Asset Finance Software Market Size, Share & Industry Analysis, By Asset Type (Hard Assets and Soft Assets), By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small & Medium Enterprises) By End-user (Transportation, IT & Related Services, Construction, Agriculture, Medical Equipment, Banks, Industrial/Manufacturing Equipment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

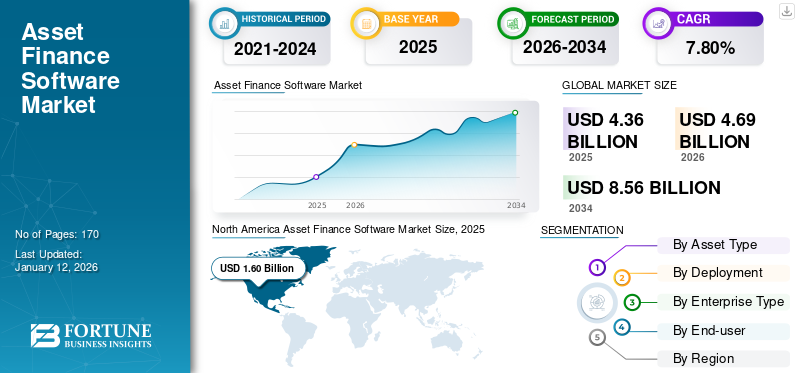

The global asset finance software market size was valued at USD 4.36 billion in 2025 and is projected to grow from USD 4.69 billion in 2026 to USD 8.56 billion by 2034, exhibiting a CAGR of 7.80% during the forecast period. North America dominated the asset finance software market with a market share of 36.84% in 2025.

The purpose of asset finance software is to help manage IT assets, such as associated contracts, asset tracking (organizations or leased assets), and invoice management. A business can gain many advantages, such as greater efficiency, increased productivity, profitability, and smooth inventory processes with this software. Some of the tools considered in this market study are Ausloans’ Zink, LDMS Engage, FIS Asset Finance, Banqsoft Asset Finance Software Suite, and automotive finance and equipment finance offered by Alfa Financial Software Limited, among others.

The increasing adoption of technology in finance, the need for efficient asset management, and the growing demand for automation and streamlined processes in financial institutions provide significant growth opportunities for the market. Additionally, the rise of subscription & usage-based models, integration of AI & machine learning for better decision-making, and expansion of asset financing into new industries are driving the market growth. The continued migration to cloud-based solutions and emphasis on data security and compliance are further contributing to the development of the industry. The rising demand for optimized financial processes within companies to efficiently manage assets, optimize resource allocation, and improve overall financial planning and reporting is one of the key drivers of the market. Additionally, automating asset management processes to track and manage assets throughout their lifecycle accelerates market growth.

However, this industry had been temporarily impacted by the outbreak of the COVID-19 pandemic. In addition, the lack of logistics and raw materials supply had disturbed every industry's supply chain and hindered new product launches, increasing the need for finance assets. Thus, the increasing use of assets on a lease basis surged the demand for this software in the post-COVID-19 era.

Asset Finance Software Market Trends

Rising Adoption of Subscription-based Models to Boost Software Demand

In the automotive industry, environmental considerations, technological advancements, and fluctuating consumption patterns are causing a shift from independently owned vehicles to an autonomous and shared mobility model.

The liability for leasing and flexibility ownership increases by bundled services in corporate fleets, paying for transport on demand, or functionality driven by new vehicle technologies. In addition, new players aim for flexible mobility opportunities, leveraging the availability of new technologies, such as EVs. For instance,

- Onto, the U.K.-based EV subscription start-up, provides a range of commitment-level options and a vast variety of services for mobility, ranging from car leasing to servicing.

- Furthermore, in August 2020, Porsche collaborated with Clutch Technologies and announced the Porsche Drive subscription and Porsche Passport plans to provide on-demand access to a-la-carte mobility services and cars, while Audi offers a rental car plan through their Silvercar proposition.

Thus, the aforementioned factors are likely to propel the asset finance software market share during the forecast period.

Download Free sample to learn more about this report.

