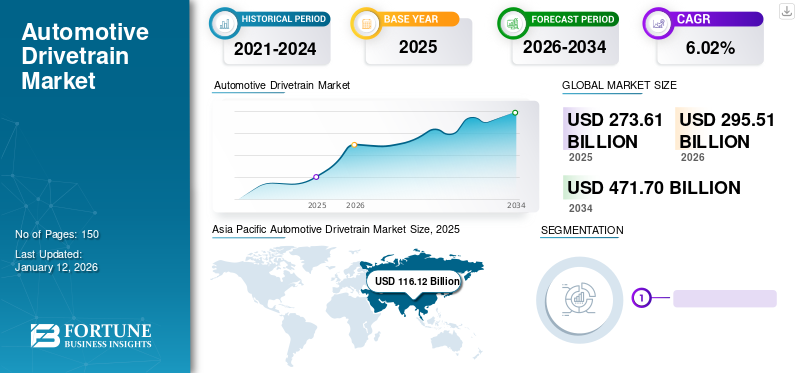

Automotive Drivetrain Market Size, Share & Industry Analysis, By Drive Type (Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All Wheel Drive (AWD)), By Vehicle Type (Passenger Cars, Commercial Vehicles, and Electric Vehicle), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global automotive drivetrain market size was USD 273.61 billion in 2025 and is projected to grow from USD 295.51 billion in 2026 to USD 471.7 billion in 2034 at a CAGR of 6.02% during the forecast period. Asia Pacific dominated the global market with a share of 42.44% in 2025. The Automotive Drivetrain Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 59.66 Billion By 2032

The drivetrain is a combination of parts of the vehicle that work together with an engine for the movement of wheels. This complete system also drives different parts of the car into motion. These components include differential, transmission, driveshaft, axles, constant velocity joints (CV joints), universal joints (U joints), and wheels.

The drivetrain connects the engine to the wheel, enabling the vehicle to move. As the engine starts running, the drivetrain transfers power through the transmission to drive wheel, which can be a rear-wheel, front-wheel, or all wheels. Modern passenger and commercial vehicles are equipped with all-wheel drive systems, although some models use front-wheel drive. In addition, motorcycle & e-mobility automotive drivetrain manufacturers are actively expanding their presence and business internationally by adopting new strategies and collaborations.

The COVID-19 pandemic impacted the global automotive drivetrain market by causing disruptions in supply chains, manufacturing operations, and consumer demand. Lockdown measures, economic uncertainties, and reduced vehicle production led to a temporary slowdown in automotive drivetrain market growth. However, the pandemic has also highlighted the importance of drivetrain technologies in enhancing vehicle efficiency and performance, driving the adoption of automotive electric drivetrain components market and hybrid drivetrains as automakers seek to meet sustainability goals and regulatory requirements.

Automotive Drivetrain Market Trends

Integration of AWD and 4WD Systems is the Current Ongoing Market Trend

The adoption of AWD and 4WD systems is expanding due to their benefits in enhancing vehicle stability, especially in adverse weather conditions. Traditionally associated with off-road and high-performance vehicles, these drivetrain configurations are now becoming more common in mainstream passenger cars and electric vehicles (EVs), driven by consumer demand for enhanced safety, traction, and driving dynamics. These systems distribute power to all four wheels, providing better traction and control compared to front-wheel drive (FWD) or rear-wheel drive (RWD) configurations. A 2023 study published in the International Journal of Automotive Technology noted that the implementing AWD systems in passenger cars can significantly reduce the risk of skidding and improve handling on slippery roads, leading to safer driving experiences.

Consumer preference for SUVs and crossover vehicles, which often come equipped with AWD or 4WD, plays a significant role in driving this trend. In 2023, global SUV sales continued to rise, with SUVs making up over 40% of total passenger car sales globally. This surge in popularity is particularly pronounced in markets such as North America and Europe, where consumers prioritize vehicle versatility and safety features. For example, in the U.S., SUV sales grew by 10% year-over-year in 2023, highlighting the growing demand for vehicles with AWD capabilities.

