Aroma Chemicals Market Size, Share & Industry Analysis, By Source (Synthetic and Natural), By Product (Benzenoids Terpenes/ Terpenoids, Musk Chemicals, and Others), By Application (Food & Beverages, Fine Fragrances, Cosmetics & Toiletries, Soaps & Detergents, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

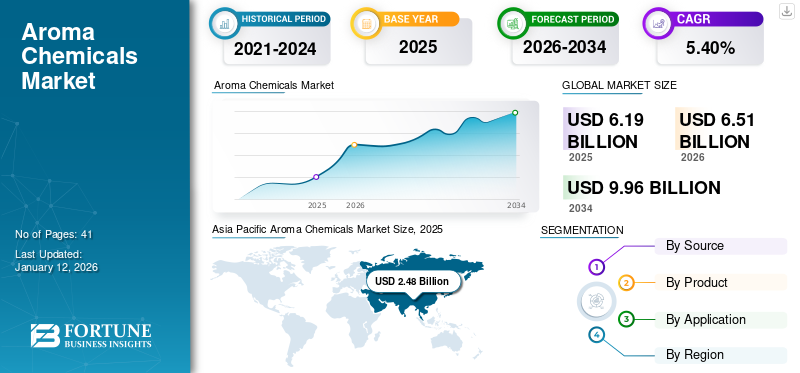

The global aroma chemicals market size was valued at USD 6.19 billion in 2025. The market is projected to grow from USD 6.51 billion in 2026 to USD 9.96 billion by 2034 at a CAGR of 5.40% during the forecast period. Asia Pacific dominated the aroma chemicals market with a market share of 40% in 2025.

The aroma chemicals industry began to develop significantly in the late 19th century, with the first commercial synthesis of aroma compounds, such as vanillin and coumarin. These chemicals are compounds that are used to create scents or flavors in products. They are also known as fragrances, odorants, or flavors. The efficacy to offer excellent diffusive properties required to create long-lasting fragrances has made aroma chemicals an essential ingredient in various applications, including food and beverages, personal care and cosmetics, household products, fine fragrances, and soaps and detergents.

Major players in the global aroma chemicals market include BASF SE, Solvay, Privi Speciality Chemicals Limited, and others. These companies lead in innovation and sustainable practices while expanding their market share through mergers, partnerships, and acquisitions.

GLOBAL AROMA CHEMICALS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 6.19 billion

- 2026 Market Size: USD 6.51 billion

- 2034 Forecast Market Size: USD 9.96 billion

- CAGR: 5.40% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 40% share, rising from USD 2.48 billion in 2025 to USD 2.61 billion in 2026, driven by demand from personal care, fine fragrances, and food & beverages.

- By source: Synthetic aroma chemicals dominated due to high demand across cosmetics, personal care, and F&B industries.

- By application: Fine fragrances held the largest share (54.1% in 2023), followed by cosmetics & toiletries and soaps & detergents.

Key Country Highlights:

- China, Japan, India: Growth supported by rising demand for natural and organic fragrances, high consumer spending, and expanding personal care sectors.

- Germany, France, U.K.: Strong demand in soaps, detergents, and luxury fragrances.

- United States: Largest North American market, driven by cosmetics, personal care, and F&B industries.

- Brazil: Growth from household hygiene and detergent demand.

- Middle East & Africa: Rising cosmetic and personal care consumption with increasing beauty awareness.

MARKET TRENDS

Momentum Toward Sustainability to Shape Market

The growing consumer shift toward natural and organic products due to their benefits on the skin, and thus avoiding synthetic ingredients due to their adverse health effects, is one of the reasons why the perfume industry is moving toward sustainable fragrances. Concerns over environmental and sanitary risks have led consumers to use perfumes that are made using more natural ingredients. The fragrance market is slowly introducing more naturally derived compounds for perfume compositions. In addition, greener fragrance formulations are sustainable, as these processes include conversion, extraction, and fractionation, which are cleaner and more efficient with less waste generated and energy used.

- Asia Pacific witnessed a aroma chemicals market growth from USD 2.48 billion in 2025 to USD 2.61 billion in 2026.

