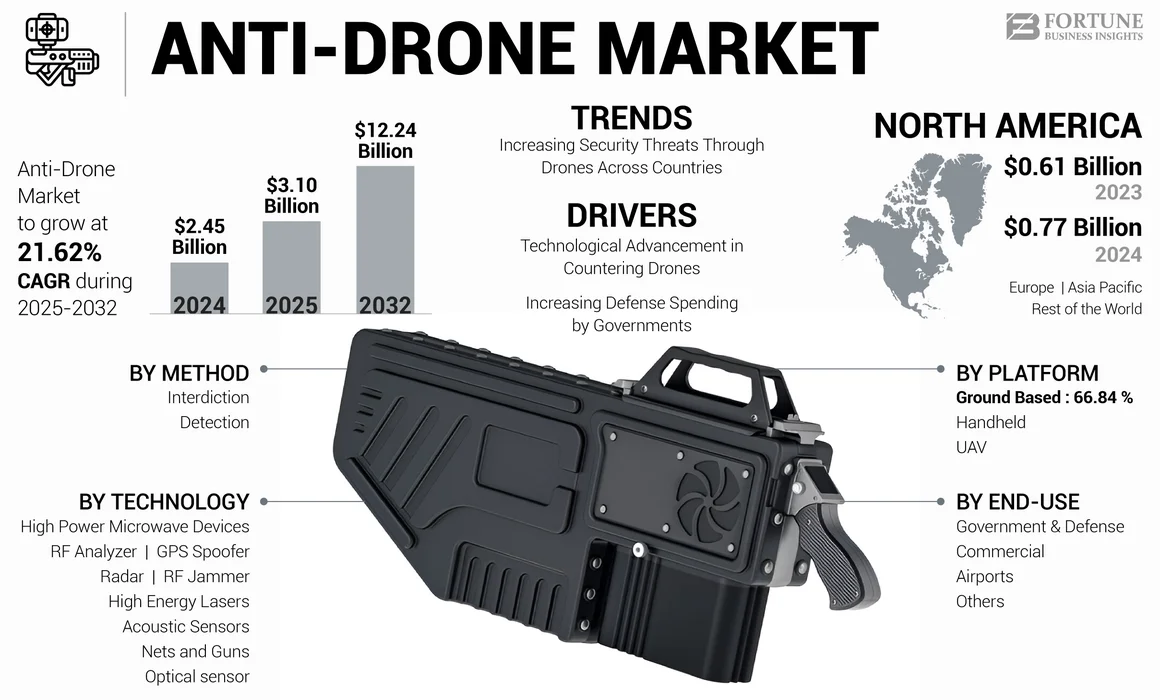

Anti-Drone Market Size, Share & Industry Analysis, By Method (Detection and Interdiction), By Technology (RF Analyzer, Acoustic Sensors, Optical Sensors, Radar, RF Jammer, GPS Spoofer, High Power Microwave Devices, Nets and Guns, and High Energy Lasers), By Platform (Handheld, UAV, and Ground Based), By End-use (Government and Defense, Commercial, Airports, and Others), and Regional Forecasts, 2025-2032

KEY MARKET INSIGHTS

The global anti drone market size was valued at USD 2.45 billion in 2024. The market is projected to grow from USD 3.11 billion in 2025 to USD 12.24 billion by 2032, exhibiting a CAGR of 23.55% during the forecast period.

Anti-drone technology, also known as counter-UAS (Unmanned Aircraft System) or counter-UAV (Unmanned Aerial Vehicle) technology, refers to systems designed to detect, track, and neutralize drones. These technologies have become increasingly important due to the rapid proliferation of drones, which pose potential security threats in civilian and military contexts. Anti-drone systems are used to safeguard sensitive airspaces, critical infrastructure, and public safety from unauthorized or malicious drone activities.

Drone countering systems are used to detect and counter unauthorized drones that may have been used to drop explosives, smuggle contraband, and gather intelligence on sensitive assets. This technology is used to protect airports, critical infrastructure, and other areas such as stadiums, military installations, and battlefields. Systems are offered in fixed or portable configurations. Such systems have multiple sensors that help detect enemy drones.

