Bioinformatics Services Market Size, Share & Industry Analysis, By Service Type (Sequencing, Gene Expression, Data Analysis, Drug Discovery, and Others), By Application (Metabolomics, Pharmacology, Genomics, Transcriptomics, and Others), By End-User (Pharmaceutical & Biotechnology Companies, CROs & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

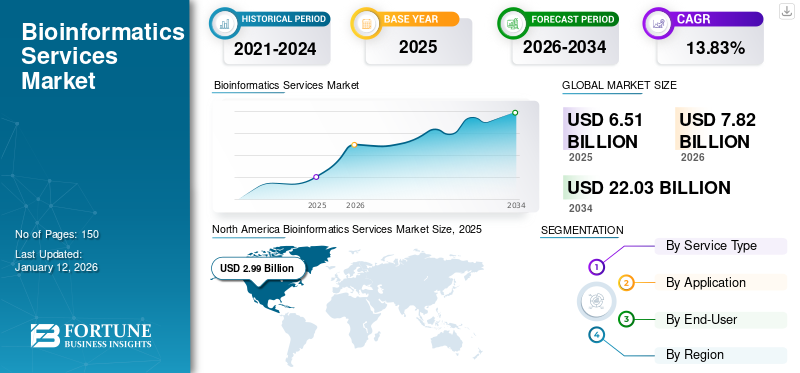

The global bioinformatics services market size was valued at USD 6.51 billion in 2025 and is projected to grow from USD 7.82 billion in 2026 to USD 22.03 billion by 2034, exhibiting a CAGR of 13.83% during the forecast period. North America dominated the bioinformatics services market with a market share of 45.87% in 2025.

Bioinformatics is an interdisciplinary field that combines computer science, biostatistics, and life sciences to develop algorithms and tools for mining and interpreting tremendous amounts of biological data. Bioinformatics services offer different approaches for the discovery, characterization, and validation of genomic and proteomic biomarkers for a variety of disease areas. The growing application of these services in various fields such as human medicine, agriculture, forensic science, and veterinary science for research purposes is one of the critical factors driving its penetration rate across the globe.

The increasing adoption of cloud-based bioinformatics solutions has led to a reduction in cost and increased accessibility to clinical data. This has encouraged government authorities to focus on the effective implementation of these solutions in healthcare facilities to accelerate research projects and meet the growing demand for personalized medicine to guide better treatment decisions.

- According to a research article published by Advances in Bioinformatics in August 2021, bioinformatics may provide better conclusions at the genomic level with prior identification of infection and better focus on treatment through productive personalized medicine improvement.

Moreover, the outsourcing of bioinformatic services by industry players for analyzing and interpreting clinical data generated during the drug discovery process has led to the emergence of service providers. Increasing innovation in the fields of biopharmaceutical, biotechnology, and medication disclosure is driving the demand for bioinformatics services. Therefore, the rising demand for these services in various industries, such as genomic research, forensics, and biopharmaceuticals, among others, is anticipated to drive the global bioinformatics services market growth during the forecast period.

During the COVID-19 pandemic, the global bioinformatics services market exhibited positive growth owing to accelerated demand for analyzing and interpreting genomic data of the virus, facilitating the identification of suitable vaccines against the infection. During the pandemic, various government and industry players increased their investment to increase their focus on analyzing and interpreting the genomic data generated against COVID-19 infection. In order to support this clinical research, the market players accelerated their R&D activities to provide effective solutions, which led to a positive impact on their revenue generation streams.

Global Bioinformatics Services Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.51 billion

- 2026 Market Size: USD 7.82 billion

- 2034 Forecast Market Size: USD 22.03 billion

- CAGR: 13.83% from 2026–2034

Market Share:

- North America dominated the bioinformatics services market with a 45.87% share in 2025, driven by the strong presence of service providers, growing initiatives to analyze large-scale clinical data, and robust research infrastructure.

- By service type, the sequencing segment is expected to retain the largest market share, owing to its widespread applications in genomics, precision medicine, and the accelerating adoption of next-generation sequencing technologies.

