Cellular Health Screening Market Size, Share & Industry Analysis, By Test Type (Single Panel Tests [Telomere Tests, Oxidative Stress Tests, Inflammation Tests, and Heavy Metal Tests] and Multi-Panel Tests), By End User (Hospital-based Laboratories, Independent Laboratories, & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

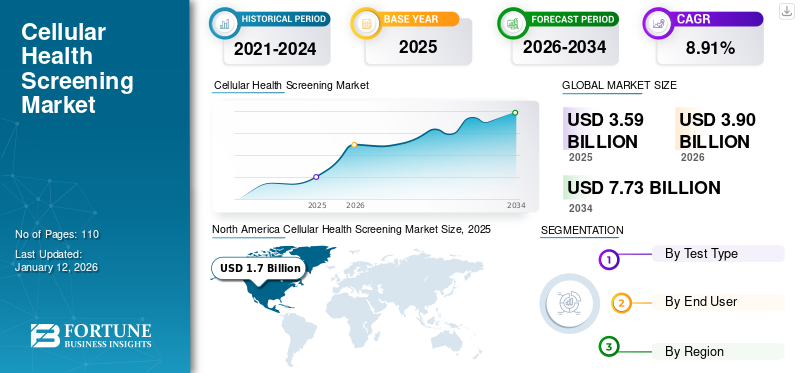

The global cellular health screening market size was valued at USD 3.59 billion in 2025 and is projected to grow from USD 3.9 billion in 2026 to USD 7.73 billion by 2034, exhibiting a CAGR of 8.91% during the forecast period. North america dominated the cellular health screening market with a market share of 47.32% in 2025.

Cellular health tests are used to assess and determine physiological factors of health, such as biological aging and oxidative stress, based on factors, such as lifestyle, environment, psychology, and diet, on human cells. The screening analyzes basic indicators of cell health, such as cellular toxicity, cell viability, intra and extracellular fluid levels, and cell ageing, among others. The incidence of early biological ageing, heavy metal exposure, stress, and nutritional deficiency is increasing among the global population. Moreover, increased awareness of health and disease prevention is expected to augment the adoption of cellular health screening across the globe.

- In 2021, the National Poisoning Data System (NPDS) of the American Association of Poison Control Centers (AAPCC) reported 8,884 single exposures to heavy metals in the U.S.

Moreover, the rising emphasis of key players and government authorities toward health-challenge prevention and early disease detection is expected to propel market growth. Also, rising studies of understanding telomeres as a biomarker for cognitive function and the impact of oxidative stress on cell health can further drive global market growth.

- In 2022, Denton County Public Health (DCPH) and Dalio Center for Health Justice (DCHJ) launched a comprehensive Social Determinants of Health (SdoH) screening initiative across seven emergency departments of hospitals in the U.S. The goal was to uncover and address social barriers that interfere with patients’ health and often perpetuate and exacerbate preventable conditions.

Cellular Health Screening Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.59 billion

- 2026 Market Size: USD 3.9 billion

- 2034 Forecast Market Size: USD 7.73 billion

- CAGR: 8.91% from 2026–2034

Market Share:

- North America dominated the cellular health screening market with a 47.32% share in 2025, driven by high consumer awareness, the presence of major players, and early adoption of advanced telomere and oxidative stress tests in clinical settings.

- By test type, Single Panel Tests accounted for the largest share in 2024, supported by growing demand for tests focused on specific markers such as heavy metals, telomeres, and oxidative stress. However, Multi-Panel Tests are expected to witness the highest CAGR, owing to their ability to simultaneously assess multiple biomarkers cost-effectively.

Key Country Highlights:

- Japan: Growth is driven by government-led mass screening programs in educational institutions and increased access to preventive health diagnostics.

- United States: Strong government and private initiatives toward personalized and precision health (e.g., NIH’s “Nutrition for Precision Health” program) and new product launches by players like Quest Diagnostics support the country’s dominant role.

- China: Rising awareness about lifestyle diseases, increasing healthcare investments, and expanding molecular diagnostics infrastructure are expected to boost cellular screening adoption.