Asset Finance Software Market Growth Factors

Growth in Global Average Price of Assets to Propel Market Development

The rising demand for branded equipment and new commercial models has become one of the primary growth factors in the market. As a company's preferences and trends toward retail equipment purchases have augmented tremendously, the need for utility vehicle financing and loans is anticipated to rise, maintaining dominance in the market. Therefore, the global average cost of cars has increased concurrently with the demand for utility vehicles for carrying goods in manufacturing organizations. Thus, a considerable rise in vehicle prices forced companies to shift from direct purchases to finance vehicles. For instance,

- In the U.S., the standard cost of a new car purchase increased to USD 36,718 in 2019 from USD 35,742 in 2018, with interest charges of approximately 6% and 2%, respectively.

As a result, these steep prices imposed over the average cost of vehicles are expected to boost the asset finance software market growth during the forecast period.

RESTRAINING FACTORS

High Installation Costs of Software to Hinder Market Augmentation

The asset finance software allows customers to purchase assets and aids in managing them. However, the installation costs are high and require professionals to complete the task. Furthermore, the software is available on a monthly, quarterly, or yearly basis, but the software is expensive. In addition, high screen loading time is an issue for the users, but the developments in the upcoming upgrades are expected to minimize these errors.

Hence, the factors mentioned above are expected to restrain the market growth.

Asset Finance Software Market Segmentation Analysis

By Asset Type Analysis

Hard Assets to Lead Owing to their Surging Demand after Pandemic

By asset type, we have considered hard assets and soft assets. Amongst them, the hard assets segment emerged as the largest sub-segment, accounting for 65.41% of the market share in 2026 owing to the high demand for heavy equipment in the manufacturing, agriculture, and transportation industries. Furthermore, as the price of these heavy equipment is comparatively higher than that of soft assets, customers often prefer buying these assets on a finance basis.

The soft assets segment will grow steadily during the forecast period owing to increasing number of startups in the Middle East & Africa, Asia Pacific, and South America. Therefore, the need for soft assets, such as software and light equipment required for the setup is increasing, fueling the market's growth during the forecast period.

By Deployment Analysis

Cloud Segment to Lead Owing to Swift Digital Transformation

Based on our analysis, the deployment of the software is implemented over cloud and on premises. The cloud segment holds 7.86% market share in 2026. It is also expected to grow at the highest rate during the forecast period as cloud-driven deployment enables minimal maintenance, a decrease in cost, quicker distribution, and increased scalability.

The on-premises segment has high software installation costs and upgrading charges, making users choose cloud-based software owing to its benefits. This shift in using cloud-driven software hampered the growth of the on-premises segment.

By Enterprise Type Analysis

Large Enterprises Segment to Dominate Due to Surging Product Demand

Based on enterprise type, the market is segmented into large enterprises and small & medium enterprises. As per our study, the large enterprises segment will dominate the market during the forecast period due to the early adoption of the software. Moreover, large enterprises' high demand for managing assets fueled the segment’s revenue growth.

Furthermore, the small & medium enterprises segment is predicted to witness a rapid growth rate during the forecast period owing to new developments in SME asset finance. For instance,

- In May 2021, a U.K. start-up bank announced plans to introduce an SME asset finance product powered by Mambu's cloud banking platform.

By End-user Analysis

Increasing Usage of Second-hand Vehicles to Boost Transportation Industry

Based on end-user, the market is segmented into transportation, IT & related services, construction, agriculture, medical equipment, banks, industrial/manufacturing equipment, and others. According to our analysis, the transportation segment represented the largest sub-segment, holding a 35.07% share in 2026 owing to a surge in purchasing second-hand transportation facilities on a financial basis. Furthermore, in the post-COVID-19 pandemic era, rates of new vehicles were booming, forcing individuals to choose second-hand transportation facilities through the asset finance software, boosting the market growth.

To know how our report can help streamline your business, Speak to Analyst

Furthermore, the construction segment is expected to record the highest CAGR during the forecast period as many construction companies have started to purchase equipment, such as excavators, bulldozers, loaders, and others on a finance basis.