The anti-drone market is experiencing rapid growth, driven by increasing security concerns over unauthorized drone activities. Key players in this market include major defense contractors and specialized technology firms. Prominent companies such as Lockheed Martin Corporation, Raytheon Technologies, Thales Group, SAAB AB, and Israel Aerospace Industries lead the industry through innovation in detection systems, directed energy weapons, and artificial intelligence-based solutions. Emerging firms like Dedrone and Blighter Surveillance Systems are contributing with scalable and customizable anti-drone technologies.

Anti-Drone Market Overview & Key Metrics

Market Size & Forecast

- 2024 Market Size: USD 2.45 billion

- 2025 Market Size: USD 3.11 billion

- 2032 Forecast Market Size: USD 12.24 billion

- CAGR: 23.55% from 2025–2032

Market Share

- North America dominated the anti-drone market with a 31.43% share in 2024, driven by the presence of leading defense contractors, increasing defense budgets, and rapid adoption of counter-UAS technologies for protecting critical infrastructure and military bases.

- By technology, RF Jammer accounted for the largest share in 2024 due to its effectiveness in disrupting hostile drone communications. However, High Energy Lasers are expected to witness the fastest growth by 2032, supported by increasing defense investments in laser-based counter-drone systems for real-time interdiction.

Key Country Highlights

- United States: Leading the market with extensive defense spending and R&D programs such as Black Dart and integration of high-powered microwave and laser systems for counter-drone measures.

- China: Rapid adoption of anti-drone solutions fueled by Belt and Road Initiative projects and rising demand for border and infrastructure protection.

- India: Increasing procurement of indigenous counter-drone systems by armed forces and deployments for airport and border security, including contracts with Bharat Electronics Limited.

- Europe (U.K. & NATO nations): Investments driven by rising drone threats from geopolitical conflicts like the Russia–Ukraine war and initiatives such as NATO’s air defense support to Ukraine.

ANTI DRONE MARKET TRENDS

Increasing Security Threats Through Drones Across Countries to Propel Market Growth for Counter Drone Technology

Advancements in drone technology have created threats to national security or commercial and critical infrastructure through the use of advanced drones. Such drones, while being armed, are capable of attacks. Such incidents have reportedly increased in recent years, and hence, security threats have led governments to think of anti-drone technologies

- North America witnessed anti drone market growth from USD 0.61 Billion in 2023 to USD 0.77 Billion in 2024.

- According to a survey by Droneii, governments have increased the use of drones in 2021 compared to other sectors.

The use of drones in warfare has led states to carry out attacks with very little reference to international law norms. This has led to a state of continuous warfare in the world. Militaries around the world are putting in resources to stop terrorist drone attacks.

Since 2008, the U.S. has increased its lethal targeting of militants through the use of weaponized drones. The recent war between Russia and Ukraine has raised concerns due to the use of drones in warfare.

Ukraine, though traditionally used the military drone Bayraktar in warfare, recent trends point out the use of small commercial drones in warfare. Small drones, such as the DJI Mavic 3, cost less than military drones and have been seen to be more effective in being fitted with small bombs. This has raised concerns about non-military drones being used in warfare.

There is a rise in the number of consumer drones that are available at lower prices and may be used for unlawful purposes. This has further necessitated the development of anti-drone technologies. Such drones enable terrorist organizations to target civilians and continue to cause growing concerns.

- In June 2021, drones were used to drop explosives at Jammu airport in India. This was the first attack on defense establishments using drones.

Thus, the increasing use of military and non-military drones for attacks on defense and civilian infrastructure and establishments has necessitated the need for this type of drone technology.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET OPPORTUNITIES

Market is Witnessing Significant Growth, driven by Rising Private Investments and Technological Advancements

The proliferation of drones has raised alarms due to their misuse for surveillance, smuggling, and attacks. Governments and industries are investing heavily in anti-drone technologies to protect sensitive areas such as airports, military installations, and public events. Advances in artificial intelligence (AI), machine learning, radar systems, and electronic countermeasures (e.g., jamming devices) have enhanced the precision and efficiency of anti-drone solutions. These innovations are attracting investments from both governments and private entities. Startups specializing in anti-drone technologies are leveraging cutting-edge solutions like AI-powered detection systems and IoT-connected devices. This has created an attractive investment landscape for venture capitalists and private equity firms.