These systems can dynamically adjust power distribution to optimize performance and energy use. A 2024 paper in the Journal of Power Electronics highlighted that electric AWD systems could extend the driving range of EVs by optimizing torque distribution, thus reducing energy consumption.

Download Free sample to learn more about this report.

Automotive Drivetrain Market Growth Factors

Increasing Adoption of Electric Vehicles is a Major Driver for Market Expansion

Stringent emission regulations, government incentives, and growing consumer preference for sustainable transportation solutions are driving the shift toward EVs. This trend is reshaping the drivetrain market, which includes components such as transmission, driveshafts, and differentials that deliver power from the engine to the wheels.

Many countries have set ambitious targets for reducing greenhouse gas emissions, prompting a transition from internal combustion engine (ICE) vehicles to EVs. For instance, the European Union aims to cut emissions from new cars by 55% by 2030 compared to 2021 levels as part of the European Green Deal. Similarly, the U.S. has set a goal for 50% of all new vehicle sales to be electric by 2030. These regulatory pressures are compelling automakers to accelerate the development and production of EVs, which in turn is boosting the demand for advanced drivetrain technologies.

Automotive drivetrain systems in EVs differ from those in traditional ICE vehicles. EVs typically use single-speed transmissions unlike the multi-speed transmissions used in ICE vehicles. This simplification, combined with the higher efficiency and torque characteristics of electric motors, necessitates advancements in drivetrain technology. Automakers are investing in lightweight materials and innovative designs to enhance the efficiency and performance of EV drivetrains. For example, Tesla's Model S Plaid, launched in 2021, features a tri-motor setup with advanced torque vectoring capabilities, demonstrating the cutting-edge drivetrain innovations in the EV sector.

Additionally, research aimed at improving battery efficiency and reducing costs is complementing drivetrain advancements. For instance, a study published in the Journal of Power Sources in 2023 highlights significant improvements in battery technology, which directly impacts the drivetrain's efficiency and overall vehicle performance. These advancements are crucial for making EVs more competitive with traditional vehicles in terms of range, cost, and performance.

RESTRAINING FACTORS

Associated High Costs and Fluctuating Raw Material Prices May Restrain Market Growth

Limited availability and high cost of raw materials required for electric vehicle (EV) batteries, particularly rare earth metals such as lithium, cobalt, and nickel, represent crucial restraints for the market. As of 2024, the demand for EVs continues to rise, driven by environmental regulations and consumer preferences for cleaner, more sustainable transportation options. However, the supply chain for raw materials used in EV batteries faces challenges such as geopolitical tensions, mining regulations, and labor disputes, leading to supply fluctuations and price volatility.

According to industry reports, the prices of key raw materials such as lithium and cobalt have surged in recent years due to increasing demand from the EV industry and limited production capacity. For instance, lithium prices rose by over 100% between 2020 and 2024, while cobalt prices more than doubled during the same period. These price hikes increase the manufacturing cost of EV batteries and pose risks of supply shortages and production delays for automakers.

Addressing the issues of raw material scarcity and cost required in the investment of alternative battery chemistries with reduced reliance on rare earth metals, as well as efforts to diversify the supply chain and promote recycling initiatives. Additionally, advancements in battery technology and manufacturing processes aimed at reducing material usage and improving efficiency could alleviate the constraints faced by the automotive drivetrain market. Failing to address these challenges may hinder the widespread adoption of electric vehicles and impede the global automotive drivetrain market growth.

Automotive Drivetrain Market Segmentation Analysis

By Drive Type Analysis

Higher Efficiency and Cost Effective Property Makes Front Wheel Drive Segment Dominate Market

On the basis of type, the market is segmented into Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All Wheel Drive (AWD).

The front wheel drive segment is anticipated to hold the largest market share of 49% in 2026. Front wheel drive is extremely efficient in terms of cost compared to other drive types and offers many benefits such as reduced mass, efficient use of space, fuel consumption, absence of friction from the driveshaft, and balanced weight distribution for better traction. Many passenger cars globally delpoy these drives and manufacturers also prefer them owing to cheaper manufacturing cost, space efficiency, and sporty performance characteristics.

