U.S. Resilient Flooring Market Size, Share & Industry Analysis, By Product Type (Luxury Vinyl Tile, Vinyl Sheet & Floor Tile, Rubber, Linoleum, Laminate, Wood, and Cork), By Application (Residential, Commercial, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

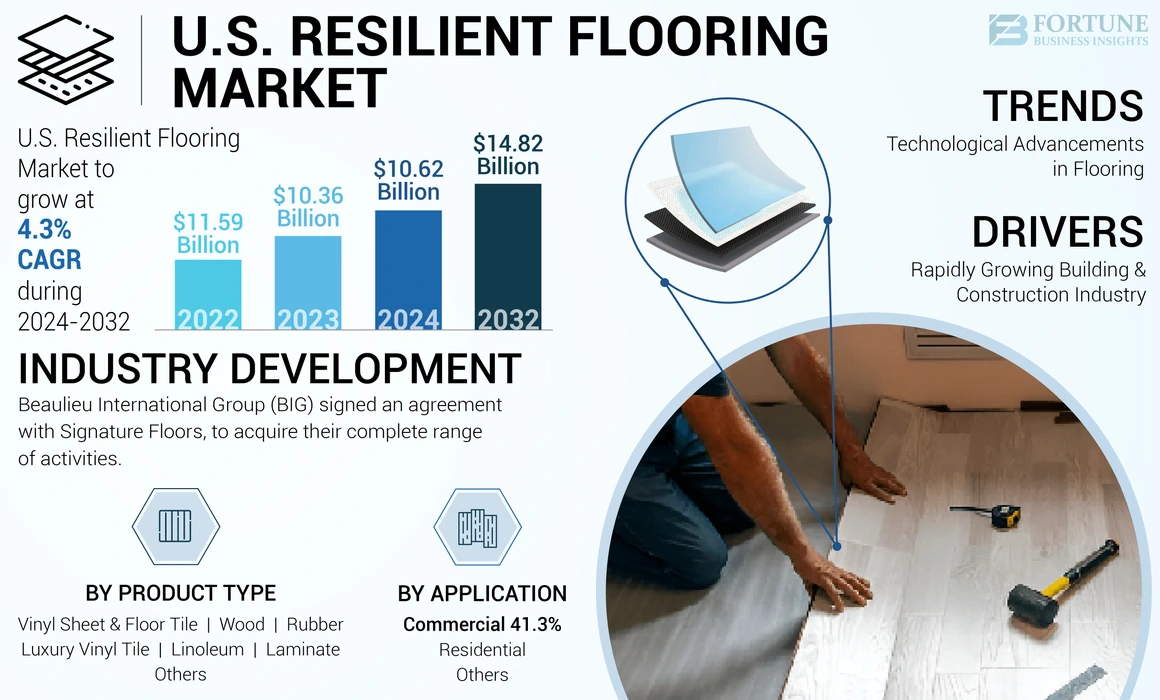

The U.S. resilient flooring market size was valued at USD 10.36 billion in 2023. The market is projected to grow from USD 10.62 billion in 2024 to USD 14.82 billion by 2032 at a CAGR of 4.3% during the forecast period.

Resilient flooring is durable, easy to clean, and suitable for pets and young children. The resilient flooring makes it comfortable to stand on for long periods and features a pliable and waterproof surface. Resilient flooring is also available in a variety of styles and colors, making it easy to match with any home decor.

Major players in the U.S. resilient flooring market include Mohawk Industries, Forbo Flooring Systems, Tarkett SA, and Interface Inc., among others. These companies lead in innovation and sustainable practices while expanding their market share through mergers, acquisitions, and partnerships.

MARKET DYNAMICS

MARKET DRIVERS

Rapidly Growing Building & Construction Industry is anticipated to Drive Market Growth

Flooring is an integral part of the building, and the growing building and construction industry is anticipated to be a key driver for the growth of the U.S. resilient flooring market.

The construction sector witnessed a significant recovery following the setback encountered during the COVID-19 pandemic. The Central Banks of the world's major economies, including the United States adopted the Easy Money Policy during the pandemic, making easy availability of loans at lower rates, resulting in increased investment into building and construction projects. Apart from that, many people working from home had more time and more savings to focus on the remodeling and renovations of their homes. All these factors together led to the rise in demand for resilient flooring.

After significantly controlling the spread of COVID-19, the government launched several initiatives to get industrial activities back on track, which has pushed rising urbanization. For instance, to generate high-paying jobs, the Biden administration came up with the Bipartisan Infrastructure Law. Under these initiatives, the government kept a target to spend around USD 1.2 trillion for funding infrastructure projects, which include a range of civil construction projects across the country. This initiative also provides expanded funding, enabling states to retrofit several. Therefore, the rising building and construction industry, supported by government initiatives and the increasing purchasing power of consumers is poised to significantly drive the growth of the resilient flooring market during the forecast period.

