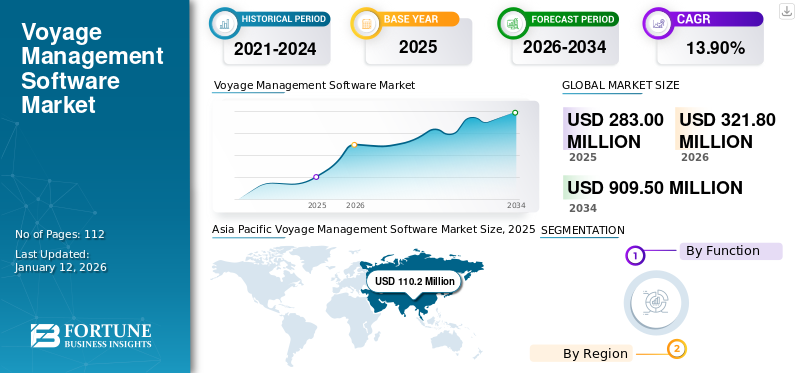

Voyage Management Software Market Size, Share & Industry Analysis, By Function (Chartering, Operations, Financials, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global voyage management software market size was valued at USD 283 million in 2025. The market is projected to grow from USD 321.8 million in 2026 to USD 909.5 million by 2034, exhibiting a CAGR of 13.90% during the forecast period. The Voyage Management Software Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 92.0 million by 2032, driven by Implementation of Voyage Optimization for Effective Management and Fleet Operations. Asia Pacific dominated the market with a share of 39.00% in 2025.

Voyage Management Software (VMS) provides operations, chartering, and financial activities for maritime businesses. It engages daily reports based on real-time data, hydrodynamics, ocean data, and vessel energy efficiency to create valuable insights. Also, voyage management software can maintain comprehensive data about the main systems, such as electric power, fuel consumption, hull, propulsion, and operations. With the increasing transportation of goods across different regions, companies are adopting various software, such as voyage optimization, allowing the sailors to maximize efficiency, monitor fleets and connect to the sailors, which creates a growth opportunity for the market.

Additionally, the maritime industry aims to shift operations by improving fuel efficiency and reducing carbon emissions. Implementing digital technologies increases efficiency at sea and in the shore-side workplace and reduces costs. For instance,

- In January 2024, Great Eastern Shipping, an Indian shipping company, partnered with Harbor Lab, an Athens-based company, introducing new technologies to optimize its port management processes. The technology implementation will include an end-to-end integration with the company’s existing Veson voyage management software and SAP accounting system to create a port call management process by covering tasks and settling all claims and invoices.

IMPACT OF ARTIFICIAL INTELLIGENCE (AI)

Integration of Artificial Intelligence into the Voyage Management Software Propels Market Growth

Artificial Intelligence (AI) is expected to impact the shipping industry. Adopting AI in the marine industry may automate route optimization, cargo tracking, scheduling, monitoring equipment performance, and providing real-time weather and ocean conditions data for navigation.

Moreover, the adoption of AI by the market players could revolutionize operations and plan and predict energy-efficient voyages to lower emissions while addressing rising fuel costs and improving safety. The players implement AI technology into voyage optimization to reduce vessel fuel consumption, carbon emissions, and running costs. For instance,

- In June 2023, Yara Marine Technologies collaborated with Molflow, an artificial intelligence application developer, Halmstad University, Chalmers University of Technology, and Gothenburg University to develop and pilot an AI-based semi-autonomous voyage planning system to lower emissions while addressing rising fuel costs.

Voyage Management Software Market Trends

Rising Software Demand for Complex Supply Chain Operations and Database Management Solutions to Strengthen Market Growth

Supply chain operations in the marine industry require complex processes. It involves a vast network of shipping companies, ports, cargo handling facilities, and customs & regulatory agencies to develop effective and efficient maritime supply chains for businesses and economies globally.

In addition, the shipping industry aims to implement software for logistic processes by developing innovative fleets and ships to simplify operations. Moreover, key players are using automated cargo handling equipment and tracking systems in their existing solutions by aiming at maritime supply chain companies.

Download Free sample to learn more about this report.

Voyage Management Software Market Growth Factors

Implementation of Voyage Optimization for Effective Management and Fleet Operations to Drive Market Growth

Fleet operations are massive and complicated and require time management for sailors to detail the minor changes to procedures and policies to be followed. Additionally, extreme weather conditions affect maritime operations negatively and disturb global supply chains.

