Asia Pacific and Middle East & Africa Building & Construction Sealants Market Size, Share & Industry Analysis, By Resin (Silicon, Polyurethane, Polysulfide, Emulsion, Hybrid Polyurethane Sealant, and Others), By Type (One Component and Two Components), By Technology (Water-based, Solvent-based, and Others), By Application (Flooring, Sanitary & Kitchen, Glazing, and Others), By End-use Industry (Commercial, Residential, and Industrial), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

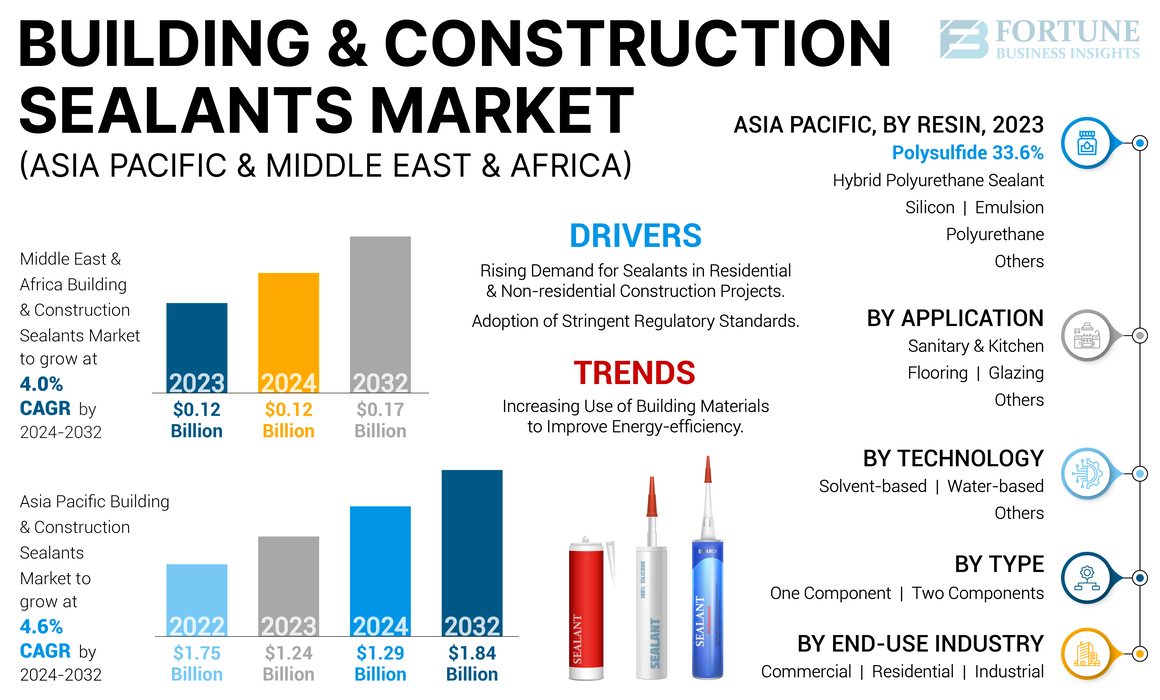

The Asia Pacific and Middle East & Africa building & construction sealants market size was valued at USD 1.24 billion and USD 0.12 billion, respectively, in 2023. The Asia Pacific market is projected to grow from USD 1.29 billion in 2024 to USD 1.84 billion by 2032, exhibiting a CAGR of 4.6% during the forecast period. The Middle East & Africa market is projected to grow from USD 0.12 billion in 2024 to USD 0.17 billion by 2032, exhibiting a CAGR of 4.0% during the forecast period.

Sealants are essential materials used to seal gaps or joints in buildings and other construction projects. They are used for several purposes, such as weatherproofing, soundproofing, and fireproofing. They are commonly used in commercial and residential construction projects to ensure the structural integrity of structures and enhance their energy efficiency. These materials are available in different types, each designed for specific purposes and challenges encountered in different construction activities. Choosing the right sealant involves considering factors such as the type of surface material, environmental conditions, ease of application, joint size, performance requirement, cure time, cost, and manufacturer recommendations. Careful consideration of these factors can help ensure the selection of the right sealant, providing effective long-term protection to construction components.

The COVID-19 pandemic had a significant impact on the construction industry, and the demand for sealants used in the building & construction industry was not immune to this impact. In the advent of the pandemic, several construction projects were put on hold, delayed, or canceled due to the uncertainty surrounding the economic outlook and health concerns. This resulted in a decrease in demand for building & construction sealants and other materials. The supply chain disruptions caused by the pandemic led to shortages of raw materials and labor across the globe, resulting in unforeseen challenges.

