Asia Pacific Refrigerator Market Size, Share & COVID-19 Impact Analysis, By Product Type (Top Freezer Refrigerator, Bottom Freezer Refrigerator, Side by Side Refrigerator, and French Door Refrigerator), and Distribution Channel (Online and Offline), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

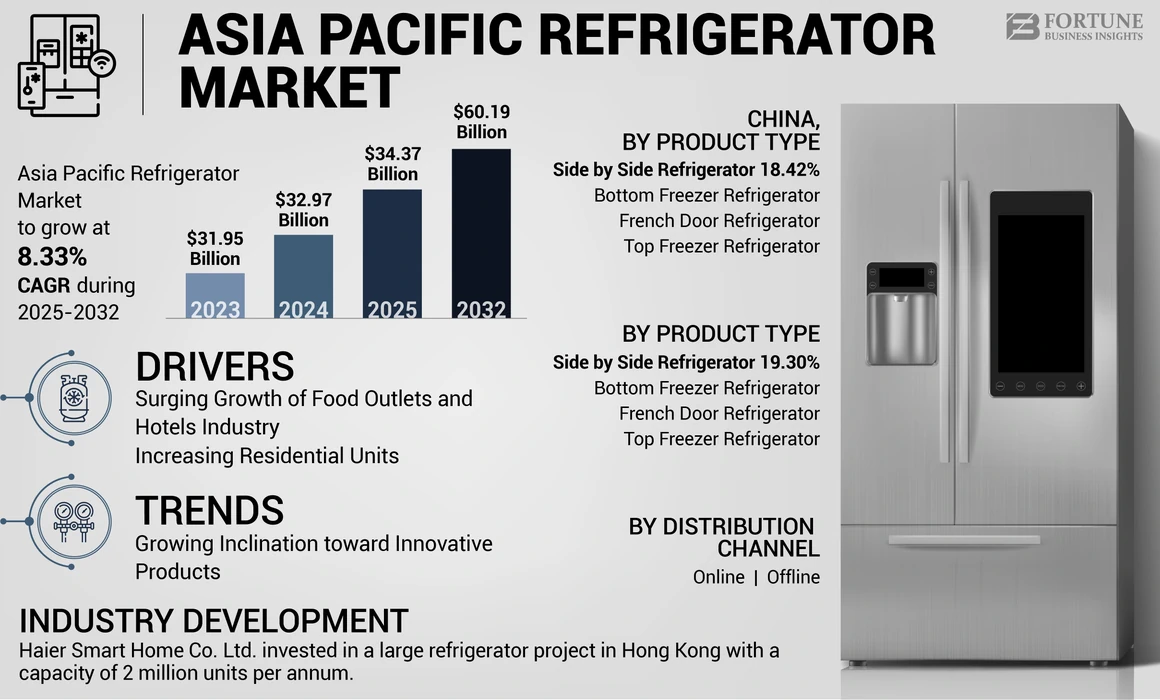

The Asia Pacific refrigerator market size was valued at USD 32.97 billion in 2024. The market is anticipated to grow from USD 34.37 billion in 2025 to USD 60.19 billion by 2032, exhibiting a CAGR of 8.33% during the forecast period.

The product has established a robust Asia Pacific market presence over the years as people are attracted by its ability to help increase the food's shelf-life for a long time. The product's capability to help break bacteria development, sustain the hygienic condition of the food, and the presence of multiple compartments for various food items is helping to gain traction. The rising growth of household expenditure in countries of this region is assisting to hike the Asia Pacific refrigerator market growth. According to the data presented by the World Bank Group, an international financial institution, household and NPISH’s final consumption expenditure as of percentage of GDP in Malaysia reached 61% in 2020, up from 57% in 2018.

COVID-19 IMPACT

COVID-19 Pandemic Resulted in Decreased Demand for Refrigerators

The COVID-19 outbreak resulted in reduced consumption of food coolers owing to the implementation of lockdown and social distancing. For instance, the data released by Gadgets 360 NDTV in April 2020 states that heavy appliance businesses are assessed to have a negative impact of up to 60% decline in March and almost 100% in April. In addition, the import and export of trade complications in countries worldwide have resulted in declining sales due to various preventive measures. These factors impacted the market dynamics during the COVID-19 pandemic.

ASIA PACIFIC REFRIGERATOR MARKET TRENDS

Download Free sample to learn more about this report.

