Ultraviolet (UV) Sensor Market Size, Share & Industry Analysis, By Sensor Type (UV-A, UV-B, UV-C, and Combined UV), By Type (UV Phototubes, Light Sensors, and UV Spectrum Sensors), By Technology (Photodiodes, Phototransistors, CMOS-based Sensors, and Others), By Application (Industrial, Consumer Electronics, Healthcare, Automotive, Agriculture, Military & Defense, and Others), and Regional Forecast, 2026 – 2034

UV SENSOR MARKET SIZE AND FUTURE OUTLOOK

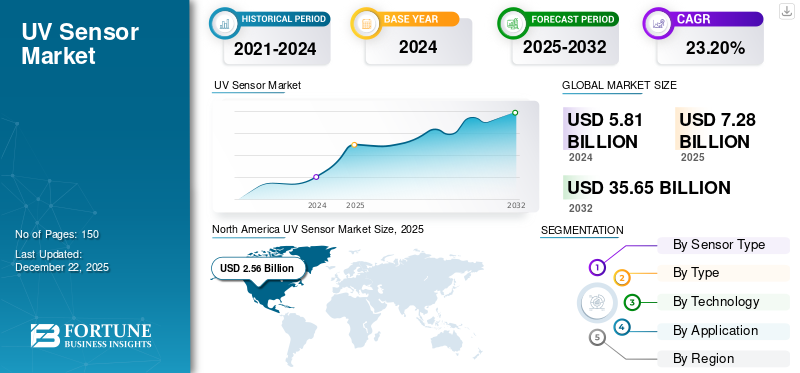

The global UV sensor market size was valued at USD 5.81 billion in 2025. The market is projected to grow from USD 7.28 billion in 2026 to USD 35.65 billion by 2034, exhibiting a CAGR of 23.20% during the forecast period. North America dominated the global market with a share of 35.20% in 2025.

The market refers to the development, production, and distribution of sensors that detect Ultraviolet (UV) radiation across various wavelengths, including UV-A, UV-B, UV-C, and combined UV. These sensors are widely utilized in industrial, consumer electronics, healthcare, automotive, agriculture, military & defense, and other applications. The advancements in sensor technology, miniaturization, and integration with IoT ecosystems enhance the adoption of these sensors across diverse industries. Solar Light Company, LLC, Endress+Hauser Group Services AG, Enting Water Conditioning, Hamamatsu Photonics K.K., Broadcom Inc., Sony Semiconductor Solutions Corporation, Balluff GmbH, Ushio America, Inc., Sumita Optical Glass, Inc., and Adafruit Industries LLC are the key players operating in the market.

The COVID-19 pandemic initially disrupted the market due to supply chain interruptions, reduced manufacturing activities, and postponed deployments across various sectors. However, the market witnessed significant growth post-pandemic, driven by increasing demand for UV-based disinfection systems and heightened awareness of hygiene and air quality monitoring.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs imposed between major trading nations have had a combined impact on the market. Increased tariffs on imported electronic components have raised production costs for manufacturers, leading to price hikes and reduced competitiveness in international markets. For instance,

- The imposition of U.S. tariffs on imported components is projected to raise production costs by approximately 4 to 6%, with notable implications for the sensors and consumer electronics segments.

This has majorly affected the company’s dependency on cross-border supply chains for raw materials and sensor modules. However, some domestic manufacturers have benefited from reduced foreign competition, encouraging localized production and innovation. Overall, while the tariffs have posed short-term challenges, they have also encouraged strategic shifts in sourcing and manufacturing strategies within the industry.