- Europe: The market benefits from active partnerships and distribution expansions, such as Genomic Vision’s collaboration with CliniSciences to expand access to telomere and genomic tests across 15 countries.

COVID-19 IMPACT

Decreased Screening Tests Amid COVID-19 Affected the Market Growth

The COVID-19 pandemic had a negative impact on the cellular health screening market in 2020. The impact was owing to international lockdowns imposed by government authorities that restricted patients from visiting hospitals and preventive screening programs. Similarly, the pandemic led to a decline in demand for cellular health tests across health settings owing to high prioritization toward COVID-19 screening tests and the lower revenue realization by key players in 2020.

- According to the annual report published by Quest Diagnostics in 2020, the revenue of the gene and esoteric testing services segment declined by 40.3% in 2021 from USD 2.4 billion in 2020, owing to lower demand for genetic tests.

However, post-pandemic, the market regained its global growth owing to a high emphasis by several organizations on the advancement of cellular health tests with new technologies in 2021. Moreover, the increasing number of patient visits across healthcare settings and growing awareness of health and lifestyle disorders among the population drove the market expansion after the pandemic.

- For instance, in March 2021, researchers at Queen Mary University of London and Cardiff University developed a rapid test for the diagnosis of a constellation of rare and debilitating genetic conditions using high-throughput single telomere length analysis (HT-STELA).

Cellular Health Screening Market Trends

Growing Product Deployment by Industry Players Globally to Boost Market Expansion

The incidence of health and lifestyle awareness is increasing among the global population. Thus, industry players are focusing on the introduction of new screening tests owing to rising health awareness globally. Similarly, rising technological advancements in the production of telomere and nutritional health tests for the detection of cellular health are catering to screening adoption across the globe.

- In September 2021, Genomic Vision launched TeloSizer, built on proprietary molecular combing technology to expand the company’s offering in the field of telomere biology and cellular health analysis.

Also, the product deployment of inflammatory and telomere tests across clinical laboratories is increasing owing to high demand. Moreover, the increasing emphasis of market players toward the launch of multi-panel tests to offer cellular health screenings for the detection of cellular ageing and chronic and metabolic disorders further augmented global cellular screening market growth.

- For instance, according to data revealed by BioReference Health, LLC, the company operates with the largest healthcare plans in the U.S. It processes more than 12.0 million tests annually, including the IgE blood tests.

Thus, the increasing presence of new cellular health detection with advanced technologies and its rising adoption across clinical settings are propelling global cellular health screening market growth.

Download Free sample to learn more about this report.

Cellular Health Screening Market Growth Factors

Increase in Prevalence of Genetic Disorders to Augment Cellular Health Tests Adoption

The prevalence of genetic disorders among the global population is high owing to mutation in a single gene or multiple genes, structural chromosomal aberrations, or environmental factors, such as ultraviolet rays or chemical exposure, among others. Moreover, a rise in the presence of genetic tests for several disease indications across clinical settings and a shift of prioritization toward genetic health risk tests is anticipated to boost market growth.

- According to data published by Elsevier Inc., in November 2021, an estimated 3.5% to 5.9% of the global population suffers from 1 of approximately 7,000 rare or genetic conditions.

- The National Cancer Institute (NCI) conducted a research study from February 2020 to June 2020 among 2,947 individuals. The results stated that about 21.6% of the study population had undergone a genetic test, followed by genetic health‐risk tests of about 7.7%.

Thus, the increasing prevalence of genetic diseases has led to the high adoption of diagnostic screenings among patients. Moreover, the emerging presence of next-generation DNA sequencing technologies and increasing diagnostic and therapeutic research for genetic disease screening are expected to boost cellular health test adoption across clinical settings.

- As per NCBI statistics in 2023, as of November 2022, a total of 129,624 and 197,779 genetic tests were registered in the Genetic Testing Registry in the U.S. and globally, respectively.

RESTRAINING FACTORS

Lower Adoption of Preventive Health Screenings Among the Population to Restrict Market Growth

The prevalence of genetic diseases is increasing among the global population. However, the awareness of diagnostic screening is limited. Moreover, the lack of appropriate preventive services, including government-recommended screenings and vaccinations, further restricts market growth.

