Wireless Intercom Market Size, Share & COVID-19 Impact Analysis, By Type (Outdoor Intercom and Indoor Intercom), By Technology (Wi-Fi Band, Radio Frequency, and Others (Cellular), By End-user (Transportation & Logistics, Retail, Hospitality, Security & Surveillance, Event Management, and Others (Manufacturing, IT) and Regional Forecast, 2026-2034

Wireless Intercom Market Size

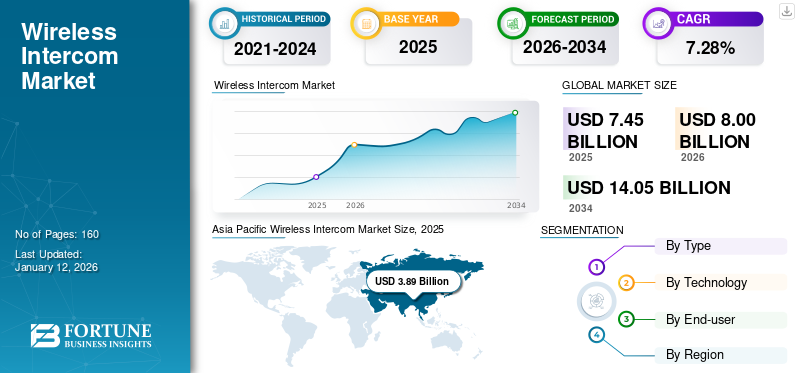

The global wireless intercom market size was valued at USD 7.45 billion in 2025 and is projected to grow from USD 8 billion in 2026 to USD 14.05 billion by 2034, exhibiting a CAGR of 7.28% during the forecast period. Asia Pacific dominated the global market with a share of 52.17% in 2025.

A wireless intercom system is a pivotal component of the intercom market. This wireless intercom solution leverages technologies, such as Wi-Fi-based wireless communications systems, to enable seamless and cordless communication. Unlike traditional wired intercoms, these systems eliminate the need for physical connections, offering increased flexibility and mobility. These systems find applications in various settings, including homes, offices, industrial facilities, and public venues, enhancing security, convenience, and efficiency.

In an increasingly interconnected world, these systems have become essential tools for real-time and long-range communication. They provide a cost-effective and reliable means of staying connected across different areas of a property or facility. Their adaptability, scalability, and integration capabilities make them a vital component in modern communication networks. As technology continues to advance, the role of cordless intercom systems in facilitating efficient and secure communication is poised to expand.

COVID-19 IMPACT

Halted On-Site Installations and Maintenance Services Plunged Market Growth amid Pandemic

The COVID-19 pandemic had a significant impact on the wireless intercom industry. Initially, the industry faced challenges due to disruptions in the global supply chain, leading to delays in the manufacturing and delivery of cordless intercom systems. Lockdowns and restrictions also hindered on-site installations and maintenance services, affecting project timelines. In addition, with businesses and institutions temporarily shutting down or shifting to remote work arrangements, there was a temporary slowdown in the demand for these products in certain sectors, such as commercial buildings and offices.

However, despite these initial setbacks, the long-term outlook for the cordless intercom industry is positive. As organizations adapt to the new normal, the demand for wireless intercoms is expected to grow. Key players in the industry are finding innovative solutions to tackle the negative effects of COVID-19. They are investing in research and development to introduce advanced features that cater to the evolving needs of customers, such as touchless and remote access capabilities. Moreover, companies are expanding their e-commerce channels to reach a broader customer base and offer virtual support for installations and troubleshooting. These strategies, coupled with the resilience of the industry, are likely to drive growth and recovery, positioning these systems as essential communication tools in a post-pandemic world.

Wireless Intercom Market Trends

Growing Use of Wireless Intercom Systems in Hotels and the Hospitality Industry is the Latest trend

The growing use of cordless intercom systems in hotels and the expanding hospitality industry is exerting a substantial influence on the global market. Cordless intercom systems are increasingly being adopted in hotels due to their ability to enhance guest services, streamline operations, and ensure security, which is expected to drive market growth during the forecast period. These systems provide seamless communication between staff members across various departments, facilitating quicker response times to guest requests and enhancing overall guest experiences. Moreover, these systems offer a cost-effective and flexible solution for hotels, allowing for easy scalability as needed. The growth of the hospitality sector is driven by the rising demand for advanced communication systems. In an effort to cater to the ever-evolving expectations of modern travelers, hotels are recognizing the importance of features such as touchless communication, integration with other smart hotel technologies, and the ability to provide personalized services. These aspects are becoming essential in attracting and retaining guests. Above mentioned factors are further contributing toward the wireless intercom market growth.

