Yeast Extract Market Size, Share & Industry Analysis, By Type (Autolyzed and Hydrolyzed), By Grade (Food Grade, Feed Grade, and Others), By Form (Powder, Flakes, and Liquid/Paste), By Application (Food and Beverages [Bakery, Alcoholic Beverages, Dairy Products, Processed Foods, and Others], Animal Feed, Pharmaceuticals, Biofuel, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

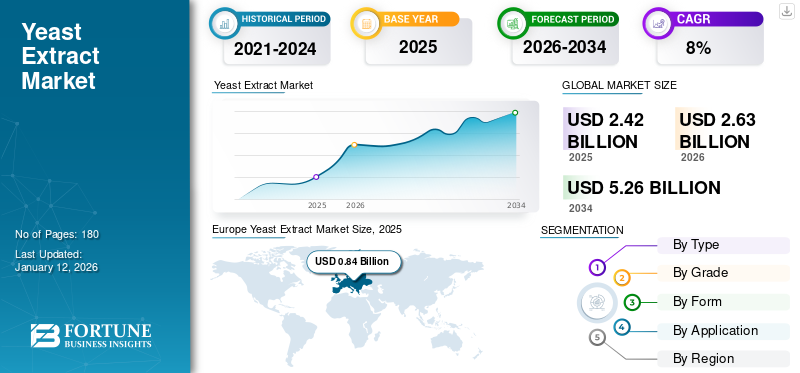

The Yeast Extract Market was valued at USD 2.42 billion in 2025 and increased to USD 2.63 billion in 2026, with the market projected to reach USD 5.26 billion by 2034, registering a CAGR of 9.06% from 2026 to 2034. Europe dominated the yeast extract market with a market share of 34.64% in 2025. Some of the prominent manufacturers in the industry are Angel Yeast, Lesaffre, Ohly, Lallemand, AB Mauri, Halcyon Proteins, and DSM.

Yeast extract is a clean-label ingredient used in food and beverage products, such as sauces, soups, ready-to-eat meals, and savory snacks. It is made from the same fresh yeast used in various products, including bread, beer, wine, dairy products, plant-based foods, and processed foods. It is characterized by a savory taste of its own and used as a spice to round off the taste of food products. The rising consumption of alcohol and growing demand for bakery items will propel the market forward during the forecast period.

Yeast Extract Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 2.42 billion

- 2026 Market Size: USD 2.63 billion

- 2034 Forecast Market Size: USD 5.26 billion

- CAGR: 9.06% from 2026–2034

Market Share

- Europe dominated the yeast extract market with a 34.64% share in 2025, driven by growing adoption of plant-based diets, increasing demand for clean-label ingredients, and widespread use in bakery, alcoholic beverages, and processed foods.

- By type, autolyzed yeast extract is expected to retain the largest market share in 2025 due to its extensive use in soups, dressings, and bakery applications, along with its health benefits and clean-label appeal.

Key Country Highlights

- Germany: Leads European demand due to wide usage in packed foods, bakeries, breweries, and rising biofuel production.

- United States: Strong growth driven by clean-label trends, increasing demand for bakery and alcoholic products, and growing biofuel production.

- China & India: Rapid urbanization and changing consumer preferences toward processed and packaged food boost yeast extract usage.

- Brazil: Significant demand due to increasing ethanol and biofuel production, along with growth in the snack and meat industries.

- Middle East (Saudi Arabia, U.A.E.): Market expansion driven by rising bakery consumption and a shift toward functional, natural ingredients

MARKET DYNAMICS

MARKET DRIVERS

Ease of Incorporation in Wide Range of Foods & Beverages to Aid Market Growth

Yeast extract plays a vital role as a bread-leavening agent. It is used broadly in the food & beverage industry to ferment draft beverages with glucose. It comprises nutrients, such as selenium, chromium, protein, potassium, zinc, magnesium, and iron and is helpful as a dietary supplement. It is versatile and popular in bouillons, seasoning sauces, soups, or savory snacks. It is also excellent for preparing vegetarian and vegan dishes.

Additionally, it is used as a flavor enhancer in various beverages and bakery products. Thus, the growing demand for natural flavoring agents in the food industry will drive the market’s growth. The driving force behind the growth of the yeast extract market is the increased consumption of alcoholic beverages and consumer preference for fresh and healthy foods comprising natural ingredients.

