Atrial Fibrillation Market Size, Share & Industry Analysis, By Drug Class (Anticoagulants and Antiarrhythmic Drugs), By Route of Administration (Oral, Intravenous, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), and Regional Forecast, 2026-2034

Atrial Fibrillation Market Size

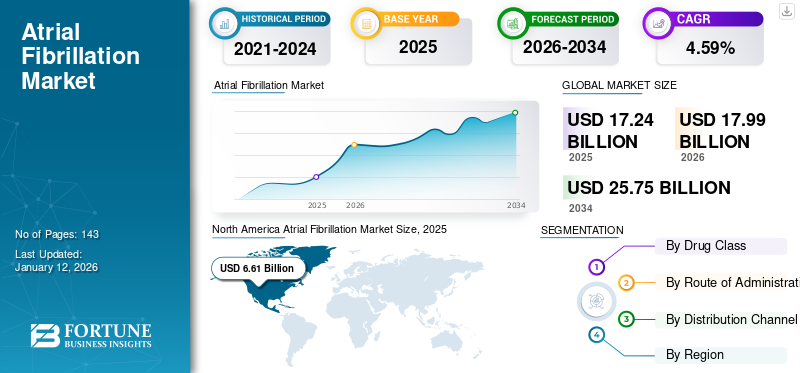

The global atrial fibrillation market size was valued at USD 17.24 billion in 2025. The market is projected to grow from USD 17.24 billion in 2026 to USD 25.75 billion by 2034, exhibiting a CAGR of 4.59% during the forecast period. North America dominated the atrial fibrillation market with a market share of 38.33% in 2025.

Atrial fibrillation (Afib) is a condition characterized by irregular heart rate resulting in blood clots. The condition, if left untreated, can increase the risk of stroke and is common among groups of people suffering from cardiovascular conditions, including hypertension, atherosclerosis, cardiomyopathy, and others. Furthermore, factors such as increasing age, obesity, smoking, and others also increase the risk of developing this condition among the population. The growing prevalence of the condition across the globe is one of the predominant factors raising the demand for the drugs.

- According to an article published in the National Center for Biotechnology Information in 2021, the prevalence of atrial fibrillation is estimated to be around 37.5 million across the globe and is projected to increase by more than 60.0% by the year 2050.

Moreover, the approval of new drugs, increasing investments by companies to develop novel drugs to treat patients, growing awareness among patients in developing nations, and growing initiatives by government organizations to improve patient access to these drugs are some factors promoting market growth.

Global Atrial Fibrillation Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 17.24 billion

- 2026 Market Size: USD 17.99 billion

- 2034 Forecast Market Size: USD 25.75 billion

- CAGR: 4.59% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 38.33% share in 2025. This is driven by the rising prevalence of atrial fibrillation, a conducive regulatory environment for the development and approval of new drugs, a growing geriatric population, and a high incidence of associated conditions like hypertension.

- By Drug Class: The Anticoagulants segment accounted for the largest market share in 2026. Its dominance is fueled by strong recommendations from health bodies, such as NICE in the U.K., for their use in preventing strokes associated with Afib, coupled with an increasing number of clinical trials and new drug approvals in this category.

Key Country Highlights:

- Japan: The market is driven by the introduction of novel drug delivery systems, such as the launch of a β1 Blocker transdermal patch for treating atrial fibrillation, and a rising awareness of the condition within the rapidly growing Asia Pacific market.

- United States: Growth is propelled by a high prevalence of the condition, a supportive regulatory environment for new drug applications like nasal sprays, and a large geriatric population. However, the market also faces challenges such as drug recalls due to manufacturing practice violations.

- China: As a key country in the fastest-growing Asia Pacific region, the market is expanding rapidly, with projections indicating that 72.0 million people in the region will suffer from Afib by 2050, driving significant demand for effective treatments.

- Europe: The market is supported by a growing geriatric population and increasing prevalence of heart diseases. Significant investment from regional biotech companies, such as a Danish firm securing funding for a novel Afib therapy, is also a key growth driver.

