Application Specific Integrated Circuit (ASIC) Market Size, Share & Industry Analysis, By Product Type (Full-Custom, Semi-Custom (Array-Based and Cell-Based), and Programmable), By End-User (Consumer Electronics, Automotive, Industrial, Biomedical and Healthcare, Telecommunications, and Others), and Regional Forecast, 2026-2034

Application Specific Integrated Circuit Market Current & Forecast Market Size

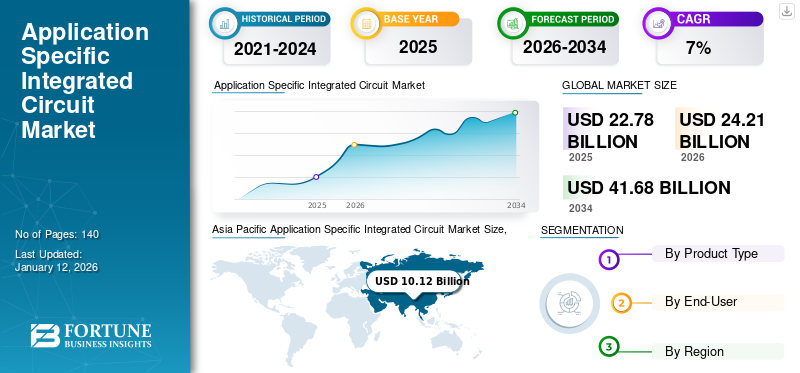

The global application specific integrated circuit market size was valued at USD 22.78 billion in 2025 and is projected to grow from USD 24.21 billion in 2026 to USD 41.68 billion by 2034, exhibiting a CAGR of 7% during the forecast period. Asia Pacific dominated the global market with a market share of 44.40% in 2025.

Application specific integrated circuits are custom integrated circuits developed for specific uses or applications. Typically, ASIC designs are initiated for products expected to have large-scale production. Integrated circuits tailored for a particular application may include a substantial portion of the required electronics.

The market growth is expected to be driven by the increasing demand for electronic devices, the growing demand for High-Performance Computing (HPC), and the rapid adoption of IoT devices in consumer electronics. According to an industry analyst's estimate, global IoT applications are expected to produce a revenue range of USD 4 trillion to USD 11 trillion in 2025. The substantial growth in this area brings both significant opportunities and challenges for the integrated circuit industry. Moreover, the rapid adoption of customization and co-design solutions is driving the market share.

Amid the COVID-19 pandemic, the ASIC market observed significant impacts. The global supply chain disruptions due to the outbreak had a profound effect on Application Specific Integrated Circuit production and distribution. Many semiconductor manufacturers faced challenges in obtaining necessary raw materials, components, and equipment, leading to delays in production and increased operational costs. In addition, changes in consumer behavior due to the pandemic resulted in varying demand trends for ASICs across different industries. For instance, the increased use of remote work and online activities led to a surge in demand for ASICs used in networking and communication equipment.

Generative AI Boosting ASIC Market Growth and Sustainability

Advanced-design Capabilities of Generative AI for Application Specific Integrated Circuits Impelled Market Growth

The potential impact of generative AI on the market is significant, offering the opportunity to enhance design capabilities, improve performance, boost reliability, and drive innovation in energy efficiency and sustainability. Through AI algorithms, engineers can generate and evaluate various design options based on specific criteria such as efficiency, size, and cost, resulting in more efficient and innovative solutions. In addition, these algorithms can analyze data from Application Specific Integrated Circuit systems to predict potential failures or maintenance needs, ultimately reducing downtime, increasing reliability, and extending equipment lifespan, thereby reducing overall costs.

Furthermore, the synergy between generative AI and ASICs holds immense potential for designing algorithms. As a burgeoning field, AI explores leveraging circuit boards to enhance the designing capabilities and minimize errors. The AI can facilitate ASICs by generative training data, exploring complex 3D datasets, and simulating complex design processes. The market is anticipated to experience a growing influence as the technology develops, leading to advancements in different applications and sectors.

Emerging Trends & Technological Advancements in ASIC Market

Rapid Adoption of Customization and Co-Design Solutions is a Key Trend

Many companies are now choosing customized Application Specific Integrated Circuit solutions designed for their specific needs in terms of performance and power restrictions. Tailored ASICs offer advantages such as improved performance, reduced power consumption, and a smaller physical footprint compared to standard semiconductor solutions. This enables businesses to set their products apart and gain a competitive edge in the market. In addition, integrating ASICs with software, firmware, and system-level design through co-design methodologies allows for more seamless integration of complex electronic systems, resulting in better performance and faster time-to-market.

