CBRNe Sensors Market Size, Share & Industry Analysis, By Sensor Type (Chemical Sensors, Biological Sensors, Radiological Sensors, Nuclear Sensors, and Explosive Sensors), By System (Handheld & Man-Portable Detectors, Fixed Point Detectors, Mobile Labs, CBRNe Sensor Networks, and Wearables), By Equipment (Spectrometers, Chromatographs, and Detectors), By End-User (Defense, Homeland Security, Industrial Safety, Environmental Monitoring, and Others), and Regional Forecasts, 2024-2032

KEY MARKET INSIGHTS

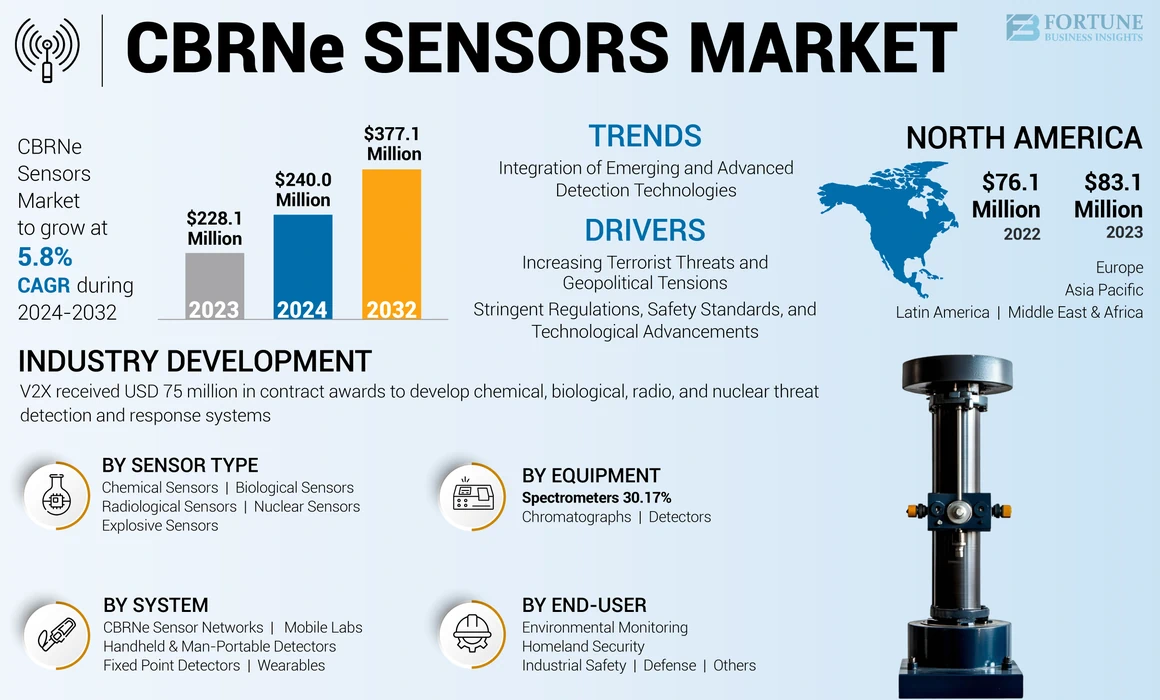

The global CBRNe sensors market size was valued at USD 228.1 million in 2023. The market is projected to grow from USD 240.0 million in 2024 to USD 377.1 million by 2032, exhibiting a CAGR of 5.8%. North America dominated the CBRNe sensors market with a market share of 36.43% in 2023.

The CBRNe sensor market is expected to grow rapidly in the coming years due to the CBRNe threat, technological advancements, and increasing investments in defense and security infrastructure. Overall, the increasing focus on CBRNe defense and security is expected to drive the growth of the CBRNe sensor market in the coming years. The installation of CBRN surveillance and protection systems in ports and airports will continue to grow as these infrastructures are a country's gateway to the world. Therefore, they provide a layer of safety and security against threats to human and national security.

The use of drones as CBRN platforms is being considered as another way to remove people from harm. These drones are equipped with special cameras that can detect CBRN threats in various environments, from cities or industries to rural areas. In addition to identifying possible threats, drones can be used in response and rescue operations, especially in inaccessible areas. With the proliferation of wireless CBRN detectors, the market for CBRN sensor networks is growing. Providing real-time information on potential threats is critical to prevent and mitigate CBRN incidents as soon as possible and protect public health and safety.

