Viscosupplementation Market Size, Share & Industry Analysis, By Type (Single injection and Multi injection), By Source (Animal and Non-animal), By Application (Knee Osteoarthritis, Hip Osteoarthritis, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

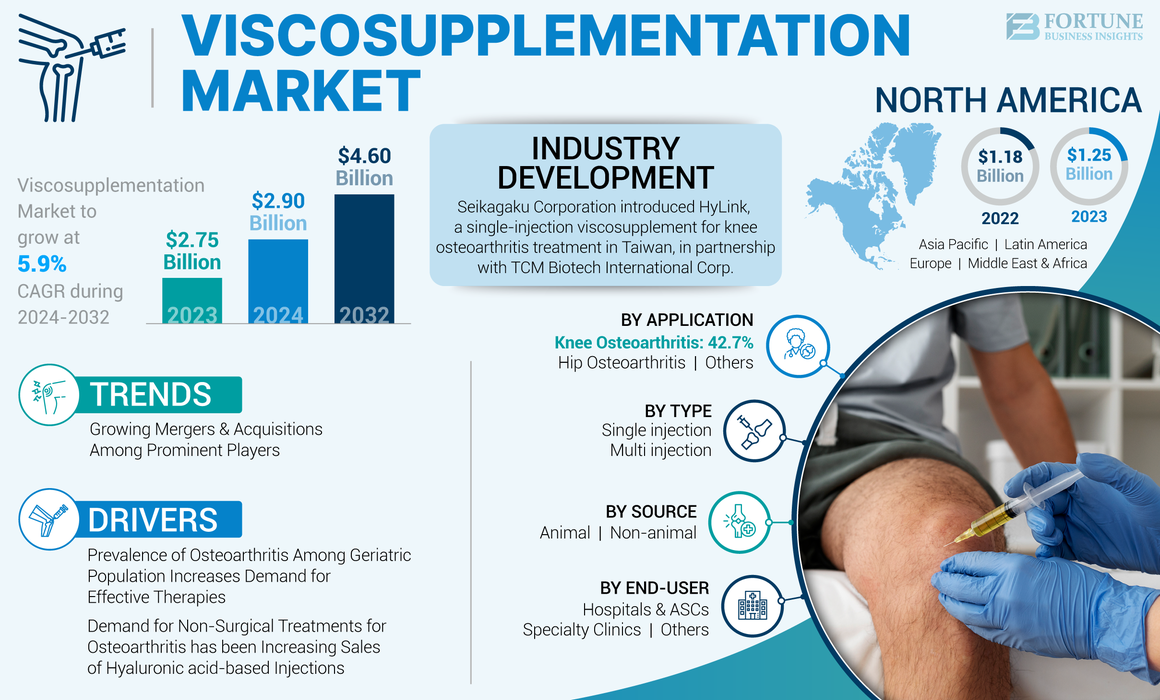

The global viscosupplementation market size was valued at USD 2.75 billion in 2023. The market is projected to grow from USD 2.90 billion in 2024 to USD 4.60 billion by 2032, exhibiting a CAGR of 5.9% during the forecast period. North America dominated the viscosupplementation market with a market share of 45.45% in 2023.

Viscosupplementation is a technique that involves injecting hyaluronic acid into diarthrodial joints, such as the knee, hip, shoulder, and elbow. This procedure restores the synovial fluid’s rheological characteristics, resulting in analgesic, anti-inflammatory, and chondroprotective benefits.

Viscosupplementation is one of the primary treatments for osteoarthritis. It aims to restore the viscoelastic properties of synovial fluid and is also indicated after arthroscopic surgeries.

Apart from these indications, this treatment is also applicable for patients who have rheumatoid arthritis to improve their quality of life, mobility, and range of motion. It is only applied to RA patients when other treatment options are no longer working.

For maintaining an active lifestyle, individuals are seeking this therapy to delay the need for a total knee replacement or to avoid total knee replacement surgery. The prevalence of osteoarthritis (OA) is rising and is globally driven primarily by the growing aging population and an increase in the number of obese individuals. Though there is no cure for arthritis, many treatment options have been developed to improve the daily activities of the affected individuals.