Additionally, manufacturers are adopting and developing new extracting technologies that are cleaner and less damaging to the environment. For instance, Privi Speciality Chemicals Limited aims to reduce emissions, improve eco-friendly operations, and recycle waste through its manufacturing processes. The company uses high-value chemicals of aroma from Crude Sulphate Turpentine (CST) and agrochemicals from by-products, thus reducing waste and enhancing profits. Moreover, rising technological advancements in extraction and synthesis, increasing demand in emerging markets, growing sustainability and eco-friendly production processes, and rising customization and personalization in natural fragrances will upsurge the market growth during the forecast timeframe.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Cosmetics Industry to Drive Aroma Chemicals Market Growth

The increasing demand for cosmetics and personal care products, such as creams, facemasks, peels, and others, due to the widening usage among both men and women shall augment the cosmetics market growth. Changes in lifestyles and a rise in per-capita disposable income have contributed to the shift toward natural and organic cosmetics, thereby creating avenues in the market. Rapid urbanization and booming e-commerce business have resulted in increased consumer interest in different premium and new cosmetic products.

Aroma chemicals are widely used in cosmetics and toiletries such as gels, aftershaves, lipsticks, moisturizers, foundations, body and hand washes, body lotions, soaps, shampoos, and others. Such chemicals are used in these products to induce natural scents without hampering the product quality and formulation. As cosmetics have become an integral part of an individual’s life, major cosmetic manufacturers are introducing new products that contain natural ingredients, thus accelerating their sales globally. Furthermore, factors such as rising consumer awareness and preference for unique fragrances, expansion of the personal care and cosmetics sectors, innovations in product formulations, and increasing disposable incomes, as well as urbanization, will further stimulate market growth.

Growing Product Consumption in Food & Feed Industry to Fuel Market Growth

Aroma chemicals are widely used to formulate and develop food and feed products in a variety of flavors. These chemicals are used to produce appealing flavor compositions, such as vanillin and ethylvanillin in sweets, raspberry ketone to produce a fruity flavor, mint oil for minty tastes, and others. As people are increasing their consumption of bakery products, cakes, ice creams, and chocolates, it will fuel the demand for various chemicals to develop desired flavors in these products. With the addition of aroma chemicals, these products will retain their fresh kick, smell, and taste. Similarly, feed producers, to enhance the taste of the feed product, commonly utilize chemicals, such as vanillin and cinnamaldehyde. Due to their efficacy in offering excellent taste and smell, these chemicals have become an essential ingredient in the food and feed industry, and growth in the food and beverage industry is set to fuel the market growth.

MARKET RESTRAINTS

Synthetic Chemicals in Perfumes and Their Potential Health Effects May Affect Industry

About 95% of synthetic chemicals in fragrances are derived from petroleum-based chemicals, such as benzene derivatives, phthalates, aldehydes, and others, which are considered harmful and toxic to human health. These chemicals cause birth defects, cancer, allergies, asthma, and nervous system disorders among adults and children. In addition, some of these synthetic chemicals are cited as dangerous on the EPA’s hazardous waste list.

According to the Environmental Working Group (EWG) researchers, about 75% of fragrance products contain phthalates, which have resulted in breast cancer, diabetes, reduction in sperm count, reproductive malformation, and disruptive hormonal activities. Additionally, the high cost of natural aroma ingredients, fluctuating raw material prices and availability, high competition from alternative products and substitutes, and stringent regulatory frameworks over environmental concerns and sustainability are among the strong factors that may hamper the overall market growth.

MARKET CHALLENGES

Increased Production Cost Poses Challenge to Market

The aroma chemicals market growth faces several challenges, including the high cost of natural aroma ingredients, which are often scarce and expensive due to their reliance on agricultural production. Furthermore, fluctuating raw material prices and availability, along with stringent regulatory frameworks, add complexity to the market that requires significant compliance efforts and investments. Additionally, environmental concerns and the push for sustainability are reshaping the market, as companies must adopt greener practices while balancing profitability. Moreover, competition from alternative products and substitutes, such as synthetic alternatives and bio-based innovations, intensifies the need for differentiation and strategic adaptation in the industry.

MARKET OPPORTUNITIES

Key Factors Shaping Growth and Innovation in Market

The market is poised for substantial growth, fueled by rising demand for innovative fragrances, natural ingredients, and clean-label products. The ongoing trends, such as personalized and functional scents, offer opportunities for the development of natural ingredients. Additionally, innovations in biotechnology, synthetic biology, and green chemistry are paving the way for sustainable and eco-friendly aroma compounds, meeting both consumer and regulatory demands. Moreover, strategic partnerships and investments in R&D and production infrastructure are critical for stakeholders seeking to stay competitive. For manufacturers, suppliers, and investors, the market's trajectory underscores the importance of aligning with sustainability goals while leveraging cutting-edge technologies. With its focus on innovation and environmental stewardship, the market holds transformative potential for the future, promising growth and value creation across the value chain.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic affected the cosmetic market. With nationwide lockdown, international travel bans, and shutdown of retail businesses, the purchasing behavior drastically changed in personal care and beauty industries as product sales had fallen across many beauty segments. Furthermore, disruptions in supply chains and production, changes in consumer behavior and demand patterns, recovery trends and post-pandemic market outlook and strategic adjustments by companies exhibited a decline in year-on-year growth in the year 2020.