Moreover, the logistic challenges forced manufacturing companies to operate at a reduced capacity or complete shutdown their production facilities. This eventually led to fluctuations in product prices, with longer lead times for these materials, which affected the availability and cost of building & construction sealants. However, as the pandemic slowed down and restrictions were eased, the construction sector gradually resumed activities, leading to the demand for construction sealants. The global construction industry has been recovering from the effects of the pandemic as the supply chains have normalized. This, in turn, has led to a rebound in the demand for building & construction sealants, and the trend is likely to continue as construction activities pick up.

Asia Pacific and Middle East & Africa Building & Construction Sealants Market Trends

Increasing Use of Building Materials to Improve Energy-efficiency of Construction Spaces to Boost Market Proliferation

Sustainable building practices and products are becoming increasingly important as people become more concerned about the environment. The incorporation of sealants can play an important role in construction practices by reducing the energy needed to heat and cool building spaces. This can help reduce greenhouse gas emissions and conserve energy resources. Sealants help improve the durability and lifespan of building materials by protecting them from weathering, moisture, and other environmental factors. This can reduce the need for repairs and replacements, which can help reduce waste and resource consumption. In addition, using sealants that meet green building standards can help builders and designers achieve compliance needs, resulting in financial incentives and increased marketability.

Download Free sample to learn more about this report.

Asia Pacific and Middle East & Africa Building & Construction Sealants Market Growth Factors

Rising Demand for Sealants in Residential and Non-residential Construction Projects to Surge Product Demand

The construction sector is growing rapidly in many parts of the world, driven by factors such as population growth, urbanization, and economic development. This has resulted in a rising demand for building & construction sealants as they are widely used to seal joints, gaps, and cracks in buildings and structures. From sealing gaps to improving insulation and fire resistance, construction sealants play a critical role in ensuring that buildings are safe, comfortable, and energy-efficient. These sealants offer a range of functions critical to the performance and longevity of buildings and structures. The growing demand from construction activities globally and a rising emphasis on energy efficiency and sustainability are expected to increase the use of construction sealants during the forecast period.

Adoption of Stringent Regulatory Standards to Drive Market Growth

Governments and regulatory bodies have been implementing stringent standards and building codes to ensure safety, durability, and environmental sustainability in construction projects. These standards cover various aspects, including safety for fire resistance and structural integrity. Along with that, these standards have been increasing the focus on environmental sustainability requirements for reduced VOC emissions and non-toxicity, and energy efficiency mandates for improved insulation and reduced air leakage. Compliance with these regulations is crucial for builders and developers to obtain permits and approval for their projects. In addition to this, regulatory bodies often require construction materials, including sealants, to undergo testing and certification to ensure quality and performance. This certification assures stakeholders that the sealants used meet industry standards. Thus, the adoption of stringent regulatory standards plays a significant role in fueling the demand for construction sealants and driving market growth in tandem.

RESTRAINING FACTORS

Harmful Chemicals Used in the Production of Sealants May Hinder Market Growth

Several sealants contain hazardous chemicals, such as Volatile Organic Compounds (VOCs) that can contribute to air pollution and adversely affect human health. Environmental regulations may limit the amount of VOCs present in sealants, making it difficult for manufacturers to produce high-VOC sealants. These regulations can increase the cost of sealants, as manufacturers may need to invest in new equipment or change their existing production processes to meet the requirements of the regulations. This can make it more difficult for smaller manufacturers to compete with established players who have more resources to invest in compliance. In addition to limiting the use of certain chemicals, environmental regulations may require proper disposal of these sealants or completely eliminate the use of sealants that contain toxic materials. Thus, the adoption of stricter environmental regulations may hinder the Asia Pacific and Middle East & Africa building & construction sealants market growth.

Asia Pacific and Middle East & Africa Building & Construction Sealants Market Segmentation Analysis

By Resin Analysis

Polysulfide Segment Led Owing to its Wider Adoption in the Construction Industry

Based on resin, the market is segmented into silicon, polyurethane, polysulfide, emulsion, hybrid polyurethane sealant, and others.

The polysulfide segment held the leading Asia Pacific and Middle East & Africa building & construction sealants market share in 2023. It is the resin employed in the construction industry for sealing and bonding applications. Polysulfide's superior chemical properties offer excellent adhesion, durability, and resistance to abrupt weather conditions. Thus, polysulfide sealants are used to join glass, filling joints, and expansion joints to ensure important structural materials stay in place. Asia Pacific and Middle East & Africa are experiencing rapid urbanization with the growing population. This factor is expected to prompt new building construction activities and repair work on old structures.