MARKET CHALLENGES

The Emergence of Counter-Drone Technology and the Violation of National Security Represent Significant Challenges within the Market

security frameworks, as there has been a substantial rise in unauthorized access to restricted areas. This situation undermines the protective measures implemented by the government for safeguarding prominent individuals and critical locations. In response, various mitigation technologies have been developed by leading market participants to restrict drone activities, particularly in the aviation sector.

Numerous key industry players, along with government entities, are concentrating on the advancement of counter-drone technologies to address the diverse threats posed by the increasing use of sophisticated drones. Companies are employing a range of techniques to detect the presence of drones in their surroundings.

MARKET DRIVERS

Technological Advancement in Countering Drones to Drive Market Growth

Companies across the world have started using drones for hunting other drones and new radar systems and lasers to stop drones. From using high-tech laser systems, radar systems, and electronic signal jammers to revamping the older systems, such as repurposed fighter aircraft with powerful radars to look down and shoot UAVs, modern militaries are trying to minimize threats using technology.

- In May 2022, the U.S.-based tech company Epirus claimed that its high-powered microwave system had been able to disable 66 small drones in mid-flight by frazzling their electronics.

- In June 2022, Israel’s Elbit systems took down several unmanned target aircraft using a laser, which was mounted on a light aircraft.

- Since 2002, the U.S. Defense Agency has been conducting an annual counter-drone exercise, the Black Dart, to counter rising drone-based threats. Black Dart's live fire exercise led to the deployment of an anti-drone laser system on a warship.

The U.S. CRAM system, originally designed to intercept rockets and artillery, has been used to shoot down drones attacking the U.S. forces in Iraq. Such systems fire a stream of high explosive cannon shells at 4,500 rounds a minute.

- Similarly, the U.S. is also using the US PAC-3 patriot missile systems to take down drones.

- Israel's iron dome system is using artificial intelligence to shoot down rockets and drones.

Increasing Defense Spending by Governments to Drive the Market Growth

The conflict in Ukraine has shown that additional systems will be necessary to combat rogue drones in the years ahead. The U.S. Department of Defense intends to invest USD 668 million in research for new drone defense technologies and approximately USD 78 million to acquire such technology by 2026.

The Indian military has placed fresh orders with domestic firms for counter-drone technologies totaling USD 1.5 billion. The Indian Navy has also entered into a contract with Bharat Electronics Limited (BEL) for a domestic anti-drone naval system.

Since 2019, the government of the U.K. has financed 18 initiatives to advance technologies. The government allocated nearly USD 2.5 million to finance projects involving this kind of drone technology. The French defense procurement agency has informed Thales and CS Group about the development and delivery of the PARADE drone countermeasures program, committing USD 32.85 million to it.

This rise in expenditure on research and development, as well as the acquisition and implementation of technologies, will propel the advancement of this technology.

MARKET RESTRAINTS

Procurement Costs and Government Regulations and Control to Act as Restraint for Market

Counter-drone technology is mostly a part of military and defense projects. Several governments across the world use different counter-UAV solutions based on different technologies. Most of these systems are very expensive and need to pass through critical government regulations.

However, although different countries have different drone regulations, there has not been any standardization of technologies.

Most countries classify the systems based on how the system finds a drone (radars), what the system does after finding the drone (RF jamming, drone collision, microwave attack, lasers or nets), and based on platform (ground, mobile, mounted or handheld).

For airports and local law enforcement agencies, the regulatory landscape for counter-drone technologies is still unclear. The detection methods for counter-UAV operations often require working in the radio frequency spectrum. They can pose threats to manned aircraft and surveillance, communication, and navigation signals used by air traffic control. Hence, such systems could violate aviation rules and regulations and act as a restraint for the anti drone market growth.

Impact of COVID-19

The COVID-19 pandemic led to an abrupt increase in the use of drones for various purposes due to social distancing and government measures aimed at controlling the virus. As of October 2022, approximately 865,505 drones were registered in the U.S. alone. The quantity of drones experienced a remarkable increase, and the danger posed by rogue drones also escalated during the pandemic. A drone's capacity to fly at low altitudes can hinder its detection by radars. With the ongoing utilization of drones by both state and non-state entities, the demand for C-UAS technology has gained increasing significance among defense organizations globally.

