API Security Testing Tools Market Size, Share & Industry Analysis, By Deployment Mode (Cloud-Based and On-Premises), By Enterprise Type (Large Enterprises and Small and Medium Enterprises (SMEs)) By End-User (IT & Telecommunications, BFSI, Retail and Consumer Goods, Healthcare and Life Sciences, Government and Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

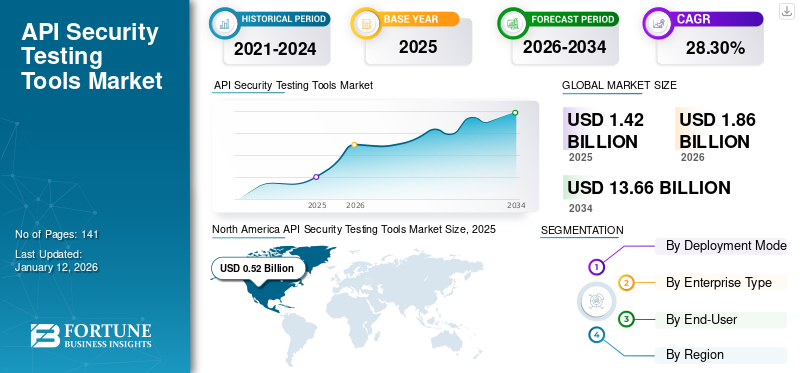

The global API security testing tools market size was valued at USD 1.42 billion in 2025. The market is projected to grow from USD 1.86 billion in 2026 to USD 13.66 billion by 2034, exhibiting a CAGR of 28.3% during the forecast period.

API security testing helps identify and stop vulnerabilities and associated potential business risks. Majorly, the procedure is adjusted to both the company's overall strategy and best practices and API being tested.

The API security testing tools market is majorly driven by the rising necessity for real-time detection and prevention of security attacks with AI and Machine Learning (ML), and increasing prominence on automation to improve product competencies. As an essential tool for various security testing firms, the environment of these security testing tools also redirects healthy competition within the industry and regional aid for new testing-driven enterprises. For instance,

- According to the Palo Alto API security 2023 report, the ability to detect APIs with sensitive data is a key security feature in 94% of organizations. The standards that organizations have put in place to promote the adoption of API are responsible for an increase in the usage of API security testing tools.

Also, the shift toward remote working and hybrid workflows due to the COVID-19 pandemic has increased the number of cyber threats and attacks. Thus, there were concerns related to transitioning, prominently team member misuse, rise in IT work operations, and cyberattacks. Such factors caused enterprises to adopt and implement security solutions such as zero trust security, API security testing tools, and others.

Hence, various enterprises and organizations in the market are shifting toward implementing these security testing tools across their business procedures, thus contributing to the rising demand for these solutions in the market.

IMPACT OF GENERATIVE AI

Integration of Generative AI in API Security Testing is Creating Numerous Opportunities in the Market

Identifying susceptibilities in APIs needs application security testing solutions and it is difficult to create test cases tailored for different web applications being tested so that their appropriate business functionality can be tested before sending them to production. In such situations, generative AI becomes a valuable API security tool, where users can use the generative AI application to generate test cases that would otherwise need a huge amount of manual work.

Generative AI tools hold a large potential across various industry verticals, and their capabilities in API security testing can help create test plan generation with a new feature called intelligent mode. Other improvements include comprehensive insights, updating workflows, and new incorporations with several CI/CD (continuous integration/continuous development) solutions such as Jenkins, GitLab, BitBucket, and Harness.

With comprehensive testing, the generative AI helps to increase testing parameters and software quality. It also explores several inputs, boundary conditions, and combinations, empowering the creation of use cases that were not considered before by the test engineers. Hence, the preference for generative AI-based, automated API security testing is increasing to reduce manual labor and improve the overall quality. API testing is one of the places where automated testing is vastly used, predominantly agile development, DevOps, and uninterrupted delivery cycles. For instance,

- According to industry experts, currently, 56% of enterprises commonly make use of automated API testing solutions. It also predicts that generative AI will impact automated testing in the future and that better changes can be experienced in the coming years.

Such developments and advancements can ensure the right usage of technologies such as generative AI. It would also open up numerous opportunities for enhanced innovations and improved security protection across APIs.

API Security Testing Tools Market Trends

Implementation of IAST (Interactive Application Security Testing) is a Key Trend in the Market

Interactive Application Security Testing (IAST)) examines code for security susceptibilities while the application is processed by a human tester or automatic testing and any activity that interacts with the application functionality. This mechanism reports identity vulnerabilities in actual time and does not add extra time to the user's CI/CD (Continuous Integration/Continuous Deployment) pipeline.