UV SENSOR MARKET TRENDS

Integration of UV Sensors into Smart Devices is a Growing Market Trend

The increasing integration of these sensors into wearable devices and smartphones is a key trend reshaping the market growth. Rising consumer awareness about the harmful effects of ultraviolet radiation has created a huge demand for real-time monitoring solutions. As a result, electronics manufacturers are incorporating these sensors into smartwatches, fitness bands, and smartphones to provide users with increasing UV exposure data. Advancements in miniaturization and low-power sensor technology have enabled seamless integration without impacting device performance or battery life. This trend supports the growing consumer preference for multifunctional health monitoring devices. Therefore, the wearable and mobile electronics component is becoming a significant contributor to the growing UV sensor market share. For instance,

- As per the 2023 GSMA's State of Mobile Internet Connectivity Report, over 54% of the global population, i.e., around 4.3 billion individuals, own a smartphone.

MARKET DYNAMICS

Market Drivers

High Demand for UV-Based Disinfection Systems Drives Market Growth

The growing demand for UV-based disinfection systems across various sectors is a major market driver. UV-C light, known for its germicidal properties, is increasingly being adopted in healthcare, transportation, commercial, and residential settings to disinfect air, water, and surfaces. For instance,

- UV-C disinfection has demonstrated high efficacy, with studies reporting up to a 99.99% reduction in specific bacteria such as Clostridium difficile, according to ScienceDirect.com.

These systems rely on UV light sensors to monitor and regulate radiation levels for safety and effectiveness, increasing the need for reliable sensor technologies. This has been further accelerated by a heightened global focus on hygiene and infection control following the COVID-19 pandemic. Industries are investing in advanced disinfection solutions to ensure public health and regulatory compliance. Thus, the integration of these sensors into disinfection systems is expected to witness sustained growth.

Market Restraints

High Costs of Development and Production Hinders Market Growth

The high cost associated with the development and production of advanced UV sensors hinders market growth. The integration of advanced technologies, such as miniature sensors and high-precision components, results in increased manufacturing costs, which can limit affordability, especially for small and medium-sized enterprises. Additionally, the market faces challenges related to the standardization and maintenance of these sensors, which require regular adjustments to ensure accuracy over time. These factors hinder the widespread adoption of the product in cost-sensitive industries or regions with limited budgets for advanced technological solutions.

Market Opportunities

Growing Implementation of these Sensors for Environmental Monitoring is Expected to Expand Market

The expanding use of these sensors in environmental monitoring applications presents a significant opportunity for market growth. Governments and organizations are increasingly investing in systems that measure UV radiation levels as concerns about climate change and its effects on public health grow. For instance,

- In April 2025, Sidewalk Labs initiated a project to develop a smart neighborhood in Toronto, incorporating technology to enhance sustainability, enable data-driven urban planning, and improve overall quality of life.

These sensors provide critical data for assessing environmental conditions, issuing health warnings, and guiding agricultural practices, which boosts demand for accurate UV sensing technologies. Furthermore, the growing focus on sustainable development and environmental protection is driving the adoption of these sensors in various monitoring systems. They are being integrated into weather stations, environmental sensors, and smart city infrastructure to improve public safety and inform policy decisions. This creates long-term growth opportunities for manufacturers in the market.

SEGMENTATION ANALYSIS

By Sensor Type

Rising Demand for Disinfection Drives UV-C Segment Dominance

Based on sensor type, the market is divided into UV-A, UV-B, UV-C, and combined UV.

UV-C sensors dominate and are expected to grow at the highest CAGR during the forecast period due to their critical role in sterilization and disinfection systems, especially in healthcare and public facilities following the COVID-19 pandemic. Their effectiveness in detecting and controlling harmful UV-C radiation enhances their demand. The segment dominated the market with a share of 45.02% in 2024.

UV-A sensors hold the second-highest market share owing to their extensive use in wearables, smartphones, and environmental monitoring systems where low-intensity UV measurement is required.

By Type

Broad Integration into Consumer Electronics Fuels Light Sensor Segment Growth

Based on type, the market is divided into UV phototubes, light sensors, and UV spectrum sensors.