REGIONAL INSIGHTS

As per our report, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Asset Finance Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 1.60 billion in 2025. The region has taken a significant lead in infrastructure development and technology adoption. A strong presence of large IT companies and rapid digitization in the U.S. and Canada would drive the market. In addition, increasing the use of connected, smart, and secure technologies for asset-centric applications is also expected to drive the market's growth.

Asia Pacific

Asia Pacific is emerging as one of the fastest-growing regional markets and offers immense potential for market growth. The growing adoption and deployment of advanced technologies, such as cloud-based solutions, fuels the demand for subscription-based asset finance software. The Japan market is valued at USD 0.24 billion by 2026, the China market is valued at USD 0.31 billion by 2026, and the India market is valued at USD 0.23 billion by 2026.

Europe

Europe holds the second highest share in the global market owing to the presence of key players in the region. For instance, Banqsoft is a supplier of financial solutions for digital banking, asset finance, and credit management organizations in the Nordics, delivering solutions to aid auto finance companies stay competitive in the market. The UK market is valued at USD 0.31 billion by 2026, while the Germany market is valued at USD 0.31 billion by 2026.

Middle East, Africa, and South America

The growing productivity in the manufacturing and agriculture industries in the Middle East, Africa, and South America is expected to boost the opportunity for asset finance software suppliers. The manufacturing industries are becoming a crucial economic indicator of Middle East & African countries over the past few years. According to the World Bank’s World Development Indicators database, the Middle East and African manufacturing sector has gained steady growth, expanding at 12.37% in 2020. Hence, the need for software in renting manufacturing equipment and tractors for agriculture will be high in the upcoming years, fueling the regional growth.

Key Industry Players

Key Players Launch New Products to Strengthen their Market Positioning

Major players in the market are developing new and advanced asset finance solutions for customers in the market. They also aim to enhance their existing product portfolio to provide flexible and easy-to-use asset finance solutions. In addition, the companies focus on partnerships, collaboration, and acquisitions to improve their product offerings.

List of Top Asset Finance Software Companies:

- Oracle Corporation (U.S.)

- Banqsoft (Poland)

- ieDigital (U.K.)

- Lendscape Limited (U.K.)

- Alfa Financial Software Limited (U.K.)

- Odessa Technologies (U.S.)

- CHG-MERIDIAN (Germany)

- Ausloans Finance Group (Australia)

- CGI Inc. (Canada)

- FIS (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: UTB partnered with Alfa, an asset finance software specialist, to improve service levels for lenders, increase the speed of decision-making and disbursements, and deliver a range of services to support UTB's ambitious growth plans.

- October 2022: CHG-MERIDIAN collaborated with OPC Asset Solutions, an asset lifespan manager based in Mumbai. The CHG-MERIDIAN Group's plan focuses on internationalization, growth, and sustainability.

- September 2022: Alfa Financial Software Limited launched Version 5.7 of Alfa Systems, the company’s software tool for asset finance that offers new enhancements in the user experience, charges and billing, and configuration.

- November 2021: Toyota Financial Services (U.K.) expanded its partnership with ieDigital to introduce a mobile app and web portal for customers.

- November 2021: Banqsoft and Wasa Kredit collaborated on a core system for Asset Finance, which is delivered as a service. Further, Wasa Kredit aimed to strengthen its presence within the Swedish asset finance industry by introducing new financial services with a robust digital footprint, including hire purchase, consignment, leasing, and loans.

REPORT COVERAGE

The research on the market comprises prominent areas worldwide to get a better knowledge of the industry. In addition, the study provides insights into the most recent market trends and an analysis of technologies being adopted quickly globally. It also highlights some of the growth-stimulating restrictions and elements, enabling the reader to gain a detailed understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Asset Type

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 8.56 billion by 2034.

In 2025, the market value stood at USD 4.36 billion.

The market is projected to record a CAGR of 7.80% during the forecast period of 2026-2034.

By deployment, the cloud segment is likely to lead the market.

Growth in global average price of assets will propel market growth.

Oracle Corporation, Banqsoft, ieDigital, Lendscape Limited, Alfa Financial Software Limited, Odessa Technologies, CHG-MERIDIAN, Ausloans Finance Group, CGI Inc., and FIS are the top players in the market.

North America is expected to hold the highest market share.

By end-user, the construction segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us