SEGMENTATION ANALYSIS

By Method

Interdiction Segment to be Fastest Growing Segment Due to Development of Advanced Technology to Counter Drones

By method, the market is segmented into detection and interdiction.

The interdiction segment is projected to grow at a higher CAGR during the forecast period. The growth of the segment is attributed to the rising technological advancement in interdiction methods. RF jamming has been a popular interdiction technique. RF jamming causes disruption in the radio frequency link between the drone and its operator by generating large volumes of RF output.

- In September 2021, the Indian Navy’s contract with BEL for the Naval Counter Drone System demonstrated this capability. It can instantly detect and jam micro drones.

The detection segment dominated the market with the largest share of 49% in 2024. The global increase in military spending and rising threats from drones create demand for detection techniques in emerging economies, such as India and China, which are helping boost the segment’s market growth.

By Technology

Rise in Use of High Energy Lasers Will Propel Market Growth

Based on technology, the market is classified into RF analyzer, acoustic sensors, optical sensors, radar, RF jammer, GPS spoofer, high power microwave devices, nets and guns, and high energy lasers.

The high energy lasers segment is expected to grow at the fastest rate due to its ability to use automated target cueing and a full spectrum of electro-optical/infrared sensors to track, identify, and quickly take down drones. The increasing use of such lasers by military users has led to a high growth rate for the segment.

The RF jammer segment accounted for the largest market share in 2024. The RF drone signal jammer blocks the communication between the hostile drone’s video, telemetry, command, control, navigation systems, and the device’s operator. By jamming the communication channels, the drone is effectively disabled and forced back to its home base or grounded at its current location. Hence, it has been the most popular choice. The segment is expected to capture 21% of the market share in 2025.

Other technologies, such as GPS spoofers, acoustic sensors, optical sensors, radars, nets and guns, and high-power microwave devices, are expected to drive the growth of the market due to investment in these technologies from emerging economies such as China and India.

- American aerospace firm General Dynamics collaborated with Epirus to integrate the Leonidas high-power microwave weapon onto Stryker combat vehicles for enhanced Anti-Drone swarm capabilities.

RF analyzer segment is expected to record a CAGR of 22.38% during the forecast period.

By Platform

Rise in Ground Based Drone Defense Systems to Propel Segment Growth

Based on platform, the market is segmented into ground based, UAV, and handheld.

The ground based segment accounted for the highest market share in 2024. The segment is also expected to grow at the highest CAGR during the forecast period. The growth of the segment is attributed to the rising expenditure on ground based defense systems. Thus, higher growth numbers are anticipated during the 2025-2032 period.

- The ground based segment is expected to hold a 66.84% share in 2024.

- In June 2021, the British Ministry of Defense employed Rafael’s drone Dome counter UAV system to protect world leaders during the G7 Summit.

The handheld segment is predicted to hold 19% of the market share in 2025, owing to the increase in demand for drone guns and nets. Such devices are portable and thus are a more popular choice in border areas. The segment is anticipated to show a high CAGR during the forecast period.

- In September 2022, the border security force in India deployed drone defense guns in the Punjab region of India.

The UAV segment is expected to grow at a moderate CAGR of 20.2% during the forecast period as compared to other segments. The rise in the use of advanced combat drones for attacking other drones and rising military budgets in procuring such drones are expected to surge the demand for these systems.

To know how our report can help streamline your business, Speak to Analyst

By End-use

Government & Defense Segment to Grow Due to Increasing Defense Budgets Facilitating Investment in Counter Drone Technology

Based on end-use, the market is segmented into government & defense, commercial, airports, and others.

The government & defense segment has been the largest segment with a high market share in 2024 and is anticipated to grow at the highest CAGR during the projected period. The growth of the segment is attributed to the rising expenditure on defense modernization and the increase in threat from drones. The Russia-Ukraine war has further demonstrated the effectiveness of having drone defense systems, and thus, growing economies have also started to make or procure counter-drone systems. Thus, higher growth numbers are anticipated during the forecast period. The segment is expected to capture 35% of the market share in 2025.

- Greece has been protecting important sites across the country by using Israel’s counter-drone technology, which is similar to Drone Dome but customized for the specific needs of Greece.