The COVID-19 pandemic has accelerated the development of advanced CBRN detection tools. Projects such as TOXI-TRIAGE are creating integrated field toolboxes for responders, incorporating sensors that detect toxic chemicals and assess exposure in real-time. These tools enhance situational awareness and facilitate efficient rescue operations during CBRN incidents.

GLOBAL CBRNe SENSORS MARKET OVERVIEW

Market Size & Forecast:

- 2023 Market Size: USD 228.1 million

- 2024 Market Size: USD 240.0 million

- 2032 Forecast Market Size: USD 377.1 million

- CAGR: 5.8% from 2024–2032

Market Share:

- North America dominated the CBRNe sensors market with a 36.43% share in 2023, driven by significant investments in defense infrastructure, advanced technologies, and interagency coordination across the U.S. and Canada.

- By sensor type, chemical sensors are expected to retain the largest market share in 2025, supported by rising demand for rapid threat detection, innovation in detection methods, and growing defense modernization programs.

Key Country Highlights:

- United States: A surge in federal defense contracts, including a November 2024 agreement with Bruker Corporation for next-gen biological detection systems, highlights growing commitment to CBRNe preparedness.

- United Kingdom: In October 2023, the Ministry of Defence awarded an £88 million contract to Smiths Group PLC to develop next-generation chemical sensors, emphasizing strategic homeland defense initiatives.

- Germany: AeroVironment Telerob is expanding deployment of unmanned ground systems with integrated CBRNe detection capabilities across NATO-aligned operations.

- India: Partnerships with U.S.-based defense firms launched in November 2024 are accelerating the co-development of indigenous CBRNe sensor platforms for regional and military use.

- Japan: The Ministry of Defense, in December 2024, signed a contract with Mirion Technologies to enhance radiological threat detection capabilities under its national preparedness program.

CBRNe Sensors Market Trends

Integration of Emerging Technologies and Advanced Detection Technologies

Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML are being increasingly integrated into CBRNe sensors to improve their accuracy and efficiency in agent identification. AI-powered sensors can analyze data more effectively and provide real-time insights into potential threats. ML algorithms are being used to enhance the performance of CBRNe sensors by enabling them to learn from data and improve detection capabilities over time. These technologies are being integrated with sensors for applications, such as sensor data fusion and anomaly detection, concentration estimation, predictive analytics and decision support, autonomous sensing and processing, biothreat detection and identification.

Wireless Network of CBRNe Detectors:

The use of wireless networks for CBRNe detectors is on the rise. These networked systems provide real-time information on potential threats, which is crucial for the prevention and mitigation of CBRNe incidents at the earliest possible stage. The connectivity and data-sharing capabilities of these wireless networks enhance the overall situational awareness and response capabilities.

Application of Wireless Network: Early warning and real-time monitoring, improved situational awareness, autonomous detection and identification, and interoperability and collaboration.

FRET Sensors:

Fluorescence Resonance Energy Transfer (FRET) sensors are being developed for CBRNe detection. These sensors use fluorescence to detect chemical and biological agents, offering improved sensitivity and selectivity compared to traditional methods. Advancements in areas such as surface plasmon resonance, electrochemistry, and piezoelectric sensing are enabling these multifunctional FRET-based biosensor platforms.

Download Free sample to learn more about this report.

CBRNe Sensors Market Growth Factors

Increasing Terrorist Threats and Geopolitical Tensions to Propel Market Growth

The increasing terrorist threats and geopolitical tensions globally are expected to drive significant growth in the CBRNe (Chemical, Biological, Radiological, Nuclear and explosive) sensors market, particularly in the Five Eyes countries (the U.S., the U.K., Canada, Australia, and New Zealand) over the next few years. According to the Homeland Threat Assessment 2024 by the U.S. Department of Homeland Security, terrorism remains a top threat to the homeland, with the threat of violence from individuals radicalized in the U.S. expected to remain high. The report also highlights the threat of illegal drugs produced in Mexico and the potential for disruptive and destructive attacks, espionage against critical infrastructure, and threats to economic security.

BlackRock's Geopolitical Risk Dashboard also indicates a heightened risk of terrorism ahead of the 2024 U.S. presidential election, with the potential for major cyber-attacks causing sustained disruption. The United Nations Security Council has also expressed concern over terrorist groups remaining a significant threat in conflict zones, with ISIS affiliates in North Africa weakened but still active. These heightened security threats are likely to spur increased investments in homeland security and defense capabilities, including advanced CBRNe sensors, across the Five Eyes countries and globally. The market is expected to benefit from this increased demand, with the market poised for significant growth over the next few years.

- For instance, in September 2023: Smiths Detection announced a major contract with the U.S. Department of Defense to supply advanced sensors for military applications.