Companies are increasingly adopting various options, such as voyage optimization, which help sailors maximize efficiency during these challenges. Voyage optimization selects the best route based on the weather prediction, currents, and ship performance characteristics regarding energy consumption, safety, and environment.

In addition, deploying fleet operations allows the sailors to plan voyages while considering regulations and policies. This enables shore-side crews to monitor fleets and connect and implement specific, broad-ranging company policies. The factors mentioned above are driving the growth of the voyage management software market.

RESTRAINING FACTORS

Managing Complex Software and Lack of Technical Knowledge Restrains Market Growth

The marine sector has observed significant technological changes across industries. Increasing investment in digitization, autonomous shipping, and systems in voyage software acts as the restraining factor for marine engineers. The implementation and integration of voyage management software with existing systems can be complex for smaller shipping companies, creating high resource costs.

Marine engineers cannot adapt to the software's deployment, affecting marine businesses. On the other hand, companies working with lesser data volumes, less technical knowledge, and limited access to analysis lead to a significant financial commitment.

Voyage Management Software Market Segmentation Analysis

By Function Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Chartering Function Due to Continuous Visibility Fuels Market Growth

Based on function, the market is classified into chartering, operations, financials, and others.

Voyage management software is used in shipping industries to generate comprehensive and valuable insights about the main system. Various organizations deploy the software to adopt multiple functions, including chartering, financials, operations, and analytics.

The chartering segment holds the largest market share of 39.34% in 2026. It is expected to grow at the highest CAGR due to the ongoing awareness of market conditions, enabling businesses to determine the optimal time for booking transportation for their cargo. The chartering solution offers visibility into handling inquiries, calculating cargo, and generating indications for various voyages within a specified period. It leverages private shipping data and artificial intelligence (AI) to identify significant industry trends and offer charterers a market perspective. For instance,

- In October 2023, Alba Tankers, a Danish company operating chemical and oil, partnered with Seaber.io, a Finnish maritime technology company, to deploy chartering and scheduling processes and help Alba Tankers operate and improve its operational efficiency.

Moreover, financial function shows steady growth due to the organizations adopting the software to streamline the financial tasks, reduce the overall risks involved, and eliminate the need to enter and maintain all voyage transactions in spreadsheets manually.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Voyage Management Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific holds the highest voyage management software market share and is expected to grow with the highest CAGR during the forecast period due to increasing R&D investments, strengthening voyage management software, and optimizing technological support to the regional maritime industry. China exceeded Japan and South Korea in shipbuilding activities to become the world's largest shipbuilding country. The Japan market is projected to reach USD 17.9 billion by 2026, the China market is projected to reach USD 64.9 billion by 2026, and the India market is projected to reach USD 11.9 billion by 2026. These aspects made APAC a growing region in the global marine management market. In addition, various market players are growing their presence by partnering and collaborating with local market players to expand their business in this region. For instance,

- In December 2023, MariApps Marine Solutions partnered with Kuwait Oil Tankers’ Company (KOTC) to enhance the digitalization of KOTC fleet operations. Through the partnership, MariApps will implement the smartPAL suite to address every feature of ship management and operations, implement electronic oil record books and digital logs, and support KOTC in providing a fleet monitoring center in Kuwait.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to show remarkable voyage management software market growth during the projected period due to the continuous increase in offshore construction. The European Union and the shipping industry also collaborate to reduce emissions by slow steaming for just-in-time arrival. The UK market is projected to reach USD 11.8 billion by 2026, while the Germany market is projected to reach USD 19.5 billion by 2026. Furthermore, the European Union joined forces with the Oil Companies International Marine Forum (OCIMF) and Intertanko by deploying Virtual Arrival, a voyage management software to optimize and reduce the emission of the vessel. Thus, it is expected to create a high growth rate in the European market. For instance,

- In January 2023, Sedna, an enterprise email solution company, partnered with Voyager to streamline and enhance the use of shipping information across their marine technologies. The partnership allows Voyager to integrate the Sedna email platform, enabling the shipping information, such as invoicing data and vessel tracking, between the two platforms to enhance business developments by connecting email with main business systems.

North America

North America displays noticeable growth due to the essential business information in the maritime industry, creating high demands for correct data solutions and allowing users to integrate tailored data into their business models. Additionally, companies, such as Northrop Grumman Corporation, offer voyage management software to the U.S. Navy by providing computer-based navigation, monitoring, and planning systems to meet the U.S. Navy’s electronic chart display and information system-navy (ECDIS-N) requirements. The U.S. market is projected to reach USD 50.6 billion by 2026.