COVID-19 IMPACT

Market Witnessed a Slow Growth Amid Pandemic Due to Temporary Halt in Supply Chain

The market witnessed a slow growth during the pandemic. A multitude of factors, such as the implementation of stringent lockdowns, disruption in demand and supply chain, and temporary closure of various clinics, among others, impacted this market. The pandemic also impacted the treatment strategies adopted by healthcare professionals for all types of atrial conditions.

According to an article published in the Journal of Clinical Medicine in 2022, a significant difference was observed in the selection of invasive interventional and non-invasive therapeutic strategies by clinicians. In addition, there was a significant decline in conducting catheter ablation and percutaneous left atrial appendage occlusion procedures. In contrast, pharmacotherapy was the preferred option for healthcare professionals during the pandemic.

Furthermore, growth slowed down in 2020; however, it bounced back to normal levels post-pandemic. This rebound was attributed to the reopening of healthcare facilities, an increase in diagnoses, and a growing demand for drugs.

Atrial Fibrillation Market Trends

Increasing Focus on Monoclonal Antibodies by Key Players

The growing prevalence of the condition is facilitating the demand for developing novel and innovative drugs in order to manage the condition effectively. The key manufacturers operating in the market are shifting their focus to introduce novel drugs, such as human monoclonal antibodies, to cater to the growing demand.

- For instance, Anthos Therapeutics is developing a fully human monoclonal antibody, abelacimab. The drug is a novel dual-acting Factor XI/XIa Inhibitor with the capability of hemostasis-sparing anticoagulation.

Furthermore, the regulatory bodies are encouraging the key players to develop various drugs by offering various approvals and designations to the drugs in order to expedite the trial process and an early launch of these drugs for proper treatment.

Download Free sample to learn more about this report.

Atrial Fibrillation Market Growth Factors

Rising Burden of Geriatric Population Coupled with Increasing Prevalence of Cardiovascular Disorders to Augment Market Growth

The growing burden of cardiovascular diseases across the globe is one of the prominent factors increasing the risk of atrial fibrillation and related complications. Many researchers have demonstrated that people who are suffering from high blood pressure, underlying heart diseases, hypothyroidism, and others are at a greater risk of developing the condition.

- According to the World Health Organization (WHO) 2023 data, about 1.28 billion adults aged between 30 and 79 years are suffering from hypertension.

Hypertension is most often associated with impaired heart physiology, such as impaired ventricular filling, slowing of atrial conduction velocity, and left atrial enlargement, among others. These factors are likely to increase the risk of developing cardiac arrhythmias.

Furthermore, most heart-related complications are common among the elderly population, and increasing age also increases the chances of this condition. According to the United Nations 2023 report, the number of people aged 65 years and above is projected to reach 1.6 billion by 2050. Therefore, the increasing burden of cardiovascular disorders, along with the growing old-age population, is driving the demand for these drugs.

RESTRAINING FACTORS

Rising Product Recalls Coupled with Presence of Alternative Treatment Approaches May Limit Market Growth

Despite the growing awareness regarding proper management of the condition and robust research & development to launch new drugs, the rising voluntary recalls of a few products due to safety issues, mislabeling, quality concerns with regards to manufacturing, and others may hamper market growth. The rise in product recalls is likely to hamper the brand presence and shift patient preference toward alternative treatment methods, thereby limiting the adoption of these drugs.

- For instance, in August 2023, Sun Pharmaceuticals recalled 360 bottles of dofetilide capsules due to the violation of current good manufacturing practices (CGMP) regulations for finished products. The drug is prescribed for the maintenance of normal sinus rhythm in patients with this condition.

- In addition, in September 2023, Marlex Pharmaceuticals recalled one lot of 0.25 mg digoxin tablets and one lot of 0.125 mg digoxin tablets due to a label mix-up. The label mix-up of the drugs might lead to adverse events owing to patients receiving either sub-potent or super potent doses.

Hence, the increasing number of product recalls is shifting patient preference toward alternative treatment methods, thereby impeding the global market growth.

Atrial Fibrillation Market Segmentation Analysis

By Drug Class Analysis

Anticoagulants Segments’ Growth is Driven by its Increasing Number of Drug Approvals

Based on drug class, the market is segmented into anticoagulants and antiarrhythmic drugs.