Rising Demand for Bakery Products to Propel Market Forward

Bread is a staple food in many countries, and the demand for baker’s yeast is rising. Packaged baked goods, such as cakes are also experiencing increasing demand worldwide, which will create new market opportunities. Furthermore, the sales of bakery items are driven by the constant demand for specialty breads and the impact of inflation on retail prices. According to the Federation of Bakers, more than 11 million loaves of bread are sold daily across the U.K. Thus, the increased demand for bakery products worldwide will likely drive the global yeast extract market growth in the future.

MARKET RESTRAINTS

Availability of Substitutes to Hinder Market Growth

The availability of various substitutes for yeast extract, such as Hydrolyzed Animal Proteins (HAPs), Hydrolyzed Vegetable Proteins (HVPs), and nucleotides in the food industry is anticipated to restrict the market’s growth. Moreover, the U.S. Food and Drug Administration (FDA) has granted GRAS status to monosodium glutamate (MSG), HAPs, and HVPs for use in foods and beverages, which will affect the product’s demand. However, HVPs and HAPs have safety concerns due to the formation of intermediate products, such as dichloro propanol (DCP) and monochloro propanol (MCH) during the manufacturing process, which may be mutagenic. These factors will impact the growth of the global yeast extract market share over the forecast period.

MARKET CHALLENGE

Product-Related Allergies to Hamper Market Growth

Yeast extract contains glutamate, a type of amino acid. Glutamate is primarily responsible for providing an umami flavor. This amino acid is naturally present in the extract. It is a neurotransmitter, which is a chemical that sends messages to the brain. Higher levels of glutamate correspond to a higher degree of pain sensitivity. Chronic, severe, or persistent pain triggers a continuous release of glutamate. Numerous individuals could be sensitive to glutamate, which could result in symptoms like headaches or a condition called “Chinese Restaurant Syndrome.” Furthermore, the extract may cause several allergic responses, stomach discomfort, or skin problems in people who are sensitive or allergic to it. Therefore, allergies and sensitivities associated with yeast extract may impede its demand.

MARKET OPPORTUNITY

Application of Yeast Extracts in Animal Feed to Create Market Growth Opportunities

Yeast extracts are traditionally used in the food & beverage industry. They are one of the most vital and popular ingredients in the food industry as they improve palatability. A similar trend is also being seen in the animal feed and pet food sectors. Yeast extract contains rich beta-glucans and mannan-oligosaccharides, which have immunity-supporting properties. Additionally, the presence of nucleotides plays a key role in the development and maturation of immune cells. Keeping livestock healthy is one of the vital priorities for the producer. Thus, livestock producers are focusing on using natural antibiotic resistants and antibiotic growth promoters to improve an animal’s resistance against microbial infections and support its immune system. This factor may influence the sales of yeast extracts.

YEAST EXTRACT MARKET TRENDS

Rapid Adoption of Veganism to Positively Influence Market Growth

Increasing adoption of veganism has led to the growing use of nutritional yeast extracts, which is expected to be a prevailing trend. Since nutritional yeast has a cheesy taste and is gluten-free and vegan, and is gaining traction. The consumption of salt-free, organic, vegan, and plant-based protein products is growing globally. The usage of inactive dried nutritional yeast is growing in animal feeds. As a result of these factors mentioned above, the demand for nutritional yeast will increase rapidly. Yeast is a single-cell fungus that develops naturally in plants and soil and does not have a cardiovascular and nervous system. Thus, the consumption of this product leads to no animal suffering, cruelty, and exploitation, making it a suitable choice for the vegan population. Yeast-based products are rich in minerals, vitamins, and antioxidant contents. The extracts are used as a leavening agent in various food products to improve their texture and flavor and add nutritional content. Moreover, yeast-based extract is a suitable alternative for food manufacturing companies to develop products with naturally sourced ingredients.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic considerably affected the industry. Yeast extract is one of the key ingredients used to produce several essential food products, including bread and other bakery items. During the first half of 2020, trade was restricted, which had a negative impact on the market and created severe raw material shortages, especially in countries that mainly depended on importing raw materials. Companies from different end-use industries were searching for local producers to procure raw materials to maintain production and achieve sustainability during this challenging time. This factor balanced the product sales during the COVID-19 period.

Furthermore, yeast extract manufacturing companies reframed their strategies to reach customers during the pandemic. Key players were extensively involved in partnerships and collaborations with local players, expanding their production plants near key marketplaces and strengthening their presence on e-commerce platforms. These strategies helped them achieve sustainability during the challenging period.

SEGMENTATION ANALYSIS

By Type

Autolyzed Segment Held Significant Market Share Owing to Wide Use in Various Food Applications

By type, the market is segmented into autolyzed and hydrolyzed.