South America

South America demonstrates steady growth in the market due to progressions in shipping and transportation technologies with increasing globalization and contribution of economic growth in commercial harbors. In addition, the increase in service-oriented architecture will grow market share in the region.

Middle East & Africa

Similarly, advanced and equipped ports with the latest technologies in the Middle East & Africa are making maritime processes flawless. Also, various companies are investing in regional harbors using AI-driven software to enhance safety, improve valuable insights, efficiency, and reliability, save fuel, and minimize emissions.

List of Key Companies in Voyage Management Software Market

Key Players to Adopt Mergers and Acquisitions Strategies to Expand Market Share

The key voyage management software players, such as Wärtsilä, Veson Nautical, DANAOS, MariApps Marine Solutions, Blue Water Trade Winds Pvt. Ltd., SEA/(Maritech Services Limited), Q88 LLC, are focused on expanding their geographies by launching industry-specific solutions to launch new products to attract a large customer base, thereby increasing sales. New product launches and Innovations attract a vast customer base, thus improving revenue. Additionally, the report provides comprehensive information that vendors can utilize to gain a competitive edge. Many businesses are forming mergers & acquisitions, partnerships, and collaborations to enable market growth.

LIST OF KEY COMPANIES PROFILED:

- Wärtsilä (Finland)

- Veson Nautical (U.S.)

- DANAOS (Greece)

- MariApps Marine Solutions (Singapore)

- Blue Water Trade Winds Pvt. Ltd. (India)

- SEA/ (Maritech Services Limited) (Singapore)

- Q88 LLC (U.S.)

- ONEOCEAN (U.K)

- Dataloy Systems AS (Norway)

- OrbitMI, Inc. (U.S.)

- The Ark Marine Solutions Pte. Ltd. (TAMS) (Singapore)

- ION Group (U.S.)

- Herberg Systems GmbH (Germany)

- Vasco Systems Pte. Ltd. (Singapore)

- Marine Digital GmbH (Germany)

- Nextvoyage Maritime Software Pte. Ltd. (Singapore)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Veson Nautical launched a new software, Emission Expense Settlement Workflow, a contract management system integrated within its IMOS platform for various voyages to the European Union. The software supports users in calculating the commercial sustainability of each contract based on their carbon contracts and expenses. It helps them resolve the emission costs outlined in their contracts.

- December 2023: Blue Water introduced a new self-service platform to its portfolio, BOSS on Demand (BOND). BOND will provide access to a customized version of the company’s voyage optimization and reporting applications, including features for data collection and validation for various analysis functions.

- December 2023: Veson Nautical acquired Shipfix, a combined data platform with advanced AI-enabled tools for the maritime and trading sectors. Through the acquisition, Veson will continue to offer Shipfix’s data and understanding capabilities alongside Veson’s existing end-to-end workflows to provide shipping trading and operations solutions in the market.

- October 2023: Lloyd’s Register integrated its existing digital platforms into the new OneOceanLR. The platform will integrate digital solutions from OneOcean, ISF Watchkeeper, and Hanseaticsoft with other digital products, providing maritime stakeholders with data-driven solutions and minimizing the need for support on separate systems.

- March 2023: Chevron, a petroleum refinery company, partnered with Blue Water Trade Winds to deploy its BOSS Voyage Optimization Suite across Chevron’s time-chartered fleet. The software is used to deliver voyage optimization support, including vessel performance analysis, weather routing, and other fleet management functions, expanding the environmental features of Chevron’s ships.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.90% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Function

By Region

|

Frequently Asked Questions

The market is projected to reach USD 909.5 million by 2034.

In 2026, the market stood at USD 321.8 million.

The market is projected to grow at a CAGR of 13.90% over the forecast period (2026-2034).

The chartering segment is anticipated to exhibit the highest CAGR during the forecast period.

Implementation of voyage optimization for effective management and fleet operations is expected to drive market growth.

Wartsila, Veson Nautical, DANAOS, MariApps Marine Solutions, Blue Water Trade Winds Pvt. Ltd., SEA/ (Maritech Services Limited), Q88 LLC, ONEOCEAN, Dataloy Systems AS, and OrbitMI, Inc., among others, are the top players in the market.

Asia Pacific dominated the market with a share of 39.00% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us