Key Country Highlights:

- United States: Increased government investments in national bioinformatics infrastructure and rising adoption of genomic data analysis in healthcare research are driving market growth.

- Europe: Growing clinical research funding, initiatives like large-scale genomic sequencing projects, and advancements in personalized medicine are fueling the demand for bioinformatics services.

- China: Rapid growth in clinical trials and the rising need for advanced data analysis tools to manage large clinical research datasets are boosting market expansion.

- Japan: Focus on integrating bioinformatics in pharmaceutical R&D, coupled with technological innovation in sequencing and data analytics, is enhancing market opportunities.

Bioinformatics Services Market Trends

Growing Application of Bioinformatics in Personal Medicine and Vaccines

Bioinformatics plays a significant role in gene sequencing diagnostics and has been an essential tool to investigate the genetic causes of disease. The introduction of novel bioinformatics technologies and tools is anticipated to speed up personalized medicine research by integrating a massive amount of genomic data analysis. It plays a significant role in analyzing large-scale biological data to gain insights that allow breakthroughs in medicine, genetics, and drug discovery. This benefits the cost reduction and time frame required for the completion of a research study. Moreover, the application of bioinformatics services is increasing in diagnosis, intervention, drug development, therapy, and personalized vaccination.

The growing application of bioinformatics services in personalized medicine research has encouraged healthcare professionals to deliver personalized treatments with enhanced efficacy and reduced side effects.

- North America witnessed a bioinformatics services market growth from USD 2.99 Billion in 2025 to USD 3.56 Billion in 2026.

Download Free sample to learn more about this report.

Bioinformatics Services Market Growth Factors

Growing Applications and Research Grants to Surge the Demand for These Services

One of the critical drivers contributing to global bioinformatics services market growth is the continuous expansion of bioinformatics applications in various fields. These applications include sequencing and analyzing genomes, identifying genes and their functions, predicting protein structure and functions, gene expression, drug discovery, and others. Other factors, such as development and processing costs, increase while implementing any bioinformatics software or tool as it adds up to the maintenance and security costs. This encourages researchers and industry players to outsource these services to reduce the procurement cost of these tools or platforms. The emergence of new players offering these services is surging the demand for bioinformatics services.

Moreover, many public and private entities are providing research grants to support research projects to understand the molecular mechanisms underlying diseases and develop targeted therapies with fewer side effects.

- In November 2023, the Australian Government invested USD 66 million in 25 genomic research projects to support the research of severe diseases and chronic conditions. This support from government entities is anticipated to surge the effective implementation of tools and techniques used to analyze and interpret complex datasets. Therefore, these factors are expected to increase the demand for these services.

RESTRAINING FACTORS

Managing Diverse Biological Data and Ethical Concerns May Restrict Market Growth

One of the major challenges witnessed in the market is integrating and managing diverse biological data due to a lack of standardization. It is challenging to handle and analyze large and complex data sets, such as genome sequences and gene expression data. Moreover, developing accurate and efficient algorithms to align these requirements needs skilled professionals, which is lacking in emerging countries.

- According to a study published by The Lancet Infectious Diseases in September 2023, severe shortages of competent experts in genomics and bioinformatics exist in Africa. This, coupled with inadequate genomic infrastructure, had a cumulative effect on the use of next-generation sequencing technologies for research and public health practice.

Another concern is addressing the ethical and legal issues related to the storage, sharing, and use of genomic data, as there are still no established guidelines regarding these datasets. Moreover, developing user-friendly and accessible tools for analysis and data management needs constant upgradation in areas such as DNA sequencing and data storage. Hence, addressing the scalability and ethical concerns serves as some major restraint when dealing with large data sets, which is likely to restrict bioinformatics services market growth.

Bioinformatics Services Market Segmentation Analysis

By Service Type Analysis

Sequencing Segment Dominated the Market Due to Its Wide Applications

On the basis of service type, the market is segmented into sequencing, gene expression, data analysis, drug discovery, and others.