RWD is majorly found in school buses, minivans, full-size pick-ups, truck-based SUVs, high-performance cars, sport & premium vehicles, sedans, and light commercial vehicles. Moreover, many sports cars and luxury vehicles prefer RWD system that allows a better balance of weight. It was also majorly preferred in the early days of motoring, and it is capable of handling rear wheels in bad weather conditions. Furthermore, rising sales of luxury vehicles and growth in the trucking industry will propel the RWD drivetrain automotive supercenter in the future.

The AWD drive type offers inherent traction advantage in all conditions by distributing power to each wheel, enhancing staybility in rapidly changing environment and improving traction on snow and wet roads. It is commonly used for SUVs, cars, and minivans. With the rising electric vehicle sales and the preference of companies and consumers for AWD in upcoming vehicles, there is anticipated strong demand for AWD type systems in the future.

To know how our report can help streamline your business, Speak to Analyst

By Vehicle Type Analysis

Passenger Car Segment Holds Largest Market Share due to Increasing Urban Population, and Commuting Needs

Based on vehicle type, the market is segmented into passenger cars, commercial vehicles, and electric vehicle.

The global market is dominated by passenger car segment which also holds the largest share of 66.67% in 2026. This is due to various factors, including rising industrialization, increasing urban population, and commuting needs. Moreover, presence of a large number of vehicle, rising disposable incomes, and changing consumers' preference toward adopting advanced cars are altogether responsible for the rising automotive drivetrain market share. Further, rising economic conditions, increasing disposable income of individuals, rapid urbanization, and expanding higher class population sections are boosting consumer spending on luxury items, further propelling growth in the passenger car segment.

In regards to product choice and revenues, the commercial vehicle segment is booming. Many drivetrain manufacturers catering to medium and heavy commercial vehicles (MCV and HCV) are focusing on AWD for vehicles with higher power capacity. Therefore, the commercial vehicle segment is projected to rise subsequently over the projected period.

The rising adoption of BEV and HEV vehicles across the globe and development related to its components, including electric drive systems, transmissions, and powertrain units is accelerated due to players' active involvement. Moreover, the rising concern over increasing environmental pollution and their low operating costs will propel the EV-based drivetrain in the coming years.

REGIONAL INSIGHTS

Based on geography, the market is studied across Asia Pacific, Europe, North America, and the rest of the world.

Asia Pacific Automotive Drivetrain Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific stood at USD 116.12 billion in 2025 and increased to USD 125.69 billion in 2026, emerging as the fastest-growing region. It is also expected to dominate the global market along with the highest CAGR. A significant factor contributing to the growth of this region is the presence of automotive manufacturers, strong supply chain, and supportive government policies. Furthermore, high population and economically strong countries such as China and India, accounting for more than 45% of the global population are expected to promote market expansion. Favourable governmental measures aimed at reviving the auto industry post- COVID-19 further bolstered its growth. Furthermore, rising sales of AWD vehicles and expected growth in EVs and ICE vehicle sales in South Asia drives market expansion. High urbanization and development of smart cities are anticipated to propel the automotive market growth. The Japan market is projected to reach USD 14.92 billion by 2026, the China market is projected to reach USD 68.53 billion by 2026, and the India market is projected to reach USD 12.24 billion by 2026.

Europe holds the second-largest position in the market with Germany leading as primary hub for major auto manufacturers in the region. Furthermore, they are early adopters of new trends and technologies, with Germany also ranking as the second-largest manufacturing hub for auto parts across the world. The rapid adoption of EVs in Norway, Germany, the U.K., and the Netherlands is responsible for the growth of market in Europe. The UK market is projected to reach USD 12.91 billion by 2026, while the Germany market is projected to reach USD 23.41 billion by 2026.

North America is projected to be the third-largest in the global market for automotive drivetrain due to rising sales of vehicles and increasing consumer preference for comfortable driving experiences and pollution-free commuting. Furthermore, the regional government is actively looking into the development relating to automotive components, which will support and promote manufacturing capabilities and contribute to the growth of the market. The US market is projected to reach USD 42.24 billion by 2026.