Download Free sample to learn more about this report.

Factors Driving Growth of the Application Specific Integrated Circuit Market

Widespread Adoption of Tech-enabled Features of ASICs in Consumer Electronics is Aiding Market Growth

The demand for ASICs has been increasing due to their advantageous features, such as lower power consumption, higher integration, intellectual property protection, and increased functionality. The market for Application-Specific Integrated Circuits is expanding as a result of greater investment in the development of advanced integrated circuits.

Despite the high cost of ASIC design, many high-volume applications can greatly benefit from its use. Application Specific Integrated Circuit design can be customized to meet the product's specific requirements. By utilizing ASIC, a significant portion of the overall design can be integrated into a single integrated circuit, reducing the need for additional components. Therefore, ASICs are commonly used in high-volume products such as cell phones and office supplies.

What Are the Key Challenges Limiting Market Growth?

High Development Cost of Application Specific Integrated Circuits May Hinder Market Expansion

Creating application-specific integrated circuits is a costly process that can utilize various levels of customization to reduce expenses. Consequently, the market for application-specific integrated circuits is forecasted to experience gradual growth in the upcoming years, primarily due to the expensive nature of producing custom circuits, the challenges involved in circuit development, and functional reliability issues. The high expenses and technological intricacies associated with application specific integrated circuits have hindered their adoption in markets where cost is a significant factor.

Application Specific Integrated Circuit Market Segmentation Analysis

By Product Type Analysis

Integral Role of Full-Custom ASICs with Enhanced Features Boosted Segment Growth

Based on product type, the market is segmented into full-custom, semi-custom, and programmable.

In terms of market share, the full-custom segment dominated the market with share of 50.47% in 2026. Enhanced reliability and speed are provided by these ICs, along with intellectual property protection, while reducing power consumption. Designers can customize mechanical structures, logic cells, circuits, and layouts, and optimize memory cells on the IC, reducing processing time and mitigating risks. However, full custom ASICs have a comparatively longer manufacturing time for a specific application compared to semi-custom and programmable ASICs.

The semi-custom segment is projected to witness the highest CAGR during the forecast period. The segment growth can be credited to its digital logic and electrical characteristics, incorporating properties such as inductance and capacitance. These qualities enhance electrical efficiency and allow for a high component density. Moreover, cell-based ASICs provide flexibility and can be applied in a variety of products, irrespective of design complexity, due to the incorporation of advanced static random-access memory and internet protocol cores, which enable smooth system operation.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Dominated Due to the Reliability and Efficiency of ASIC Chips

By end-user, the market is divided into consumer electronics, automotive, industrial, biomedical and healthcare, telecommunications, and others.

In terms of market share, the consumer electronics segment dominated the market with share of 27.30% in 2026. The industry is set to offer promising opportunities for all participants involved in the supply chain, mainly due to the increased use of Application Specific Integrated Circuits in smartphones, tablets, and laptops on a global scale. ASICs provide various benefits, such as low energy consumption, IP protection, smaller size, and improved data transfer capacity, leading to their widespread adoption in the consumer electronics sector. In addition, the rapid progress in electronic devices has led to greater reliability and efficiency, further driving the growth of this market.

The industrial segment is estimated to witness the highest CAGR during the forecast period. The utilization of Application Specific Integrated Circuit chips in industrial systems reduces the likelihood of failure and provides dependable performance by consolidating traditional components into a single IC. The market is experiencing growth due to the rising incorporation of programmable timers, microcontrollers, and thermal controllers in industrial applications. In addition, many suppliers are offering IC chips tailored for industrial use.