The anticoagulants segment accounted for the largest market with a share of 78.92% in 2026. The growing emphasis of the government to increase the use of anticoagulants in order to manage the condition and related complications is one of the key factors contributing to segment growth.

- For instance, in November 2021, the National Institute for Health and Care Excellence (NICE) recommended the usage of four DOACs: apixaban, dabigatran, rivaroxaban, and edoxaban for preventing Afib-associated strokes.

Moreover, the increasing number of clinical trials initiated by the key players to launch new anticoagulants to cater to the rising demand is also promoting the segment’s growth.

On the other hand, the availability of a conducive research environment to promote the development of antiarrhythmic drugs for managing the condition, shifting manufacturers' focus on developing and seeking approval for new drugs, and others are a few factors fueling the segment’s growth.

- In June 2022, Eagle Pharmaceuticals submitted a new drug application (NDA) to the U.S. FDA for its drug candidate, landiolol, which is a beta-1 adrenoceptor blocker developed for short-term reduction of ventricular rate in patients suffering from Afib, atrial flutter, and supraventricular tachycardia.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration Analysis

Oral Segment’s Dominance is led by Wide Availability of Orally Administered Drugs

Based on route of administration, the market is segmented into oral, intravenous, and others.

The oral segment dominated the market with a share of 84.98% in 2026 and is anticipated to continue its dominance during the forecast period. The wide availability of these drugs, increasing uptake of oral anticoagulants, and increasing research and development to develop and launch new drugs based on oral administration are factors bolstering the segment growth.

- For instance, according to a press release published by NHS England in November 2023, an estimated 460,000 have started taking direct oral anticoagulants (DOACs) since January 2022, preventing about 17,000 strokes and 4,000 deaths in England.

The intravenous segment is expected to grow at a CAGR of 3.6% during the forecast period. The intravenous route of administration-based medications is predominantly used to manage acute rate control in the condition. The limited focus on developing intravenous drugs for managing the condition and atrial flutters is slowing the segment’s growth.

By Distribution Channel Analysis

Retail Pharmacies’ Dominance Fueled by Consumer Focus and Strategic Investments

Based on distribution channel, the market is categorized into hospital pharmacies, online pharmacies, and retail pharmacies.

The retail pharmacies segment accounted for the lion’s share and is expected to continue its dominance in the coming years, contributing 48.03% globally in 2026. The various advantages, such as the high focus on consumer satisfaction, increasing investment by the retail pharmacies to expand their channel, and cost-effectiveness by reducing shipping costs as in the case of online pharmacies, among others, are a few factors contributing to its market share.

- For instance, in 2023, Reliance Retail established its first standalone pharmacy store, Netmeds, in Chennai and entered the retail pharma market.

In addition, the online pharmacies segment is anticipated to witness lucrative growth in the forthcoming years. The shifting patient preference toward e-pharmacies is due to factors such as convenience, heavy discounts levied on medicine, home delivery, reduction in transportation costs, and others.

REGIONAL INSIGHTS

Based on region, this market is divided into Europe, the Middle East & Africa, North America, Latin America, and Asia Pacific.

North America

North America Atrial Fibrillation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025 and was valued at USD 6.61 billion. The rising prevalence of atrial fibrillation in the region, along with the availability of a conducive environment for developing and seeking approval for new drugs, are some factors driving the adoption of these drugs in the region.

- For instance, in October 2023, Milestone Pharmaceuticals submitted a New Drug Application (NDA) to the U.S. FDA for Etripamil, a nasal spray developed for patients suffering from atrial fibrillation and paroxysmal supraventricular tachycardia (PSVT).

Moreover, the rising burden of the old age population and the growing prevalence of hypertension, among others, are a few other factors supporting the growth of the North American market. The U.S. market is projected to reach USD 6.14 billion by 2026.

Europe

Europe held the second position in the global market in 2025. The growing prevalence of various heart diseases, the increasing geriatric population in the region, and increasing investment by regional drug manufacturers to develop drugs are a few prominent factors contributing to the growth of the market. The UK market is projected to reach USD 0.68 billion by 2026, while the Germany market is projected to reach USD 1.12 billion by 2026.