- According to an article published in NCBI in 2020, only 8.0% of the U.S. population undergo routine preventive health screenings.

Similarly, the lack of presence of trained professionals across health settings limits the adoption of preventive screenings and can further hamper market growth.

Cellular Health Screening Market Segmentation Analysis

By Test Type Analysis

Increasing Presence of Single Panel Tests to Augment Single Panel Test Segment Growth

By test type, the market is segmented into single panel tests and multi-panel tests.

Among these, the single panel tests segment accounted for the largest market share with 85.16% in 2026. The dominance was attributed to the increase in the prevalence of genetic and cardiovascular diseases among the population. Moreover, rise in the presence of advanced cellular tests for the detection of cellular nutrition metabolites and heavy metal poisoning across the globe.

- According to data published by the Annual Review of Genomics and Human Genetics in May 2022, about 10,000 of the U.S. population suffered from short telomere syndromes owing to short telomere mutations in idiopathic pulmonary fibrosis. On the other hand, the multi-panel tests segment is expected to register the highest CAGR during the forecast period. The rising launch of multi-panel tests for the detection of a combination of cellular biomarkers and increasing collaborations by industry players are expected to boost segment growth. Moreover, the high potential advantages of multi-panel tests, such as high precision and low costs as compared to single-test panel tests, are expected to drive market growth from 2023 to 2030.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Increasing Number of Pharmacies to Augment Segmental Growth Globally

Based on end user, the global cellular health screening market is segmented into hospital-based laboratories, independent laboratories, and others.

The hospital-based laboratories segment held a dominant share of the market with 59.97% in 2026. The dominant share was owing to increasing hospital visits for screening of nutrition assays and inflammation tests and the extensive adoption of preventive tests across hospital settings. Moreover, the rise in the number of diagnostic test prescriptions by healthcare professionals during outpatient visits further augmented segment growth.

The independent laboratories segment is anticipated to register the highest CAGR from 2025 to 2032. The factors anticipating growth of the market include a rising number of accredited standalone laboratories providing cellular health screening across the globe and increasing preference for early diagnosis of diseases such as cancer, neurodegenerative diseases and other genetic disorders among the population across private laboratories.

- According to data published by Marwood Group Advisory, LLC, in October 2021, about 3,000 independent laboratories operated in the U.S. in 2021.

REGIONAL INSIGHTS

Rise in Introduction of Advanced Cellular Tests to Augment the North American Market Growth

On the basis of region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Cellular Health Screening Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North American market for cellular health screening was valued at USD 1.7 billion in 2025 and is anticipated to continue to dominate the global market during the forecast period. The rising awareness of cellular health screenings across clinical settings in the region drives the industry expansion. Moreover, the rise in the presence of industry players with extensive product portfolios and rising approvals of screening tests across new disease indications further boosted the North American market. The U.S. market is projected to reach USD 1.79 billion by 2026.

- In August 2022, Proteomics International Ltd., announced the spin-off of an independent business, OxiDx Pty Ltd, to commercialize technology for measuring oxidative stress developed by Proteomics International and The University of Western Australia.

Europe

Europe is the second most dominant region in the global cellular health screening market. The European market held a significant share due to the robust activities of existing market players towards organic strategies and clinical studies to develop and commercialize novel cellular tests across clinical settings. The UK market is projected to reach USD 0.17 billion by 2026, while the Germany market is projected to reach USD 0.37 billion by 2026.

- In June 2023, Genomic Vision announced an exclusive European distribution agreement with CliniSciences. The agreement will provide Genomic Vision with the capability to offer its innovative technology, products, and services across 15 European countries, extending the reach of its cutting-edge genomic solutions in these key markets.

Asia Pacific

The Asia Pacific region is anticipated to exhibit the highest CAGR over the forecast timeframe due to the increasing government initiatives to augment preventive health screenings across health settings, further propelling the uptake of cellular health screening across the region. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.15 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

- In March 2023, the Maharashtra Health Department launched mass screening programs in government-run educational institutions with 12,000 teams for conducting tests, such as X-ray, ECG, blood tests, 2D echo, sonography and CT scans, among others.