- For instance, as per the data provided by the World Health Organization (WHO) in July 2023, approximately 528 million people in the world were living with osteoarthritis in 2019. Out of 528 million people, 73.0% of people are older than 55 years. With increasing aging populations and growing rates of injury, the prevalence of osteoarthritis is anticipated to continue to increase globally.

- Similarly, according to data published by the Osteoarthritis (OA) Action Alliance in August 2019, around 32.5 million people in the U.S. were affected by osteoarthritis in 2019.

Therefore, the rising incidence of osteoarthritis among patients is expected to drive the need for these treatments, which relieve joint pain by enhancing lubrication, consequently boosting market growth throughout the forecast period.

The COVID-19 pandemic had a negative impact on the viscosupplementation market in 2020 due to the decline in visits to hospitals and ASCs for the treatment of pain associated with osteoarthritis.

- For instance, as per the data provided by the Clinical Pharmacology and Therapeutics Journal in June 2020, the presence of osteoarthritis-related disorders can cause life-threatening complications for osteoarthritis patients during COVID-19 infection. This has caused healthcare providers and orthopedic specialists to thoroughly assess and appraise osteoarthritis individuals, not only for managing symptoms but also for potential comorbidities resulting from osteoarthritis treatment amidst the COVID-19 outbreak.

Due to factors mentioned above, the market experienced a decline in growth during the pandemic period. However, as COVID-19 restrictions were reduced in the post-pandemic period, the hospital visits for osteoarthritis treatment increased, resulting in considerable market growth from 2021 to 2023.

Global Viscosupplementation Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 2.75 billion

- 2024 Market Size: USD 2.90 billion

- 2032 Forecast Market Size: USD 4.60 billion

- CAGR: 5.9% from 2024–2032

Market Share:

- North America dominated the viscosupplementation market with a 45.45% share in 2023, driven by the strong presence of leading market players, increasing regulatory approvals for hyaluronic acid-based injections, and a rising volume of osteoarthritis treatments in hospitals and ASCs.

- By type, the single injection segment is expected to retain its largest market share owing to its advantages in reducing the number of clinic visits, minimizing complications associated with invasive procedures, and providing long-lasting pain relief with a single dose.

Key Country Highlights:

- United States: Increasing adoption of hyaluronic acid injections as a non-surgical option for delaying knee replacement surgeries is driving treatment demand.

- Europe: Rising osteoarthritis prevalence, coupled with a strong focus on new product launches by key players, is fostering market expansion.

- China: The growing geriatric population susceptible to osteoarthritis and a shift towards minimally invasive treatments are propelling market growth.

- Japan: Continuous product approvals for viscosupplements targeting hip and knee osteoarthritis are enhancing patient access to advanced therapies.

Viscosupplementation Market Trends

Growing Mergers and Acquisitions Among Prominent Players is Considered as Significant Market Trend

Osteoarthritis is the most prevalent form of arthritis affecting a larger population across the world, which is more common in geriatric populations. This has resulted in an increasing need for effective therapy for osteoarthritic patients. The viscosupplementation therapy is a non-surgical option for treating osteoarthritis symptoms. Therefore, the majority of market players are entering into mergers and acquisitions to introduce new products in the market and provide effective therapy for osteoarthritis. This trend is anticipated to continue throughout the forecast period in order to enhance their market positions and broaden their product offerings.

- In December 2021, Avanos Medical, Inc. entered into a definitive agreement to acquire OrthogenRx, Inc., a company providing hyaluronic acid-based therapies for the treatment of knee osteoarthritis (OA) pain, at USD 160.0 million.

Download Free sample to learn more about this report.

Viscosupplementation Market Growth Factors

Growing Prevalence of Osteoarthritis Among Geriatric Population Increases Demand for Effective Therapies Fueling Market Growth

The prevalence of age-related diseases, particularly osteoarthritis, is increasing across the globe. Intra-articular injection of hyaluronic acid derivatives, also called viscosupplementation, has become increasingly popular among treatment modalities in recent years.