Another majorly consumed sealant after silicon is polyurethane sealant. They are available in single or multi-component formulations and are primarily used in horizontal joints or vertical applications that do not sag. Hybrid polyurethane sealants offer a unique combination of properties of polyurethane and silicone sealants. They are often used in construction applications to seal windows, doors, and other building components. Its superior performance makes it popular among heavy-duty industrial applications.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

One Component Sealants Accounted for Dominant Share Due to Ease of Application

In terms of type, the market is segmented into one component and two components.

One component segment accounted for the largest market share in 2023. One component sealants are easier to use and ideal for simpler applications, while two components sealants are more specialized and offer greater strength and durability for more demanding applications. The choice between the two depends on the specific application, curing time, the conditions in which the sealants will be used, and the desired level of performance. One component sealants are preferred where ease of use, cost-effectiveness, tolerance to environmental factors, and minimal wastage are important considerations.

On the other hand, two components sealants offer greater strength and durability and are more suitable for demanding applications that require chemical resistance, high-temperature resistance, or greater adhesion strength.

By Technology Analysis

Others (Reactive) Segment Dominated the Market Due its Superior Properties Making it a Preferred Customers Choice

In terms of technology, the market is segmented into water-based, solvent-based, and others.

Others segment accounted for the largest market share in 2023, while the water-based segment is expected to witness the fastest growth during the forecast period.

The others segment includes reactive sealants. These reactive sealants offer many advantages over alternatives, such as solvent and water-based, making them an ideal choice for a wide range of construction and industrial applications. Their strong adhesion, fast curing time, durability, and versatility make them effective and reliable solutions for sealing and bonding applications encountered in the construction industry. In addition, reactive sealants do not contain Volatile Organic Compounds (VOCs), which harm human health and the environment, thereby making them more attractive to customers and resulting in higher demand relative to water and solvent-based alternatives.

By Application Analysis

Rising Adoption of Glass in Construction Structures to Increase Demand for Sealants Used in Glazing Applications

In terms of application, the market is segmented into flooring, sanitary & kitchen, glazing, and others.

The glazing segment accounted for dominant market share in 2023. With the expanding construction sector worldwide, materials such as glass are slated to witness higher adoption in construction activities. Tall buildings with glass facades are a common sight in developing countries across the globe. Other than that, glass is used as an insulation material and structural component. Glazing sealants offer an alternative to traditional systems such as gaskets and other mechanical attachments. They are used to attach glass, metal, or other panel materials to a building’s window or curtain wall metal framing system. Thus, they are a critical component in modern architecture, where buildings without glass are unimaginable in the current scenario.

Flooring segment is anticipated to witness the fastest growth during the forecast period. Sealants are used in flooring to protect the underlying material from moisture, stains, and other types of damage. Consumers increasingly seek durable and sustainable flooring solutions that protect the surface and extend its lifespan. As consumers become more aware of such solutions, demand for sealants used in flooring applications is expected to expand during the forecast period.

By End-use Industry Analysis

Rising Demand for Affordable and Sustainable Housing to Result in Wider Product Adoption in Residential Segment

In terms of end-use industry, the market is segmented into commercial, residential, and industrial.

Residential segment accounted for the largest market share in 2023. Sealants play a critical role in home construction, where they are used in waterproofing, noise reduction, and improving health and safety by sealing gaps that could allow pests to enter homes. In addition, applying appropriate sealants can significantly reduce the hassle associated with maintenance, while improving the aesthetics of living space. Thus, rising consumer awareness regarding the product benefits is slated to result in the wider adoption of sealants in the residential sector during the forecast period.

REGIONAL INSIGHTS

By region, the market is segregated into the Middle East & Africa and Asia Pacific.

Asia Pacific accounted for a major market share in 2023. Developing countries are expected to witness significant growth rates during the forecast period. This includes India, which is witnessing rapid growth in its urban population, resulting in a higher demand for residential and commercial buildings. The Indian construction sector has been one of the key drivers of the country’s economic growth in recent years, and it is expected to play a critical role during the forecast period. Moreover, the infrastructure sector is undergoing a massive transformation, with several large-scale projects in the pipeline. This includes large-scale infrastructure development projects such as the Smart Cities Mission and Bharatmala Pariyojana. In addition, the residential real estate market in India has witnessed significant growth over the past few years. The government has launched several schemes such as the Pradhan Mantri Awas Yojana to promote affordable housing and improve the availability of housing finance. As the availability of information online and through other channels increases, consumers and builders are becoming more aware of the benefits of sealants in construction applications. This, in turn, is expected to result in greater adoption of sealants in the construction industry, driving the use of building & construction sealants in India.

