AUV & ROV for Offshore IRM Market Size, Share & Industry Analysis, By Type (ROV {High Capacity Electric Vehicle, Small Vehicle, Heavy Work-Class Vehicle, and Work-Class Vehicle}, AUV {Man-portable, Light Weight Vehicle, and Heavy Weight Vehicle}), By Water Depth (Shallow Water, Deep Water, and Ultra-deepwater), By Application (Offshore Renewable, Oil & Gas, Aquaculture, Security & Defense, Scientific/Institutional Survey, and Others), and Regional Forecast, 2026-2034

AUV & ROV for Offshore IRM Market Size

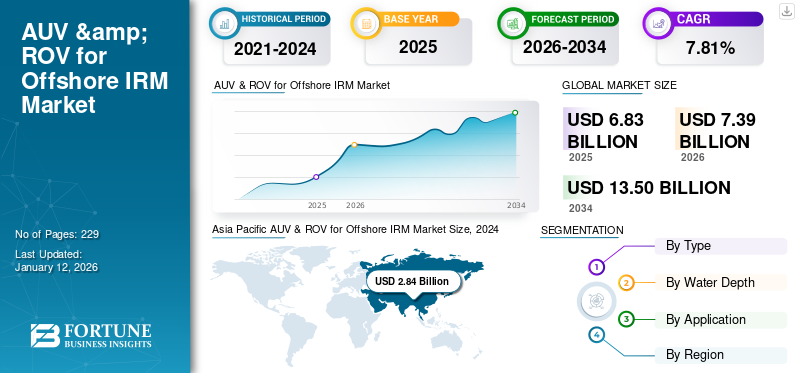

The global AUV & ROV for offshore IRM market size was valued at USD 6.83 billion in 2025 and is projected to grow from USD 7.39 billion in 2026 to USD 13.50 billion by 2034, exhibiting a CAGR of 7.81% during the forecast period. Asia Pacific dominated the global market with a share of 46.36% in 2025. The Auv & rov for offshore irm market in the U.S. is projected to grow significantly, reaching an estimated value of USD 807.53 million by 2032.

Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) have become integral tools in the realm of offshore inspection, repair, and maintenance (IRM). These advanced robotic systems offer unparalleled capabilities for navigating and exploring the intricate underwater infrastructure of offshore installations such as oil rigs, pipelines, and subsea cables. AUVs, equipped with sophisticated sensors and mapping technologies, autonomously traverse the underwater terrain, collecting high-resolution data and images. Their ability to operate independently without direct human control makes them ideal for surveying expansive areas efficiently and cost-effectively.

On the other hand, ROVs, controlled by human operators from a surface vessel, provide intricate manoeuvrability and agility for performing precise tasks such as repairs, maintenance, and intricate inspections at great depths. Equipped with cameras, manipulator arms, and various tools, ROVs enable real-time visual assessment and intervention in complex underwater scenarios where human access is impossible or hazardous. Together, Autonomous underwater vehicles (AUVs) and ROVs complement each other in offshore IRM operations. AUVs conduct initial surveys, mapping the underwater terrain and identifying potential issues, while ROVs undertake targeted interventions based on the data gathered.

The COVID-19 outbreak negatively impacted the AUV & ROV for offshore IRM market. The pandemic led to disruptions in supply chains, project delays, and a decline in oil prices, profoundly affecting the offshore industry. According to the International Energy Agency, the demand for crude oil dropped by more than 30 million barrels of oil in early April 2020. In addition, it was reported that the West Texas Intermediate (WTI) benchmark of crude oil prices dropped to around USD –37.63 per barrel at one point on 20th April 2020. Restrictions on travel and on-site operations hindered planned maintenance schedules and new project commencements, leading to reduced demand for AUV & ROV services.

AUV & ROV for Offshore IRM Market Trends

Rising Focus on New Renewable Energy Sources to Provide Lucrative Opportunities

The expansion of offshore renewable energy sources, particularly offshore wind farms, has led to the construction of complex and expansive underwater infrastructure. Governments of different countries such as the U.K., China, the U.S., and other developing nations have been focusing on deploying wind farms offshore to generate maximum electricity due to the availability of high wind speed and the presence of abundant areas for constructing extremely tall wind turbines. For instance, in 2023, India announced to setup about 4GW of offshore wind energy on the Tamil Nadu coast.