Download Free sample to learn more about this report.

Wireless Intercom Market Growth Factors

Increasing Need for Robust Security Solutions to Drive Market Growth

The growing need for robust security solutions across various industries is a driving force behind the market’s growth globally. In recent times, security is a paramount concern for businesses and institutions, leading them to seek comprehensive communication and access control systems that can enhance their security measures. Wireless intercoms play a pivotal role in this scenario by providing a secure and efficient means of communication, both for day-to-day operations and emergency situations. These systems allow for quick and reliable communication among security personnel, staff, and management, ensuring that responses to incidents are swift and coordinated. Moreover, these systems facilitate secure access control, enabling organizations to monitor and manage entry points effectively.

With the increasing adoption of wireless technology, these intercom systems are convenient, adaptable, scalable, and capable of integration with other security measures such as surveillance cameras and alarms. The COVID-19 pandemic has further accelerated the demand for touchless and remote communication options, making wireless intercoms even more attractive for industries looking to enhance their security protocols while minimizing physical contact.

RESTRAINING FACTOR

Risk of Interference from Other Wireless Device is Restraining Market Growth

The risk of interference from other wireless devices is a significant constraint for the global market growth. As the number of wireless devices and networks continues to proliferate, the electromagnetic spectrum becomes increasingly congested. This congestion can lead to interference issues, disrupting the seamless communication that cordless intercom systems rely on. Interference from Wi-Fi networks, Bluetooth devices, and other wireless technologies can result in signal degradation, dropped calls, and compromised audio quality, thereby reducing the reliability of cord intercom systems.

Furthermore, interference-related challenges are pronounced in densely populated urban areas and industrial settings where multiple devices and networks coexist. To address this issue, the cordless intercom industry invests in advanced frequency management techniques, interference mitigation technologies, and improved signal processing capabilities. Furthermore, adhering to industry standards and regulations for frequency allocation and device certification can help alleviate interference concerns. As the demand for these systems continues to grow, finding effective solutions to mitigate interference risks will be essential for the industry to thrive globally.

Wireless Intercom Market Segmentation Analysis

By Type Analysis

Indoor Segment holds the Highest Market Revenue Owing to increasing demand for Indoor Intercom devices in the Hospitality Industry

By type, the market is classified into indoor and outdoor. Indoor segment has gained dominance due to surging demand in the retail and hospitality industries. These sectors prioritize seamless communication between staff for efficient operations and enhanced customer service. The ability of indoor intercoms to facilitate real-time communication and security within enclosed spaces has made them indispensable. The indoor intercom segment is projected to dominate the market with a share of 60.32% in 2026.

Outdoor segment is projected to exhibit the highest CAGR during the forecast period. This is attributed to the growing need for outdoor intercom systems in various applications, including access control, surveillance, and emergency communication. The proliferation of smart cities and increased security concerns are driving the adoption of outdoor intercoms for public safety and convenience.

By Technology Analysis

Wi-Fi band Segment Dominates Owing to Heavy Demand for Wi-Fi Based Intercom Systems

Based on technology, the market is classified into the Wi-Fi Band, radio frequency, and others (Cellular). The Wi-Fi band segment is dominating the cordless intercom industry due to the surging demand for Wi-Fi-based cordless intercom systems across various end-users. Wi-Fi intercoms offer the advantage of easy installation, scalability, and compatibility with existing Wi-Fi infrastructure, making them an attractive choice for residential, commercial, and industrial applications. The convenience of wireless communication within the Wi-Fi spectrum has fueled their adoption, boosting revenue in this segment. The Wi-Fi Band segment is projected to dominate the market with a share of 39.72% in 2026.

The cellular network segment is anticipated to exhibit the highest CAGR during the forecast period. This growth can be attributed to the increasing reliance on cellular networks for data and voice communication. Furthermore, the Radio Frequency (RF) segment is following similar growth trends of the Wi-Fi band segment. RF intercoms are versatile, offering reliable communication in various scenarios, including industrial, military, and public safety applications.