IAST empowers developers to resolve security vulnerabilities while testing and reporting the associated risks. It also helps minimize the time required to remediate security susceptibilities compared to penetration testing. Other benefits of IAST include ease of installation, help to ensure agile work operations, actionable insights for development teams, lesser false-positive rates, and many more. Such benefits and added advantages contribute to the rise in the implementation of IAST solutions and thus cater to market players in designing and developing new IAST-driven solutions to expand their product line. For instance,

- In February 2024, Invicti Security and Mend.io announced a partnership to provide users with a complete range of supply chain security tools and application security testing. It combines Invicti's IAST, DAST, and API security testing solutions with Mend's SCA, SAST, and container security applications.

Such new advancements and implementation enhance the growth of IAST solutions in the market.

Download Free sample to learn more about this report.

API Security Testing Tools Market Growth Factors

Increased Regulatory Scrutiny to Augment the Need for API Security Testing Tools across Various Sectors

APIs (Application Programming Interfaces) have become an essential part of modernized software infrastructure with the growing need to share and extract data within and across enterprises. Hence, the digital economy has upsurge the adoption of APIs. However, with the growth of APIs, there has also been equivalent progress in API security risks. As per the present scenario, API-based data breaches have conceded tens of thousands of sensitive customer data and records.

The rise in API-centered attacks has caused standards and regulatory bodies to offer a way to implement several standards and regulations to ensure that APIs are secured and critical data is protected. Hence, various regulatory bodies have released security standards to stimulate attacks. For instance,

- In October 2023, The CFPB (Consumer Financial Protection Bureau) proposed a regulation that would fast-track a move to open banking, in which users would have regulators over their financial data and get new protections over firms misusing their customers' data. The proposed regulations need to create and uphold interfaces to accept and reply to requests for enclosed data. Screen-scraping is not an accepted technique, and APIs have replaced it.

- In March 2022, the release of PCI DSS version 4.0 comprises deliberations for API security inside its standard. An Application Programming Interface would come into the PCI DSS range for any enterprise, introducing an API interface to transmit or receive data from a cardholder's account. The standard calls for the constant detection and prevention of web-centered attacks.

Such regulatory initiatives and standards ensure that enterprises' precautions are in place to secure their network of partners, businesses, and customers. This forces enterprises to adopt and implement security regulations across APIs to deliver a protected environment across their network, thereby increasing the demand for API security solutions across different sectors.

RESTRAINING FACTORS

Complexity of Tools can lead to Failure in Accomplishing Operation Efficiency, thereby Hampering Market Growth

API security testing can be diverse, particularly while testing numerous APIs or when testing APIs that are incorporated with other systems. In software development procedures, API security testing encounters various technical issues, which might restrain the progress of these solutions. Several factors, such as errors in managing and handling complex solutions due to a lack of skilled professionals and documentation, can cause testers difficulty understanding the behavior, affecting the testing procedures' productivity, accuracy, and dependability. Understanding and resolving these security issues is crucial for effective API security testing.

Not all APIs behave similarly. Due to exterior dependencies, some APIs may not be accessible in the specified time. Hence, some APIs behave contradictorily in the initial development phase. Such complexity can cause failure in achieving overall effectiveness across workflows. Also, most API security testing frameworks or tools need a sufficient amount of programming knowledge and understanding of API Automation. Lack of expertise and skilled professionals, especially across start-ups and small enterprises, can impact the overall efficiency of work operations, thereby affecting the demand for these solutions across enterprises.

Such factors can impact the overall productivity of these security testing tools and the efficiency of businesses, thereby hampering the API security testing tools market growth.

API Security Testing Tools Market Segmentation Analysis

By Deployment Analysis

Added Benefits of Cloud-based Deployments to Upsurge Its Market Progress

Based on deployment mode, the market is bifurcated into cloud-based and on-premises.

Cloud-based deployment mode is projected to grow with the highest CAGR during the study period. Cloud-based API security testing has emerged as a new model wherein security providers accomplish on-demand application testing procedures in the cloud. It essentially enables organizations to save costs while preserving a secured application. Cloud-based security solutions help enterprises increase the speed of turnaround time in security testing, enhance scalability as per enterprise’s requirements, offer better accessibility from multiple locations, and provide cost-effectiveness. Such benefits increased the usage of cloud-based API security tools across enterprises, thereby increasing the API security testing market share. For instance,

- In November 2023, 42Crunch, the API DevSecOps solution provider, collaborated with Microsoft to incorporate services to aid enterprises in implementing a complete-lifecycle approach to API security. The partnership integrates the API security audit and susceptibility testing solution of 42Crunch with Microsoft Defender for Cloud to offer Microsoft users uninterrupted API safety from design to runtime.