Growing Inclination toward Innovative Products to Spike the Demand

Manufacturers are increasingly shifting their focus towards producing innovative kitchen fridges capable of connecting with smart devices. This also includes odor-eliminating technology and smart compressor that help to save energy. For instance, the Motorola Smart fridge has attractive attributes: smart sensors for precise temperature control, Wi-Fi connectivity, odor-killing technology, and smart storage space. Furthermore, the escalating manufacturing of mini drink coolers and chillers that are convenient for small space use has helped to increase demand. For instance, LG has come up with LG 45 liters 1 Star Bar Fridge Refrigerator with a 45 L capacity with a separate freezer compartment.

ASIA PACIFIC REFRIGERATOR MARKET GROWTH FACTORS

Surging Growth of Food Outlets and Hotels Industry Aid the Market Development

The escalating growth of tourism in countries of this region is assisting to spike the utilization of the product, especially in food outlets such as coffee shops, fast food chains, cafes, and others. In addition, the rising establishment of hotel businesses fostering the consumption of refrigerators has a vital contribution. As per the data presented by the Central Statistics Agency of Indonesia (BPS), the hotel occupancy rate across Indonesia reached 47.38% in August 2022, compared to 25.10% in August 2021. Other factors driving the growth of this market are the increasing popularity of sensor technology-based fridges and increasing demand for compact-sized home appliances among the holds in the region.

Increasing Residential Units Propel the Market Growth

The rising construction of residential units in countries of this region has led to foster the increasing purchase of refrigerators. According to the data published by the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), there were 865,909 new houses in Japan, 6.6% up over the previous year. In addition, evolving kitchen decoration trends and the growing popularity of outdoor spaces among millennial households are increasing product consumption.

RESTRAINING FACTORS

High Cost of Maintenance is Hampering the Market Growth

The escalating cost of repairing and maintaining refrigerators in case of multiple complications such as part replacement or fixing required is a hampering factor for the market growth. For instance, the home service brand Home Advisor states that the average refrigerator repair cost is between USD 200 to 300.

ASIS PACIFIC REFRIGERATOR MARKET SEGMENTATION ANALYSIS

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Top Freezer Segment to Remain at the Forefront Due to Its Space-Saving Benefits Over Counterparts

The market analysis can be conducted based on various product types such as top freezer, bottom freezer, side-by-side, and French door.

Based on product type, the top freezer is projected to be the dominant segment owing to the product's compact form with less occupying space while offering separate space for freezing. Likewise, the product's availability in a reasonable price range boosts its preference rate.

Bottom freezer, side-by-side, French door, and other (compact, counter depth) segments also possess significant market sizes due to their storage space, feature benefits, and utilization in commercial settings.

By Distribution Channel Analysis

Better Specialty Shops’ Sales Support to Result in Offline Segment Hold Dominant Market Share

The market is segmented online and offline based on the distribution channel.

Offline is anticipated to be the leading segment because of the channel’s ability to help avoid delivery waiting time, observe the actual physical condition of the product, and be more convenient in case of repair and replacement.

On the other hand, online sales channel has experienced rising growth as they can help shop conveniently for consumers. Detailed information about the product and the increasing availability of a quick delivery system heightened its consumption rate.

REGIONAL INSIGHTS

To know how our report can help streamline your business, Speak to Analyst

India is estimated to have a robust presence in the Asia Pacific market. The escalating consumption of frozen food items resulting in escalating product utilization is likely to fuel the demand. As per the survey conducted over Lucknow-based respondents by the Department of Agriculture Economics, Uttar Pradesh, India; in 2022, 72% consumed frozen food products. In addition, increasing demand for alcohol-free soft drinks requiring the usage of soft drink chillers among Indian and South Asian consumers is positively impacting product revenue generation in the region. According to the data presented by the United States Department of Agriculture, Foreign Agricultural Services (USDA), in 2021, USD 96 million of non-alcoholic beverages were imported for local consumption in the Philippines.

China exhibited a leading position in the Asia Pacific refrigerator market share in 2022. The significant necessity of storing seafood in fridges and the considerable imports of seafood to this country has played a vital role in spiking the product consumption rate in the country. According to the United States Department of Agriculture, Foreign Agricultural Services (USDA) data, China imported USD 18.7 billion (4.1 MM tonnes) of seafood for local consumption, 22% up over the previous year. In addition, the rising growth of the disposable income led to a surge in the purchasing power of the people, which is assisting to rise the market growth.