By End-User Analysis

Hospitality Segment Generate Prominent Revenue Owing to Increasing Demand for Cordless Intercoms in Hotels and Resorts

By end-user, the market is segmented into transportation & logistics, retail, hospitality, security & surveillance, event management, and others (Manufacturing and IT). The hospitality industry is leading market growth by holding a substantial market share. Hotels, resorts, and other hospitality establishments prioritize effective communication for guest services and staff coordination. The Hospitality segment is expected to lead the market, contributing 38.19% globally in 2026. Cordless intercom systems provide seamless communication, enhancing guest experiences and operational efficiency, which has led to substantial revenue generation in this sector.

To know how our report can help streamline your business, Speak to Analyst

The transportation and logistics industry is expected to grow at the fastest CAGR in the market. This is due to the increasing need for real-time communication among logistics and transportation teams to optimize supply chain operations, track shipments, and ensure efficient logistics management.

The retail, security and surveillance, and event management segments are also showing a growth pattern that mirrors the trends observed in the hospitality sector. Retailers use cordless intercoms to improve customer service and streamline in-store communication. Security and surveillance applications demand cordless intercoms for monitoring and responding to incidents effectively. Event management relies on these systems for smooth coordination during large gatherings and festivals. The collective growth trend across various industries is driving market growth.

REGIONAL INSIGHTS

Based on geography, the market has been studied across Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific market was valued at USD 3.15 billion in 2022 and is anticipated to dominate market growth in the coming years. The market is experiencing robust growth in the Asia Pacific region. Rapid technological advancements, particularly in China, India, Japan, and South Korea, are driving this expansion. The Japan market is forecast to reach USD 0.83 billion by 2026. The China market is poised to reach USD 1.8 billion by 2026. The India market is set to reach USD 0.56 billion by 2026.

Asia Pacific Wireless Intercom Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

China and India, in particular, are experiencing expansion across diverse sectors, including retail, defense, and hospitality, driving the demand for wireless communication devices. Additionally, Japan and South Korea, renowned for their innovation and notable industry players, are making substantial contributions to the sector. A shared emphasis on modernization, urbanization, and technology-driven solutions is fueling the adoption of cordless intercom systems, thereby fostering economic growth. This trend is positioning these nations at the forefront of the cordless intercom industry.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is experiencing significant growth. This expansion can be attributed to several factors, such as a strong emphasis on security and the increasing adoption of smart home and office technologies. North America is home to numerous key players in the industry and the demand for cordless intercom systems is rising across residential, commercial, and industrial sectors. Additionally, the integration of cordless intercoms with home automation systems and the need for contactless communication due to the COVID-19 pandemic have further fueled market growth. This region's commitment to technological innovation and security is propelling the wireless intercom market share growth. The U.S. market is estimated to reach USD 1.58 billion by 2026.

Europe

Europe market is witnessing steady growth. The region emphasizes strongly on security and connectivity, which has led to increased adoption in various sectors. European countries, including the U.K., Germany, France, and Italy, are integrating cordless intercom systems into residential and commercial properties for improved access control and communication. Moreover, the growing trend for smart homes and buildings in Europe has boosted the demand for cordless intercoms, which seamlessly integrate with other smart technologies. The region is also influenced by stringent security regulations and the need for advanced communication solutions, particularly in industrial settings. All these factors contribute to the expanding market in the region. The UK market is expected to reach USD 0.24 billion by 2026. The Germany market is anticipated to reach USD 0.33 billion by 2026.

Middle East & Africa

In the Middle East & Africa region, the market is experiencing notable growth. The MEA region, with the U.A.E., Saudi Arabia, and South Africa, has been investing significantly in infrastructure development and security solutions. This has led to a rising demand for cordless intercom systems, especially in sectors such as real estate, hospitality, and oil & gas, where security and efficient communication are paramount. Additionally, the adoption of smart technologies in urban planning and construction projects has further driven the market's growth in the MEA region.

Rest of The World

South America is also witnessing growth in the cordless intercom market. Brazil, Argentina, and Colombia are embracing these systems to enhance security in residential and commercial areas. South America's increasing urbanization and the need for integrated communication solutions have fueled the demand for cordless intercoms, especially in gated communities and high-rise buildings. The market's growth is expected to continue as these countries seek advanced security and access control measures.

KEY INDUSTRY PLAYERS

Companies Making Substantial Investment in Intercom Technology Research and Development

Prominent companies such as Panasonic Corporation play a significant role in the wireless intercom market due to their substantial investments in advanced intercom technology research and development. Panasonic is also actively introducing new products to strengthen its presence in the market. Additionally, other key players in the cordless intercom industry, including Clear-Com, LLC, Motorola Solutions Inc., Commend international GmbH, Zenitel NV, Alcatel-Lucent, Riedel Communications GmbH & Co. KG, Samsung Corporation, RTS Intercom Systems, Aiphone Co Ltd., and more, have expanded their manufacturing capabilities across various countries. This expansion has a substantial impact on the market's overall growth. Furthermore, many companies prioritize initiatives such as product launches, partnerships, and acquisitions involving small and medium enterprises to extend their global reach.

