Video Laryngoscope Market Size, Share & COVID-19 Impact Analysis, By Product (Reusable, and Single-use); By Type (Integrated Display Models, and Cart-based Models); By End Users (Hospitals, ENT Clinics, and Others (Pre-hospital, EMS, etc.)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

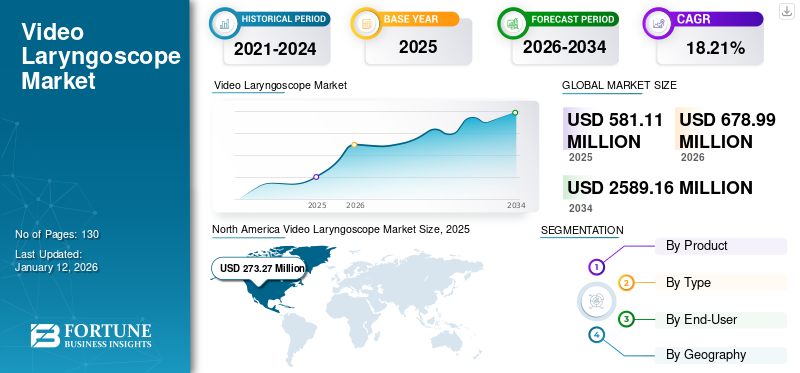

The global video laryngoscope market size was USD 581.11 million in 2025 and is projected to grow from USD 678.99 million in 2026 to USD 2589.16 million by 2034, exhibiting a CAGR of 18.21% during the forecast period. North America dominated the video laryngoscope market with a market share of 47.03% in 2025.

Video laryngoscope is a device that is used in the visualization of an enlarged video image of airway structures. In the past few years, these systems have become a substitute for the traditional direct laryngoscope. In direct laryngoscope, anesthesiologists only have a narrow view of the larynx, which can fail the attempts to pass the endotracheal tube (ETT) in its trajectory towards the airway and can slip into the esophagus.

Whereas the video type of laryngoscope provides high-quality video images that can facilitate accurate ETT placement in difficult airways, thereby avoiding complications resulting from failed tube placement.

Also, according to a study published by NCBI, it was observed that endotracheal intubations using video laryngoscope were performed more successfully in a shorter period of time compared to the traditional direct laryngoscope. This, along with the globally increasing prevalence of obesity among the population and the increasing inpatient admissions in emergency departments of hospitals, are some of the major factors anticipated to boost the adoption of these medical devices for endotracheal intubations during the forecast period.

Video Laryngoscope Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 581.11 million

- 2026 Market Size: USD 678.99 million

- 2034 Forecast Market Size: USD 2589.16 million

- CAGR: 18.21% from 2026 to 2034

Market Share:

- North America dominated the market with a 447.03% share in 2025, driven by high adoption rates of advanced devices, greater patient affordability, and a developed healthcare infrastructure. The U.S. market focus by key players also supports this dominance.

- Reusable video laryngoscopes held the largest product segment share in 2026 due to technical superiority, ease of use during emergency intubations, and availability of disposable blades.

Key Country Highlights:

- Japan: Growth fueled by rapid healthcare infrastructure development and rising awareness of minimally invasive airway management techniques.

- United States: Leading market with widespread adoption of technologically advanced video laryngoscopes, supported by robust healthcare systems and high patient affordability.

- China: Market expansion driven by emerging healthcare infrastructure, increasing inpatient admissions, and rising obesity prevalence, leading to more difficult airway management cases.

- Europe: Significant CAGR anticipated due to growing numbers of obese patients requiring emergency intubations, alongside well-established healthcare systems in the U.K., Germany, France, Spain, and others.

LATEST TRENDS

Download Free sample to learn more about this report.

Introduction of Technologically Advanced Devices is a Prominent Trend

Manufacturers have cited the market opportunity by catering unmet needs of healthcare professionals for performing difficult intubations and are constantly focusing on introducing advanced devices in the video laryngoscope market that can improve both the performance and safety during intubations.

- For instance, in February 2018, Dilon Technologies Inc. introduced CoPilot VL+ in the market. It is an advanced and award-winning device developed to help healthcare providers get the optimum view of the airway when placing breathing tubes.

