Automated Test Equipment Market Size, Share & Industry Analysis, By Device Type (Integrated Circuits, Hard Disk Drives, Printed Circuit Boards, and Others (Line Replaceable units)), By Application (Automotive & Transportation, Consumer Electronics, Telecommunication, Healthcare, Semiconductor Fabrication, and Others (Military, Utilities)), and Regional Forecast, 2026–2034

Automated Test Equipment Market Size

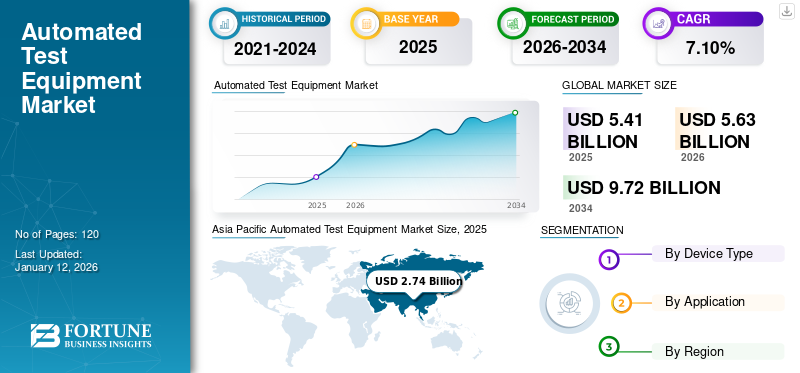

The global automated test equipment market size was valued at USD 5.41 billion in 2025 and is projected to grow from USD 5.63 billion in 2026 to USD 9.72 billion by 2034, exhibiting a CAGR of 7.10% during the forecast period. Asia Pacific dominated the global market with a share of 50.70% in 2025.

Automated Test Equipment (ATE) is test machinery used in the electronic device and system testing industry that uses instruments to perform the performance, quality, functionality, and stress tests performed on electronics. ATE test products and samples with minimal human intervention and automates the traditional manual electronic testing process. Many devices tested by ATE are termed Device Under Test (DUT), Equipment Under Test (EUT), and Unit Under Test (UUT).

Global Automated Test Equipment Market Overview

Market Size:

- 2025 Value: USD 5.41 billion

- 2026 Value: USD 5.63 billion

- 2034 Forecast Value: USD 9.72 billion

- CAGR: 7.10% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific dominated the market with a 50.70% share in 2025, driven by a strong presence of global electronic manufacturers and rising demand for digital products.

- Leading Device Type: Integrated Circuits (ICs) dominate the market due to their widespread adoption in consumer electronics and automotive infotainment systems.

- Leading Application: The consumer electronics segment leads due to high manufacturing volumes and the critical need for automated testing in production lines.

- Fastest-Growing Application: The automotive & transportation segment is growing with the highest CAGR, propelled by the rise of autonomous vehicles and advanced infotainment systems.

Industry Trends:

- Demand for 5G Test Solutions: The rapid commercialization of 5G networks is creating a high-volume demand for advanced ATE capable of testing new, high-speed components.

- Integration of Data Analytics: ATE systems are evolving to not just test but also extract and analyze performance data from sensors on chips (SoCs), driving demand for smarter equipment.

- Strategic Acquisitions & Consolidation: Key players are actively acquiring smaller, specialized companies to expand their technological capabilities and geographical footprint, particularly in Europe.

- Advancements in Chip Packaging: The industry is adapting to test increasingly complex 2.5D and 3D integrated circuits, which require more sophisticated and high-power testing solutions.

Driving Factors:

- Electrification of Automobiles: The global shift to Electric Vehicles (EVs) is a major driver, creating a massive need to test high-voltage components like Silicon Carbide (SiC) chips used in battery management systems.

- Growth in Consumer Electronics: An ongoing surge in demand for smartphones, laptops, and other devices requires extensive testing of advanced processing chipsets.

- Rise of AI and Autonomous Systems: The integration of AI and complex systems in autonomous vehicles is propagating the demand for ATE in the automotive component manufacturing industry.

- Government Support for EV and Semiconductor Industries: Government subsidies and policies promoting EV adoption and domestic semiconductor fabrication are creating significant market opportunities.

Restraining Factors:

- Technological Testing Challenges: The increasing complexity of modern multi-die chip packages (2.5D/3D ICs) creates significant technical challenges for ATE systems.

- Supply Chain Volatility: The market remains vulnerable to supply chain disruptions and raw material shortages, which can impact production and pricing.