MARKET RESTRAINTS

Volatility in Raw Material Prices and Concerns Associated with Waste Management Limit Market Growth

Fluctuations in raw materials prices may limit the growth of the resilient flooring market by affecting the manufacturer's profitability. Increasing prices of the major raw materials used in the manufacturing of flooring products, including vinyl and others, result in increased production costs and, thereby, higher costs of the finished products. Higher prices ultimately affect the demand for the products, thereby affecting their competitiveness in the market.

Additionally, the U.S. resilient flooring industry is associated with the generation of a significant amount of waste during manufacturing, installation, remodeling, or renovation and demolition. The waste generated mainly includes scraps, old flooring materials, adhesives, packaging, and other related waste. Disposal of large volumes of waste is costly and time-consuming. Moreover, some of these wastes, including underlays, adhesives, and packing materials, are hazardous to human health and the environment. The disposal of such hazardous waste is guided by the rules and regulations specified by regulatory and environmental bodies.

MARKET OPPORTUNITIES

Manufacturing of Sustainable Products is to Present Lucrative Opportunities

The manufacturing and use of many flooring products affect the environment and human health. Hence, the production of environment-friendly and energy-efficient flooring products is anticipated to present lucrative opportunities in the near future.

Certain flooring products emit VOCs, which can pollute the indoor environment, affecting human health. To deal with such restraints, manufacturers are focusing on reducing the VOC content of the product. For instance, in November 2022, Tarkett S.A. launched its renowned Johnsonite brand of flooring products. The brand's adherence to stringent material health, renewable energy, product circularity, climate requirements, water stewardship, and social fairness criteria provides a competitive edge to the company.

Reducing water and energy requirements for manufacturing resilient flooring products helps increase the product's sustainability and improves the company's profitability. To reduce their carbon footprint, manufacturers are also moving toward the adoption of solar technology. Additionally, investment in research and development to manufacture products from flooring waste presents significant opportunities for the market during the forecast period.

MARKET CHALLENGES

Environmental Challenges May Limit Market Growth

While some resilient flooring products are eco-friendly, others, such as vinyl, raise concerns about their environmental impact during manufacturing. There is a growing pressure on manufacturers to adopt greener practices. Moreover, there is a strong consumer shift toward environmentally friendly materials, including linoleum and rubber flooring, both of which are derived from renewable resources. These materials are durable and help reduce carbon footprints, appealing to sustainability-conscious buyers.

U.S. RESILIENT FLOORING MARKET TRENDS

Download Free sample to learn more about this report.

Technological Advancements in Flooring is a Prominent Trend in the Market

The development of resilient flooring, especially LVT, benefits from technological innovations such as digital printing, which allows for realistic and customizable designs. Enhanced antimicrobial properties and ease of cleaning also make resilient flooring a preferred option post-COVID-19, particularly in healthcare and educational facilities.

IMPACT OF COVID-19

Flooring products are highly used in the construction industry. The COVID-19 pandemic severely impacted the industry due to a shortage of labor, movement restrictions, raw material shortages, and disruption in the supply chain. This caused significant setbacks in production and operations. For instance, according to Ceramic Tile and Stone Consultants, Inc., U.S. imports of floor-covering products from China declined by 21%.

SEGMENTATION ANALYSIS

By Product Type

Luxury Vinyl Tile Segment Dominated Owing to Durability

Based on product type, the market is classified into luxury vinyl tile, vinyl sheet & floor tile, rubber, linoleum, laminate, wood, and cork.

The luxury vinyl tile (LVT) segment held the highest share of the U.S. market in 2023 and is estimated to record significant growth during the forecast period. LVT is waterproof, making it ideal for kitchens, bathrooms, basements, and other moisture-prone areas. It is also highly durable, withstanding heavy foot traffic and requiring little maintenance, making it popular in commercial sectors such as retail, healthcare, and hospitality.

The vinyl sheet & floor tile segment is slated to register significant growth during the forecast period. Vinyl sheets & floor tile can be installed in large sections, minimizing seams, and enhancing its water resistance. This feature is a key driver in spaces where hygiene and easy cleaning are priorities, such as hospitals and schools.

The rubber segment is expected to grow considerably during the forecast period. The growing demand for sustainable building materials has boosted the popularity of rubber flooring made from recycled materials. Rubber’s recyclability makes it an attractive choice for companies focused on sustainability.

The laminate segment is anticipated to register notable growth. Modern laminate flooring is highly resistant to scratches and stains, making it ideal for busy households with pets or children. Improvements in laminate’s wear layers and high-definition printing have made it more realistic and durable, enhancing its appeal in both residential and light commercial applications.

By Application

Rising Consumer Spending to Foster Residential Segment Growth

In terms of application, the market is segmented into residential, commercial, and others.

The residential segment accounted for the largest U.S. resilient flooring market share in 2023. The implementation of government’s green building materials programs is expected to provide growth opportunities for residential construction in the region. The demand for residential construction is high due to rising consumer spending, the development of new products, and builders' efforts to meet the growing demand for residential properties.