Additionally, the introduction of fully disposable devices by market players, such as Vivid Medical and Intersurgical Ltd., has further boosted the preference of healthcare providers towards these devices. They promise to reduce the cross-contamination caused during various procedures by reusable direct laryngoscope.

Moreover, a few key players are adopting inorganic growth strategies such as acquisitions in order to establish their foothold in the market and commercialize their products at the global level. Thus, such initiatives by these players are expected to result in the introduction of advanced devices. It will subsequently boost the demand for these devices during the forecast period.

DRIVING FACTORS

Possession of More Advantages than Direct Laryngoscopy Devices to Surge Demand

The increasing incidence of failure in intubation using a direct laryngoscope often results in severe conditions, including dental damage, laryngeal spasm, bronchospasm, dysrhythmias, cardiac arrest, brain damage, or even fatalities. Thus, to prevent these conditions, the adoption of new laryngoscopes with visualization capabilities is increasing in healthcare settings around the world.

- As per a survey conducted by the American Society of Anesthesiologists, it was estimated that in the span of 14 years (i.e., 2003-2016), difficult and failed intubation rates by healthcare providers declined significantly in both urban hospitals and smaller settings in the U.S. due to the increasing use of video laryngoscope.

Also, the growing publications and studies indicating the safety and superiority of these devices over direct laryngoscopy procedures, along with the introduction of innovative products by video laryngoscope market players, have been instrumental in the higher adoption of these products globally. This adoption is further augmented by the facilitation of an integrated video display, as opposed to cart-based display models, and the introduction of fully disposable devices such as the “I-view” by Intersurgical Ltd.

RESTRAINING FACTORS

High-cost May Limit Adoption in Emerging Countries

One of the major factors restricting the video laryngoscope market growth is the lower adoption of anesthesia video laryngoscope in emerging countries due to their high cost and the lack of favorable reimbursement policies to provide coverage. For instance, according to the data published by Medtronic, the cost of reusable devices ranges from USD 1,000 to USD 8,000 depending upon its technical specialty compared to the cost of a single-use traditional laryngoscope, i.e., USD 18.0.

Thus, the high costs of these devices, as well as maintenance, are set to hinder growth. At the same time, the availability of cost-effective alternate devices for endotracheal intubations is also a major restraining factor for the growth opportunities of this market.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Reusable Segment to Hold a Dominant Share of the Global Market During 2025-2032

In terms of the product, the market segments are reusable and single-use video laryngoscope. The reusable segment held the dominating share of 88.48% in 2026 owing to its technical superiorities over single-use devices, such as easy to operate, efficient to perform difficult intubation during an emergency, and availability of disposable blades. On the other hand, the single-use segment is anticipated to grow at a significant CAGR during the forecast period, fueled by the shifting focus of market players towards introducing advanced devices in the market.

By Type Analysis

Integrated Display Models Segment to Grow Rapidly Backed by Emergence of Advanced Devices

Based on the type, the market is segmented into integrated display models and cart-based models. The cart-based models held the dominant share of 63.07% in 2026. The presence of a large number of market players with strong product offerings for cart-based models and their comparatively higher costs are some of the major factors responsible for the dominance of this segment.

However, the integrated display models segment is anticipated to grow at a comparatively higher CAGR owing to the increasing introduction of advanced devices with an integrated display by key players. For instance, in August 2017, Verathon Inc. launched its new GlideScope Go in the market. It is a compact, easy to use, portable, and high-resolution system intended to help clinicians in hospitals and pre-hospital settings.

By End-Users Analysis

Hospitals Segment Dominated in 2024 Stoked by Rising Demand for Anesthesia Management Devices

On the basis of end-users, the market is fragmented into hospitals, ENT Clinics, and others (pre-hospital, EMS, etc.). The hospitals segment held a dominant video laryngoscope market share of 89.83% in 2026 and is anticipated to register a comparatively higher CAGR during the forecast period. The dominance is attributed to the higher number of surgeries performed in hospitals that require patients to be on anesthesia. Hence, it would result in more number of intubations in hospitals compared to other settings. Besides, the ENT clinics and others segments are expected to grow at a moderate CAGR in the upcoming years because of the lower adoption of these devices in these settings.

