Asparagus Market Size, Share & Industry Analysis, By Product Type (Fresh, Canned, and Frozen), By Variety (Green, White, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

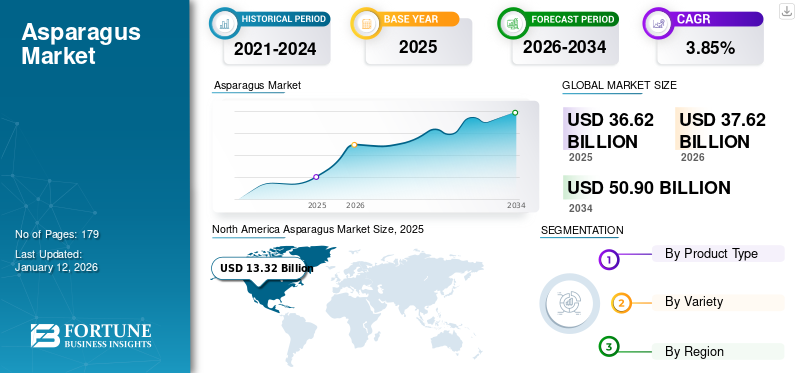

The global asparagus market size was valued at USD 36.62 billion in 2025. The market is projected to grow from USD 37.62 billion in 2026 to USD 50.90 billion by 2034, exhibiting a CAGR of 3.85% during the forecast period of 2024-2034. North America dominated the asparagus market with a market share of 36.37% in 2025.

Moreover, the U.S. asparagus market is projected to reach USD 13.88 billion by 2032, fueled by increasing consumption of nutrient-rich vegetables.

Asparagus, also referred to as Asparagaceae, belongs to a family of flowering plants, and its family name is based on asparagus officinalis (edible garden asparagus). The asparagus plant is mainly native to Western Asia, Europe, and North America, where it is cultivated as a vegetable crop. With respect to the importance and adoption rate of asparagus, the value of the commodity is increasing enormously day by day, and it is recognized as a superfood among consumers. This crop is enriched with basic nutrients, such as amino acids, vitamins, and minerals, and is also considered a fiber-rich food. Apart from agricultural purposes, asparagus is also used as an herbal medicine and is still a part of traditional Chinese medicine practices. However, the proper cultivation of the crop needs strict farming conditions, such as accurate temperature, skilled labor, good drainage, and specific soil composition. However, with time, the integration of advanced farming techniques helps to ensure high-quality yield production.

The onset of the COVID-19 pandemic in 2020 led to a disturbance in the production and supply of commodities. The sudden halt poses stress on the cultivation system and creates several hurdles for the growers. However, being considered a nutritious superfood, the asparagus industry experienced a spike in its demand in 2021-22. During the pandemic phase (2021-22), consumers were seeking health benefitting products that can be incorporated into their daily routines. As a result, such health consciousness triggered the global asparagus market share.

Asparagus Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 36.62 billion

- 2026 Market Size: USD 37.62 billion

- 2034 Forecast Market Size: USD 50.90 billion

- CAGR: 3.85% from 2026–2034

Market Share

- North America dominated the global asparagus market with a 36.37% share in 2025, driven by increasing demand for nutrient-rich vegetables and health-conscious dietary habits.

- By product type, the fresh asparagus segment led the market in 2024 due to strong consumer preference for clean-label and nutrient-dense produce.

- By variety, green asparagus held the largest share due to its cost-effective and easy cultivation, while white asparagus was the fastest-growing due to its gourmet appeal in European markets.

Key Country Highlights

- United States: Projected to reach USD 13.88 billion by 2032, fueled by rising demand for healthy plant-based foods and innovations like “asparagus nuggets” targeting convenience-driven consumers.

- China, Peru, Mexico, Germany: Together account for over 80% of global asparagus production, with increased cultivation expected due to favorable climate and rising export demand.

- Germany, France, Switzerland (Europe): Rising preference for white asparagus and growing vegan population support consistent market growth.

- Japan and South Korea: Part of Asia Pacific’s fast-growing market, driven by demand for exotic, nutrient-rich vegetables in both domestic consumption and export-oriented farming.

Asparagus Market Trends

Strong Surge in Quick Service/Foodservice Restaurants Aid Growth of Asparagus Industry

The rising number of food service/quick service restaurants is considered one of the major factors that can help in boosting the demand for asparagus. Although asparagus is recognized as a seasonal vegetable, it is still widely available on the HoReCa’s menu throughout the year. The product’s easy-to-cook and versatile nature makes it one of the preferred choices for consumers. Also, multiple restaurants use vegetable asparagus as an ingredient or a side dish to prepare a range of cuisines such as Italian, Mediterranean, and Asian. Thus, a large spike has been experienced in the opening of vegan restaurants. The HoReCa sector is trying to experiment with asparagus and prepare a wide range of vegan dishes. Moreover, new entrants are eyeing the vegan trend and are focusing on creating healthy vegan preparations for consumers.

Download Free sample to learn more about this report.

