Bio-Decontamination Market Size, Share & COVID-19 Impact Analysis, By Product (Equipment and Consumables), By Agent (Hydrogen Peroxide, Chlorine Dioxide, Peracetic Acid, and Nitrogen Dioxide), By Type (Chamber Decontamination and Room Decontamination), By End-user (Pharmaceutical & Medical Device Manufacturers, Contract Manufacturing and Research Organizations, Hospitals & Healthcare Facilities, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

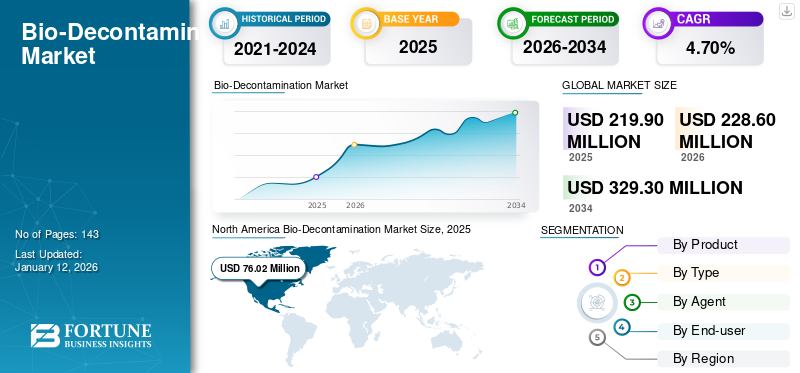

The global bio-decontamination market size was valued at USD 219.9 million in 2025 and is projected to grow from USD 228.6 million in 2026 to USD 329.3 million by 2034, exhibiting a CAGR of 4.70% during the forecast period. North America dominated the bio-decontamination market with a market share of 34.60% in 2025.

Bio-decontamination is a process of eliminating harmful micro-organisms using physical and chemical methods. The process is an inevitable step performed in various healthcare settings and manufacturing facilities to prevent the transmission of micro-organisms and control infection. Pharmaceutical & medical device manufacturing companies, research organizations, and hospitals are heavily investing in these processes to provide sterile end products. Thus, the rising demand from various drug and medical device developers is augmenting the sales of these products.

Furthermore, the growing implementation of stringent regulations in hospitals and healthcare facilities by governments to prevent contamination in pharmaceutical products, integration of new technologies in the products, and increasing product launches are the other factors propelling the market’s growth.

- For instance, in 2021, Amira Srl Unipersonale launched Bioreset Max, a lightweight and compact hydrogen peroxide vapor generator for bio-decontamination. The device can automatically adjust the hydrogen peroxide at an optimal level of efficacy.

Global Bio-Decontamination Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 219.9 million

- 2026 Market Size: USD 228.6 million

- 2034 Forecast Market Size: USD 329.3 million

- CAGR: 4.70% from 2026–2034

Market Share:

- North America dominated the bio-decontamination market with a 34.60% share in 2025, driven by the increasing number of hospital admissions, a rising incidence of hospital-acquired infections, and growing emphasis of healthcare facilities and pharmaceutical companies on effective decontamination processes.

- By product, the equipment segment is expected to retain its largest market share owing to technological advancements, stringent infection control regulations, and the rising demand for automated and efficient decontamination systems in healthcare and pharmaceutical manufacturing environments.

Key Country Highlights:

- United States: Growing number of surgical procedures and hospital-acquired infections has intensified the adoption of advanced decontamination solutions across healthcare facilities and pharmaceutical manufacturing units.

- Europe: Expansion of pharmaceutical and medical device companies, rising disease burden, and strategic initiatives by key players to introduce advanced decontamination technologies are driving market growth.

- China: Increasing pharmaceutical and medical device production capacities, coupled with heightened awareness regarding infection control measures, is boosting demand for bio-decontamination systems.

- Japan: Focus on ensuring aseptic environments in healthcare and research facilities, along with growing investments in advanced sterilization and decontamination technologies, is contributing to market expansion.