South Korean market is projected to display substantial growth, owing to the increasing number of dual-income households and their disposable spending escalating the consumption of refrigerators, especially the premium quality has a vital contribution. Furthermore, the upsurging growth of the urban population surging the need for the product for residential and commercial places is assisting in hiking the demand. For instance, in the data published by the World Bank Organization, an international financial institution, the urban population as a percentage of the total population in South Korea increased from 80% in 2000 to 81% in 2021.

KEY INDUSTRY PLAYERS

Key Players are Shifting toward the Incorporation of AI Technology

The key players in the market are increasingly adopting Artificial Intelligence (AI) technology to manufacture refrigerators. This will thus transform the experience of owning a refrigerator as it reduces human interaction in terms of manual temperature adjustment, power usage, and even assisting in monitoring the intensity of usage. For instance, Panasonic AI- enable refrigerator was launched in June 2020. This product comes with three sensors to help increase the automation in temperature adjustment. It also offers optimum cooling and up to 49% power saving through its intelligent Econavi sensors and 6-speed inverter compressor.

List of Top Asis Pacific Refrigerator Companies:

- Haier Smart Home Co. Ltd. (China)

- LG Electronics Inc. (South Korea)

- The Samsung Group (South Korea)

- The Whirlpool Corporation (U.S.)

- Voltas Limited (India)

- Electrolux AB (Sweden)

- Panasonic Corporation (Japan)

- Sharp Corporation (Japan)

- Hitachi, Ltd (Japan)

- Toshiba Corporation. (Japan)

- Godrej Group(India)

- Intex Technologies (India)

KEY INDUSTRY DEVELOPMENTS:

- April 2022 – Haier Smart Home Co. Ltd. invested in a large refrigerator project with a capacity of 2 million units per annum in Hong Kong.

- November 2022 – Voltas Limited invested USD 121.37 million to install a refrigerator manufacturing plant in Chennai, India.

- September 2021 - Carrier Global Corporation, an American multinational heating, air conditioning, and refrigeration solutions provider, acquired Guangdong Chigo Heating & Ventilation Equipment Co., Ltd. to expand its presence in the Chinese refrigerant flow solutions business. This acquisition will likely support the refrigerant needs among Chinese refrigerator manufacturing industries.

- September 2020 – Whirlpool announced the launch of its new refrigerator range in India, starting from USD 537.1.

- June 2020: Toshiba announced that it will manufacture its home appliances at the Pune manufacturing complex, including refrigerators.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, end-users, and leading product types. Besides this, the free sample of the report on the market outlooks key insights into the current market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.33% during 2025-2032 |

|

Unit |

Value (USD Billion) |

|

|

By Product Type

|

|

|

By Distribution Channel

|

|

Segmentation |

Asia Pacific (By Product Type, Distribution Channel, and by Country)

|

Frequently Asked Questions

According to Fortune Business Insights, the Asia Pacific refrigerator market size was valued at USD 32.97 billion in 2024, and is projected to grow from USD 34.37 billion in 2025 to USD 60.19 billion by 2032.

At a CAGR of 8.33%, this market forecasted to grow during (2025-2032).

The market growth is fueled by increasing household expenditure, rising construction of residential units, and the expansion of foodservice and hospitality industries.

Top freezer refrigerators are the most preferred due to their compact design, space-saving benefits, and affordability.

Smart refrigerators with AI technology, odor control, smart sensors, and energy-efficient compressors are increasingly in demand. Brands like Motorola, Panasonic, and LG are launching feature-rich models targeting tech-savvy consumers.

The growth of hotels, cafes, and food chains across Asia Pacific boosts the demand for commercial refrigerators. Countries like Indonesia and India are seeing increased refrigerator consumption due to tourism and foodservice expansion.

Offline channels dominate due to consumers’ preference for seeing the product before purchase and faster service for repairs or replacements. However, online channels are growing rapidly, offering convenience, variety, and fast delivery.

Key players include Haier Smart Home (China), LG Electronics, Samsung, Whirlpool, Panasonic, Godrej, Voltas, and Electrolux. These companies are focusing on AI integration, regional investments, and localized manufacturing to expand their market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us