Light sensors lead the market due to their widespread integration into consumer electronics and smart devices, offering basic UV intensity detection along with ambient light sensing. Their ability to measure UV index for health and safety purposes drives their widespread adoption. The segment is expected to hold 42.61% of the market share in 2025.

UV spectrum sensors are expected to grow at the highest CAGR of 26.71% during the forecast period, as they provide advanced multi-band UV monitoring capabilities, increasingly demanded in precision-driven sectors such as environmental science and agriculture.

By Technology

Cost Efficiency and Integration Ease Propels CMOS-Based Sensor Growth

By technology, the market is categorized into photodiodes, phototransistors, CMOS-based sensors, and others.

CMOS-based sensors lead the market and are projected to grow at the highest CAGR of 26.78% during the forecast period, due to their low power consumption, affordability, and compatibility with compact electronic devices. They are also easier to integrate into various electronic devices, enhancing their adoption across industries. The segment is set to hold 38.81% of the market share in 2025.

Photodiodes hold the second largest share due to their high sensitivity and established use in industrial and medical UV sensing applications.

By Application

To know how our report can help streamline your business, Speak to Analyst

Increased Advanced Manufacturing Needs Drive Industrial Segment’s Dominance

The market is categorized by application into industrial, consumer electronics, healthcare, automotive, agriculture, military & defense, and others.

The industrial segment dominates the market as UV sensing is essential in UV curing, equipment protection, and quality control in manufacturing processes. These applications require high precision and reliability, which is effectively provided by UV sensors. The segment is anticipated to acquire 30.90% of the market share in 2025.

The healthcare segment is expected to grow at the highest CAGR of 28.23% during the forecast period (2025-2032), driven by the rising implementation of UV-C-based sterilization systems and increasing investments in infection control technologies.

UV SENSOR MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America UV Sensor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest share of the market with a valuation of USD 2.56 billion in 2025 and USD 3.22 billion in 2026, driven by the early adoption of advanced technologies and the strong presence of major players. High demand for UV-based disinfection, environmental monitoring, and wearable technologies has further boosted sensor deployment across healthcare, industrial, and consumer sectors. Additionally, supportive regulatory standards and significant investments in R&D contribute to the region's market leadership. The U.S. market is likely to expand with a valuation of USD 1.88 billion in 2026.

Download Free sample to learn more about this report.

The U.S. holds the highest share of the market owing to the strong presence of key industry players, advanced technological infrastructure, and high adoption of UV monitoring solutions across various sectors. Additionally, supportive government regulations and increased awareness regarding UV radiation effects further drive market growth in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third leading region, expected to hit USD 2.15 billion in 2026 and is anticipated to witness the highest CAGR in the market due to rapid industrial growth, increasing urbanization, and rising investments in smart electronics. For instance,

- According to industry experts, by 2030, 55% of the population in the Asia Pacific region is expected to live in urban areas, with a 50% rise in urban population projected by 2050. This accelerates the opportunity in areas such as food security, environmental sustainability, and the development of resilient urban infrastructure.

The growing adoption of these sensors in air and water purification and expanding consumer electronics production in China, Japan, and South Korea is fueling demand for the product. China is likely to hold USD 0.5 billion in 2026. Additionally, improving healthcare infrastructure and increasing awareness of UV safety are accelerating the market penetration. India is projected to reach a market value of USD 0.41 billion in 2026, while Japan is estimated to be valued at USD 0.5 billion in the same year.

Europe

Europe accounts for the second-largest share of the market with the valuation of USD 2.39 billion in 2026, exhibiting a CAGR of 24.84% during the forecast period, owing to strict environmental and occupational safety regulations that encourage the use of UV monitoring systems. The U.K. market continues to grow, predicted to be valued at USD 0.59 billion in 2026. The region also benefits from a mature industrial sector and high demand for these sensors in automotive, electronics, and healthcare applications. Growing consumer awareness about UV exposure risks further supports market expansion in this region. For instance,

- According to Copernicus.org, real-time UV index retrieval systems, such as UVIOS, are employed to monitor and forecast UV radiation levels across Europe using satellite data and predictive models.