On-premises deployment mode accounted for the highest market share of 50.50% in 2024, as it allows enterprises to keep their sensitive information to themselves while still keeping focus on securing APIs. On-premise deployments are common in large enterprises, where maintenance and infrastructure facilities are non-disrupting factors. The deployments also improve efficiency and security by providing better data transfer rates, additional data security, and customization options.

By Enterprise Type Analysis

Rising Concerns about Data Breaches and Cyberattacks across Large Enterprises to Drive Segment Growth

Based on enterprise type, the market is classified into large enterprises and small and medium enterprises (SMEs).

Large enterprises held the highest market share in 2024. As large enterprises hold huge amounts of sensitive data, they become more prone to cyberattacks and data breaches. API security tools offer better visibility and access control by loading sensitive information and applications overdue private firewalls. Hence, these enterprises deploy such testing tools by considering several factors, such as the sensitivity of data, complexity of API infrastructure, and licensing models. Certain companies also integrate these tools into their CI/CD pipelines. Large enterprises segment is likely to hold 56.61% of the market share in 2026.

SMEs is anticipated to grow with the highest CAGR of 33.00% during the forecast period owing to the adoption of API security testing tools. SMEs consider deploying such testing tools by keeping in mind how they could support large and complex projects. Better options in this category are focused on performance, flexibility, data services, and capabilities to improve security and data protection. Also, small-scale enterprises have equivalent presence among numerous industries across the market. Such factors contribute to the growth of these security testing tools across SMEs.

By End-User Analysis

Rising Necessity of API Security Testing Tools across Retail and Consumer Goods to Drive Segment Growth

Different end-users of the market include IT & telecommunications, BFSI, retail and consumer goods, healthcare and life sciences, government and defense, and others (media & entertainment, manufacturing).

Retail and consumer goods are projected to grow with the highest CAGR of 35.90% during the study period. API security testing is vital in retail as it makes sure that APIs are robust, safe, and resistant to potential assaults and threats. Hence, APIs have become an essential component of practically every software owing to the numerous aids they offer. Hence, the demand for these security testing tools is increasing, thereby driving the progress of the market. For instance,

- In February 2023, Cequence Security announced enhancements to its API security testing competencies to empower security teams to track at the speed of business by implementing constant protection standards over pre-production and production API environments. With the enhancements, retail customers can build policies that are constructed to look clearly for credit card numbers.

IT and telecommunication accounted for the highest market share in 2024. As the IT and telecom sector started deploying API security testing tools. Telecom providers are high-value targets for attackers, and thus, this reason drove the adoption of these testing tools across the sector, thereby contributing to the market's progress. IT and telecommunication is projected to account for 25.22% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market has been analyzed by region across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America API Security Testing Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market value at USD 0.52 billion in 2025. In 2023, the market size stood at USD 0.32 billion. North America accounted for the highest market revenue share in 2024. North America's market demand is driven by the increasing diversity, volume, and sophistication of cyber threats designed at a growing exposure footprint. Challenges of in-house staffing and outdated security practices and adaptation drive the demand for these security testing tools across the region. Also, several organizations in the region are expanding and upgrading the API security testing tools to strengthen their product portfolio and enhance user experience. The U.S. market is anticipated to accumulate USD 0.39 billion in 2026. For instance,

- In the U.S., more than 809 data breaches occurred in the healthcare sector in 2023, according to the Identity Theft Resource Center. API security testing helps recognize weaknesses and vulnerabilities in healthcare systems that invaders could exploit to get illegal access. Vulnerability testing, such as weak authentication mechanisms, insufficient access controls, or unsecured communication channels, is also part of this.

As per Fortune Business Insights, Asia Pacific is anticipated to be the third-largest market with a value of USD 0.44 billion in 2026 and to grow with the highest CAGR during the forecast period. Owing to the presence of major players and software developers in India, China, Japan, South Korea, and others. In recent years, cyber-attacks and data breaches have increased in Asia Pacific. To reduce risks and protect their digital assets from evolving threats, organizations prioritize cyber security measures such as API security testing. The market in China is expected to account for USD 0.1 billion in 2026. The market in India is likely to hit USD 0.09 billion and Japan is projected to hit USD 0.08 billion in 2026. For instance,

- In January 2023, T-mobile revealed that a threat had stolen the personal data of 37.0 million prepaid and postpaid customer accounts via one of its APIs, resulting in a breach.