The Middle East & Africa market is expected to witness substantial growth during the forecast period due to the increasing demand from construction activities. For example, Saudi Arabia’s construction sector has been thriving over the past decade, and the country’s market is expected to keep growing at a CAGR of 4.8% during 2024-2032. The construction sector in the country is driven by the government's initiatives to diversify the economy and promote private investment. The government plans to further increase the contribution of the private sector to the overall economy. Even though large-scale construction firms, such as Saudi Oger and Saudi Arabian Parsons, already exist, the government is working toward promoting small and medium-scale enterprises in the sector by providing support, training, and financial incentives. As the country's construction sector is slated to expand during the forecast period, the demand for construction materials, including different types of sealants is expected to increase, thus driving the building & construction sealants market growth.

KEY INDUSTRY PLAYERS

Market Players Focus on Strategic Planning to Strengthen their Share

The Asia Pacific and Middle East & Africa building & construction sealants market is fragmented and highly competitive, with several players competing for share. Competition is primarily based on factors such as price, product quality, innovation, and brand recognition. The existing established players have an advantage due to their larger distribution channels and brand recognition, while smaller players may differentiate themselves through niche products or superior customer services. The market shows the presence of major companies such as 3M, Sika AG, Henkel AG & Co. KGaA, Dow, Wacker Chemie AG, BASF SE, Bostik, Pidilite Industries Limited, Asian Paints, MAPEI S.p.A., H.B. Fuller Company, ASTRAL ADHESIVES, and other players. The major players in the market have been actively consolidating to reduce the overall competition.

List of Top Asia Pacific and Middle East & Africa Building & Construction Sealants Companies:

- 3M (U.S.)

- Sika AG (Switzerland)

- Henkel AG & Co. KGaA (Germany)

- Dow (U.S.)

- Wacker Chemie AG (Germany)

- BASF SE (Germany)

- Bostik (France)

- Pidilite Industries Limited (India)

- Asian Paints (India)

- MAPEI S.p.A. (Italy)

- H.B. Fuller Company (U.S.)

- ASTRAL ADHESIVES (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – 3M completed the acquisition of EMFI S.A. and SAPO S.A.S. (“EMFI/SAPO”), manufacturers of polyurethane-based structural adhesives and sealants. The acquisition is part of the company’s strategic move that will enable them to better serve customers in France and across Europe.

- July 2021 – H.B. Fuller signed a distribution agreement with Jubilant Agri and Consumer Products Limited (JACPL), a 100% subsidiary of Jubilant Industries Limited, to address the growing demand for adhesive applications in the B2B woodworking segment. This strategic collaboration will help expand the reach of H.B. Fuller’s high-performing adhesive solutions through a wide range of technologies, including water-based, hot-melt moisture cures, and polyurethanes.

- April 2021 – Sika inked an agreement to acquire Japan-based Hamatite. Hamatite is majorly involved in manufacturing adhesives and sealants for the construction and automotive sector. The acquisition will help Sika to strengthen its position in the Japanese market. The added access to Japanese OEMs will help the company to extend its product offerings in the Japanese construction industry.

- December 2020 – Sika launched a new polyurethane technology under the brand name PURFORM. The company claims that the new technology is highly versatile. It is used to develop durable and high performance polyurethane adhesives and sealants used in different applications in the construction sector and automotive industry.

- November 2020 – Pidilite Industries acquired Huntsman Group's Indian subsidiary. Huntsman Advanced Materials Solutions manufactures and sells adhesives, sealants, and other products under brands such as Araldite, Araldite Karpenter, and Araseal in the country. Such acquisitions help companies to make their strong presence in India.

REPORT COVERAGE

The Asia Pacific and Middle East & Africa building & construction sealants market research report provides a detailed analysis and focuses on crucial aspects such as competitive landscape, resins, types, technologies, applications, and end-use industries. It offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the market's growth in recent years. It includes historical data and forecasts revenue growth at regional and country levels and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.6% for Asia Pacific, CAGR of 4.0% for Middle East & Africa |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Resin

|

|

By Type

|

|

|

By Technology

|

|

|

By Application

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the Asia Pacific market size was USD 1.24 billion in 2023 and will reach USD 1.84 billion by 2032, while the Middle East & Africa market stood at USD 0.12 billion in 2023 and will reach USD 0.17 billion by 2032.

The market will register a CAGR of 4.6% for the Asia Pacific market and will record a CAGR of 4.00% for the Middle East & Africa market during the forecast period.

By resin, the polysulfide segment held the largest market share in 2023.

The rising demand for building & construction sealants from residential and non-residential projects is expected to drive market growth.

3M, Sika AG, Henkel AG & Co. KGaA, Dow, Wacker Chemie AG, and BASF SE are a few of the major players in the market.

Asia Pacific held the largest market share in 2023.

The increasing use of building materials to improve sustainability and energy efficiency of construction buildings is slated to surge product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us