Offshore wind farms consist of extensive subsea structures such as turbines, foundations, power cables, and substation infrastructure situated in challenging marine environments. AUVs and ROVs play a crucial role in conducting detailed inspections of these structures, identifying potential issues, and ensuring their efficient operation. Thus, the expansion of offshore renewable energy projects worldwide would provide an opportunity, consequently propelling the AUV & ROV for offshore IRM market growth during the forecast period.

Download Free sample to learn more about this report.

AUV & ROV for Offshore IRM Market Growth Factors

Increasing Demand for Offshore Oil & Gas Exploration to Surge the Demand for AUVs and ROVs

The limited presence of oil & gas reserves and their continuous consumption have stressed the governments of the countries to increase the research & development for the discovery of additional oil & gas reserves. According to the BP Statistical Review of World Energy 2021, the total proven oil reserves across the globe are around 1732.4 thousand million barrels. The surging consumption of oil & gas energies across the globe due to the rising population, urbanization, and industrialization has also led to an increase in oil & gas exploration activities worldwide.

According to the U.S. Energy Information Administration’s (EIA)- International Energy Outlook 2023 (IEO2023), the global supply of crude oil, other liquid hydrocarbons, and biofuels is expected to last through 2050 as per the ongoing consumption rate. Thus, there is an immediate need for research & development to discover additional oil & gas wells. The discovery of the additional oil & gas reserves would be beneficial for promoting sustainability and catalyzing the high energy demand until the full operation of renewable energy meets 100% of the energy demand. Thus, the growing exploration of oil & gas in offshore locations has increased the size and sophistication of offshore installations, subsequently leading to the expansion of AUV & ROV AUV & ROV for offshore IRM market.

Advancements in Autonomous Technologies and Sensor Systems to Boost the AUV & ROV for Offshore IRM Market Growth

Advancements in autonomous technologies and sensor systems represent a significant growth driver for AUV & ROVs for offshore IRM market. These advancements have revolutionized the capabilities of AUVs and ROVs, making them more efficient, reliable, and adaptable for a wide range of offshore operations.

The integration of sophisticated autonomous features enables these vehicles to operate with minimal human intervention, performing tasks in complex and challenging underwater environments. Advanced autonomy allows for improved navigation, obstacle avoidance, and adaptive decision-making capabilities, enabling AUVs and ROVs to execute missions with increased precision and efficiency.

Moreover, the evolution of sensor systems has been pivotal in enhancing the capabilities of AUVs and ROVs. Modern sensor technologies include high-resolution cameras, sonars, LiDAR, multi-beam echo sounders, and various environmental sensors. These sensors enable comprehensive data collection, facilitating detailed inspections, precise mapping of underwater structures, and real-time monitoring of environmental conditions such as temperature, pressure, and chemical composition. Hence, the advancement in integrated technology in the AUV & ROV is driving their adoption in the allied industries.

RESTRAINING FACTORS

High Initial Investment Costs May Hinder the Market Growth

The high initial investment costs associated with the purchase and deployment of autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) have emerged as a restraining factor in the offshore inspection, repair, and maintenance (IRM) industry. These costs encompass various components, including the procurement of the vehicles, specialized equipment, advanced sensor systems, training, and ongoing maintenance. The initial purchase of AUVs and ROVs involves substantial capital investment due to their sophisticated technology, specialized design, and robust construction to withstand harsh underwater conditions. In addition, outfitting these vehicles with advanced sensor arrays, manipulators, cameras, and other necessary equipment adds to the overall acquisition cost. Furthermore, the need for specialized software for data processing and analysis also contributes to the initial investment.

For many organizations, especially smaller companies or those entering the offshore IRM market, the high upfront costs can act as a restraining factor to entry or expansion. Therefore, these companies tend to stick toward the traditional approaches of IRM in the offshore sector.

AUV & ROV for Offshore IRM Market Segmentation Analysis

By Type Analysis

ROV Segment Registered the Dominant Share Owing to the Ability to Execute Complex Operations

Based on type, the AUV & ROV for offshore IRM market is segmented into ROV and AUV.

The ROV segment further includes high capacity electric vehicle, small vehicle, heavy work-class vehicle, and work-class vehicle. The ROV segment held a dominant part in the AUV & ROV for offshore IRM market share owing to their wide utilization in IRM tasks that require human operators for real-time controlling and manipulation. ROVs have also gained preference due to their ability to execute complex manipulations using robotic arms, tools, and sensors, making them suitable for detailed and precise work.