IMPACT OF TRADE PROTECTIONISM

Trade protectionism significantly impacts the aroma chemicals market by altering the dynamics of global supply chains and influencing market accessibility. Tariffs and non-tariff barriers, such as import quotas and stringent regulatory requirements, increase production costs and create uncertainties for manufacturers reliant on international trade. Policies, such as anti-dumping duties and trade restrictions, disrupt raw material procurement and the flow of finished goods. Furthermore, companies mitigate these challenges by diversifying sourcing strategies, investing in local production facilities, and leveraging free trade agreements to maintain competitive pricing. For instance, a trade dispute between major economies over fragrance ingredient imports led to increased tariffs, prompting companies to shift operations to tariff-neutral regions and establish collaborative resolutions through bilateral negotiations.

RESEARCH AND DEVELOPMENT

Research and development in the market are driving innovation through the development of novel aroma compounds tailored to evolving consumer preferences. Sustainable and green chemistry approaches, such as utilizing renewable raw materials and environmentally friendly synthesis methods, are becoming industry priorities. Also, advances in biotechnology and fermentation processes enable the production of bio-based aroma chemicals, reducing reliance on petrochemical sources. Moreover, collaborative efforts between academia and industry foster innovation, with partnerships accelerating the discovery of new compounds and scalable production techniques. The growing enhancement in R&D efforts bolsters market competitiveness by enabling differentiation through unique and sustainable offerings. In addition, emerging technologies, such as AI-driven molecular design and precision fermentation, hold immense potential to shape the future of aroma chemical development.

REGULATORY LANDSCAPE

The regulatory landscape is shaped by a complex global framework overseen by key regulatory bodies, such as the European Chemicals Agency (ECHA), the U.S. Food and Drug Administration (FDA), and the International Fragrance Association (IFRA). These organizations establish compliance requirements, including safety evaluations, labeling standards, and restrictions on hazardous substances. Adherence to these regulations impacts market dynamics, as manufacturers must invest in testing, documentation, and reformulation to meet stringent standards, often leading to higher costs. Recent updates, such as increased scrutiny of allergenic compounds in the EU or stricter import controls in Asia, are reshaping industry practices. Also, proactive regulatory compliance ensures market access and fosters consumer trust, but it also necessitates continuous innovation and adaptation by manufacturers.

SEGMENTATION ANALYSIS

By Source

Synthetic Aroma Chemicals Segment to Dominate Market Owing to High Demand from Various End-use Industries

Based on the source, the market is segmented into synthetic and natural.

The synthetic segment is expected to dominate the market with a share of 77.88% in 2026. Synthetic aromas are an essential ingredient for manufacturers operating in the cosmetics, personal care, and food & beverage industries. In the food industry, they can replicate the scent of natural foods for snacks, carbonated sodas, and candies. Synthetic chemicals are vital for many fragrance manufacturers to produce a strong natural scent without compromising the characteristics of other chemicals used in fragrance formulations.

The natural aroma chemicals are majorly extracted from pure plant extracts, such as pine, eucalyptus, camphor, citronella, and citrus. These are majorly incorporated into haircare, skincare, and personal care products such as soaps, lotions, perfumes, and shampoos. The growing demand for sustainable and eco-friendly products majorly drives the growth of this segment. Additionally, the growing plant-based extraction from major regions, such as North America, Europe, and Asia Pacific, will further provide high-quality natural essential oils.

By Product

Terpenes/Terpenoids Segment to Hold Largest Market Share Due to its Preferred Medicinal Properties

Based on the product, the market is segmented into terpenes/terpenoids, benzenoids, musk chemicals, and others.

Terpenes/Terpenoids emerged as the dominant segment with a share of 40.86% in 2026. Terpenoids and their derivatives are used as antimalarial drugs, such as artemisinin. They possess medicinal properties, such as anti-carcinogen, antimicrobial, and antiseptic medicinal properties. Increasing demand for terpenes in pharmaceutical, cosmetics, food, and other sectors shall augment the segment’s growth.

The growth of benzeneoids is majorly driven due to increasing demand for fine fragrance and flavor applications. Moreover, green chemistry and catalysis advancements to improve production efficiency, coupled with regulatory compliance and sustainability concerns, will further drive innovation. The growing key players' focus on eco-friendly production methods and reducing environmental impact is further augmenting the segment growth.