The autolyzed segment dominated the global market by holding a prominent share of 62.84% in 2026. Owing to its taste profile, the product is widely used in various food applications, including soups, dressings, and bakery products. It is a rich source of vitamin B and micronutrients, offering health benefits to the final product. Additionally, increasing demand for clean-label ingredients and additives in the food industry will further drive the growth of this segment.

The hydrolyzed yeast extract segment is anticipated to record the highest CAGR of 9.48% during the forecast period. Compared to autolyzed yeast extracts, hydrolyzed products contain higher antioxidant, anti-aging, moisturizing, and soothing properties. Therefore, they are popular in cosmetics and personal care products in the current scenario. The increasing demand for natural ingredients in the cosmetics industry will also significantly contribute to the segment's growth.

By Grade

Wider Product Adoption in Food Application to Drive Food Grade Segment Growth

Based on grade, the market is segmented into food grade, feed grade, and others.

Under grade segmentation, Food Grade yeast extract recorded a market size of USD 1.59 billion in 2026, representing a 60.64% share. Food-grade yeast extracts are pure, high-quality, and safer for human consumption. As a result, they are widely used in fermenting food products, such as bakery products, processed foods, including noodles & packed meals, dairy products, alcoholic beverages, and fermented non-alcoholic beverages. Pharmaceutical industry players also utilize the product to ferment medicinal formulas. Additionally, the growing demand for clean-label ingredients in the food & beverage industry will create demand for the product. Therefore, the segment is anticipated to record a steady growth rate during the forecast period.

The feed grade segment is anticipated to register the highest growth rate during the forecast period. This segment led the market share by 26% in the year 2024. Globally, the animal feed production is gradually expanding with a double-digit year-on-year growth. According to the European Feed Manufacturers' Federation (FEFAC), the compound feed production in the European Union reached 147.3 million tons in 2022. Increasing livestock farming and emerging concerns regarding food security are significantly contributing to increasing the demand for animal feeds. Additionally, the growing need for premium-quality, natural, and functional ingredients is driving the demand for the product. Yeast extract is one of the primary ingredients used to increase feed products' nutritional benefits and palatability. Therefore, the segment is anticipated to record the highest CAGR during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Form

Longer Shelf-Life to Propel Demand for Powdered Form of Extract

Based on form, the market has been segmented into powder, flakes and liquid/paste.

The powder form segment is anticipated to hold the largest market share by 64.97% in 2026. Industry players, such as AngelYeast, Kerry, Lesaffre, and Lallemand widely offer powder-form products. This form of extract offers a higher shelf-life as it contains less moisture. It also offers customers more functional flexibility and storage convenience, especially those belonging to the bakery and processed food sectors. Additionally, powdered form of extract offers the flexibility to reduce salt or sodium content in the yeast product. As a result, the segment is anticipated to hold the largest share of the market.

The liquid extract segment is anticipated to record the fastest CAGR during the forecast period. Compared with powdered extract, the yeast cells are more structured in liquid form. The cells in a liquid pitch are healthy and full of fluid; their membranes are intact and the cells are stocked with glycogen. Thus, it offers higher vitality and functional benefits. Additionally, it is a sustainable option for the end-use industry players as its production requires minimal processes. Therefore, the segment is anticipated to record the highest growth rate during the forecast period.

The flakes segment is projected to exhibit a CAGR of 8.63% during the forecast period.

By Application

Clean-Label and Functional Ingredients Demand in Food & Beverage Applications to Drive Segment Growth

Based on application, the global market is segmented into food & beverage, animal feed, pharmaceuticals, biofuel, and others.

The food & beverage segment is further categorized into bakery, alcoholic beverages, dairy products, and processed foods. The food & beverage led the market with a value of USD 0.99 billion in 2026, holding a 37.47% market share. Due to their health benefits, yeast extracts are being increasingly utilized in various food & beverage applications, such as dairy alternatives, bakery products, energy drinks, and confectionery products. They are an efficient tool to build unique taste profiles. This is primarily done by bringing out some flavor notes and reducing and removing different ingredients for nutrition or clean label purposes. These extracts perform in numerous processed foods and canned & frozen goods in several savory or sweet food & beverage segments. Yeasts are natural, well-suited ingredients for producing vegan and vegetarian products without artificial composition. Furthermore, the demand for spreads and desserts made from this extract is also increasing among consumers. This change in the consumption pattern is also expected to positively influence the market growth.