- For instance, according to data provided by the World Health Organization (WHO), the number of individuals aged 60 years and older was 1.00 billion in 2019. This number is expected to increase to 1.40 billion by 2030 and 2.10 billion by 2050.

Moreover, the escalating prevalence of osteoarthritis is another factor contributing to the growth of the market.

- For instance, as per the data provided by the Lancet in August 2023, as of 2020, nearly 15.0% of people aged 30 and older experienced osteoarthritis. It is predicted that approximately 1.00 billion individuals will be living with osteoarthritis by the end of 2050.

- Similarly, as per the data published by the World Health Organization (WHO) in July 2023, nearly 528.0 million people worldwide were living with osteoarthritis in 2019. About 73.0% of people living with osteoarthritis were older than 55 years, and 60.0% were females.

Such a growing aging population and rising prevalence of osteoarthritis are expected to drive demand for effective treatment with hyaluronic acid-based injections during the forecast period.

Growing Demand for Non-Surgical Treatments for Osteoarthritis has been Increasing Sales of Hyaluronic acid-based Injections Boosting Market Growth

The increasing demand for non-surgical treatment for osteoarthritis is one of the factors driving the market’s growth. When the more conservative measures fail and surgery is to be avoided, viscosupplementation is another option for the treatment of osteoarthritis.

In addition, the treatment with viscosupplement injections can help patients delay or postpone their knee surgeries, which are necessary to treat osteoarthritis.

- For example, as per the data provided by Peak Health and Wellness in November 2023, patients who received a single hyaluronic acid injection were able to postpone surgery by 1.4 years. Individuals with five or more injections were able to postpone surgery for an average of 3.6 years.

Therefore, the increasing adoption of non-surgical methods, such as hyaluronic acid-based injections to delay osteoarthritic surgeries, is a factor contributing to market growth.

RESTRAINING FACTORS

High Cost of Therapy Might Restrain Market Growth

The viscosupplementation treatment for osteoarthritis is costly, and the patient may need more than one injection. Also, some of the doctors stated that, the effectiveness of these injections is not consistent.

- For example, as per the data provided by the Arthritis Society Canada in December 2021, the cost of viscosupplementation injections ranges from (USD 200 – USD 350 per treatment course).

Moreover, middle-class people and individuals living in emerging countries of the Middle East & Africa and the Asia Pacific region are unable to afford this therapy due to its higher cost, which limits its use. Thus, the high cost of hyaluronic acid-based injections and the overall treatment of osteoarthritis are expected to restrict the viscosupplementation market growth during the forecast period.

Viscosupplementation Market Segmentation Analysis

By Type Analysis

Potential Advantages Associated with Single Injections are Increasing its Adoption to Drive Segmental Growth

The market is segmented into single injections and multiple injections in terms of type.

The single injection segment held the largest market share in 2023 and is expected to grow at a faster CAGR during the forecast period. The growth of the segment is mainly attributed to the fact that the single injection viscosupplements are associated with several advantages. These include a decrease in the number of recurrent outpatient clinic visits and a reduction in the number of viscosupplement injections for the patient, leading to a potential decrease in complications linked with the minimally invasive procedure.

- For example, Monovisc is a single-injection viscosupplement manufactured by Anika Therapeutics, Inc., and is utilized for the treatment of knee joint pain caused by osteoarthritis. This single injection can provide pain relief that lasts for up to six months.

Moreover, the multiple injection segment is expected to experience significant growth throughout the forecast period. New product launches and increasing research studies are some of the factors expected to result in segmental growth throughout the forecast period.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in August 2021, a retrospective study was conducted by collecting patient data from 16 rehabilitation clinics in the U.S. The study aimed to compare the effectiveness of the multiple course of treatment of viscosupplementation with single course treatment. The study results revealed that the multiple courses provided superior results over a single course.

- For example, in January 2019, OrthogenRx, Inc. announced the launch of TriVisc, a three-injection hyaluronic acid regimen used for the treatment of patients with osteoarthritic knee pain.