Europe region is to be anticipated as the second-largest market with USD 0.42 billion in 2026, recording the second-largest CAGR of 22.74% during the forecast period. Europe is projected to grow at a substantial rate during the study period. The demand for security testing tools has increased significantly as a result of the proliferation of digital transformation initiatives, cloud adoption, and an increasing number of connected devices. Organizations in the European Union recognize the importance of proactive security measures and they are willing to invest in comprehensive API security testing tools. The market in U.K. is expected to account for USD 0.08 billion in 2026. The market in France is likely to hit USD 0.06 billion and Germany is projected to hit USD 0.09 billion in 2026. For instance, The Middle East & Africa is expected to be the fourth-largest region with the value of USD 0.2 billion in 2026, driven by rising demand for consumer electronics, increasing urbanization, and changing lifestyles due to increased disposable income. These security testing tools are an essential component for these factors to help eliminate data fraud and provide secure transactions to the stakeholders. The GCC market is anticipated to reach USD 0.07 billion in 2025.

South America is projected to depict considerable growth rates during the forecast period. Major South American companies continue to invest in software testing for healthcare in emerging markets to reduce operating costs and increase profits. This is expected to increase the API security testing tools market share in the region over the coming years.

Key Industry Players

Rising Mergers and Acquisitions and Collaborations to Advance Technological Advancements to Aid Business Expansion

Prominent market players, such as Wallarm Inc., Noname Security, Cequence Security, Inc., Salt Security, APIsec, Alphabet Inc., StackHawk Inc., and others, are attentive to offering advanced inventive technologies-driven API security testing tools. These players are expanding their product portfolio owing to the growing demand for security solutions, security over cyberattacks, data breaches, etc. Market players are implementing several business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses globally.

List of Top API Security Testing Tools Companies:

- Wallarm Inc. (U.S.)

- 42Crunch Ltd (U.K.)

- Noname Security (U.S.)

- Cequence Security, Inc. (U.S.)

- Salt Security (U.S.)

- APIsec (U.S.)

- Appknox, Xysec Labs (Singapore)

- Alphabet Inc. (U.S.)

- Akamai Technologies, Inc. (U.S.)

- StackHawk Inc. (U.S.)

- Imperva (Thales) (U.S.)

- Synopsys, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Akamai Technologies, Inc. made major advancements to its App & API Protector tool, which secures end-users against sophisticated application-layer distributed denial-of-service attacks. Additional features of App & API Protector include simple start onboard, CVE protection catalog, client-side protection & compliance, advanced SOCC services, and web security analytics updates.

- October 2023: 42Crunch Ltd introduced API Capture with the objective of automating the generation of OpenAPI contracts and API security testing configurations from API traffic and Postman collections. It is a service model that provides companies with improved compliance controls, which help minimize the time and costs of developing secure APIs.

- August 2023: Salt Security introduced the Salt Technical Ecosystem Partner (STEP) program, enabling its end-users to harness the capabilities of the deep API adaptive intelligence Salt. As part of the program, the company integrates its AI-based API security insights across companies' existing tools and workflows.

- April 2023: Noname Security completed its OEM agreement with IBM with the aim of allowing the company to retail its Advanced API Security platform under the IBM brand. With this, the company aims to enrich its product capabilities and provide customers with enhanced services.

- April 2023: Sequence Security secured an investment from Prosperity7 Ventures with the objective of expanding its global presence and product expertise. Along with this, the company aims to make major advancements by integrating new-age technologies and business models that will enhance business outcomes.

REPORT COVERAGE

The market research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies deployed rapidly globally. It further highlights some drivers and restraints, helping the reader gain in-depth knowledge about the market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 28.3% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment Mode, Enterprise Type, End-User, and Region |

|

Segmentation |

By Deployment Mode

By Enterprise Type

By End-User

By Region

|

Frequently Asked Questions

The global market is predicted to reach USD 13.66 billion by 2034.

In 2025, the market value stood at USD 1.42 billion.

The market is projected to grow at a CAGR of 28.30% during the forecast period.

By end-user, the retail and consumer goods lead the market with the highest CAGR during the forecast period.

Increased regulatory scrutiny to augment the need for API security testing tools across various sectors.

Some of the top players in the market are Wallarm Inc., 42Crunch Ltd, Salt Security, APIsec, Cequence Security, Inc., Noname Security, Alphabet Inc., and Appknox, Xysec Labs, among others, are the top players in the market.

North America held the highest share of the market in 2025.

Small and medium enterprises are expected to grow with the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us