By Water Depth Analysis

Deep Water Segment Holds the Major Share Due to Vast HydroCarbon Potential

Based on water depth, the AUV & ROV for offshore IRM market is segmented into shallow water, deep water, and ultra-deepwater.

The deep water segment, which includes water ranging from a depth of 200 meters to around 2,000 meters, holds the major share in the AUV & ROV for offshore IRM market because of the large presence of the oil & gas infrastructures. Deepwater also has huge hydrocarbon potential and includes less drilling and exploration expenses than ultra-deepwater.

The ultra-deepwater is also gaining traction in the market to discover more oil & natural gas reserves. The technological advancement and growing research & development in this field are assisting in the segment growth.

Furthermore, the shallow water segment is growing at a considerable rate in the market due to the rising deployment of offshore renewable energies such as floating solar, wind turbines, and tidal energy. The expansion of aquaculture activities is also driving the segment's growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Oil & Gas Segment Accounts for a Major Share Due to Vast Presence of Offshore Infrastructures and High IRM Requirements

Based on application, the AUV & ROV for offshore IRM market is segmented into offshore renewable, oil & gas, aquaculture, security & defense, scientific/institutional survey, and others.

The oil & gas is one of the major segments and holds the dominant share in the market owing to the vast presence of offshore oil & gas infrastructures such as rigs, pipelines, manifolds, control systems, and others.

Moreover, offshore renewable infrastructures consisting of wind turbines, floating solar, and tidal power are gaining traction across the globe for reducing carbon emissions and meeting the net zero carbon emissions target by 2050. In addition, the growing investment in the defense sector by countries across the globe to increase the country’s military power and cater to the growing geopolitical tensions around the world has boosted the adoption of AUV and ROV in the security & defense sectors.

REGIONAL INSIGHTS

Geographically, the AUV & ROV for offshore IRM market is studied across North America, Europe, the Asia Pacific, and the rest of the world.

Asia Pacific AUV & ROV for Offshore IRM Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 3.17 billion in 2025 and USD 3.53 billion in 2026. The Asia Pacific market for AUV & ROV for offshore IRM holds the maximum share owing to the rapid development taking place in the offshore oil & gas infrastructures and renewable energies development. According to the Global Wind Energy Council, the global offshore wind industry is forecast to add 380GW of capacity by 2032, nearly half of which will come from the APAC.

Europe market for AUV & ROV for offshore IRM holds a considerable share due to the rapid development in tidal energies, offshore wind energies, and floating solar PV. There has been rapid development in offshore renewable energies in Europe after the COVID-19 pandemic. The European Union has also laid targets such as wave and tidal to reach 100 MW in the EU by 2025 and around 1 GW by 2030.

The rest of the world's regions are expected to witness growth during the forecast period. The rest of the world, comprising the Middle East & Africa and Latin American countries, has shown gradual growth in the market. The extensive presence of offshore oil & gas infrastructures in the Middle East & African countries have been the primary reasons for the increasing adoption of AUV & ROV in this region. The Middle East & Africa region consists of nearly 38.4% of the world's total proven natural gas reserves of 6,951.8 trillion cubic feet (tcf) in 2018, among which most of the exploration sites are located offshore.

The Middle East & Africa region consists of the most hydrocarbon reserves and production capacity across the globe. According to the Organization of the Petroleum Exporting Countries (OPEC), 80.4% (1,241.82 billion barrels) of the world's proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle East, amounting to 67.1% of the OPEC total. Thus, the requirement for AUV and ROV has been on the rise in this region for IMR purposes in offshore infrastructures.

Key Industry Players

Fugro Is One Of The Major Players Active In The Market As It Caters To The Oil & Gas And Offshore Renewable Energy Sectors

There are several players operating in the market like Oceaneering International, Fugro, Sapura Energy, James Fisher & Sons, etc. Oceaneering is one of the key players active in the market. It is one of the largest manufacturer and operator of work class ROV systems. Oceaneering’s ROV fleet includes deepwater work class systems and ultra-deepwater search and rescue systems. Fugro is also one of the major players active in the market as it caters to the oil & gas and offshore renewable energy sectors.