Regional Market Dynamics and Growth Opportunities

In terms of geography, the market is segregated into South America, North America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific Application Specific Integrated Circuit Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 10.12 billion in 2025 and USD 10.76 billion in 2026. The demand for ASIC in the region has experienced remarkable growth due to several key factors. Initially, there is an increasing need for energy-efficient devices, which is being fueled by the region's swift economic expansion and growing industrialization. Furthermore, the widespread use of smartphones in the region has significantly contributed to the expansion of the market. The increased use of these devices, particularly in developing economies such as China, Japan, and India, has created a favorable environment for the growth of the market. Moreover, factors such as the ongoing digitalization process, the growing adoption of advanced technology gadgets, developments in the electronic automotive industry, and an increasing need for miniaturization have collectively contributed to this growth. The Japan market is projected to reach USD 2.03 billion by 2026, the China market is projected to reach USD 4.33 billion by 2026, and the India market is projected to reach USD 1.39 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe’s market for Application Specific Integrated Circuit is estimated to grow at the highest rate during the forecast period. The demand for cellular IoT solutions is on the rise, industrial automation is experiencing rapid transformation, industry players are engaged in aggressive R&D efforts, and similar developments are occurring. Therefore, these factors are driving the European market for ASICs. Major players in this market in Europe include Infineon Technologies, NXP Semiconductors, and other companies. These companies play a significant role in both the supply chain and the innovation of ASICs. The UK market is projected to reach USD 0.96 billion by 2026, while the Germany market is projected to reach USD 0.91 billion by 2026.

North America

North America is expected to register the second-highest growth rate in the market during the forecast period. The growth is driven by the widespread use of IoT and the emergence of 5G technologies. Consumer electronics products, healthcare monitoring systems, and electric and hybrid vehicles have experienced significant growth in the U.S. Moreover, North America has a large number of Application Specific Integrated Circuit manufacturers and solution providers due to their early adoption of ASIC technology. The U.S. market is projected to reach USD 4.56 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to register a significant growth rate in the market during the forecast period. The Application Specific Integrated Circuit market growth in the region is attributed to increasing urbanization, rising demand for consumer electronics, and varying lifestyles due to increased disposable income.

South America

South America’s market for Application Specific Integrated Circuit is poised for significant growth during the forecast period. As urbanization and the expansion of telecommunications infrastructure in South America progresses, the need for ICs that can facilitate wireless connectivity, such as ASICs for mobile phones, IoT devices, and base stations, is increasing.

KEY INDUSTRY PLAYERS

Market Players Use Partnership, Product Development, and Merger & Acquisition Strategies to Expand Their Business Reach

Key companies present in the market are providing advanced ASICs by improving energy efficiency and reliability with their small size in their product portfolio. These companies prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increase in demand for products.

List of Top Application Specific Integrated Circuit Companies:

- Analog Devices, Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Microsemi Corporation (U.S.)

- Broadcom Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Intel Corporation (U.S.)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- ON Semiconductor (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Intel revealed its intentions to create an Application Specific Integrated Circuit accelerator aimed at minimizing the performance impact of Fully Homomorphic Encryption (FHE). In addition, the company will launch a beta version of a software toolkit for developers designed for encrypted computing.

- August 2022: Broadcom Inc. revealed the release of the StrataXGS Tomahawk 5 switch series, which offers a single, monolithic device with 51.2 Terabits/sec of Ethernet ASIC switching capacity.

- April 2022: Intel unveiled information about its latest Intel Blockscale ASIC. This Application-Specific Integrated Circuit is the result of extensive Intel Research and Development (R&D) and offers customers efficient hashing for proof-of-work consensus networks.

- March 2021: Intel and the U.S. Defense Advanced Research Projects Agency (DARPA) signed a three-year collaboration aimed at boosting the progress of domestically produced structured ASIC platforms. The partnership, known as Structured Array Hardware for Automatically Realized Applications (SAHARA), facilitates the creation of tailor-made chips equipped with cutting-edge security countermeasure technologies.

- February 2021: Renesas Electronics Corporation, a company that supplies advanced semiconductor solutions, agreed to acquire Dialog Semiconductor Plc, a provider of power management, charging, AC/DC power conversion, and ASICs, for a total equity value of around USD 5 billion.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as prominent companies, leading product types and end-users. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 41.68 billion by 2034.

In 2025, the market value stood at USD 22.78 billion.

The market is projected to grow at a CAGR of 7% during the forecast period.

In 2026, the consumer electronics segment led the market.

The widespread adoption of tech-enabled features of ASICs in consumer electronics is aiding market growth.

Analog Devices, Inc., NXP Semiconductors, Microsemi Corporation, Broadcom Inc., Infineon Technologies AG, Intel Corporation, Renesas Electronics Corporation, STMicroelectronics, Texas Instruments Incorporated, and ON Semiconductor are the top companies in the global market.

In 2025, Asia Pacific held the largest market share.

Europe is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us