- The Sequencing segment is expected to hold a 37.4% share in 2024.

The sequencing segment dominated the market with a share of 37.72% in 2026, owing to the increasing adoption of next-generation sequencing technology due to cost reduction. This is accelerating the research and development activities in various fields, such as precision medicine, disease prognosis, and biomarker development. This also influences the preference of pharmaceutical companies, CROs, and research institutes to adopt this service in their clinical studies. This is surging the demand for this service and subsequently augmenting its growth.

- For instance, as per an article published by 3billion, Inc. in December 2022, the cost of sequencing a genome fell substantially from USD 1 million in 2007 to USD 1000 in 2014, and it was USD 600 in 2022 due to advances in sequencing technology.

Data analysis held a substantial share of the global market, followed by the drug discovery services segment. The growth of these segments is attributed to their growing demand in conducting clinical studies of genomics, proteomics, and metabolomics. Moreover, the integration of these services reduces manufacturing costs and time, accelerating the drug development process.

The gene expression and the others segment are estimated to grow at a comparatively lower CAGR due to a lack of data availability and limited exposure to bioinformatics in these areas.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Investment in Genomics Led to its Dominance in the Market

In terms of application, the market is segmented into metabolomics, pharmacology, genomics, transcriptomics, and others.

The genomics segment held a dominating global bioinformatics services market share of 35.68% in 2026. An increasing number of genomic research programs and growing support of government entities toward supporting these projects by providing research grants are some of the factors contributing to the segment’s growth. Integration of advanced technologies such as artificial intelligence and machine learning in decoding, assembling, and analyzing genomes is driving the segment’s growth.

- For instance, in March 2022, the Australian government invested AUD 28.1 million (USD 21.1 million) to establish Genomics Australia, an agency that will support the integration of genomic medicine into Australia's healthcare system.

Metabolomics segments held a notable market share in 2024, followed by the pharmacology segment. The growing utilization of these services in identifying and characterizing metabolites, as well as in drug design, is driving the segment’s growth. Transcriptomics and the other segments offer lucrative growth opportunities for the bioinformatics services market.

By End-User Analysis

Pharmaceutical & Biotechnological Companies Led Owing to Advanced Technology Adoption

On the basis of end-user, the market is segmented into pharmaceutical & biotechnology companies, CROs & research institutes, and others.

The pharmaceutical & biotechnology companies segment dominated the global market share of 45.52% in 2026. A large number of clinical studies are carried out by pharmaceutical & biotechnological companies in order to provide novel treatment interventions for a wide range of diseases. In order to do so, these companies integrate various tools and techniques to accelerate drug discovery programs, which is driving the demand for these services. In July 2023, Nvidia invested USD 50 million in Recursion Pharmaceuticals to accelerate the development of the pharma company’s artificial intelligence drug discovery program.

The CROs & research institutes held a substantial share of the global market in 2024. The major driving factor for the integration of these services in these settings is to reduce manufacturing costs and time.

The others segment includes academic institutes, hospitals, and clinics where studies are mostly conducted at a pilot scale. Integration of these solutions offers lucrative opportunities for the segment’s growth.

REGIONAL INSIGHTS

Geographically, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Bioinformatics Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market share and recorded a revenue of USD 2.99 billion in 2025. One of the reasons for the region’s market dominance is the presence of companies providing these services all over the world with a well-established distribution network. Another reason for the growth of the market is the growing number of projects and initiatives to encourage the use of bioinformatics in healthcare to analyze large volumes of clinical data. In April 2021, the U.S. government invested USD 300 million to build and support a National Bioinformatics Infrastructure. The U.S. market is projected to reach USD 3.21 billion by 2026.

Europe

Europe held a notable market share in 2024. Clinical research funding is on the rise, particularly for genomics. This is driving demand for genomics solutions across the European region. Additionally, personalized medicine and ongoing technological innovation, including Next-Generation Sequencing (NGS) and High-Performance Computing (HPC), are expected to drive market growth in Europe during the study period. In December 2023, U.K. Biobank released the sequence data of half a million samples to approved researchers across academia, industry, charitable organizations, and government. The initiative was made to aid scientists in drug discovery and other biomedical developments. The UK market is projected to reach USD 0.52 billion by 2026, while the Germany market is projected to reach USD 0.56 billion by 2026.