The commercial segment is anticipated to witness growth with a moderate CAGR of 23.54% during the forecast period. Growth is expected in the forecast period due to increasing commercial uses of drone defense technology in protecting large public safety at gatherings and important conventions.

- In 2021, such counter-drone devices were used to protect important world leaders at the G7 summit.

The airports segment is anticipated to grow with the significant growth rate during the forecast period. The rising drone threats at airports have led to an increase in investment in drone defense systems for airports.

- In 2021, the airport of Jammu reported drone attacks. Drones were used to drop explosives at the airport.

- In 2018, the U.K. reported drone sightings near the runway of Gatwick airport. More than 100 flights were diverted or canceled in just three days.

The others segment is anticipated to grow with a moderate CAGR due to increasing use in protecting civil infrastructure, large crowd gatherings, protecting important people, and other critical infrastructure.

ANTI DRONE MARKET REGIONAL OUTLOOK

The market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World, based on region.

North America

North America Anti-Drone Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the anti-drone market share in 2024. The region stood at USD 0.77 billion in 2024 and is projected to grow at a moderate CAGR during the forecast period. In 2023, the regional market value is USD 0.62 billion. The growth has been attributed to the presence of key players in the defense domain, such as Raytheon Technologies Corporation, Lockheed Martin Corporation, Liteye Systems, and others in the region. The U.S. has the highest defense spending in the world and thus held a higher share of the market in 2024. The U.S. market size is expected to be USD 0.60 billion in 2025.

Asia Pacific

Asia Pacific is expected to be the third-largest market with a size of USD 0.89 billion in 2025. The market in the Asia Pacific region is projected to grow at the highest CAGR due to the increase in investment in drone technology and rising defense budgets. The increase in security systems at airports and the protection of international borders in the region are expected to drive the growth of the region. The market value in China is expected to be USD 0.43 billion in 2025.

On the other hand, India is projecting to hit USD 0.22 billion and Japan is likely to hold USD 0.15 billion in 2025.

- In August 2021, the Indian Navy signed a contract with Bharat Electronics Limited to supply naval counter drone systems. It is the first system to have been inducted by the Navy. It can instantly detect, jam micro drones, and use a laser-based kill mechanism to terminate the target.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.99 billion in 2025, exhibiting the second-fastest growing CAGR of 24% during the forecast period. Europe's growth is attributed to the increasing expenditure on defense-type modernization, along with the procurement of advanced defense systems from other countries in the region. The war between Ukraine and Russia has further demonstrated the importance of having advanced drone defense systems. The market value in U.K. is expected to be USD 0.18 billion in 2025.

On the other hand, Germany is projecting to hit USD 0.14 billion and France is likely to hold USD 0.23 billion in 2025.

- In October 2022, NATO decided to deliver air defense systems to Ukraine to help the country protect itself against drones and protect critical infrastructure.

Rest of the World

The rest of the world is anticipated to be the fourth largest market with a value of USD 0.27 billion in 2025. The anti-drone market share in the Rest of the World is expected to showcase significant growth owing to rising drone threats and an increase in defense sector spending. Middle Eastern countries such as Saudi Arabia, Israel, Turkey, and others have seen unmanned military systems posing an increasing threat to critical infrastructure. This is expected to surge the demand for counter drone technology from the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Focusing on Innovation and New Projects

Key players such as Raytheon Technology Corporation, Lockheed Martin Technology, and others focus on innovation and new projects to reinforce their market position. The market is dominated by key manufacturers such as Raytheon Technology Corporation, Lockheed Martin Corporation, Elbit Systems, and Israel Aerospace Industries, among others. These players majorly focus on developing partnerships with government and defense authorities for new projects.

LIST OF KEY COMPANIES PROFILED

- Raytheon Technology Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Israel Aerospace Industries (U.S.)

- DroneShield (Australia)

- Detect Inc (U.S.)

- Dedrone Holdings Inc. (U.S.)

- Liteye Systems Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- SaaB AB (Sweden)

- Thales Group (France)

KEY INDUSTRY DEVELOPMENTS

January 2025 - Elbit Systems Ltd. secured a contract valued at around USD 60 million to provide its multi-layered Counter Unmanned Aerial Systems (C-UAS) to a European NATO member. The agreement will be executed over a span of 3 years. Under the terms of the agreement, Elbit Systems will provide its ReDrone™ modular Counter-UAS system.

