U.S. Photobook and Album Market Size, Share & COVID-19 Impact Analysis, by Product Type (Flush Mount, Lay Flat, and Standard), By Size (Square, Portrait, and Landscape), 2025-2032

KEY MARKET INSIGHTS

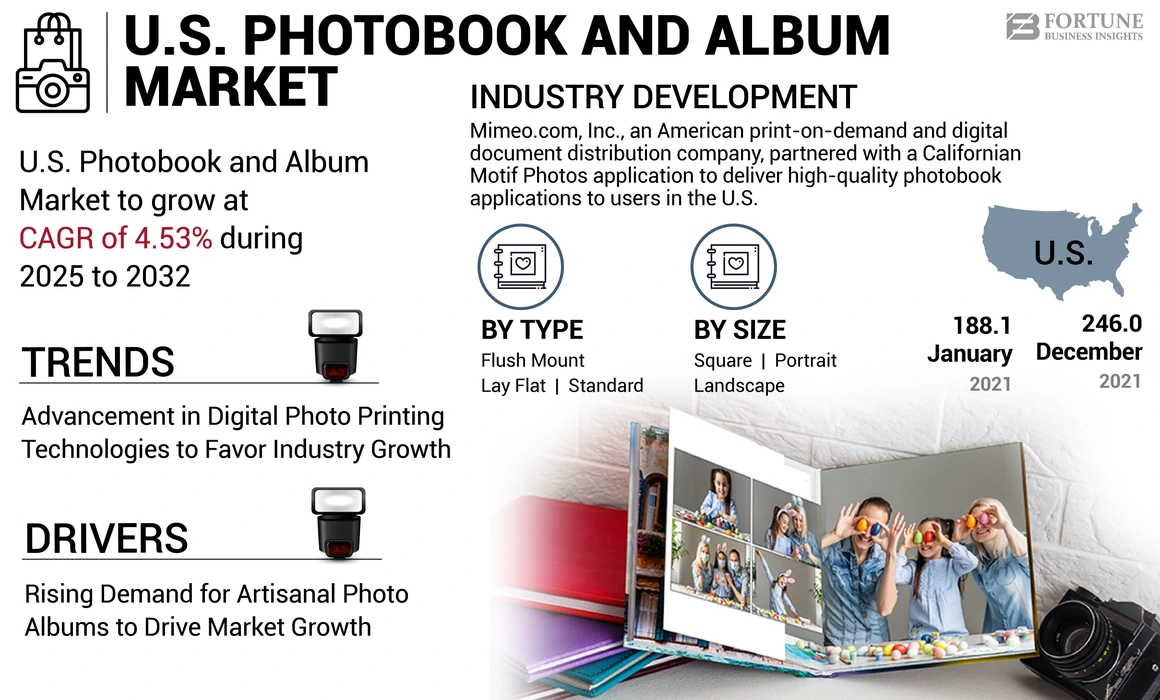

The U.S. photobook and album market size is projected to grow at a CAGR of 4.53% during the forecast period.

Americans increasingly use photo printing applications and platforms to preserve their special life moments in the form of albums. From 2017 to 2022, Adobe, Inc., a U.S.-based photo printing software company, reported a two-fold jump in the number of its Adobe Creative Cloud platform subscribers and reached 30 million in 2022. The growing awareness regarding the availability of advanced photo printing applications and increasing demand for photo capturing & printing photographs among Americans are mainly supporting photobook and album revenues in the U.S.

U.S PHOTOBOOK AND ALBUM MARKET TRENDS

Advancement in Digital Photo Printing Technologies to Favor Industry Growth

The emergence of state-of-art photo printing technologies allows U.S.-based photobook and album makers such as Shutterfly, LLC, Mixbook, and others to offer high-quality custom prints & albums, favoring the U.S. market growth. In addition, increasing manufacturers’ utilization of cutting-edge tools & machines and specialized raw materials, such as acrylic & metal prints, to produce personalized photo albums is accelerating the product revenues in the U.S. Furthermore, continual advancements in web-to-print technologies enable manufacturers to prepare classic photobook and album products, thereby creating lucrative market growth opportunities. For instance, in 2022, Adobe, Inc. released Adobe Photoshop’s newer version wherein users can use complex objects and regions such as buildings, sky, plants, and streets to prepare & print a particular web photograph.