Apart from the food & beverage sector, the use of yeast extract to produce pharmaceuticals, including dietary supplements, has also increased recently. A growing risk of getting infected with viruses and pathogens leads to chronic ailments. Hence, research and investment in new pharmaceuticals and dietary supplements to treat such diseases are expected to rise in the future. Hence, the demand for these extracts is also expected to increase in the pharmaceutical sector.

Animal feed segment is anticipated to a 26% of the market share in 2025, while Bio-fuel segment is projected to exhibit a CAGR of 10.87% during the forecast period.

YEAST EXTRACT MARKET REGIONAL OUTLOOK

The market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Yeast Extract Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe holds the largest market share and is valued at USD 0.90 billion in 2026. The European market is mainly analyzed in leading European countries, such as Germany, France, the U.K., Italy, Spain, and Russia. The adoption of plant-based diet regimes in the region has influenced food manufacturers to use plant-based ingredients to make bakery products, including breads and cakes. For instance, as per data provided by the National Centre for Social Science Research (NatCen), the vegan population in the U.K. increased from 0.25% in 2014 to 1.21% in 2019. Thus, bakery manufacturers are adopting plant-based ingredients that mimic the properties of animal-sourced products, such as milk, eggs, and butter. Thus, the demand for yeast extract in the region is anticipated to grow with a steady CAGR during the forecast period.

Germany will hold the largest share of the European market in the study period owing to the wider acceptance of the product in packed foods, bakery products, breweries, and biofuel production. Evolution in the policies, adoption of a plant-based diet, sales of vegan food products, and increase in alcoholic beverage production in the country will drive the product’s demand. According to the Brewers of Europe, the beer production volume increased from 85.44 million hectoliters in 2021 to 87.83 million hectoliters in 2022. Increasing production of beer and other alcoholic beverages will positively influence the product’s demand in the country. The U.K. is anticipated to reach USD 0.18 billion in 2026. The German market is likely to hit USD 0.18 billion by 2026 and France is projected to hold USD 0.12 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the second-largest regions estimated to capture a significant value USD 0.73 billion in 2025 of the global market, exhibiting a CAGR of 30.06% during the forecast period. North America is also considered a substantial region in the global market, driven by the intense demand for clean-label ingredients and additives – flavor enhancers that offer aroma and a clean taste. Consumers in the region are becoming more health-conscious and eco-friendly since they are becoming increasingly interested in the traceability, natural origin, and sustainability or nutritional impact of the food they purchase and consume.

The U.S. is one of the key markets for the product, anticipating to hit USD 0.5 billion in 2026. Increasing demand for bakery products, rising alcoholic beverage production, and growing fermented beverage trends are a few factors that will influence the product’s demand. Biofuel production is another key factor widely affecting and driving the product’s demand. Additionally, the popularity of clean-label and natural products is actively shaping the industry landscape.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific is anticipated to emerge as the third-fastest growing market with a size of USD 0.55 billion in 2026. Urbanization and rise in disposable income have influenced consumers across India, China, and Southeast Asian countries to opt for prepared foods, packed meals, bakery products, and fermented beverages. Furthermore, the economic evolution and high literacy rate has boosted female workforce participation across the Asia Pacific market. According to the Ministry of Labour and Employment, an Indian Government ministry, nearly 26.5% of women were in the labor force in 2021-22, compared to 22.3% (2017-18) across India. The increasing number of working women and nuclear families in urban areas will likely drive the bakery industry growth. It will also drive the demand for the product across Asian countries. The market for China is anticipated to reach USD 0.16 billion in 2025. The Indian market is likely to hit USD 0.08 billion and Japan is projected to hold USD 0.11 billion in 2026.

South America

South America is the fourth-largest region and it is anticipated to hit USD 0.23 billion in 2025. The demand for the product is steadily growing across Brazil, Argentina, Chile, Colombia, Peru, and other South American nations. Brazil is expected to hold the dominant share of the South American market in terms of value, mainly due to the rising penetration of packaged snacks and food products and the high demand for meat products in the country. Yeast extract is one of the key ingredients in producing ethanol and biofuel. Brazil is one of the leading ethanol-producing countries. According to the Renewable Fuels Association, Brazil held nearly 28% of the global ethanol production in 2023. Increasing biofuel production in South American countries, such as Brazil and Argentina will drive the product’s demand in the future.