Asparagus Market Growth Factors

Augmented Demand for Frozen Asparagus Drives its Adoption Rate

The diversity and availability of frozen vegetables have elevated substantially in the past few years, offering individuals a comprehensive range of sustainable, convenient, and healthy food options. Whether utilized as a meal or a side dish, frozen vegetables have emerged as a cost-effective solution that can be used to prepare a variety of cuisines. Similarly, other frozen vegetables and frozen asparagus are also experiencing a high demand due to their nutritional profile and culinary versatility. Prominent factors such as long shelf life, ease of storage and transport, and minimal risk of food waste necessitate consumers to opt for frozen vegetables, including asparagus. By witnessing this growing demand, various retailers or major companies are also exploring new ways to promote the consumption of asparagus by making it more appealing and accessible to consumers. For instance, in May 2023, CESURCA, a firm managed by Centro Sur, an electric company in Ecuador, introduced its latest line of frozen asparagus.

Surging Cultivation of Asparagus Fuels its Utilization Rate in Numerous Cuisines

The cultivation rate of asparagus has been continuously increasing across key asparagus-producing nations, which is positively shaping the market. China, Peru, Mexico, and Germany altogether account for more than 80% of the global asparagus production. Moreover, this production rate is expected to increase in the upcoming years owing to the surge in planting area as well as harvesting of asparagus crops. Another major factor responsible for the growth of the asparagus industry is the rising health consciousness, which influences consumers to shift toward plant-based products, such as asparagus. Apart from this, the improved cultivation rate of asparagus also creates numerous opportunities for the product’s utilization in the food processing sector. Asparagus is highly used as an ingredient in packaged food products or ready-to-consume meals due to its enormous health-benefiting properties, such as being high in antioxidants, rich in folic acid, rich in vitamin E, and others. Thus, food enthusiasts are also experimenting with asparagus and using it in the formulation of snacks, dips, pickled asparagus, and crackers.

RESTRAINING FACTORS

High Labor Costs and Seasonality Challenges Obstruct Industry's Sales

High labor costs for the cultivation of asparagus and seasonality challenges are the main hurdles faced by producers globally, hampering the asparagus market growth. Asparagus is a highly perishable crop that requires high labor from the stage of planting to harvesting and packaging. Also, the processing and picking of asparagus shoots are mostly done manually, which adds up to the high labor cost. Thus, such high prices pose a stress on farmers, leading to limited cultivation of asparagus.

The seasonal challenge is also a crucial problem that deters the consumption rate of asparagus. Asparagus is a perennial plant species that is cultivated only in the spring season. The product’s farming season ranges from 6 to 8 weeks, from late March to June. As a result, this seasonal availability fails to cater to the evolving consumer demands.

Asparagus Market Segmentation Analysis

By Product Type Analysis

Fresh Segment Dominated Market Due to Numerous Health Advantages

On the basis of product type, the global market is divided into fresh, canned, and frozen.

Out of all the categories, the fresh segment leads in the market and secures the top position in 2024. The demand for fresh asparagus is mainly increasing amongst health conscious individuals who are seeking clean and fresh products that can help them improve their mechanisms. Also, the product’s high nutrient load and palatable taste further contribute to the consumption of fresh asparagus. Moreover, in order to consume fresh products, the developing nations are importing fresh asparagus from major producers for their use.

Canned asparagus emerged as the fastest-growing segment in the market, primarily due to its convenience and long shelf life. Canned products are majorly useful for individuals who have hectic lifestyles and do not have sufficient time to purchase fresh products. In this scenario, the consumers buy canned products that are healthy and nutritious and can fulfill their daily dietary intake.

The freshsegment led the market share by 63.04% in 2026.

To know how our report can help streamline your business, Speak to Analyst

By Variety Analysis

Green Variety Leads Due to Easy Cultivation and Cost Effectiveness

Based on variety, the market is distributed into green, white, and others.

Amongst all, the green variety of asparagus is projected to dominate the market with a CAGR of 3.31% during the forecast period, specifically due to its vast production and affordability. As compared to the white variety, green asparagus tends to have a stronger and grassier flavor and a firm texture. Also, the easy cultivation of green asparagus and its cost-effectiveness make it one of the preferred choices among growers.

White asparagus is expected to capture the market share by 34% in 2025, recognized as the fastest-growing segment and is anticipated to grow at a stronger pace in the near term. This variety is majorly popular in European countries, such as Switzerland, Germany, and France, owing to its sweeter taste and nutritional properties. Compared to other varieties, white asparagus is considered an expensive commodity due to its limited production and high-priced harvesting methods. Unlike green, the white variety is cultivated underground and without exposure to sunlight. Thus, such factors make it a high-value specialty crop.

