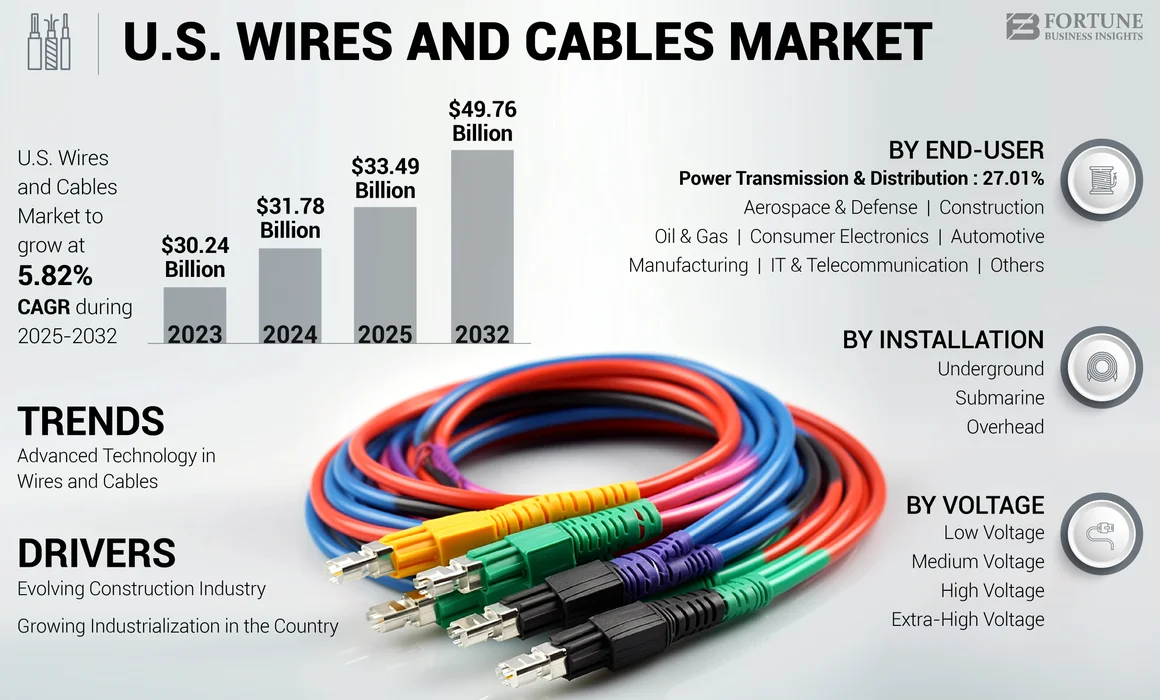

U.S. Wires and Cables Market Size, Share & Industry Analysis, By Installation (Overhead, Underground, and Submarine), By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), By End-User (Aerospace & Defense, Construction, IT & Telecommunication, Power Transmission & Distribution, Oil & Gas, Consumer Electronics, Manufacturing, Automotive, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. wires and cables market size was valued at USD 31.78 billion in 2024. The market is projected to grow from USD 33.49 billion in 2025 and projected to reach USD 49.76 billion by 2032, exhibiting a CAGR of 5.82% during the forecast period.

Wires and cables are used in both to transmit electricity or electronic signals from one end to another. Cables are more heavy-duty than wires and can endure more energy. They are used in multiple applications, such as industrial machinery, power distribution, and commercial lighting. They use different types of materials to perform according to the application.

Southwire Company is one of the major players in the U.S. market. The company delivers different wires and cables for multiple applications. It also offers products such as building wires, genesis cables, armored power cables, mining cables, transit cables, and others.

MARKET DYNAMICS

MARKET DRIVERS

Evolving Construction Industry is Propelling Demand for Market

The construction industry has shown significant growth in recent years. The construction site has special electrical requirements for wires and cables. Not every electrical firm will provide such services since there are special standards to uphold and legal requirements to fulfill. The building wiring cables segment comprises the wires and cables required for the wiring of residential and commercial buildings. This segment showed some growth due to momentum in the housing sector. In recent years, public construction spending in the U.S. rose by 16.3% to USD 437.7 billion, driven by educational construction at USD 93 billion (up 11.9%) and highway construction at USD 133.6 billion (up 18.0%).