U.S PHOTOBOOK AND ALBUM MARKET GROWTH FACTORS

Rising Demand for Artisanal Photo Albums to Drive Market Growth

Increasing popularity and demand for premium-based handcrafted wedding albums among Americans to preserve their wedding memories is accelerating the U.S. photobook and album market growth. In addition, rise in the number of photo booths offering artisanal photobook printing services is accelerating the demand for photobooks nationwide. Besides, the growing number of wedding photojournalists offering theme-based wedding photography services is surging the wedding album demand in the U.S. According to data presented by the U.S. Bureau of Labor Statistics (LBS), as of May 2021, the number of photographers in the U.S. reached 38,420.

RESTRAINING FACTORS

Download Free sample to learn more about this report.

Higher Cost of Professionally Made Flush Mount Albums to Limit Market Growth

The higher cost of professionally made flush mount and premium lay flat albums limits its demand among U.S.-based middle-income population groups. Furthermore, higher prices and shortage of raw material supplies, such as leather & acrylic covers, lamination rolls, and specialty papers, required to produce a premium quality album are lowering the U.S. market size.

As per statistical data presented by the Federal Reserve Bank of St. Louis, U.S., the producer price index of printing and writing papers in the U.S. increased from 188.1 in January 2021 to 246.0 in December 2021, considering a price index of 100 in May 1982.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, the market depicts the presence of established and emerging album-maker companies. Key market player, Shutterfly LLC, exhibited a significant U.S. photobook and album market share in 2022. The company’s leading position was attributed to its regular introduction of newer photo albums and book collections in the U.S. In October 2021, Shutterfly LLC. partnered with KonMari Media, Inc., a media company, to introduce the Shutterfly x KonMari collection of various products such as photobook and album, calendars, cards, ornaments, and home décor products in the U.S.

The U.S. market analysis can be conducted based on understanding the business performances of various other key players such as Mixbook, Fujifilm Corporation, Photobook Worldwide, and others.

List of Top U.S. Photobook and Album Companies:

- Shutterfly, LLC. (U.S.)

- Mixbook (U.S.)

- Fujifilm Corporation (Japan)

- Photobook Worldwide (Malaysia)

- nPhoto (Poland)

- Nations Photo Lab (U.S.)

- PastBook (Netherlands)

- Artifact Uprising LLC. (U.S.)

- RitzPix (U.S.)

- Walgreens (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Mimeo.com, Inc., an American print-on-demand and digital document distribution company, partnered with a Californian Motif Photos application to deliver high-quality photobook applications to users in the U.S.

- January 2021 – Nations Photo Labs invested USD 5.6 million to acquire newer equipment and furniture and set up a newer production facility of photo book products in Pennsylvania, U.S.

- July 2020 – Sutterfly, LLC., invested USD 23 million in its Ohio, U.S.-based manufacturing facility to enhance its photo products offerings in the U.S.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Free sample of this market research report provides a detailed market analysis. The report also provides a detailed market outlook and market forecasts based on different product types. It focuses on key aspects such as an overview of the cost structure of the albums, the U.S. industry supply chain, and the smartphone penetration rate shaping the overall U.S. photo album industry.

In addition, the report provides detailed information on new product launches, key industry developments, such as mergers, partnerships, & acquisitions, and the impact of COVID-19 on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have effectively contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.53% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Size

|

Frequently Asked Questions

According to Fortune Business Insights, the U.S. photobook and album market is projected to grow at a CAGR of 4.53% during the forecast period, driven by increased use of photo printing platforms and custom album demand.

Growing at a CAGR of 4.53%, the market will exhibit steady growth in the forecast period (2025-2032).

Growth is fueled by rising use of photo printing apps, greater awareness of digital photo tools, and increased demand for preserving special moments in high-quality printed formats.

Advancements in digital photo printing and web-to-print technologies allow companies like Shutterfly and Mixbook to offer personalized, high-quality albums with acrylic and metal finishes.

There is growing demand for handcrafted, premium wedding albums as Americans seek personalized ways to preserve their memories, especially through photo booths and wedding photojournalists.

High costs of professionally made albums, such as flush mount and lay flat formats, along with rising raw material prices, deter price-sensitive U.S. consumers from premium options.

Major players include Shutterfly LLC, Mixbook, Nations Photo Lab, and Artifact Uprising, with Shutterfly holding a significant market share due to its product innovation and partnerships.

Companies like Nations Photo Lab and Shutterfly are investing millions in new production facilities and equipment, improving scalability and boosting product availability.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us