COVID-19 IMPACT

Market Witnessed Strong Growth Amid Pandemic Owing to Increase Product Demand for Disinfection

The COVID-19 pandemic accelerated the demand for these products for sterilization and disinfection purposes across pharmaceutical & biotech companies, research organizations, and others. The pandemic compelled the pharmaceutical and biotech companies to focus more on the steps for decontamination to minimize the risk of cross-contamination in their products, which simultaneously increased the demand for bio decontamination solutions. Furthermore, the outbreak highlighted the importance of proper decontamination processes in hospitals, clinics, and other healthcare facilities to reduce the risk of acquiring Hospital-Acquired Infections (HAIs). Therefore, this led to a surge in the demand for and adoption of decontamination products.

Also, the key players operating in the market witnessed stellar growth in their revenues during the pandemic due to an increase in their product sales. For instance, TOMI Environmental Solutions, Inc. witnessed revenue growth of about 249.3% in 2020 as compared to 2019.

However, the market developed at a normal pace during the post-pandemic period due to various factors, such as the utilization of pre-stocked products, an increase in surgical procedures, and a rising focus on reducing cases of surgical site infections, among others. For instance, TOMI Environmental Solutions, Inc. witnessed revenue growth of 7.5% in 2022 as compared to that of 2021, as the demand decreased after the pandemic.

Bio-Decontamination Market Trends

Integration of Advanced Technologies into Products

The companies operating in this market are increasing their focus on integrating new and advanced technologies to increase the efficiency of these systems. They are heavily investing in and launching advanced systems that can be used in aseptic pharmaceutical manufacturing conditions. The availability of advanced products is increasing their demand among consumers, thereby promoting market growth.

- In September 2023, Telstar introduced a new Safety Airlock System (SAS) range with its previously launched ionHP+ (ionized Hydrogen Peroxide) bio-decontamination system. The SAS unit integrated with the system allows users to achieve a log 6 reduction in bioburden. Furthermore, the ionHP technology minimizes the degradation of construction materials as it requires a low concentration of hydrogen peroxide, unlike the conventional systems.

Download Free sample to learn more about this report.

Bio-Decontamination Market Growth Factors

Rising Focus by Pharmaceutical & Medical Device Manufacturers on Launching New Products Will Augment Market Growth

The rising prevalence of various chronic disorders, increasing expenditure on healthcare, and growing diagnosis rates of these diseases are creating a large patient pool requiring proper treatment. To cater to the needs of a rising patient population, manufacturers are increasing their production capacities. Furthermore, they are also outsourcing their drug manufacturing processes to Contract Development and Manufacturing Organizations (CDMOs) or Contract Manufacturing Organizations (CMOs) to reduce the turnaround time for drug development. Regulatory organizations are imposing strict regulatory approval guidelines for the drugs manufactured by these organizations to check their safety. These factors are increasing the adoption of these products among drug developers.

Also, the rising approval of various innovative drugs by regulatory bodies has compelled manufacturers to focus on developing new drugs while considering all the safety guidelines.

- For instance, according to the U.S. FDA, about 53 novel drugs were approved in 2023, compared to 2022, when only 37 new drugs were approved.

Growing Prevalence of Nosocomial Infections to Raise Product Adoption

The rising concern regarding hospital-acquired infections and the increasing burden of these diseases are some of the major factors boosting the demand for sterilization products among healthcare facilities.

- According to the data published by the World Health Organization (WHO), an estimated 24% of patients worldwide are affected by hospital-acquired infections.

To mitigate the rising cases of hospital-acquired infections, hospitals are shifting their focus to increase their spending on bio decontamination services. They are partnering with key manufacturers, which is likely to augment market growth. For instance, in June 2018, Bioquell completed a 6-log decontamination process of a newly constructed hospital, Sidra Medicine, in Qatar.

Thus, the rising burden of infections and the growing focus on launching new and safe medical devices and drugs are the key factors driving the market growth.

RESTRAINING FACTORS

Rising Number of Product Recalls Coupled with Its Limitations to Hamper Market Growth

Despite the launch of various technologically advanced decontamination products, the increase in voluntary recalls of a few products due to damaged or hampered quality is projected to limit their adoption. This may further lead to shifting consumer preference toward other products available in the market, thus hindering the market growth in the coming years.