Growing Industrialization in the Country is Boosting Market Growth

Wires & cables are one of the major essential components in the electrical and electronics industry. The government’s initiatives to boost domestic manufacturing and infrastructure have paved the way for the sector. The ambitious renewable energy target, expansion of power transmission & distribution, and rising investments in construction and transportation (roadways, metro, railways, and airways) are some of the significant developments that promise a bright future for the wire and cable industry. For instance, in July 2024, Hellenic Cables America announced to build a USD 300 million cable manufacturing plant in Wagner’s Point, Maryland.

MARKET RESTRAINTS

Increasing Raw Material Prices to Hamper Market Growth

The main raw materials needed for manufacturing cables are plastic-based components such as PVC grains and rubber. Organic polymer materials are mostly silicon rubber and fluorine plastic, while copper is important for wires. An increase in raw materials prices, especially copper, directly affects manufacturers' profit margins, posing a challenge to market growth. Raw materials that are used for making cables have observed a sharp rise after the regeneration of the country's economies after the COVID-19 pandemic.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

Focus Toward Renewable Energy is Influencing Market Growth

Renewable energy is one of the trending sources of energy transition. Renewable sources used for power generation, heating production, and others need specific wires and cable products. With the rising use of renewables in electricity production leading to an expected growth in demand, there is an enlarged demand for manufacturers and distributors to cater to the requirements of the renewable energy markets. According to the US Energy Information Administration, the installed solar capacity totaled more than 125GW by August 2023, including 80 GW of utility-scale solar capacity and an estimated 45 GW of small-scale solar capacity.

MARKET CHALLENGES

Augmenting Insulation Durability for Long Period Poses Significant Challenges

Cumulative cost and difficulty pose significant challenges to insulation durability in the industry. High voltage cables and wires require advanced insulations that can fluctuate the cost of products. For instance, undersea cables on the seabed must survive temperature variations, salinity, and extreme water pressure. These situations reduce insulation over time. Therefore, manufacturers must advance durable, resilient insulation products and components to ensure prolonged cable life.

U.S. WIRES AND CABLES MARKET TRENDS

Advanced Technology in Wires and Cables to Boost Market Growth

With technological advancements and awareness about sustainability, the power and cables sector has also embraced and evolved to incorporate these features. The United Nations describes renewable energy as energy that replenishes faster than it is consumed. This sector requires special and advanced wire and cable products to manage the flow of electricity. The general types are solar, wind, geothermal, hydropower, and bioenergy. The U.S. renewable energy market is based on these power sources.

In 2023, about 60% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases. About 19% was from nuclear energy, and about 21% was from renewable energy sources. The U.S. holds a significant growth trend in new renewable energy projects to boost the deployment of the wires and cables industry.

Impact of COVID-19

The COVID-19 pandemic badly impacted the U.S. wires and cables market. This was due to the disruption in global supply and demand. In addition, a break in the operations in industrial and commercial sectors, such as manufacturing, led to the low production of components. The major factors negatively impacting the market were the inaccessibility of raw materials, the unavailability of workers, the closing of borders, and the import and export of goods stuck to the market growth.

Segmentation Analysis

By Voltage

Low Voltage Segment Accounted for Majority Market Share Owing to Their Wide Adoption in Multiple Sectors

Based on voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra high voltage.

The low voltage segment held the largest U.S. wires and cables market share in 2024 owing to its wide application in multiple sectors. Their wide application in sound and security, automation, windmills, and nuclear and thermal power stations, among other applications, further drives segment’s market growth.

The medium voltage segment is projected to hold the second largest share due to its growing application in commercial buildings, mobile substation equipment, universities, institutions, and hospitals. They are broadly used for power distribution between low voltage applications and high voltage mains power supply.

By End-user

Power Transmission & Distribution Segment Dominates Market Backed by Expansion of Commercial Projects

Based on end user, the market covers aerospace & defense, construction, IT & telecommunication, power transmission & distribution, oil & gas, consumer electronics, manufacturing, automotive, and others.

Power transmission & distribution is the dominating segment driven by the expansion of transmission projects. Increased power demands in commercial structures are a major factor influencing the U.S. wires and cables market growth.

The construction segment has the second-highest share of the market. This is due to the country's expansion of commercial and residential buildings.

To know how our report can help streamline your business, Speak to Analyst

By Installation

Overhead Installation Dominates the Market Due to Its Increasing Demand

Based on installation, the market is segmented into overhead, underground, and submarine.

The market is dominated by overhead installation owing to the associated benefits, such as being less expensive to build and maintain and preferred for long-distance electrical transmission. This is raising the demand for wires and cables in multiple applications. For instance, PLP, a global leader in infrastructure solutions for electric power, introduced its Aeolus line monitoring service, a groundbreaking new platform for measuring and examining wind-induced conductor motion on overhead lines.