December 2024 - OpenAI teamed up with Anduril Industries Inc. to integrate its artificial intelligence technology into the weapons manufacturer’s anti-drone systems, signifying the AI developer’s most substantial move into the defense industry to date.

August 2024 - Mahindra Group and Sentrycs Ltd entered into an MoU to create and deliver anti-drone solutions in India for both civilian and military applications. The pact centers on the transfer of technology and production of radio frequency counter-drone systems, which is in line with the Make in India initiative. The system will autonomously detect, track, identify, and address drone threats.

August 2024 - Big Bang Boom Solutions Private Limited. (BBBS), among India’s rapidly expanding defence start-ups, secured a significant contract valued at more than USD 22.9 million by the Indian Air Force and the Indian Army. This notable order, the biggest under the Indian Defence Exhibition (IDEX) initiative, highlights BBBS’s prominent position in advancing state-of-the-art anti-drone technology for the country.

June 2024- Indra, Escribano, and TRC entered into a partnership agreement to offer a counter-drone solution (C-UAS) that addresses the needs and demands of the Spanish Armed Forces in operational zones. The arrangement outlines the establishment of a joint venture involving Escribano and Indra, with TRC collaborating with the latter.

REPORT COVERAGE

The global anti drone market report provides a detailed analysis of the market. The report focuses on key aspects such as leading companies, anti-drone technologies, and leading anti-drone system providers. It offers insights into the market trends and highlights key industry developments related to the market. Increasing use of drones for terrorism, smuggling, espionage, and unauthorized surveillance is a major driver. Governments and military organizations are investing heavily to protect critical infrastructure, borders, airports, and public spaces. The commercial drone market is expanding rapidly, increasing the need for counter-drone solutions to address safety and privacy concerns. Integration of AI, machine learning, multi-sensor fusion (radar, RF, optical, acoustic), and cloud computing enhances detection accuracy and response times. Innovations include jamming devices, laser systems, and net-based capture mechanisms. In addition to the above, it encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

CAGR |

23.55% from 2025 to 2032 |

|

Segmentation

|

By Method

|

|

By Technology

|

|

|

By Platform

|

|

|

By End-use

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the Global Aircraft Seat Actuation System Market Size is expected to reach USD 769 Million by 2033, growing from USD 502.7 Million in 2023, at a CAGR of 4.38% during the forecast period 2023–2033.

The market will exhibit a CAGR of 21.62% during the forecast period.

An aircraft seat actuation system is a mechanism that allows passengers and crew to adjust seat positions electronically. It includes motors, controllers, and switches that enable movement for comfort, especially in business and first-class cabins.

Major drivers include the rising demand for premium and business-class travel, increased focus on passenger comfort, advancements in lightweight actuation technologies, and growing aircraft deliveries globally.

North America dominates the global aircraft seat actuation system market due to the presence of major aircraft manufacturers like Boeing, strong aviation infrastructure, and increasing air travel demand in the region.

Key players include Astronics Corporation, Bühler Motor GmbH, Crane Aerospace & Electronics, ITT Inc., Moog Inc., Parker Hannifin Corporation, Safran, and TT Electronics. These companies focus on innovation, lightweight designs, and strategic partnerships.

The common types include linear actuators, rotary actuators, and electro-mechanical actuators. These are used for adjusting seat recline, leg rests, lumbar support, and headrests.

Commercial aircraft are the largest users, especially wide-body jets used for long-haul travel. However, business jets and regional aircraft are also increasingly integrating actuation systems for enhanced passenger comfort.

Key applications include first class, business class, premium economy, and economy class seating, with higher-end segments requiring more advanced and customizable actuation mechanisms.

Trends include the adoption of smart cabin systems, lightweight and energy-efficient actuators, growing demand for customizable seating, and integration with in-flight entertainment and control systems.

The market is projected to grow at a compound annual growth rate (CAGR) of 4.38%, increasing from USD 502.7 Million in 2023 to USD 769 Million by 2033, driven by technological innovation and rising passenger expectations.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us