The COVID-19 pandemic incurred a major decline in the market due to a disturbed supply chain and restrictions on imports. Semiconductors faced major challenges regarding pricing and supply. The downfall in supply bolstered the gap between supply and demand, significantly impacting the ATE sector's business. However, post-pandemic removal of lockdowns and order backlogs for semiconductors has spiked the demand, incurring high short-term recovery. Hence, the market will have a stable growth rate and revenue for ATE systems across the industry in the long term.

Automated Test Equipment Market Trends

High Volume of 5G Test Solutions and Need for Data Analysis Drive Demand for Automated Test Equipment

Rapid commercialization of 5G network services and demand from High Volume Manufacturing (HVM) players are introducing device interfacing and interconnecting drives that demand high-speed 5G testing solutions. These advancements will push the use of Sensors on Chips (SoC) and agents that can monitor device performance. This traceability is vital for ensuring ATE to pull data from sensors. This demand for data heightened the need for data extraction and analysis, driving the demand for automated test equipment. Also, growing demand for consumer electronics and an upsurge in internet usage bolstered the demand for advanced processing chipsets that need testing. This makes the ATE more compliant with modern processor testing, expanding automated test equipment market share.

Download Free sample to learn more about this report.

Automated Test Equipment Market Growth Factors

Electrification of Automobile and Emphasis on EV Adoption by Government to Bolster Market Growth

Electric vehicles have revolutionized modern mobility with effective battery management and long-distance ranges, boosting the adoption of automated test equipment. The government in the EV sector is also promoting the adoption with subsidies on vehicles, and emphasis on manufacturing efficient EVs has created leveraging opportunities. Also, the continued electrification of cars raises the demand for high voltage or SiC chips that transmit data efficiently and effectively for battery management. These SiC chips need efficient testing that drives long-term automated test equipment market growth.

RESTRAINING FACTORS

Complex Chips Causing Technological Testing Challenges to Restrain Market Growth

Packaging technology advancements have increased in recent years, from 2D integrated circuits to 2.5D, and 3D ICs have stepped up the possibilities with die sinking and hybrid bonding. These new advancements are not only complex to manufacture due to their feature capabilities but also create new tough challenges for ATE testing as it requires high-power solutions to couple with other chips in a package.

Automated Test Equipment Market Segmentation Analysis

By Device Type Analysis

Rapid Adoption of Integrated Circuits Across Consumer Electronics and Automotive Infotainment Systems to Boost Segment Growth

Based on device type, the market is categorized into integrated circuits, hard disk drives, printed circuit boards, and others (line replaceable units).

Integrated circuits dominate the market with market share of 39.06% in 2026, due to their growing adoption across consumer electronics and automotive infotainment systems. Further, the rising progress of AI and data decision-making is leveraging opportunities for modern 3D ICs. Also, prodigious demand for hard disk drives in the data storage industry further pushes the progress of automated test equipment.

The growing demand for printed circuit boards and other electronic components, such as line replaceable units in modern aviation and automotive infotainment systems, is leveraging the potential testing capabilities of automated test equipment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Consumer Electronics Segment Dominated the Market Due to Its High Manufacturing Volume

Based on application, the market is categorized into automotive & transportation, consumer electronics, telecommunication, healthcare, semiconductor fabrication, and others (military, utilities).

The consumer electronics segment dominated the market with market share of 31.96% in 2026, due to its high manufacturing volume and the need for automated testing in the production lines. ATE systems help businesses track the performance and capabilities of the electronic component by effectively collecting the data from the component for analytics and insights.

Furthermore, automotive & transportation is growing with highest CAGR owing to the progressive growth of autonomous vehicles and AI systems in automotive infotainment systems is propagating the demand for ATE systems in the automotive component manufacturing industry.

Telecom products, semiconductor fabrication, and military equipment are such applications that sustain sustainable growth for ATE testing due to growing investments and demand for advancements. Also, demand for commercially safe healthcare machinery has substantially grown ATE applications in the healthcare industry.

REGIONAL INSIGHTS

The global market is studied for regions including North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Automated Test Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is set to dominate the market with a valuation of USD 2.74 billion in 2025 and USD 2.88 billion in 2026, with a strong presence of global electronic manufacturers in developed and developing nations. Also, rising urbanization and demand for digital products have bolstered the demand for automated test equipment in the long-term. China, India, and Japan are a few countries focusing heavily on attracting investments by leveraging government policies, infrastructure, and a large consumer base. The Japan market is projected to reach USD 0.49 billion by 2026, the China market is projected to reach USD 1.44 billion by 2026, and the India market is projected to reach USD 0.16 billion by 2026.