- For instance, in July 2024: Bruker Corporation, another key player in the market, unveiled a new line of portable sensors designed for first responder and military use, featuring improved detection capabilities and ease of use.

- For instance, in November 2023: FLIR Systems, a subsidiary of Teledyne Technologies, launched a new line of Unmanned Aerial Vehicles (UAVs) equipped with CBRNe sensors for aerial surveillance and detection.

Stringent Regulations, Safety Standards, Technological Advancements Drives Market Growth

Due to increased compliance requirements, governments are implementing stricter regulations to ensure public safety and security, particularly in response to rising threats from terrorism and the proliferation of CBRNe materials. This creates a demand for advanced detection technologies that comply with these regulations. Compliance with stringent regulations often necessitates increased funding for research and development in detection technologies. Governments and private sectors are likely to invest more in CBRNe sensors with enhanced funding and investment that meet these safety standards, thereby driving market growth. International agreements and collaborations among the Five Eyes nations to enhance safety standards will further promote the adoption of advanced CBRNe detection technologies, ensuring a unified approach to national security.

- For instance, in October 2023, the U.K. Ministry of Defence awarded Smiths Group PLC an £88 million (approximately USD 107.6 million) contract to develop next-generation chemical sensors for the British armed forces. This contract underscores the commitment to enhancing detection capabilities in accordance with stringent safety standards.

Recent advancements in technology, particularly in Artificial intelligence (AI) and the Internet of Things (IoT) are transforming CBRNe sensors into more intelligent and responsive systems. These technologies enable real-time data collection and analysis, improving the accuracy and efficiency of threat detection.

Development of Multi-Functional Sensors: The trend toward creating multi-functional sensors that can detect various CBRNe agents simultaneously is gaining traction. This innovation enhances operational efficiency and reduces the need for multiple devices, making it cost-effective. The integration of unmanned systems, such as drones equipped with CBRNe sensors, is becoming more prevalent. These systems can operate in hazardous environments, providing safer and more effective monitoring and detection capabilities.

RESTRAINING FACTORS

High Initial Investment Costs of RDT&E and Challenges in Existing Systems to Restrain Market Growth

The substantial capital required for RDT&E and procurement of advanced CBRNe sensors can deter new entrants and limit the expansion capabilities of existing companies. This high cost is often associated with the complexity of developing reliable and sensitive detection systems, which can lead to reduced market competition. Government and defense budgets are often limited, and prioritizing funding for CBRNe technologies can be challenging. As a result, agencies may delay procurement or opt for less advanced solutions, stifling the CBRNe sensors market share.

Long Development Cycles of new technologies can slow down the introduction of innovative products to the market. Companies may find it difficult to recoup their investments if the development timeline is extended. Compatibility issues while integrating new sensors with existing systems can be problematic due to differences in technology, protocols, and standards. This can lead to increased costs and complexity in implementation, discouraging organizations from adopting new technologies. The integration process can disrupt existing operations, leading to temporary inefficiencies. Organizations may be hesitant to invest in new systems that could cause operational challenges during the transition period.

For instance, collaborative efforts among Five Eyes countries to share intelligence and best practices in CBRNe detection are gaining momentum. These partnerships may help streamline procurement processes and establish common standards, which can alleviate some integration challenges and encourage investment in advanced technologies.

CBRNe Sensors Market Segmentation Analysis

By Sensor Type Analysis

Chemical Sensors Segment to Grow at Faster Pace Due to Technological Advancements

The market by sensor type is classified into chemical sensors, biological sensors, radiological sensors, nuclear sensors, and explosive sensors. The chemical sensors segment currently accounts for a large share of the global market and is going to be the fastest-growing segment during the forecast period of 2024-2032. The demand for chemical sensors in the CBRNe market is expected to grow rapidly due to increasing awareness of CBRN threats, technological advancements, and the need for comprehensive CBRN defense strategies. The market will offer several opportunities attributed to the overall investments in new detection technologies and associated equipment.

The demand for explosive sensors within the CBRNe market is experiencing significant growth, driven by various factors, including increased military spending and rising global threats. There is a notable rise in defense budgets globally, particularly in emerging economies such as China, India, and Russia. These nations are investing heavily in CBRNE capabilities to enhance their defense preparedness against potential threats.