- For instance, in April 2023, one of the first fully remote inspections of offshore wind farm assets was carried out by Fugro, using one of its Blue Essence uncrewed surface vessels (USVs) with Blue Volta, an electrical remotely operated vehicle. Vattenfall and Offshore Renewable Energy Catapult jointly funded the inspection at the Aberdeen offshore wind farm in the North Sea. This collaboration gives innovators in the offshore wind supply chain the opportunity to test and prove technologies in real-world conditions to support innovation in operations & maintenance.

LIST OF TOP AUV & ROV FOR OFFSHORE IRM COMPANIES PROFILED:

- Fugro (Netherlands)

- Bluestream (Netherlands)

- James Fisher and Sons plc. (U.K.)

- Boskalis (Netherlands)

- ROVCO (England)

- Sapura Energy Berhad (Malaysia)

- Saab Seaeye Ltd (U.K.)

- TechnipFMC (U.K.)

- Oceaneering International, Inc. (U.S.)

- Nexxis (U.S.)

- Baker Hughes (U.S.)

- Aker Solutions (Norway)

- STAPEM Offshore (France)

- Forum Energy Technologies, Inc. (U.S.)

- Saipem (Italy)

- Subsea 7 (U.K.)

- Utility ROV Services (Scotland)

- Orca Maritime, Inc. (U.S.)

- DeepOcean (Norway)

- IKM Subsea (Norway)

- ROVOP (U.K.)

- Nauticus Robotics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 - Oceaneering International, Inc., announced that Oceaneering Australia secured an Inspection, Maintenance, and Repair (IMR) and Survey contract from a major Australian energy company. Oceaneering will carry out IMR and survey work scopes that include the provision of remotely operated vehicle (ROV) and survey personnel and equipment, subsea inspection, onshore project management and engineering, data processing and associated deliverables, photogrammetry, and onshore ROV video streaming for remote inspections.

- June 2023- Saipem was awarded two new contracts, one for EPCI offshore activities in the Middle East and the other for the development of underwater drones in Brazil. The total value of the new contracts is approximately USD 1 billion. Under the existing Long-Term Agreement (LTA) with Saudi Aramco, Saipem has been selected for a new offshore project. The scope of work involves the engineering, procurement, construction, and installation of five platforms and associated subsea pipelines, flowlines, and cables in the Marjan field offshore Saudi Arabia, featuring "an entirely in-Kingdom fabrication scheme.

- June 2023 - Sapura Energy Berhad and its group of companies (“the Group”) announced that its Engineering and Construction (E&C), Drilling, and Operations & Maintenance (O&M) business segments through its wholly-owned subsidiaries have secured 10 contract wins across the Asia Pacific and Atlantic regions between December 2022 to May 2023. The E&C business segment secured RM979 million in contract wins, Drilling RM352 million, while O&M secured RM34 million, amounting to a combined value of about RM1.4 billion. More than 70 per cent of the combined contract value is from projects outside of Malaysia.

- February 2023 - Oilfield services giant Baker Hughes scored a "major" contract to provide subsea equipment and services for the Angolan company Azule Energy's Agogo offshore oilfield. Azule Energy is the Angolan joint venture of oil companies BP and Eni. For Baker Hughes, the scope of work includes 23 standard subsea trees, 11 Aptara manifolds, SemStar5 fiber optic controls, and the related system scope of supply. Baker Hughes will also provide services and aftermarket support for the Agogo integrated west hub subsea production system.

- February 2022 - PaleBlue delivered a modern ROV Engineering Simulator to Aker Solutions. This simulator will help Aker Solutions to simulate the behaviour of the underwater robots (ROVs) in a controlled environment, performing accessibility checks for the underwater oil & gas installations. The PaleBlue ROV Design product integrates with a wide range of CAD data. The geometry data is imported right into the editing solution and can be optimized and manipulated in a number of ways.

The link for the first industry development in the box cannot be accessed. Please cross-check and rectify

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.81% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Water Depth

By Application

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 6.83 billion in 2025.

The global market is projected to grow at a CAGR of 7.81% over the forecast period.

The Asia Pacific market size stood at USD 3.17 billion in 2025.

Based on application, the oil & gas segment holds a dominating share in the global market.

The global market size is expected to reach USD 13.50 billion by 2034.

The increasing demand for offshore oil & gas exploration is one of the key factors propelling the market growth.

Fugro, Saab Seaeye Ltd., Oceaneering International, Inc., and Sapura Energy Berhad are some of the top/key players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us