Germany is set to be valued at USD 0.5 billion in 2026, while France is estimated to gain USD 0.28 billion in 2026.

Middle East & Africa and South America

South America is the fourth leading region, anticipated to acquire USD 0.66 billion in 2025. The Middle East & Africa and South America are projected to grow at a moderate pace due to relatively limited industrial infrastructure and slower adoption of advanced sensor technologies. However, rising awareness about sanitation and healthcare, along with gradual economic development, is supporting the steady market growth. Government initiatives and increasing investment in public health and smart city projects may gradually enhance the demand in these regions. The GCC market is estimated to gain USD 0.12 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Introduce New-age Products to Strengthen Market Positioning

Major companies operating in the industry are concentrating on strengthening their product portfolios to garner a commendable market share by integrating novel technologies into the product and catering to varied consumer requirements. Acquisitions, strategic collaborations, and partnerships are few strategies helping leaders to gain a strong foothold in the market and push the UV sensor market growth. Furthermore, introducing new products is assisting leading firms to sustain their position in a competitive market.

List of Key UV Sensor Companies Profiled:

- Solar Light Company, LLC (U.S.)

- Endress+Hauser Group Services AG (Germany)

- Enting Water Conditioning (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- Broadcom Inc. (U.S.)

- Sony Semiconductor Solutions Corporation (Japan)

- Balluff GmbH (Germany)

- Ushio America, Inc. (U.S.)

- Sumita Optical Glass, Inc. (Japan)

- Adafruit Industries LLC (U.S.)

- Apogee Instruments, Inc. (U.S.)

- Davis Instruments Corp. (U.S.)

- Genicom Co. Ltd. (South Korea)

- uv-technik Speziallampen GmbH (Germany)

- Waveshare International Limited (China)

And more..

KEY INDUSTRY DEVELOPMENTS:

- In October 2024, Nikon Corporation introduced a C-mount industrial lens, the Rayfact UV25mm F2.8. This lens, part of the Rayfact UV series, is ideal for visual inspections of semiconductor wafers and electronic components.

- In September 2024, Polysense Technologies Inc. released iEdge 4.0-enabled full-spectrum UV sensors. These sensors are integrated into the iEdge 4.0 ecosystem, offering high-precision, real-time UV monitoring for industries such as agriculture, healthcare, and environmental science.

- In May 2024, Silanna UV launched the Far-UVC Proximity Exposure Module at the International Ultraviolet Association (IUVA) Americas Conference 2024. The company also showcased its advanced Deep-UVC and Far-UVC LED technologies.

- In April 2023, Polysense Technologies Inc. released indoor and outdoor UV sensors designed to protect individuals from harmful UV exposure. These UV sensors are compatible with multiple communication modules, including WxS9900 (NB-IoT), WxS7800 (WiFi), WxS8800 (LoRaWAN), and WxSB800 (LTE Cat M/eMTC), enabling versatile connectivity options.

- In January 2023, Kyoto Semiconductor Co., Ltd. launched two GaN-based UV sensor products. The newly introduced models, KPDU086SU31-H11Q and KPDU086SU27-H11Q, are designed to deliver high-performance ultraviolet sensing capabilities.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trend analysis and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 23.20% from 2026 to 2034 |

|

Segmentation |

By Sensor Type, Type, Technology, Application, and Region |

|

Segmentation |

By Sensor Type

By Type

By Technology

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 35.65 billion by 2034.

In 2026, the market size stood at USD 7.28 billion.

The market is projected to grow at a CAGR of 23.20% during the forecast period.

The industrial sector is leading the market.

High demand for UV-based disinfection systems drives the market.

Solar Light Company, LLC, Endress+Hauser Group Services AG, Enting Water Conditioning, and Hamamatsu Photonics K.K. are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us