China is set to acquire the highest market share in the Asia Pacific region due to its dominant presence in the global market and the presence of some big manufacturers in the country drives the ATE market. The same countries, such as India and Japan, are attracting big semiconductor giants by leveraging infrastructure and subsidies, enhancing the potential of automated test equipment in the long-term. South Korea, ASEAN, Oceania, and the other Asia Pacific countries further supports the growth.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is set to grow progressively due to its strong technological innovations and demand for advanced home and entertainment devices optimized for better connectivity and performance. Also, AI integration into remote management technologies and optimization of autonomous vehicle operations is helping the market flourish. The U.S. market is projected to reach USD 0.94 billion by 2026.

Europe

Europe is witnessing a steady progress owing to economic pressure with more emphasis on electric and sustainable solutions to eliminate mass productivity. Consumers demanding sustainable electronics that are more resilient and can adapt to changing technological advancements have bolstered demand for ATE-tested SiC and processing chipsets. The UK market is projected to reach USD 0.29 billion by 2026, while the Germany market is projected to reach USD 0.18 billion by 2026.

Middle East & Africa

Middle East & Africa is a potential region for ATE test center market due to its rising urban population and demand for advanced electronics in the modern artificial intelligence and virtual reality industry. Also, rising manufacturers' investments in African countries due to commercial advantages and a growing consumer base have expanded the long-term market size.

South America is set to grow at a subtle CAGR as its minimal domestic demand for electronics minimizes the potential expansion of automated test equipment demand in this region.

KEY INDUSTRY PLAYERS

Heavy Investment and Acquisitions by Key Players to Expand Market Reach

Key players proactively focus on revamping their market potential and strategies by conducting research and competitive analysis. Major players in the market are focusing on strategic decisions by heavily investing in raising potential with new ATE test centers and acquiring local businesses in the potential market. These strategic agreements help expand the market reach in the untouched regions and grow the market size.

- For instance, in March 2024, inTEST Corporation, a global innovative test and process technology solution provider, announced the acquisition of Alfamation SpA, a state-of-the-art test and measurement solution provider for the automotive, life sciences, and specialty semiconductors market. The acquisition is a strategic move to expand a sizable footprint in Europe.

List of Top Automated Test Equipment Companies:

- National Instruments (NI) (U.S.)

- Advantest (Japan)

- Chroma ATE (Taiwan)

- Roos Instruments (U.S.)

- Teradyne (U.S.)

- Xcerra Corporation (U.S.)

- Cohu Inc. (U.S.)

- Beijing Huafeng Test (China)

- Astronics Corporation (U.S.)

- TBG Solutions (U.K.)

- Mechatronics GmBH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Chroma ATE, a prominent ATE solution provider, launched an advanced parametric test technology called the Chroma 3530 parametric test system. The advanced test system is a paradigm shift to wafer testing. Each aspect reduces the cost per wafer, enhancing test quality and complete uncompromised coverage.

- May 2024: Advantest Corporation announced a new addition of power supplies for the V93000 EXA Scale SoC platform. The DC supply scale XHC32 offers 32 channels with a current of up to 640A. The equipment enables the card to efficiently address rapidly rising power requirements for AI, High-performance computing (HPC) chips, Graphical Processing Units (GPUs), and other high-current devices such as switches and high-end processors.

- December 2023: Advantest Corporation, a leading test solution provider, announced a collaboration with wireless solution provider Amarisoft to enable the users of Amarisoft 4G and 5G callboxes. This collaboration will leverage Advantest’s Micro Line Test (MLT) test management software. At the same time, Advantest provides operator-validated test plans for a comprehensive testing experience.

- October 2023: National Instruments (NI) and Teradyne, a leading test solution provider, announced real-time analytics enablement. This initiative will deliver a semiconductor analytics solution. The new enablement enhances robust architecture, analytical capabilities, and integrated support for ATE test platforms.

- January 2023: Litepoint, a leading wireless test solution provider, announced that the 5G test solutions received full automation from Qualcomm Development Acceleration Resources Toolkit (QDART). The FSM 100 5G RAN platform is a leading solution offering high performance and reliability while meeting indoor and outdoor deployment requirements.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Device Type, Application, and Region |

|

Segmentation |

By Device Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says the market is projected to reach USD 9.72 billion by 2034.

In 2025, the market was valued at USD 5.41 billion.

The market is projected to grow at a CAGR of 7.10% during the forecast period.

Integrated circuits are the leading device type segment in the market.

Electrification of automobiles and emphasis on EV adoption by the government to bolster the ATE market growth.

National Instruments (NI), Advantest, Chroma ATE, Roos Instruments, Teradyne, Xcerra Corporation, Cohu Inc., Beijing Huafeng Test, Astronics Corporation, TBG Solutions, and Mechatronics GmBH are the top players in the market.

Asia Pacific region generated the maximum revenue in 2025.

The automotive & transportation segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us