- For instance, in December 2022, Steris Corporation initiated a voluntary recall of its VERIFY Dual Species Self-Contained Biological Indicators, 100 per box Item Number: S3061, as the spores of G. stearothermophilus and B. atrophaeus were inconsistent and gave false-negative results. Thus, due to the hampered product quality, the lot was recalled by the manufacturer.

Additionally, a few limitations associated with these products or systems, such as the short shelf life of certain disinfectants, possible corrosion from chlorine-based products, and others, will also limit market growth.

Bio-Decontamination Market Segmentation Analysis

By Product Analysis

Equipment to Dominate Market Owing to Various Technological Advancements

Based on product, the market is segmented into equipment and consumables.

The equipment segment held the largest bio-decontamination market share in 2026, driven by rising demand for decontamination processes across healthcare facilities, accounting for 80.23% of the market with a size of USD 183.4 Million. Furthermore, the implementation of strict regulations by the government authorities to minimize the cases of infections in hospitals has also supported the adoption of these products.

In addition, the companies in this market are investing their resources in developing and launching technologically advanced decontamination systems for life sciences and biotechnology companies. This is also expected to bolster the segment’s growth in the coming years.

- For instance, in May 2022, Delox, a company based in Portugal, secured USD 788,643.5 from public and private investments to reach approximately USD 1.4 million in funding since its inception. Through this fund, the company aimed to launch its patented novel bio-decontamination system.

The consumables segment will grow at a steady rate during the forecast period. The wider availability of consumables, increasing launch of different products, and rising adoption of these procedures by healthcare, drug & medical device manufacturers, and research organizations, among others, are some of the major factors supporting the growth of the segment.

- For instance, in February 2020, Advanced Sterilization Products (ASP) received the U.S. FDA clearance for a biological indicator, Sterrad Velocity. The indicator gives results in 15 minutes and is designed to assess the outcome of the hydrogen peroxide sterilization process.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Rising Emphasis on Aseptic Drug Manufacturing Processes to Augment Adoption of Chamber Decontamination

Based on type, the market is segmented into chamber decontamination and room decontamination.

The chamber decontamination segment held a dominant share of the market in 2026, accounting for 55.03% of the market with a size of USD 125.8 million. The growing emphasis by drug manufacturing facilities to improve bioburden control due to material transfer is increasing the adoption of chamber decontamination systems.

Additionally, many research facilities are adopting the chamber decontamination method to minimize the bioburden on incoming materials from animal holding areas to ensure consistency in research results and improve animal well-being. Furthermore, the market players are launching various decontamination chambers to sterilize medical devices, further propelling the segment's growth.

- For instance, in June 2020, Orbitform Medical developed and launched a UVC bio-decontamination chamber to disinfect the N-95 masks.

The room decontamination segment is projected to record a steady CAGR during the forecast period. The increasing adoption of the room decontamination method to minimize the risk of hospital-acquired infections and surgical site infections among patients is one of the key factors augmenting the segment’s growth. The launch of new and technologically advanced products to increase the efficiency of room decontamination is also contributing to the segment’s growth.

- For instance, in May 2019, Bioquell, an Ecolab solution, launched a mobile room bio decontamination system suited for various critical areas, including cleanrooms, animal facilities, and bio-safety laboratories, among others.

By Agent Analysis

Various Advantages Offered by Hydrogen Peroxide During Decontamination Boosted Its Demand

Based on agent, the market is categorized into hydrogen peroxide, chlorine dioxide, peracetic acid, and nitrogen dioxide.

The hydrogen peroxide segment held the largest market share in 2026, accounting for 62.82% of the market with a size of USD 143.6 million. The segment’s dominance is attributed to the advantages associated with hydrogen peroxide over other agents. One of the prominent advantages of using this chemical as a decontamination agent is that it is considered safe as it decomposes into water and oxygen.