By Source Analysis

Increasing Product Launches Leading to Non-animal Segment’s Dominance During Forecast Period

Based on the source, the market is bifurcated into animal and non-animal.

The non-animal segment dominated the market in 2023 and is expected to grow throughout the forecast period. The growth of the segment is mainly attributed to the fact that non-animal based viscosupplements are suitable for all types of patients having allergies to poultry products. Also, the increasing product launches for non-animal-based viscosupplements are an additional factor driving the market growth.

The animal segment is expected to grow at a significant CAGR during the forecast period. The rising product launches for animal-based viscosupplements are the main factor driving the segmental growth.

- For example, in December 2019, Fidia Pharma USA Inc. introduced TRILURON (sodium hyaluronate) in the U.S. market to treat osteoarthritis of the knee.

By Application Analysis

Increasing Number of Regulatory Approvals and Product Launches Facilities to Lead to Knee Segment’s Dominance in Forecast Period

On the basis of application, the market is segmented into knee osteoarthritis, hip osteoarthritis, and others.

The knee osteoarthritis segment held the maximum market share in 2023 and is anticipated to experience positive growth throughout the forecast period. The high growth of the segment is largely due to the increasing prevalence of knee osteoarthritis and the increasing launch of hyaluronic acid-based injections for knee osteoarthritis treatment.

- For instance, in March 2019, Seikagaku Corporation introduced HyLink, a single-injection viscosupplement for the treatment of knee osteoarthritis in Italy through a pharmaceutical company, MDM S.p.A.

Moreover, the hip segment is estimated to grow at the highest CAGR during the forecast period. The launch of new products and increasing regulatory approvals are the key factors contributing to the expansion of the hip segment.

- For example, in May 2021, Ono Pharmaceutical Co., Ltd. and SEIKAGAKU CORPORATION introduced JOYCLU 30mg intra-articular injection in Japan for the treatment of hip osteoarthritis.

Furthermore, the others segment is expected to grow during the forecast period. The growth of the segment is attributed to the launch of viscosupplements for the treatment of hand, shoulder, and foot osteoarthritis.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Growing Use of Viscosupplements by Hospitals & ASCs Due to Large Osteoarthritic Patient Volumes

Based on end-user, the market is divided into hospitals & ASCs, specialty clinics, and others.

Hospitals & ASCs segment held the largest market share in 2023. The dominance of the segment is largely due to a higher number of patients being admitted and a significant rise in viscosupplement procedures being carried out in hospitals worldwide. Moreover, the increase in the number of hospitals in both developed and developing nations, as well as the growing occurrence of joint disorders, are some of the factors that are fueling the growth of this segment.

Also, the growing emphasis on recruiting a large number of orthopedic specialists by hospitals to provide effective treatment is an additional factor driving segmental growth.

- For instance, in November 2022, University Hospitals added five new orthopedic specialists serving patients in their communities across Northeast Ohio.

In addition, the specialty clinics segment is expected to grow at the highest CAGR during the forecast period. The rising demand for specialized healthcare and the proliferation of specialized medical centers in developed countries will likely fuel significant growth in the treatment of osteoarthritic conditions.

Furthermore, the others segment is expected to grow during the forecast period due to the growing number of orthopedic clinics across the world.

REGIONAL INSIGHTS

Based on region, the market is studied across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America Viscosupplementation Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest viscosupplementation market share in 2023, generating a revenue of USD 1.25 billion. The regional market will experience significant growth throughout the forecast period due to the presence of a large number of market players providing viscosupplement products. In addition, increasing regulatory approvals for viscosupplements is another factor contributing to market growth in this region.

- For example, in March 2019, Fidia Farmaceutici S.p.A., a manufacturer of hyaluronic acid-based products, announced that the U.S. Food and Drug Administration (FDA) had approved its 3-injection regimen Triluron for the treatment of osteoarthritis.

Europe held the second-largest market share in 2023 and is expected to grow throughout the forecast period. The increasing emphasis by market players on introducing viscosupplement products in the region is one of the factors driving market growth. Moreover, the growing prevalence of osteoarthritis across European countries is an additional factor contributing to regional growth during the forecast period.