List of Top Wireless Intercom Companies:

- Clear-Com, LLC (U.S.)

- Panasonic Corporation (Japan)

- Motorola Solutions Inc. (U.S.)

- Commend International GmbH (Austria)

- Zenitel NV (Belgium)

- Alcatel-Lucent (France)

- Riedel Communications GmbH & Co. KG (Germany)

- Samsung Corporation (South Korea)

- RTS Intercom Systems (U.S.)

- Aiphone Co Ltd. (Japan)

- Zicom Electronic Security Systems limited (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 - Pro Intercom, which became a part of the McCormick Group based in Wheeling, IL in 2021, unveiled its inaugural wireless production intercom system tailored for professional applications such as theaters, places of worship, live venues, and more. The new system operated within the 1.9 GHz spectrum and featured a peer-to-peer design structure, enabling the establishment of a complete full-duplex communication network for as many as four users without necessitating a dedicated base station. With an optional expansion hub, it can accommodate up to nine users. Furthermore, the hub offered compatibility with wired Pro Intercom systems, allowing customers with existing installations to utilize a combination of both wired and wireless equipment.

- January 2023 - Dahua Technology, a global leader in video-centric AIoT solutions and services, unveiled the EACH series 2-wire hybrid video intercom system specially tailored for villa scenarios. This latest EACH series showcased the company’s ongoing commitment to technological advancement and extensive expertise in the realm of intelligent building solutions. It ushered in a new era of Extensibility, Accessibility, Convenience, and high-definition video quality for 2-wire video intercom systems.

- June 2023 - Axnes AS, a prominent global provider of wireless communication solutions, announced a partnership with Bristow Group, a renowned leader in vertical flight solutions. The partnership aimed at enhancing crucial crew connectivity and communication as part of an ongoing fleet upgrade initiative. Axnes effectively delivered its PNG Wireless Intercom System (WICS) for implementation throughout Bristow's aircraft fleet, encompassing models such as the AW139, AW189, and S-92. This collaborative effort underscored Axnes' unwavering dedication to bolstering mission-critical operations through state-of-the-art wireless communication solutions. The product represented a revolutionary wireless ICS solution engineered to streamline crew coordination and ensure seamless communication, even in demanding operational environments.

- August 2019 - Telephonics Corporation, a fully-owned subsidiary of Griffon Corporation, revealed its successful attainment of an Indefinite Delivery/Indefinite Quantity (IDIQ) contract within the Technical Category 1 as a hardware supplier from the Department of Homeland Security (DHS). This contract was aimed at providing support for the Tactical Communications Equipment and Services II program (TacCom II).

- July 2019 - Clear-Com, LLC unveiled the FreeSpeak II Digital wireless intercom system. FreeSpeak II represented a versatile solution with five channels, offering full-duplex cordless intercom capabilities. It was particularly suitable for intricate, large-scale designs or specific applications where team members needed to communicate independently without being restricted by wires.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The global report provides a detailed wireless intercom market analysis and focuses on key aspects such as leading companies, product/service types, and leading industry applications of the product. Besides this, the report offers insights into the market trends and highlights the key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the growth in recent years.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.28% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Technology

By End-users

By Region

|

Frequently Asked Questions

According to Fortune Business Insight, the market stood at USD 7.45 billion in 2025.

In 2034, the global market is expected to be valued at USD 14.05 billion.

The market is set to exhibit a CAGR of 7.28% during the forecast period (2026-2034).

Asia Pacific is anticipated to witness significant growth and was valued at USD 3.89 billion in 2025.

In the end-user industry, the transportation & logistics sub-segment is expected to witness the highest CAGR during the forecast period.

Increasing use of wireless intercom in the hospitality industry propelling the market growth globally is the current market trend.

The increasing need for robust security solutions drives market growth.

Clear-Com, LLC, Panasonic Corporation, Motorola Solutions Inc., Commend international GmbH, Zenitel NV, Alcatel-Lucent, Riedel Communications GmbH & Co. KG, Samsung Corporation, RTS Intercom Systems, and Aiphone Co Ltd., among others are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us