and the impact of COVID-19 on the market. Besides this, the report also offers insights into various opioid treatment programs.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 9.9% from 2024 to 2032 |

Unit |

Value (USD Billion) |

Segmentation |

By Drug Class

|

By Route of Administration

|

|

By Distribution Channel

|

Frequently Asked Questions

How much is the U.S. opioid use disorder (OUD) market worth?

Fortune Business Insights says that the U.S. market was worth USD 2.36 billion in 2023.

At what CAGR is the U.S. opioid use disorder (OUD) market projected to grow during the forecast period (2024-2032)?

The market is expected to exhibit a CAGR of 9.9% during the forecast period (2024-2032).

Which was the leading segment in the market by drug class?

By drug class, the buprenorphine segment account for the highest proportion of the market.

Who are the top players in the market?

Indivior PLC, Alkermes, and Orexo AB are the top players in the market.

- USA

- 2023

- 2019-2022

- 80