The rest of the world consists of Latin America and the Middle East & Africa. The Middle East is projected to contribute considerably to market growth, fueled by rising import and increasing luxury vehicle sales in the region.

KEY INDUSTRY PLAYERS

Investing in Advancing Technologies to Make Comprehensive Product Portfolio Makes ZF Friedrichshafen AG the Leading Player

ZF Friedrichshafen AG, headquartered in Germany, is considered as the leading market player in the global market due to its comprehensive product portfolio, advanced technology, and extensive global presence. ZF offers a wide range of automotive drivetrain solutions, including advanced automatic transmissions, electric drive systems, and hybrid technologies. This extensive range allows ZF to cater to various segments, from passenger cars to commercial vehicles and electric vehicles, providing integrated solutions that meet diverse market needs.

ZF invests heavily in research and development to drive innovation in drivetrain technology. The company's focus on electrification and automation, including the development of highly efficient electric axle drives advanced transmission systems, keeping it at the forefront of the industry. In 2023, ZF unveiled its next-generation electric drive units, which offer improved efficiency and performance, further solidifying its market position. With manufacturing and R&D facilities across the globe, ZF can serve regional markets effectively, ensuring proximity to key automotive hubs. This global reach allows the company to respond quickly to market demands and leverage local advantages, enhancing its competitive edge.

According to a 2023 study, ZF reported a 12% increase in revenue from its driveline technology segment, reflecting its strong market position and ongoing innovation. Additionally, the company's strategic partnerships and collaborations with major automakers enable the company to influence and stay ahead in the evolving market.

List of Top Automotive Drivetrain Companies:

- Aisin Seki Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- ZF Friedrichshafen AG (Germany)

- Dana Limited (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- Schaeffler AG (Germany)

- BorgWarner Inc. (U.S.)

- GKN Automotive (U.K.)

- Suzhou Inovance Automotive Co., Ltd. (China)

- JTEKT Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2024- Subaru and Toyota Group's Aisin collaborated on developing a next-gen EV drivetrain. The new EV drivetrains developed with Toyota Group supplier Aisin, will be lightweight, compact, and designed for Subaru's rugged, all-weather driving signature.

- February 2024- Magna received a contract from a North America-based OEM to supply a specialized primary rear eDrive system for one of the company’s high-end niche vehicle platforms. The highly complex system, a variant of Magna’s 800V eDS Duo, delivers exceptional power and performance of 726 kW of power and 8,000 Nm of torque. It integrates two e-motors, two inverters, and two gearboxes into a single package.

- December 2023- ATC Drivetrain, a remanufacturer of automotive drivetrain technology, invested around USD 7.9 million to build a new electric vehicle-focused facility in Holland.

- November 2023- BAE Partners With Eaton to improve medium duty trucks with electric drivetrains. This collaboration aimed to develop advanced, efficient, and sustainable solutions for medium-duty commercial vehicles, which are essential for various pick-up and delivery applications.

- November 2023- Hyundai and Kia revealed a new universally adaptable drivetrain system called the ‘Uni Wheel’, aimed to change both personal and commercial mobility. The innovative system integrates existing drivetrain technology re-engineered to move the main drive system components to the vacant area within a car’s wheel hub.

REPORT COVERAGE

The global market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth over recent years.

An Infographic Representation of Automotive Drivetrain Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.02% from 2026 to 2034 |

|

Unit |

Value (USD billion), Volume (Units) |

|

Segmentation |

By Drive Type

|

|

By Vehicle Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 273.61 billion in 2025. The market is projected to grow to USD 471.7 billion by 2034

In 2025, Asia Pacific stood at USD 116.12 billion.

The market is projected to grow at a CAGR of 6.02% and will exhibit steady growth during the forecast period.

The passenger car segment is the leading segment in this market.

The increase in automotive sales, growing urbanization, and rising demand for safety & comfort, along with high-powered engines, have propelled the demand for new vehicles, which drives the market growth.

ZF Friedrichshafen AG is the leading player in the global market.

Asia Pacific dominated the market share in 2025.

The increasing advancement in the engine system and rising production of AWD vehicles are expected to drive market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic