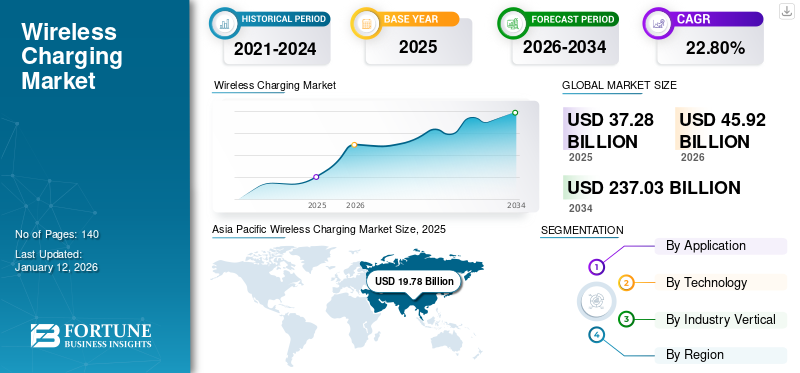

Wireless Charging Market Size, Share & Industry Analysis, By Application (Commercial Charging Station and Home Charging Unit), By Technology (Inductive, Resonant, Radio Frequency, and Others), By Industry Vertical (Consumer Electronics, Automotive, Industrial, Healthcare, and Aerospace & Defense), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global wireless charging market size was valued at USD 37.28 billion in 2025 and is projected to grow from USD 45.92 billion in 2026 to USD 237.03 billion by 2034, exhibiting a CAGR of 22.80% during the forecast period. Asia Pacific dominated the global market with a share of 53.00% in 2025.

Wireless charging, also called inductive charging, is an advanced method of charging batteries. This method is used for charging various devices such as smartphones, computer laptops, electric vehicles, and giant robots. Wireless charging comprises radio charging, resonance charging, and inductive charging. Radio charging is used for small batteries such as smartwatches, smartphones, and hearing aids. At the same time, resonance charging is used to charge heavy vehicles and industrial robots.

Meanwhile, inductive charging is used in laptops, smartphones, and other consumer electronic devices. Furthermore, the chances of short circuits and accidents are negligible due to the absence of any physical wire or cord in this type of charging method. The increasing ICT investment and rising focus on research & development of various key players on inductive charging promote the use of cordless charging in various industry verticals and also increase their market share.

The COVID-19 pandemic significantly affected the global sales of electrical and electronic goods. Government and regulatory authorities across the globe imposed nationwide lockdowns that affected businesses across different domains. This, in turn, reduced the usage of electric or non-electric vehicles, which further reduced the number of cars in electric charging stations. These factors had slightly negative impacts on the wireless electric charging station industry.

Furthermore, rising United Nations (UN) concerns and the demand for electric vehicles surge the application for sustainable future and environment friendly transportation. Thus, increasing application of electric vehicles that led to the development of lane charging is a driver that surges the demand for wireless charging.

Wireless Charging Market Trends

Dominant Application of Cordless Charging in Electric Vehicles to Drive Market Augmentation

Various countries globally are aiming to achieve the goal of reduction in carbon emissions. Passengers and logistics electric vehicles play an essential role in achieving these targets. In the last few years, the automobile industry has been shifting its operations to digital platforms. Various players in the automobile market are adopting emerging and cutting-edge technology such as the Internet of Things, artificial intelligence, and electric vehicles.

- For instance, In February 2023, according to Economics Times, the world's total sales of electric cars increased by 109% than in 2020. Further, 85% of the total global EV sales were sold alone in China and Europe.

Additionally, rocketing demand for efficient and quick charging electric vehicles has surged the demand for quick wireless EV charging stations. Furthermore, the use of Qi-based charging stations in automobile vehicles for charging various consumer electronic devices has been increasing in the last few years, as these Qi-based wireless electric chargers can charge up to three devices simultaneously. This is responsible for the increasing demand for wireless electric chargers globally.

Download Free sample to learn more about this report.

Wireless Charging Market Growth Factors

Surging Demand for Simultaneous Charging Solutions to Aid Market Expansion

The demand for high-speed wireless and simultaneous multi-device charging stations is continuously increasing in the consumer electronics industry. These wireless multi-device chargers can simultaneously charge smartphones, laptops, smartwatches, and other electronic devices without any technical error such as overheating. These chargers are built with a high-end thermal management system. These Qi-based multi-device chargers are faster, more convenient, and easy to carry than wired chargers due to the absence of a cord. Furthermore, various market players are focusing on developing and launching new Qi-based chargers to cope with the massive demand for wireless simultaneous charging stations. This is helping to strengthen the footprints of crucial market players.

- For instance, in May 2023, TATA Power, a TATA Sons subsidiary and a prominent electricity generation and distribution unit, partnered with a prominent passenger vehicle manufacturer Hyundai. The partnership aims to co-operatively develop and deploy inductive wireless charging stations.

RESTRAINING FACTORS

High Cost of Cordless Chargers to Hinder Market Progression

The initial cost associated with cordless chargers for consumer electronic goods, such as smartphones and laptops, is 50% higher than that of the existing wired chargers. This high price of cordless charging reduces the margin of various consumer goods manufacturing companies such as Xiaomi, Samsung, Apple, and others. Cordless charging also increases the cost of a charging station for an electric vehicle. The components of a wireless and cordless charger, such as transmitter, rectifier, inductive plate, and receiver, are more expensive than existing technology. This high cost of the internal components of cordless chargers affects the overall cost and ultimately increases the final price of the product. Furthermore, heavy duty cordless chargers having compatibility issues with the new age electronic devices. Thus, changing wireless technology causing compatibility issues and the need for rapid charging stations are primary restraints hampering the market growth.

Wireless Charging Market Segmentation Analysis

By Application Analysis

Commercial Charging Stations Captured Largest Market Share in 2024 owing to High Demand for Wireless Charging

The market is divided into commercial charging station and home charging station based on application.

The commercial charging station segment dominated the market with contribution of 50.07% globally in 2026. The increasing demand for commercial charging stations for electric vehicles and consumer electronics devices is a key factor driving segment growth. The cost per unit of the wireless commercial charging station is much higher than that of the home charging unit, which increases the wireless segment share. However, the home charging unit segment showed the highest CAGR in the global market during the forecast period, owing to the surging demand from domestic users.

By Technology Analysis

Resonant Segment Held Top Revenue in 2024 due to Huge Number of Resonant Unit Sales

Based on technology, the market is classified into inductive, resonant, radio frequency, and others.

The resonant segment captured a significant share in 2024. The increasing use of resonant charging technology for charging heavy batteries, such as batteries of electric vehicles, industrial robots, and various healthcare machinery, will boost segment expansion.

Meanwhile, the inductive segment will record with a share of 35.13% in 2026,and the estimated period owing to the increasing use of Qi-based charging stations for consumer electronics products.

However, the radio frequency segment is showing moderate growth due to slower adoption of technology.

By Industry Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Generated Highest Revenue in 2024 owing to Increasing Use of Electric Charging Stations

Based on the industry vertical, the market is classified into consumer electronics, automotive, industrial, healthcare, and aerospace & defense.

The automotive segment generated the highest revenue with a share of 31.86% in 2026 , owing to increasing use of electric vehicles, resulting in a growing demand for electric chargers. The unit cost of wireless electric vehicle chargers is expensive, which increases the revenue share of automotive in the market. Moreover, the consumer electronics segment followed the same trends and generated the second-highest revenue in the market due to increasing demand for wireless chargers in the consumer electronics segment. However, the industrial segment shows the highest CAGR in the forecast period due to increasing demand for wireless robot charging stations in the manufacturing industry.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Wireless Charging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds a significant wireless charging market with a share of 53.00%in 2026 . Asia Pacific dominated the global market in 2025, with a market size of USD 19.78 billion. It is growing as a dominating region in the global market. Adequate availability of advanced electric vehicle manufacturing units and modern research & development facilities in developing countries such as China, South Korea, Japan, Singapore, and Taiwan are the factors facilitating market growth in the region. Emerging countries, such as Australia, India, and ASEAN countries, play a vital role in the growth of the regional market. India, Singapore, and China are focusing on increasing the manufacturing of electric vehicles and supportive devices, which attracts global investors in India to start their manufacturing units, propelling the market growth. The Japan market is projected to reach USD 1.99 billion by 2026, and the India market is projected to reach USD 2.79 billion by 2026.

China Holds Major Share in the Market Owing to the Availability of Prominent Players

China is dominating the wireless battery charger market in the global economy. The availability of modern and advanced battery charger product manufacturing facilities will escalate market progression in the region. China is continuously focusing on researching and developing high-speed wireless battery chargers. Moreover, China has many prominent key players in the country, which is expected to drive market growth. , the China market is projected to reach USD 15.37 billion by 2026.