By System Analysis

Increased Investments in Portable Detection Technologies is Leading Market Growth

The market by system is segmented into handheld & man-portable detectors, fixed point detectors, mobile labs, CBRNe sensor networks, and wearables. The handheld & man-portable detectors segment currently accounts for a large share of the global market and will depict the fastest-growth during the forecast period. The demand for handheld & man-portable detectors in the market is projected to experience rapid growth. This trend is driven by several factors that highlight the importance of portable detection equipment in various sectors, particularly in military and defense applications. The growing threats from terrorist organizations and the potential for chemical and biological attacks have escalated the need for portable detection solutions. Handheld detectors allow for immediate threat assessment, which is crucial in a crisis.

The CBRNe sensor market is poised for substantial growth, with sensor networks playing a pivotal role in enhancing security measures against CBRN threats. The combination of technological advancements, increased government investment, and international collaboration is expected to drive the demand for these sophisticated sensor systems in the coming years.

By Equipment Analysis

Detectors is the leading Equipment with Increased Security Awareness and Collaborative International Efforts

The equipment segment is categorized into spectrometers, chromatographs, and detectors.

The detectors segment currently accounts for a large portion of the global market and will be the fastest-growing segment during the forecast period of 2024-2032. The CBRNe detectors market is projected to witness rapid growth driven by technological advancements, increased awareness of CBRN threats, and significant investments in security infrastructure. The focus on developing integrated systems that utilize real-time data for threat detection will likely shape the future landscape of this market.

The demand for spectrometers in the market is poised to grow due to escalating security concerns and advancements in detection technologies. The market's expansion reflects a broader trend toward enhanced safety measures in both civilian and military contexts, driven by the need for effective response capabilities against CBRNe threats.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Substantial Allocations in Defense Budgets are Facilitating Acquisition of Cutting-Edge CBRNe Technologies

The market by end-user is segmented into defense, homeland security, industrial safety, environmental monitoring, and others. The defense segment currently accounts for a large portion of the global market share and will be the fastest-growing segment during the forecast period of 2024-2032. The rising awareness of CBRN threats, including terrorism and geopolitical instability, is prompting governments to invest in advanced detection and protective technologies. This is particularly evident in defense applications, where robust CBRN defense capabilities are essential for personnel safety during operations.

REGIONAL INSIGHTS

North America CBRNe Sensors Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is the dominant region in the global CBRNe (Chemical, Biological, Radiological, and Nuclear) sensors market in 2023. The growth in this region is driven by significant investments in defense and security infrastructure, advanced technological developments, and a robust scientific ecosystem that fosters innovation. The increasing geopolitical tensions and threats from terrorism have further propelled the demand for sophisticated CBRNe detection and response systems. Moreover, strong interagency coordination among various government bodies enhances the effectiveness of CBRNe preparedness and response strategies.

For instance, in September 2024, Smiths Detection was awarded a contract to supply advanced CBRNe detection systems to various U.S. military bases, enhancing their operational capabilities against potential threats. Moreover, for instance, in October 2024, Thermo Fisher Scientific announced its acquisition of FLIR Systems to bolster its portfolio in CBRNe technologies, indicating a strategic move to consolidate market leadership and expand product offerings.

The United States stands out as the dominant country within North America, leading the global CBRNe sensors market. The U.S. government's commitment to national security and defense has resulted in substantial funding for advanced CBRNe capabilities. Market growth is expected to be fueled by ongoing efforts to modernize the military and civilian sectors. For instance, in November 2024, the U.S. Department of Defense awarded a significant contract to Bruker Corporation for the supply of next-generation biological detection systems. This contract highlights the U.S.'s focus on enhancing its CBRNe response capabilities through cutting-edge technology.

Europe is emerging as the fastest-growing region in the global CBRNe sensors market during the forecast period. This growth is largely attributed to increasing investments in homeland security and defense initiatives across European nations, driven by rising concerns over terrorism and asymmetric threats. The European Union's commitment to improving its collective security measures has led to enhanced funding for advanced CBRNe technologies. For instance, in December 2024, QinetiQ secured a contract with NATO to supply portable CBRNe detection systems aimed at enhancing operational readiness among member states. Furthermore, in January 2025, Smiths Detection announced a partnership with several European governments to develop integrated CBRNe monitoring systems for critical infrastructure protection.

The Asia Pacific region is recognized as the second-largest and second-fastest-growing market for CBRNe sensors globally, with an estimated market size of $3.81 billion in 2024 and a CAGR of 8% through 2031. This rapid growth can be attributed to heightened investments in military modernization and homeland security initiatives by countries such as India, China, and Japan. The increasing frequency of natural disasters and public health emergencies has also prompted governments in this region to strengthen their emergency response capabilities. Recent developments include a partnership between Indian defense contractors and U.S.-based firms announced in November 2024, aimed at co-developing advanced CBRNe detection technologies tailored for regional needs. Additionally, Japan's Ministry of Defense awarded a contract to Mirion Technologies in December 2024 for radiological detection equipment as part of its efforts to enhance national security measures.