Furthermore, the increasing demand for hydrogen peroxide to sterilize medical devices and other equipment in healthcare facilities is also facilitating the segment’s growth. The governments of various countries are also emphasizing using this agent for decontamination, thus propelling the segment’s growth.

- For instance, in April 2020, the U.S. FDA issued guidelines and emergency use authorization to the Steris V-PRO 1 Plus, maX, and maX2 low-temperature sterilization systems to decontaminate the N-95 masks. The sterilization chamber utilizes hydrogen peroxide for decontamination.

The chlorine dioxide segment held the second-largest market share in 2022 and is expected to register a significant CAGR during the forecast period. The increasing acceptance of chlorine dioxide as a decontamination and sterilization agent among companies is one of the prominent factors supporting the growth of the segment. In March 2021, ClorDisys received approval from the U.S. FDA to offer contract sterilization for medical devices using chlorine dioxide gas.

By End-user Analysis

Increasing Focus on Sterilization Makes Pharmaceutical & Medical Device Manufacturers Major Product End-users

Based on end-user, the market is segmented into pharmaceutical & medical devices manufacturers, contract manufacturing and research organizations, hospital & healthcare facilities, and others.

The pharmaceutical & medical device manufacturers segment accounted for the largest market share in 2026, representing 63.47% of the market with a size of USD 145.1 million. The dominance is due to the implementation of mandatory guidelines by the regulatory bodies to speed up the decontamination and sterilization process to prevent contamination. Many drugs and devices are being recalled due to safety concerns caused by contamination in these products.

- For instance, in March 2023, Camber Pharmaceuticals, Inc. voluntarily recalled lot E220182 of Atovaquone Oral Suspension intended for treating Pneumocystis jiroveci pneumonia due to potential Bacillus cereus contamination.

Additionally, the rising collaborations between pharmaceutical & medical device companies and decontamination product manufacturers & service providers to improve product quality, coupled with rising product recalls, are bolstering the segment’s growth.

On the other hand, increasing research & development activities, and growing demand for a decontaminated workspace in research organizations to prevent the contamination of experiments are increasing the adoption of bio-decontamination products among contract manufacturing and research organizations.

The hospital & healthcare facility segment is set to witness considerable growth in the coming years. The increasing number of surgical procedures, coupled with the rising burden of surgical site infections and hospital-acquired infections, is one of the key factors that has compelled hospitals to adopt proper decontamination strategies, thereby boosting the segment’s growth.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, and the rest of the world.

North America Bio-Decontamination Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 76.02 million in 2025 and dominated the global market share. The increasing number of hospital admissions in the region, growing volume of surgical procedures, rising incidence of hospital-acquired infections, and growing emphasis of healthcare facilities and medical device & pharmaceutical companies on decontamination processes are a few factors responsible for the region’s dominance.

- According to the 2022 data published by the U.S. Centers for Disease Control and Prevention (CDC), there was a 7% and 5% increase in CLABSI and CAUTI infections, respectively, between 2020 and 2021 in the U.S.

Additionally, increasing approval and launch of decontamination products to control the increasing rate of infections is contributing to the region’s robust growth. In 2020, Ground Effects Environmental Services Inc., a Saskatchewan-based company, developed a mobile bio-decontamination unit that released ozone gas to disrupt viruses. The US market is projected to reach USD 71.3 million by 2026.

Europe held the second-largest share of the global market in 2024. The increasing disease burden among the target population, the growing number of pharmaceutical & medical devices companies in the region, the launch of new products, and the rising focus of key companies on expanding their presence in the region are some factors supporting the regional market’s growth.

- For instance, in October 2023, ClorDiSys Solutions, Inc. expanded its presence in Europe with its chlorine dioxide gas-based decontamination technology for sterilizing medical devices in a conference held at Gothenburg, Sweden. The UK market is projected to reach USD 11.4 million by 2026, while the Germany market is projected to reach USD 15 million by 2026.