Underground wires and cables are one of the fastest-growing segments driven by the expansion in 5G connectivity. This factor may help to lead the segment’s market growth in the forecast years.

COUNTRY OUTLOOK

U.S.

Rapid Investments in Industrial Sector to Influence the Demand for the Product

Growing investments in renewable energy expansion and rising commercial and manufacturing development activities across the U.S. contribute to country’s growth. Moreover, expansion in infrastructure in power transmission & distribution, electricity generation, and construction sector is primarily expected to drive the U.S. wires and cables market growth. In 2023, the net generation of electricity from utility-scale generators in the U.S. was about 4,178 billion kilowatt hours (kWh), and EIA estimates that an additional 73.62 billion kWh were generated with small-scale solar photovoltaic (PV) systems.

Additionally, consumer electronics is likely to boost the adoption in the U.S., which will eventually fuel the growth of the market during the forecast period.

COMPETITIVE LANDSCAPE

Key Industry Players

Large Scale Wires and Cables Supply Contracts to Impact Market Growth

In terms of the competitive landscape, the market depicts the presence of established and emerging wire and cable companies. LS Cable & system accounts for significant market share in the U.S. market in 2024. The company's apex position is attributable to the strong sales performance of its flagship hybrid offerings, offering dual purpose in one system, coupled with a greater emphasis on the adoption of advanced tools. This focus on the greater adoption of advanced and green technologies has allowed the company to streamline wires and cables, considerably improving its sales and volume shipments.

For Instance, in March 2023, LS Cable & system accepted a contract of approximately USD 85 million to supply submarine cables to (TPC) Taiwan Power Corporation, which has an offshore wind farm to be built in Taiwan.

LIST OF KEY U.S. WIRES AND CABLES COMPANIES PROFILED

- Southwire Company (U.S.)

- Belden Inc. (U.S.)

- Amphenol Communications (U.S.)

- Encore Wire Corp (U.S.)

- Prysmian Group (Italy)

- Nexans (France)

- Furukawa Electric Co Ltd (Japan)

- Fujikura Ltd. (Japan)

- Sumitomo Corporation (Japan)

- LS Cable & System (South Korea)

KEY INDUSTRY DEVELOPMENTS

- July 2024 – LS Cable & System has signed a contract to supply submarine cables worth KRW 100 billion with LS Power Grid California, a U.S. power grid operator. The company will supply submarine cables to the western U.S., and it aims to use this opportunity to solidify its position in the U.S. market further.

- June 2024 – LS Cable & System signed a contract with ELIA Transmission Belgium to supply submarine cables worth approximately KRW 280 billion. The submarine cable will be supplied to Princess Elizabeth Island, an artificial energy island, a floating structure that will be a link between 3.5GW offshore wind farms and Belgium’s onshore grid to distribute and manage power.

- August 2023 – Fujikura Ltd. has reduced the weight and diameter of the harness cable used to send electrical signals to the side airbags of automobiles and has begun offering new samples. The company has achieved a 30% lighter weight and 10% smaller diameter than our current product while maintaining the same trauma resistance as the PVC tube. Increased flexibility in cable layout also contributes to weight reduction in the side airbag system.

- April 2023 – Sumitomo Electric Industries, Ltd. announced a plan to establish a power cable factory in Scotland, U.K. In the European market, where such trends are active, demand for power cables is growing. In particular, the U.K. is expected to be one of the largest markets for power cables, as the country is planning a number of offshore wind power projects to achieve the Scottish government’s net zero in 2045 and the U.K.’s net zero in 2050.

- February 2023 - Nexans, a French company, entered into a contract to provide subsea cables for the PacWave South site, the first grid-connected wave energy test facility in the U.S., situated in Oregon. PacWave South contains four berths that capture energy from wave motion.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements and pricing analysis. Additionally, it includes an overview of the installation scenario for companies, the number of replacements and maintenance in the U.S., new product launches, key industry developments such as mergers, partnerships, acquisitions, and the impact of COVID-19 on the market. Besides this, it also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.82% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Installation

|

|

By Voltage

|

|

|

By End-User

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 31.78 billion in 2024.

The market is likely to grow at a CAGR of 5.82% during the forecast period.

The power transmission & distribution segment leads the market due to rapid urbanization.

The evolving construction industry is propelling demand for the wires & cables market.

Some of the top major players in the market are LS Cable & System, Southwire Company, Belden Inc., and Nexans.

The U.S. market size is expected to record a valuation of USD 49.76 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us