The Middle East & Africa region is anticipated to grow moderately during the forecast period. The growth is driven by ongoing conflicts and security challenges that necessitate improved detection and response capabilities against potential chemical or biological threats. For instance, in October 2024, UAE Government awarded a contract to Smiths Detection for providing state-of-the-art CBRNe detection systems at key transportation hubs. For instance, in November 2024, several African nations entered into agreements with international partners to enhance their CBRNe preparedness through technology transfers and training programs.

Latin America is projected as the fourth fastest-growing region within the global CBRNe sensors market, with an estimated revenue of approximately $829 million in 2024 and a CAGR of 5.4% through 2031. This growth reflects increasing awareness among governments regarding national security threats posed by chemical or biological agents. In recent months, notable contracts include Brazil's Ministry of Defense awarding a contract to Thermo Fisher Scientific in December 2024 for advanced chemical detection systems aimed at bolstering public safety during major events such as the upcoming Olympic Games. Furthermore, Chile's government announced a partnership with local firms to develop indigenous CBRNe detection solutions as part of its national defense strategy in January 2025.

KEY INDUSTRY PLAYERS

Strong Portfolio of Major Players to Lead the Global CBRNe Sensors Market Growth

Several key players who dominate the industry through technological advancements and comprehensive product offerings characterize the CBRNe sensors market growth. Thales Group is a leading provider of integrated solutions and equipment for defense and security markets. They offer a range of CBRN solutions, including reconnaissance vehicles and biological detection systems. Teledyne FLIR is a leader in advanced sensor technologies, providing systems for CBRN defense, including airborne systems and thermal detection cameras.

List of Top CBRNe Sensors Companies:

- Smith Detection (U.K.)

- FLIR Systems, Inc. (U.S.)

- Thales (France)

- AeroVironment Telerob (Germany)

- Arquus (France)

- Bertin-Technologies (France)

- ENG Mobile Systems (U.S.)

- FNSS (Turkey)

- Indra Sistemas (Spain)

- Iveco Group (Italy)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 – V2X received USD 75 million in contract awards to further develop chemical, biological, radio, and nuclear threat detection and response systems. Under the five-year, USD 50 million program, V2X announced that it would be the first systems integrator for the CBRN Command and Control Support program.

- February 2024 – Deep-Tech Startup Detect-ION was awarded a groundbreaking research contract by the Intelligence Advanced Research Projects Activity (IARPA) to revolutionize the way chemical aerosol threats are detected and identified. With terrorist attacks, industrial accidents, and military situations on the rise, the U.S. government and intelligence community need advanced technologies to quickly and accurately identify hazardous chemical particles.

- January 2024 – Draper will expand its Unmanned Aerial Systems (UAS) capabilities to conduct Chemical, Biological, Radio, and Nuclear (CBRN) surveillance missions after being awarded a USD 26 million contract (all options) by the US Department of Defense.

- February 2023 – Teledyne FLIR Defense, a division of Teledyne Technologies Incorporated, announced that it was awarded a USD 13.3 million contract by the US Department of Defense to expand the capabilities of the R80D SkyRaider unmanned aerial system in Chemical Warfare Automatically, Biologically, Radiological and Nuclear Surveillance Mission (CBRN).

- October 2020 – FLIR Systems, Inc. was awarded a USD 26 million-contract modification to support the Nuclear, Biological, and Chemical Reconnaissance Vehicle (NBCRV SSU) upgrade program for the US Army. Another Communications Authority Agreement (OTA) was awarded through the Joint Program Management Office for Physical, Biological, Radiological, and Nuclear Defense (JPEO-CBRND) to pursue a USD 48 million contract announced in April 2019.

REPORT COVERAGE

The CBRNe sensors market research report provides a detailed information on the market and focuses on key segments such as leading companies, product types, and major product applications. Additionally, it highlights market trends and highlights key industry developments. In addition to the aforementioned, it includes several factors that have contributed to the growth of the advanced market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.8% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Sensor Type

|

|

By System

|

|

|

By Equipment

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 228.1 million in 2023.

The market is likely to grow at a CAGR of 5.8% during the forecast period of 2024-2032.

The market size in the U.S. stood at USD 73.1 million in 2023.

Some of the top players in the market are Smiths Detection, Bruker Corporation, Thales, and AeroVironment Telerob.

The U.S. dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us