- In September 2023, Acesion Pharma, a Danish biotech company, received USD 47.0 million in a series B financing round. Through this funding, the company aims to develop its atrial fibrillation therapy, AP31969.

Asia Pacific

Asia Pacific is projected to witness stellar growth in the upcoming years. Increasing novel product launches in the region, rising awareness, surging geriatric population, and rising cases of Afib are the factors contributing to regional market growth. The Japan market is projected to reach USD 0.69 billion by 2026, the China market is projected to reach USD 0.89 billion by 2026, and the India market is projected to reach USD 0.64 billion by 2026.

- According to a report, ‘Economist Impact,’ published by Johnson & Johnson in 2021, an estimated 72.0 million people will suffer from Afib in the Asia Pacific region by 2050.

Latin America and Middle East & Africa

Furthermore, the Latin America and the Middle East & Africa regions are anticipated to grow at a considerable CAGR during the forecast period. Increasing government initiatives to raise awareness about the condition and its proper treatment, the growing old age population, and the population suffering from other cardiovascular disorders are a few factors promoting the adoption of drugs.

Key Industry Players

Expansion Efforts and Innovative Offerings by Industry Leaders Drive Market Growth

The global market is semi-consolidated with a few players, including Bayer AG, Daiichi Sankyo, Sanofi, and Bristol Myers Squibb, among others. The increasing focus of the key players to expand their geographical footprint and increased focus toward launching innovative drugs, are some factors contributing to their high global atrial fibrillation market share. In addition, a strong distribution network and brand presence of these companies in the market aid in the high market share.

- For instance, in January 2019, Daiichi Sankyo entered into a license agreement with Esperion Therapeutics in order to strengthen its cardiovascular portfolio in Europe. Through this agreement, the company will expand the commercialization of the once-daily anticoagulant edoxaban and the once-daily antiplatelet prasugrel.

Some other companies, such as Johnson & Johnson, Pfizer, Inc., Eisai Co., Ltd., and others, are continuously engaging in inorganic business activities to establish their footprints in emerging nations.

List of Top Atrial Fibrillation Companies:

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (France)

- Eisai Co., Ltd. (Japan)

- Johnson & Johnson (U.S.)

- Daiichi Sankyo, Inc. (Japan)

- Par Pharmaceutical (U.S.)

- Bayer AG (Switzerland)

- Pfizer Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Bayer AG expanded its phase 3 clinical trial program for the investigational drug asundexian. The company is investigating the drug as a potential treatment in patients suffering from atrial fibrillation with a high risk of stroke or embolism.

- March 2023: Bristol Myers Squibb launched a pivotal phase 3 trial Librexia program in collaboration with Janssen Pharmaceuticals for evaluating an investigational oral factor XIa (FXIa) inhibitor (antithrombotic), Milvexian. The trial is aimed at investigating milvexian compared to apixaban in the prevention of stroke in patients with atrial fibrillation.

- July 2022: InCarda Therapeutics, Inc. enrolled the first patient in its pivotal phase 3 study, Restore-1 trial, for its product, InRhythm, for the treatment of paroxysmal atrial fibrillation.

- June 2022: Apotex Inc., a Canadian pharmaceutical manufacturer, launched a generic version of Eliquis, APO-Apixaban tablets in Canada. The drug is available in 2.5 mg and 5mg tablets.

- June 2019: TOA EIYO Ltd., in collaboration with Astellas Pharma, Inc., launched Bisono Tape 2 mg, a β1 Blocker transdermal patch in Japan. The patch is intended for treating patients suffering from atrial fibrillation.

REPORT COVERAGE

The report delivers a detailed market analysis and market sizing. It focuses on key aspects such as new product launches and technological advancements. In addition, it includes an overview of segments, key industry developments, mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of different segments, key trends, and company profiles of key market players, the competitive landscape, and the impact of COVID-19 on the market. Besides, the report offers an overview of market trends, market opportunities, and the impact of the market on the stakeholders. The report further encompasses qualitative and quantitative insights that contribute to the growth of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.59% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us