Middle East & Africa

The Middle East & Africa market is expected to see significant growth in the coming years, driven by several key factors, including the expansion of the bakery and food & beverage industries in emerging markets, such as Saudi Arabia, the UAE, Israel, Turkey, and others. The UAE market is projected to reach USD 0.02 billion in 2025. Consumers in the Middle East and Africa are becoming more health-conscious and seeking food products with natural ingredients, whole grains, and reduced additives. Yeast extract is one of the natural ingredients which contains several nutrients and assists food manufacturers in manufacturing functional food products. With increasing awareness among manufacturers about the product's benefits, the market has the potential to display a promising CAGR in the coming years.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players to Focus On Mergers and Acquisitions to Expand Their Geographical Presence

The market exhibits a semi-fragmented structure with the presence of international and regional players. Some prominent manufacturers include Koninklijke DSM N.V., Angel Yeast Co. Ltd., Lallemand Inc., Associated British Foods plc, and Lesaffre Group, who are shaping the industry with their innovations, product launches, R&D activities, and other market penetration initiatives. These key players hold nearly 28% of the global market share. Base expansion, mergers & acquisitions, and new product launches are a few key strategies adopted by them to strengthen their market presence. For instance, in July 2023, Angel Yeast announced its plans to launch vegan-friendly yeast extracts, namely AngeoPrime, Angeoboost, Angeotide, AngeoPro, Angearom, and Angeocel. These yeast and yeast extract products will be used in wider applications in diverse industries, including food & beverage.

Major Players in the Yeast Extract Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF KEY BREWING INGREDIENTS MARKET COMPANIES PROFILED

- Lesaffre (France)

- AngelYeast Co., Ltd. (China)

- Halcyon Proteins, (Australia)

- (France)

- Thai Foods International (Thailand)

- Alltech (U.S.)

- Synergy Flavors (U.S.)

- Lallemand, Inc. (Canada)

- Ohly (Germany)

- Leiber GmBH (Germany)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Lallemand, a global producer of yeast, bacteria, and specialty ingredients, acquired Evolva, a Swiss yeast-based biotech company, for approximately USD 23.5 million. This acquisition allowed the company to expand its commercial and operational network.

- December 2023: Lallemand’s Bio-Ingredients and Specialty Cultures launched a yeast extract-based product, Natural Rosé, to reduce color formulation in processed meat products.

- May 2023: Angel Yeast introduced its new yeast-based product offerings at the Shanghai exhibition. The major offerings of the company were semi-dry yeast for premade baking goods, bread improver, yeast protein, and clean label flavor improver.

- November 2022: Angel Yeast introduced new yeast-based extracts and proteins for plant-based milk and displayed them at the Food Ingredients Europe (FiE) 2022 trade show.

- July 2021: Biospringer by Lesaffre, announced the expansion of its yeast extract production site in Cedar Rapids, Iowa, U.S. Biospringer by Lesaffre’s varied range of yeast ingredients is vital for multiple food and beverage applications. This investment will aid the growing market trend of natural-origin ingredients derived from fermentation.

INNOVATION ANALYSIS AND OPPORTUNITIES

Since the product has multiple functional benefits, demand from diverse industries has increased over the years. As a result, numerous industry players have experienced intense competition in the global market. Thus, they are investing adequate funds in R&D activities to develop advanced technologies to stay ahead of the competition. The active involvement of companies in R&D activities and new product developments will open up new market opportunities in the coming years. For instance, in April 2022, Angel Yeast, a global yeast and yeast extract manufacturing company, inaugurated a smart factory for digitalized and automated ingredient manufacturing. The new factory contains a smart mixed production line, enabling automated operation, improved quality control, increased productivity, and energy efficiency. Furthermore, the company invested in opening a new R&D plant in China to research and develop novel yeast-based sports nutrition products in 2021. Such focus on innovation and adoption of advanced machinery by key players is anticipated to diversify the industry landscape in the coming years.

REPORT COVERAGE

The report includes quantitative and qualitative insights into the market using different research methodologies. This global market growth forecast also offers a detailed regional analysis, market analysis, market trends, market dynamics, regional market forecast, market analysis, forecast, and the growth rate for all possible market segments. This report provides various key insights on the market, an overview of related markets, competitive landscape, forecast period, recent industry developments, such as mergers & acquisitions, regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.06% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Grade

By Form

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 2.63 billion in 2026.

The market will exhibit promising growth during the forecast period, recording a CAGR of 9.06%.

Based on grade, the food grade segment is expected to be the leading segment during the forecast period.

Rising demand for bakery products will propel the market forward.

Angel Yeast, Lesaffre, Ohly, Lallemand, AB Mauri, Halcyon Proteins, and DSM are the leading players in the market.

europe held the highest share in 2026.

Based on type, the autolyzed is set to lead the global market.

Rapid adoption of veganism will positively influence the market’s growth in the coming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us