Latin America

The Latin American market is anticipated to grow at a considerable pace over the forecast period. The growth is due to the rising health disease prevalence amongst the young women population and the rising product portfolio expansion of major players in the region.

Middle East and Africa

The Middle East & Africa region is expected to grow at a moderate CAGR owing to the rising initiatives of public awareness toward preventive health screenings across the region.

Key Industry Players

Product Collaborations Among Major Players to Boost Their Market Share

The global market for cellular health screening is highly fragmented and consists of prominent players, such as Quest Diagnostics Incorporated, Genova Diagnostics, Immunodiagnostik AG, Laboratory Corporation of America Holdings, and others. The companies’ highest share is attributed to the strong sales of their product portfolio globally and the increasing initiatives by major players toward collaborations and partnerships with emerging players in the market.

- In October 2022, Quest Diagnostics Incorporated announced that it has entered a new phase of its collaboration with Decode Health to facilitate biomarker discovery for drug and diagnostic test development.

Other players, including SpectraCell Laboratories, Inc., Life Length, and Cell Science Systems, are highly focused on clinical studies and partnerships with industry players to expand their geographical presence, which is expected to drive the global cellular health screening market share during the forecast period.

List of Top Cellular Health Screening Companies:

- Cell Science Systems (U.S.)

- SpectraCell Laboratories, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- BioReference Health, LLC (U.S.)

- Geneva Diagnostics (GDX) (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Immundiagnostik AG (Germany)

- Innovatics Laboratories, Inc. (U.S.)

- Life Length (Spain)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Xcode Life launched a gene nutrition test covering nearly 50 aspects of nutrition. The test allows an individual to discover how genes impact metabolism, nutrient absorption, and food sensitivities.

- May 2023: The National Institutes of Health launched Nutrition for Precision Health, powered by the All of Us Research Program (NPH), working with 14 sites across the U.S. to engage 10,000 participants from diverse backgrounds.

- January 2023: Genemarkers, LLC, launched a blue light testing service with a gene expression panel with 52 genes impacted by blue light. The genes regulate biological pathways such as oxidative stress, inflammation and skin ageing.

- November 2022: Quest Diagnostics Incorporated announced the introduction of three fitness panels measuring nutrition, endurance, hydration, energy, hormones, and muscle and recovery status among athletes. The nutrition profile identifies nutrient deficiencies, assessing macronutrient and micronutrient levels that serve as coenzymes in metabolic function, omega fatty acids, and hydration indicators.

- June 2020: Genova Diagnostics introduced the Metabolomix+ test, a new at-home nutritional test that assesses antioxidants, B vitamins, minerals, digestive support, and amino acids in cells.

REPORT COVERAGE

The market report for cellular health screening provides a detailed market analysis and focuses on crucial aspects, such as leading players, test types, and major indications of the product. Additionally, it offers insights into market trends, key industry developments such as mergers, partnerships, acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report includes the factors that have contributed to the market growth in recent years with a regional analysis of different segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 8.91% from 2026-2034 |

|

Segmentation |

By Test Type

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global cellular health screening market was valued at USD 3.9 billion in 2026 and is projected to reach USD 7.73 billion by 2034.

Registering a CAGR of 8.91%, the market will exhibit steady growth over the forecast period (2026-2034).

By test type, the single panel tests segment led this market in 2025.

Major drivers include the increasing prevalence of genetic disorders, rising awareness of preventive healthcare, growing emphasis on early disease detection, and advancements in telomere and oxidative stress testing technologies.

Quest Diagnostics Incorporated, Genova Diagnostics, and Immunodiagnostik AG are the leading players in the global market.

In 2025, the North America region held the largest share of the global market.

Key trends include the launch of advanced screening technologies like TeloSizer, multi-panel test development, growing partnerships and collaborations, and increasing adoption of nutrigenomic and inflammation panels across clinical settings.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us