Musk chemicals are extracted either synthetically or naturally. They are widely found in personal care & cosmetics, food, household products, and soaps & detergents. The increasing demand for personal care products, along with a surging number of working professionals, has led to a rise in the growth of musk chemicals. The increasing popularity of various types of cosmetic products and fine fragrances shall bolster the musk chemicals market size in the forthcoming years.

By Application

To know how our report can help streamline your business, Speak to Analyst

Fine Fragrances Segment to Hold Major Share Owing to Rising Consumer Demand

Based on the application, the market is segmented into food & beverages, fine fragrances, cosmetics & toiletries, soaps & detergents, and others.

The fine fragrances segment accounted for the highest aroma chemicals market with a share of 55.15% in 2026 and is expected to continue its dominance during the forecast period. This dominance is attributable to the advancements in technology to meet changes in consumer demands and growth in the fragrance industry. The rise in per-capita disposable income and surging demand for natural flavors and fragrances would drive the fine fragrances segment.

Supportive government initiatives and key strategic development by manufacturers may also propel the fine fragrances segment’s growth. For instance, in July 2019, Givaudan, a manufacturer of flavors and fragrances acquired Drom, a perfume house creating fragrances for consumer products and fine fragrances globally. This acquisition will expand Givaudan’s market position in the fragrance industry.

The chemicals of aroma are substantially used in the manufacturing of flavorants, which are used in food preparation for flavor enhancement. Various compounds are responsible for the aroma of food products, such as esters, aldehydes, alcohols, lactones, and others. So, flavors and aromas play an important role in food quality. The rising demand for processed food, along with the increasing consumer taste preferences, shall augment the food & beverage segment.

The growing demand for aroma chemicals from the soaps & detergents segment to provide a pleasant smell and mask any unpleasant odors would drive the market growth. They are chemical compounds with complex scents that can be used to enhance the experience of using these products.

In the cosmetic & toiletries segment, aroma chemicals find their major application in shaving creams, gels, foundations, body lotions, hand washes, soaps, shampoos, aftershaves, moisturizers, lipsticks, and body washes. The growing cosmetic products demand from consumers, coupled with rising product innovation in the industry, will offer several growth opportunities for the market.

In the others segment, the medical industry will provide lucrative opportunities for the market to grow positively in the upcoming years. The agrochemicals have the potential to treat neurological disorders while providing pain relief and reducing anxiety. Also, it maintains mental health and wellness, which further leads to its increased adoption in the medical industry. The fine fragrances segment is expected to hold a 54.1% share in 2023.

AROMA CHEMICALS MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Aroma Chemicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region accounted for a market size of USD 1.87 billion in 2026. The region is expected to witness a significant growth rate during the forecast period. This growth is attributed to the growing personal care industry in China. The increasing demand for fragrances in China, Japan, and India, along with the rising importance of organic and natural fragrances, is expected to drive the regional market growth. The high spending power of consumers in these countries is another factor contributing to the market growth in the region. The Japan market is projected to reach USD 0.33 billion by 2026, the China market is projected to reach USD 1.24 billion by 2026, and the India market is projected to reach USD 0.55 billion by 2026.

Companies are focusing on investing in R&D activities and expanding their businesses in the Asia Pacific region. For instance, in September 2019, Firmenich, a manufacturer of flavors, ingredients, and fragrances, opened an innovative Fine Fragrance Atelier in China. The company provides easy access to all the fine fragrance products to customers in China and worldwide.

To know how our report can help streamline your business, Speak to Analyst

Europe

The Europe region accounted for a market size of USD 1.58 billion in 2026. In Europe, the growth is attributed to the increasing demand for fragrance in soaps & detergents and household products in Germany, France, and the U.K. Moreover, the rising consumer spending on luxury and premium fragrances on account of high-income levels and improved standards of living may propel the market growth in this region. Germany is the largest food producer in Europe. The country’s food and beverage industry provides great opportunities for flavor manufacturers, as it helps in delivering palatability. Thus, it would favor regional growth in the forthcoming years. The UK market is projected to reach USD 1.07 billion by 2026, while the Germany market is projected to reach USD 0.32 billion by 2026.

North America

The North America region accounted for a market size of USD 1.87 billion in 2026. The U.S. held the highest share in the North American market accounting for 1.07% in 2026, due to the growth of the personal care and cosmetic industries. A rise in the per-capita disposable income is likely to trigger the expansion of the personal care, cosmetics, and food & beverages industries, along with the growing number of health-conscious consumers.

South America

Increasing demand for the production of soap and detergents and household products may offer massive growth opportunities in the South American region. The rising awareness regarding the importance of household hygiene may boost the demand for detergents and household products in Brazil.