REGIONAL INSIGHTS

North America

North America Video Laryngoscope Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 273.27 million in 2025. The dominance of the region is attributed to major factors, including a higher adoption rate of advanced devices, greater affordability among patients, developed healthcare infrastructure, and constant focus of market players on the U.S. The U.S. market is projected to reach USD 319.57 million by 2026.

Europe

Europe is expected to register a significant CAGR during the forecast period owing to the increasing number of obese patients in the emergency department of hospitals, along with the presence of well-established healthcare infrastructure in developed European countries such as the U.K., Germany, Spain, France, and others. The UK market is projected to reach USD 32.14 million by 2026, while the Germany market is projected to reach USD 51.78 million by 2026.

Asia Pacific

The market in Asia Pacific is set to register a higher CAGR during the forecast period. The rapidly developing healthcare infrastructure in emerging countries, namely, Japan, China, and Australia, along with the growing awareness regarding the advanced minimally invasive treatment options, is one of the major factors responsible for the growth of the Asia Pacific video laryngoscope market. The Japan market is projected to reach USD 53.34 million by 2026, the China market is projected to reach USD 45.72 million by 2026, and the India market is projected to reach USD 15.59 million by 2026.

Latin America and the Middle East & Africa accounted for a comparatively lower share of the market owing to the presence of lower awareness among the population regarding advanced devices.

KEY INDUSTRY PLAYERS

Verathon Inc., Medtronic, and Ambu A/S Held Dominant Shares of the Market in 2024

The competitive landscape of the market is consolidated. The market is dominated by major players such as Verathon Inc., Medtronic, and Ambu A/S. Robust product portfolios, strong brand image, and wide distribution networks in developed and emerging countries are primarily responsible for the dominance of these players in the global market. Also, established players are adopting inorganic growth strategies, namely, joint ventures and acquisition of other companies in order to strengthen their product portfolios and enhance their positions in the global market.

- For instance, in August 2017, Salter Labs acquired IntuBrite, a company based in California, U.S, with an aim to include its video laryngoscope in its product portfolio and establish its foothold in the market.

Other players operating in the market are KARL STORZ, VYAIRE MEDICAL, INC., Marshall Products, Intersurgical Ltd., Vivid Medical, Inc., and PRODOL MEDITEC.

LIST OF KEY COMPANIES PROFILED:

- VYAIRE MEDICAL, INC. (Illinois, United States)

- KARL STORZ SE & Co. KG (Tuttlingen, Germany)

- PRODOL MEDITEC (Guecho, Spain)

- Marshall Products (Radstock, United Kingdom)

- Ambu A/S (Copenhagen, Denmark)

- Intersurgical Ltd. (Wokingham, United Kingdom)

- Vivid Medical, Inc. (California, U.S)

- Salter Labs (Texas, United States)

- Verathon Inc. (Washington, United States)

- Medtronic (Dublin, Ireland)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS:

- April 2021- Intersurgical Ltd., announced the launch of Universal Video Laryngoscopy web page with a view to increase the product awareness of i-view globally.

- November 2020- ZEISS International announced ZEISS NURA video laryngoscope with a view to help the physicians to maintain a safe distance from the patients in the covid-19 pandemic.

REPORT COVERAGE

The global video laryngoscope market report provides an in-depth analysis of the market and focuses on key aspects such as renowned companies, product types, and leading applications of the product. Besides this, it offers market insights into the market dynamics and highlights key industry developments. In addition to the aforementioned factors, the report encompasses market trends that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation

|

By Product

|

|

By Type

|

|

|

By End Users

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global video laryngoscope market was valued at USD 678.99 million in 2026 and is projected to reach USD 2589.16 million by 2034, growing at a CAGR of 18.21% during the forecast period.

In 2025, the market value stood at USD 273.27 million.

The market will exhibit steady growth at a CAGR of 18.21% during the forecast period (2026-2034).

The reusable video laryngoscope segment leads the market due to its technical advantages and cost-effectiveness over time. However, the single-use segment is expected to grow significantly due to infection control and ease of use.

The increasing use of these devices for difficult intubations, along with the introduction of advanced devices by market players, are the key drivers of the market.

Verathon Inc., Medtronic, and Ambu A/S are the top players in the market.

Growth is fueled by increasing emergency intubations, rising obesity prevalence, superior performance of video laryngoscopes over traditional devices, and greater adoption in hospitals due to better safety and visualization during procedures.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us