The commercial segment is predicted to witness notable growth in the coming years. Rising demand for flooring for commercial constructions, including commercial towers, airports, railway stations, banks, and other public spaces, is driving market growth in the country. Both new constructions and the remodeling of old constructions are surging the demand for hard surface and soft surface products in the non-residential sector.

The others segment is expected to grow considerably during the forecast period. Rising industrialization in the U.S. is anticipated to play a key role in driving the U.S. resilient flooring. Investment in constructing and renovating infrastructure, such as hospitals, educational buildings, government offices, and correction facilities, is anticipated to fuel growth in the other construction sector. Industrial construction activities mostly depend on government and corporate spending, thus driving industry growth.

To know how our report can help streamline your business, Speak to Analyst

U.S. RESILIENT FLOORING MARKET COUNTRY OUTLOOK

The market is growing significantly due to rising demand from the construction industry. The flooring industry is adopting modern and advanced practices, including textured designs and 3D ceramic printing, to boost U.S. resilient flooring consumption. Further, the rising trend of antimicrobial and easy-to-clean floors is likely to augment the U.S. resilient flooring market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on New Product Development and Invest in R&D to Maintain Dominance in the Market

The competitive landscape of the market is fragmented, with the presence of several players. Some of the key players in the market include Mohawk Industries, Forbo Flooring Systems, Tarkett SA, and Interface Inc. These players are engaged significantly in research and development to innovate and improve their product offerings. The adoption of various strategic strategies, such as expansion and joint ventures, also helps them in gaining a competitive edge in the market. However, the resilient flooring market competes with other types of flooring, such as hardwood and ceramic tiles. Consumer preferences can fluctuate, making it challenging for resilient flooring manufacturers to maintain market dominance.

LIST OF KEY MARKET PLAYERS PROFILED IN THE REPORT:

- Tarkett S.A (France)

- Gerflor (France)

- Polyflor Ltd (U.K.)

- Shaw Industries Group, Inc. (U.S.)

- Beaulieu International Group (Belgium)

- Trelleborg AB (Sweden)

- Mohawk Industries, Inc. (U.S.)

- Armstrong Flooring (U.S.)

- Forbo Holding AG (Switzerland)

- Interface, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Gerflor announced acquiring SnapLock Industries, a company specializing in modular surface solutions. This acquisition would expand Gerflor's already impressive portfolio of sports surface brands, which includes Taraflex, Sport Court, Stagestep, and Connor Sports. This acquisition would bring exciting new products and innovations to the flooring industry and benefit customers seeking high-quality flooring solutions.

- April 2023: Beaulieu International Group (BIG) signed an agreement with Signature Floors, an Australian B2B flooring wholesaler, to acquire their complete range of activities. This acquisition would enable BIG and Signature Floors to expand their growth opportunities in the soft, resilient, and hard flooring markets in Australia and New Zealand. BIG invests in strategic business segments and geographies in its corporate strategy.

- November 2022: Tarkett North America reintroduced its Johnsonite product line, which includes wall bases, resilient flooring, stairwell management systems, and finishing accessories. These products are all manufactured in the U.S. and feature low VOC levels, contributing to a healthier indoor environment and reducing the need for harsh chemical cleaners. Moreover, many Johnsonite product lines received Cradle to Cradle certification, indicating their adherence to stringent material health, renewable energy, product circularity, climate requirements, water stewardship, and social fairness criteria. The company is prioritizing the quality of its products while also considering its environmental and societal impact.

- June 2022: Mohawk Industries announced the acquisition of Vitromex, a leading Mexican tile manufacturer, from Grupo Industrial Saltillo in an all-cash deal valued at USD 293 million. This acquisition included four Vitromex manufacturing plants at strategic locations and a nationwide supply chain network in Mexico. By widening its product offerings, Mohawk Industries aimed to provide a strategic advantage in the Mexican market.

- February 2022: Interface, Inc. launched its newest flooring collection, Even Path. This exciting addition features its first rigid core option, providing more choices for sturdy flooring solutions. Even Path is Interface's debut rigid core collection, boasting stunning high-quality wood and stone designs built to last. These products are engineered to endure heavy static loads and conceal any subfloor imperfections, making them ideal for hard-working spaces and today's commercial market.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, printing methods used to produce these products, and end-use industries of the product. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) and Volume (Million Sq. Meter) |

|

Growth Rate |

CAGR of 4.3% from 2024 to 2032 |

|

Segmentation |

By Product Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market size was valued at USD 10.36 billion in 2023 and is projected to reach USD 14.82 billion by 2032.

Recording a CAGR of 4.3%, the market is slated to exhibit steady growth during the forecast period.

The residential application segment led the market in 2023.

The growing demand from the construction industry is a key factor driving the growth of the market.

Innovation in product design and a rising preference for sustainable, low-maintenance solutions are anticipated to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us