Asia Pacific

Asia Pacific is projected to expand at the highest CAGR during the forecast period. As the number of clinical trials increases in the region, the amount of clinical research data that needs to be analyzed and extracted is likely to increase. As a result, the demand for more sophisticated tools and techniques is expected to increase in the region. According to Clinicaltrials.gov, China accounted for a 27.7% share of global clinical trial activity in 2022. The Japan market is projected to reach USD 0.75 billion by 2026, the China market is projected to reach USD 0.43 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

Latin America and the Middle East & Africa are expected to grow at comparatively lower CAGR during the study period. The limited presence of companies offering these solutions and the lack of well-established healthcare infrastructure are some of the factors for the market’s slower growth across these regions.

Key Industry Players

Strong Global Presence Led to the Dominance of Few Market Players

In terms of the competitive landscape, the global bioinformatics service market is dominated by some global players such as Illumina, Inc., QIAGEN, Thermo Fisher Scientific Inc., and Eurofins Scientific, among others. These market players have established their position in the market by making strategic alliances with government entities to increase their service outreach.

- In November 2021, Illumina Inc. supported Canada’s Nationwide COVID-19 genome sequencing initiative by offering its sequencing and bioinformatics solutions to identify biomarkers and support the development of novel therapeutics against COVID-19.

Other prominent players, such as CD Genomics, Creative Proteomics, and Fios Genomics, among others, are focusing on upscaling their research and development activities to offer comprehensive bioinformatics solutions.

- In May 2023, CD Genomics, a provider of genomics and bioinformatics solutions, launched a long-read metagenomics sequencing service in the U.S.

LIST OF TOP BIOINFORMATICS SERVICES COMPANIES:

- Illumina, Inc. (U.S.)

- QIAGEN (Netherlands)

- CD Genomics (U.S.)

- Excelra (U.S.)

- Creative Proteomics (U.S.)

- Fios Genomics. (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Psomagen (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023 – Psomagen added a new sequencing platform, the Pacific Bioscience Revio system, to offer services such as whole genome, whole exome, single cell and bulk RNAseq, microbiome, Olink Proteomics, and others.

- August 2023 – PacBio agreed to acquire Apton Biosystems, Inc., to accelerate the development of a next-generation, high-throughput short-read sequencer.

- March 2023 – Emmes, a Clinical Research Organization (CRO), acquired Essex Management. Essex offers bioinformatics and Health Information Technology (HIT) consulting services to government, private sector and academic organizations.

- November 2022 – Arima Genomics, Inc. partnered with Basepair to empower scientists with bioinformatic analysis.

- September 2021 – Dovetails Genomics expanded its epigenetic services in the areas of bioinformatics and target enrichment to offer a one-stop solution.

REPORT COVERAGE

The market report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, offerings, application, end-user, and region. Besides this, it offers insights into the market drivers, trends, dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.83% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global bioinformatics services market stood at USD 7.82 billion in 2026 and is projected to reach USD 22.03 billion by 2034.

In 2025, the North America market value stood at USD 2.99 billion.

The market will exhibit rapid growth at a CAGR of 13.83% during the forecast period (2026-2034).

The sequencing services segment led the market in 2026 due to its widespread applications in genomics and personalized medicine. Advances in sequencing technology have significantly lowered costs, increasing adoption across research and clinical settings.

Market growth is driven by the expanding use of bioinformatics in personalized medicine, genomics research, and drug discovery, along with cloud-based solutions that lower costs and boost data accessibility. Increasing outsourcing of services by pharma and biotech firms also fuels demand.

Top companies include Illumina, QIAGEN, Thermo Fisher Scientific, Eurofins Scientific, CD Genomics, and Creative Proteomics.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us