- For instance, as per the data provided by the State of Musculoskeletal Health 2023 report, around 10.0 million people in the U.K. had osteoarthritis in 2022.

Additionally, the viscosupplementation market in the Asia Pacific region is estimated to grow at the highest CAGR during the forecast period. The growing burden of the geriatric population, which is susceptible to osteoarthritis, is one of the major factors driving the growth of the market growth in this region.

- For example, as per the data provided by the Hindu in September 2023, the percentage of people over 60 years old is expected to increase from 10.5% or 149.0 million in 2022 to 20.8% or 347.0 million by the end of 2050.

Furthermore, the increasing number of osteoarthritis cases across Latin America and the Middle East & Africa are some of the factors expected to drive market growth in these regions.

KEY INDUSTRY PLAYERS

Growing Focus of Market Players on Conduction of Clinical Trials to Enhance their Product Offerings

Zimmer Biomet and Anika Therapeutics, Inc. holds the top position in the global market, trailed by SEIKAGAKU CORPORATION, Avanos Medical, Inc., Sanofi, and Bioventus. Zimmer Biomet held the dominant share of the market due to its robust global distribution network. Furthermore, major companies started strategic initiatives such as accelerated trial screenings, introduction of new products, mergers & partnerships, and other innovations to expand their position in the global market.

- For example, in November 2022, Anika Therapeutics, Inc. announced that Cingal met the primary endpoint in the phase 3 study by demonstrating superiority compared to triamcinolone hexacetonide (TH) steroid alone in relieving osteoarthritis pain.

List of Top Viscosupplementation Companies:

- Zimmer Biomet (U.S.)

- Anika Therapeutics, Inc. (U.S.)

- Bioventus (U.S.)

- Biotech (Switzerland)

- SEIKAGAKU CORPORATION (Japan)

- Ferring (Switzerland)

- Sanofi (France)

- APTISSEN (Switzerland)

- Avanos Medical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2024 – The 4th annual conference on orthopedics, rheumatology, and musculoskeletal disorders was conducted in Bangkok, Thailand. This conference provided a platform for healthcare professionals to gain knowledge in these fields. One topic of discussion was osteoarthritis treatment with hyaluronic acid-based injections.

- September 2023 - Eurovisco held its annual meeting, gathering European osteoarthritis experts. The main aim of this event was to determine the clinical criteria that influence the success rate of treating osteoarthritis by injecting HA-based viscosupplement.

- September 2022 - Eurovisco Group met in Lyon, France, for its seventh annual meeting. During the event, the European osteoarthritis experts discussed hyaluronic acid-based therapy, which can be used to treat knee osteoarthritis.

- August 2021 - Seikagaku Corporation introduced HyLink, a single-injection viscosupplement for knee osteoarthritis treatment in Taiwan, in partnership with TCM Biotech International Corp.

- September 2020 - Bioventus achieved goals by reaching 2.0 million treatments globally with DUROLANE, its single-injection hyaluronic acid (HA) product for alleviating osteoarthritis (OA) pain.

REPORT COVERAGE

The global viscosupplementation market report provides a detailed analysis of the industry. Additionally, the key sights presented in the report are the prevalence of osteoarthritis in key countries, new product launches, key mergers, acquisitions, partnerships, and company profiles. Moreover, it includes detailed insights into market dynamics and the impact of COVID-19 on the market. Furthermore, this report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.9% from 2024-2032 |

|

Segmentation |

By Type

|

|

By Source

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.75 billion in 2023 and is projected to record a valuation of USD 4.60 billion by 2032.

In 2023, the North America market value stood at USD 1.25 billion.

The market will exhibit steady growth at a CAGR of 5.9% during the forecast period.

By type, the single injection segment was leading in the market.

The growing prevalence of osteoarthritis is one of the factors driving market growth.

Zimmer Biomet, Anika Therapeutics, Inc., Sanofi, Bioventus, Biotech, and SEIKAGAKU CORPORATION are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us