REGIONAL INSIGHTS

With respect to the region, the market covers North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America Asparagus Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America leads the global market and generated a 36.37% share in 2025. North America led the market value of USD 13.61 billion in 2026. In this region, asparagus presents an attractive market, as it is considered one of the highly valued products, which both elder and younger consumers widely accept. For ages, North America has been famous for convenient products due to their hectic lifestyle. However, with time, the growing concerns regarding health ailments necessitated Americans to shift toward healthy processed products infused with plant-sourced ingredients. With respect to the factors mentioned above, the manufacturers are collaborating to launch healthy versions of asparagus products in the market. The market in U.S. is estimated to hit USD 11.60 billion in 2026. For instance, in 2020, Prado Foods, a family-owned company in California, created “asparagus nuggets” and collaborated with Hansen Foods owner, who is selling the product in grocery stores in Michigan.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to rank as the second-largest in the market with a value of USD 10.77 billion in 2026 with a strong CAGR of 3.75% during forecast period, due to the increasing vegan/vegetarian population, followed by rising demand for asparagus-based cuisines in the market. Specifically, in European countries, individuals seek vegetarian meal options and prefer a white variety of asparagus due to their flavor and quality. This high demand for vegan products influences food chefs to introduce a variety of vegan cuisines on their menus. As a result, this demand encourages the utilization of plant-centric products, including asparagus. To support these factors, multiple national health organizations in Europe are keenly promoting plant-enriched diets to help consumers lead a healthy lifestyle. The market in U.K. is estimated for USD 1.15 billion, along with Germany projected to reach USD 3.44 billion in 2026, France likely to show USD 1.37 billion in 2025.

Asia Pacific

Asia Pacific is recognized as the third-fastest growing region, expecting a value of USD 9.57 billion in 2026 and to soar at a higher pace in the coming years. In this region, asparagus is still considered an exotic vegetable due to its high nutritional value and its universal role in every cuisine. Also, Asian countries are recognized as prominent producers of asparagus due to suitable temperate conditions and a broad range of farmlands. As a result, the region exports the surplus production of asparagus, primarily to Europe, where local production is not sufficient to cater to consumer demands. Thus, such factors help the region to mark its position at a global level. The market in China is projected to reach USD 5.82 billion, along with Japan likely to hold USD 1.17 billion and India will display USD 0.28 billion in 2026.

South America

South America and the Middle East & Africa are still at their progressing stage and are anticipated to grow at a higher pace in the near term. South America is predicted to become the fourth largest market with USD 2.08 billion in 2025. The increasing number of food service/quick service restaurants and the surge in tourism can fuel the consumption of asparagus. Also, the rising organic cultivation and demand for organic produce altogether drive the market’s potential. The UAE market is projected to hit USD 0.39 billion in 2025.

KEY INDUSTRY PLAYERS

Key Market Players Are Working Towards Launching a Variety of Asparagus

Dominating players in the market include Dole plc, B&G FOODS, INC., ALTAR PRODUCE LLC, and Teboza Asparagus, among others. In this modern era, the majority of the population is seeking for flavorsome and nutritious products that can assist in building a healthy lifestyle. Thus, owing to the high emphasis on health-benefiting products, manufacturers are trying to invest in R&D activities to produce asparagus-based products that can entice the consumer’s attention.

LIST OF TOP ASPARAGUS COMPANIES:

- Dole plc (Ireland)

- B&G FOODS, INC. (U.S.)

- ALTAR PRODUCE LLC (U.S.)

- Teboza Asparagus (Netherlands)

- Planta Trujillo – DANPER Trujillo S.A.C. (Peru)

- Thiermann GmbH & CO KG (Germany)

- Seabrook Brothers & Sons, Inc. (U.S.)

- Durst Organic Growers (U.S.)

- Sutcliffe Farms (U.S.)

- Limgroup B.V. (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Maisadour Cooperative Group, a France-based agricultural company, announced their latest launch of a recruitment campaign for finding new asparagus growers. With the help of this campaign, the firm opens lucrative opportunities for the growth of the market in the future.

- November 2023: B&G Foods, a food processing company in the U.S., announced the selling of their brand, “Green Giant U.S. shelf-stable vegetable line,” to Seneca Foods Corporation, an American food manufacturer. The sale of this line does not include Green Giant Canada, Green Giant Frozen, and Le Sueur brand.

- April 2023: Nationwide Produce, the U.K.-based fresh produce distributor, introduced the launch of their new premium brand of asparagus, “SPEAR IT.” The firm’s mission with this latest brand is to offer superior and fresh quality asparagus to consumers.

- November 2020: Enza Zaden, a manufacturer in the Netherlands, released their first-ever variety of white asparagus, “Daleza,” across the European market. This new variety was first rolled out in the French and German markets.

- April 2019: Fruidor SAS, a France-based food processing company, obtained a Zero-Pesticides Residue (ZRP) certificate for its asparagus product. This strategy is developed within the Nouveaux Champs initiative, which targets minimizing pesticide residue.

REPORT COVERAGE

The report includes quantitative and qualitative insights into the market and also offers a detailed analysis of the market sizing and growth rate for all possible segments. Various key insights presented in the research report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and market trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 3.85% from 2026 to 2034 |

|

Segmentation |

By Product Type

|

|

By Variety

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at 37.62 billion in 2026.

The market is projected to grow at a CAGR of 3.85% during the forecast period.

The fresh asparagus segment led the global market in 2025.

Increasing demand for frozen asparagus and the growing cultivation of asparagus in various cuisines drive the market’s growth.

Dole plc, B&G FOODS INC., and ALTAR PRODUCE LLC are a few of the top players in the global market.

North America dominated the asparagus market with a market share of 36.37% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us