Asia Pacific is anticipated to register the highest CAGR in the forthcoming years. The rising volume of pharmaceutical and medical device manufacturing in China, India, and other countries is driving the demand for decontamination processes in these nations. Furthermore, growing awareness among the regional population regarding decontamination and increasing adoption of this procedure in healthcare facilities will augment the growth of the market in the region. The Japan market is projected to reach USD 18.8 million by 2026, the China market is projected to reach USD 14.5 million by 2026, and the India market is projected to reach USD 7.7 million by 2026

The rest of the world is likely to observe constant growth in this market in coming years. The increasing number of nosocomial infections in various regions, growing awareness regarding the prevention of hospital-acquired infections, the rising number of hospitals, and the increasing number of pharmaceutical manufacturers in the region are a few factors accelerating the demand for these products.

Key Industry Players

Strong Product Portfolios of Bioquell and STERIS to Help Them Lead Market Growth

The market reflects a semi-consolidated structure with major players, including STERIS, Bioquell, An Ecolab Solution, TOMI Environmental Solutions, Inc., and others, capturing the largest global market share. The growing focus of key players on expanding their market presence by engaging in strategic business activities, such as collaborations, mergers & acquisitions, launching new products, and others, is a key factor contributing to their high revenue share. Additionally, a robust distribution network and strong brand presence will increase the market share of these companies.

- For instance, in November 2021, STERIS expanded its bio decontamination cleanroom solutions after acquiring Cantel Medical. The company aimed to expand its capabilities to cater to life sciences customers through this acquisition.

Other players, such as JCE Biotechnology, Amira Srl Unipersonale, Fedegari Autoclavi S.p.A., and others, are continuously engaging in business expansion initiatives to establish their footprint in emerging nations.

List of Top Bio-Decontamination Companies:

- STERIS (U.S.)

- Bioquell (Ecolab) (U.K.)

- JCE Biotechnology (France)

- Fedegari Autoclavi S.p.A. (Italy)

- TOMI Environmental Solutions, Inc. (U.S.)

- Amira Srl Unipersonale (Italy)

- Zhejiang Tailin Bioengineering Co., Ltd. (China)

- Noxilizer, Inc. (U.S.)

- ClorDisys Solutions Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: TOMI Environmental Solutions, Inc. collaborated with Cellares to integrate its ionized Hydrogen Peroxide (iHP) technology, SteraMist, into a new cell therapy manufacturing solution, the Cell Shuttle produced by Cellares.

- December 2022: Amira Srl Unipersonale entered a distribution agreement with Opira for distributing its Bioreset product range in Australia. Through this agreement, the company aimed to expand its presence.

- October 2022: STERIS partnered with ChargePoint Technology Group to offer a sterile solution to Evonik, a specialty chemicals company.

- July 2022: Bioquell received approval from the European Chemicals Agency (ECHA) and Biocidal Products Committee (BPC) for its HPV-AQ 35% hydrogen peroxide disinfectant.

- September 2021: STERIS launched two next-generation vaporized hydrogen peroxide bio-decontamination systems designed to achieve a 6-log bioburden reduction in medical devices, pharmaceuticals, and research environments.

REPORT COVERAGE

The report delivers a detailed market analysis. It focuses on key aspects, such as new product launches and technological advancements. Additionally, it includes an overview of all the segments and key industry developments, such as mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of different segments, key trends, company profiles of top market players, and the impact of COVID-19 on the market. Besides these, the report offers an overview of various market opportunities and the impact of the adoption of these products on the stakeholders. The report encompasses qualitative and quantitative insights that have contributed to the growth of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.70% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product

|

|

By Type

|

|

|

By Agent

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 219.9 million in 2025 to USD 329.3 million by 2034.

In 2025, the value of the market in North America stood at USD 76.02 million.

The market is projected to expand at a CAGR of 4.70% during the forecast period.

By product, the equipment segment is the leading segment of the market.

The key factors driving the market are the growing burden of hospital-acquired infection across the globe, increasing R&D, growing investment in decontamination processes by pharmaceutical & medical device manufacturing companies, and an increase in new product approvals & launches, among others.

STERIS and Bioquell (An Ecolab Solution), among others are some of the major players in the global market.

North America dominated the market in 2025 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us