Middle East & Africa

The Middle East & Africa region accounted for a market size of USD 0.2 billion in 2026. The rapid increase in the demand for cosmetics & personal care products, along with consumer awareness about beauty and hygiene practices, shall accelerate the product demand in the Middle East & Africa. The cosmetics market in Africa will grow at an exponential rate as the low-income population is starting to increase their spending on beauty products to achieve a better appearance.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Novel Product Innovation and Acquisition Remain Key Market Strategies of Companies

BASF SE, DSM, Kao Chemicals Europe, Privi Specialty Chemicals Limited, Solvay, and Takasago International Corporation are some of the major specialty & fine chemicals manufacturers operating in the market. It is observed that leading companies are involved in various organic and inorganic strategies to enhance their stance in the market over their competitors. Hence, to expand their product portfolio and businesses, they are focusing on expansion, product launches, and acquisitions to meet their growing demand from end-use markets. Consumers are progressively becoming more conscious of the usage of the product and its benefits, which has obliged manufacturers to develop affordable, high-quality, and sustainable products. Additionally, key players are expanding their footprint across the value chain and are integrating backward in raw material production to gain a competitive edge in the industry.

LIST OF KEY MARKET PLAYERS PROFILED IN THE REPORT:

- Privi Speciality Chemicals Limited (India)

- BORDAS S.A. (Spain)

- BASF SE (Germany)

- DSM (Netherlands)

- Hindustan Mint & Agro Products Pvt. Ltd. (India)

- International Flavors & Fragrances Inc. (U.S.)

- Kao Chemicals Europe (Spain)

- Symrise (Germany)

- Givaudan (Switzerland)

- Solvay (Belgium)

- Takasago International Corporation (Japan)

- Keva (India)

- Eternis Fine Chemicals Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Prigiv started operating at its newly established Mahad Fragrance Ingredients plant as a joint venture between Givaudan and Privi. Privi has the majority ownership of 51% in the joint venture, while Givaudan holds the remaining 49%. The new plant is set to produce a wide range of enhanced products, and there are plans to increase operations over the next two to three years gradually.

- March 2023: BASF invested in a new citral plant in China to expand its aroma ingredients business. The plants are anticipated to become operational in 2026. The decision to invest was influenced by the increasing global demand for flavor and fragrance products and BASF's dedication to sustainability initiatives.

- February 2023: Givaudan and Amyris entered into a long-term partnership agreement in which Amyris will maintain its role in producing ingredients for Givaudan's use in cosmetics and granting access to its innovation capabilities. Givaudan will serve as the partner for commercializing upcoming sustainable beauty ingredients.

- November 2022: Mohawk Industries, the global flooring giant, announced its acquisition of the Brazilian-based company Elizabeth. This move is expected to help Mohawk Industries expand its presence in the South American market and increase its production capabilities. The acquisition is also expected to benefit Elizabeth as it gains access to Mohawk Industries' extensive distribution network and resources. Both companies are committed to maintaining high quality and sustainability standards in their operations. The acquisition is a positive step forward for both Mohawk Industries and Elizabeth, who are looking forward to seeing the benefits of this partnership in the years to come.

- July 2022: AHF Products acquired certain assets from Armstrong Flooring, including the rights to the brand name. AHF is North America's largest hardwood flooring manufacturer and has purchased three of Armstrong's Global manufacturing facilities in Lancaster, Beech Creek, PA, and Kankakee, IL. They're successful in various flooring categories and responsible for commercial brands, such as Bruce Contract and Parterre.

- January 2021: Solvay introduces Eugenol Synth for fragrance uses. The high-purity synthetic eugenol will offer an alternative option to address the demand in the Flavors and fragrance (F&F) market for cases where natural origin is not crucial. Clove-derived eugenol is an aromatic floral spice extensively utilized in flavor (food and beverage) and fragrance applications.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, printing methods used to produce these products, and end-use industries of the product. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Segmentation |

By Source

|

|

By Product

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 6.51 billion in 2026 and is projected to record a valuation of USD 9.96 billion by 2034.

Recording a CAGR of 5.40%, the market is slated to exhibit steady growth during the forecast period.

By application, the fine fragrance segment led the market in 2025.

The rising consumer spending for cosmetic products and fine fragrances is expected to drive the growth of the market.

BASF SE, Privi Speciality Chemicals Limited, Givaudan, International Flavors & Fragrances Inc., Takasago International Corporation, and Solvay are the major players in the global market.

Asia Pacific dominated the aroma chemicals market with a market share of 40% in 2025.

The rising adoption of sustainable fragrances by the perfume industry is expected to drive the adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us