North America

To know how our report can help streamline your business, Speak to Analyst

In North America, the U.S. generated prominent revenue in 2024, owing to the availability of key players in the country. Moreover, the federal government of the U.S. is continuously promoting the penetration and implementation of electric vehicles in the country, which is responsible for the growth of the wireless electric charging market. However, Canada is showing the highest CAGR in the forecast period due to increasing investment of foreign players in manufacturing wireless charging units and wireless medical devices in the country. Furthermore, Mexico also strengthens its position in the market by adopting various business strategies. The U.S. market is projected to reach USD 12.29 billion by 2026.

Europe

In Europe, Germany has the most advanced and modern manufacturing units of charging facilities for electric vehicles. It has a huge demand for wireless electric charging stations, dominating the market by generating the highest revenue. However, the U.K. is showing the highest CAGR in the forecast period. Italy and France are following the same trend in the market. However, Spain and the Rest of Europe show gradual and moderate market growth. The UK market is projected to reach USD 1.39 billion by 2026, while the Germany market is projected to reach USD 1.73 billion by 2026.

Middle East & Africa

The growth in this region is moderate due to less adoption of electric vehicles and wireless electric charging in the Middle East & Africa and South America. However, Saudi Arabia, the UAE, and Brazil are focusing on developing the electronic manufacturing industry, which is showing significant growth in the market.

KEY INDUSTRY PLAYERS

Samsung Electronics Holds Prominent Market Share owing to Advanced Research & Development Facility

Samsung Electronics held a prominent market share in 2024 as the company focused on researching and developing charging solutions. It is a significant player in charging solutions to other consumer electronics product manufacturers. Furthermore, Delta Electronics, Inc., Drone Power Pvt. Ltd., Energizer Holdings, Inc., Energous Corporation, Etatronix GmbH, Sony Corporation, Infineon Technology, Integrated Device Technology, Inc., Samsung Electronics, LG Electronics, and others have adopted various growth strategies such as partnerships, collaboration, acquisition, and product launches to tackle massive competition in the market. Further, key players are focusing on expanding their business units and product launches in various countries, which is helpful for diversified product development as per customer requirements. Moreover, the continuous growth in EV charging technology is responsible for the development of the market.

List of Top Wireless Charging Companies:

- Delta Electronics, Inc. (Taiwan)

- Drone Power Pvt. Ltd. (India)

- Energizer Holdings, Inc. (U.S.)

- Energous Corporation (U.S.)

- Etatronix GmbH (Germany)

- Sony Corporation (Japan)

- Infineon Technology (Germany)

- Integrated Device Technology, Inc. (U.S.)

- LG Corporation (South Korea)

- Samsung Electronics (South Korea)

- Electreon (Israel)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Global Wireless EV charging pioneer Electreon has announced the partnership withBDX Foretagen AB, a prominent Sweden based last mile freight distribution company. The project aims to incorporate Electreon’s wireless technology to charge commercial vans.

- August 2023: Siemens AG, a global provider of various cutting-edge technologies across multiple industry verticals, and MAHALE Baher, a global provider of electric vehicle solutions, had partnered to develop and launch wireless inductive charging stations for autonomous and electric vehicles.

- March 2023: LG Corporation, a global provider of various electronic devices and charging solutions, signed an agreement to sell its car charging business to the printed circuit board manufacturer BH. By this agreement, BH became the tier-1 supplier of original equipment manufacturer companies.

- April 2023: Genesis, a prominent luxury car manufacturer announced the company is trialling the new wireless charging solution in Korea. The company says they have already installed wireless charging pads and conducted trial with GV60 and Electrified GV70.

REPORT COVERAGE

The report provides a detailed analysis of the global market and focuses on critical aspects such as leading companies, product/service types, and leading end-use industries. Besides this, the report offers insights into the market trends and highlights the key industry developments. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 22.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Technology

|

|

|

By Industry Vertical

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 37.28 billion in 2025.

By 2034, the global market is expected to be valued at USD 237.03 billion.

The market is set to exhibit a CAGR of 22.80% during the forecast period (2026-2034).

Asia Pacific is anticipated to be the dominant region, which stood at USD 24.29 billion in 2026.

In industry vertical, the automotive segment is expected to witness the highest CAGR during the forecast period.

Dominant application of cordless charging in electric vehicles is the key trend in the global market.

Surge in demand for simultaneous charging technology is driving market growth.

Delta Electronics, Inc., Drone Power Pvt. Ltd., Energizer Holdings, Inc., Energous Corporation, Etatronix GmbH, Infineon Technology, Samsung Electronics, Integrated Device Technology, Inc., LG Electronics, and others are the major companies in the market

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us