China Insurance Market Size, Share & Industry Analysis, By Type (Life and Non-life [Property, Health, Motor, and Others], By Mode (Offline and Online), By Distribution Channel (Agencies, Banks, Direct Marketing Channels, Brokers, and Others), and Country Forecast, 2025-2032

China Insurance Market Size

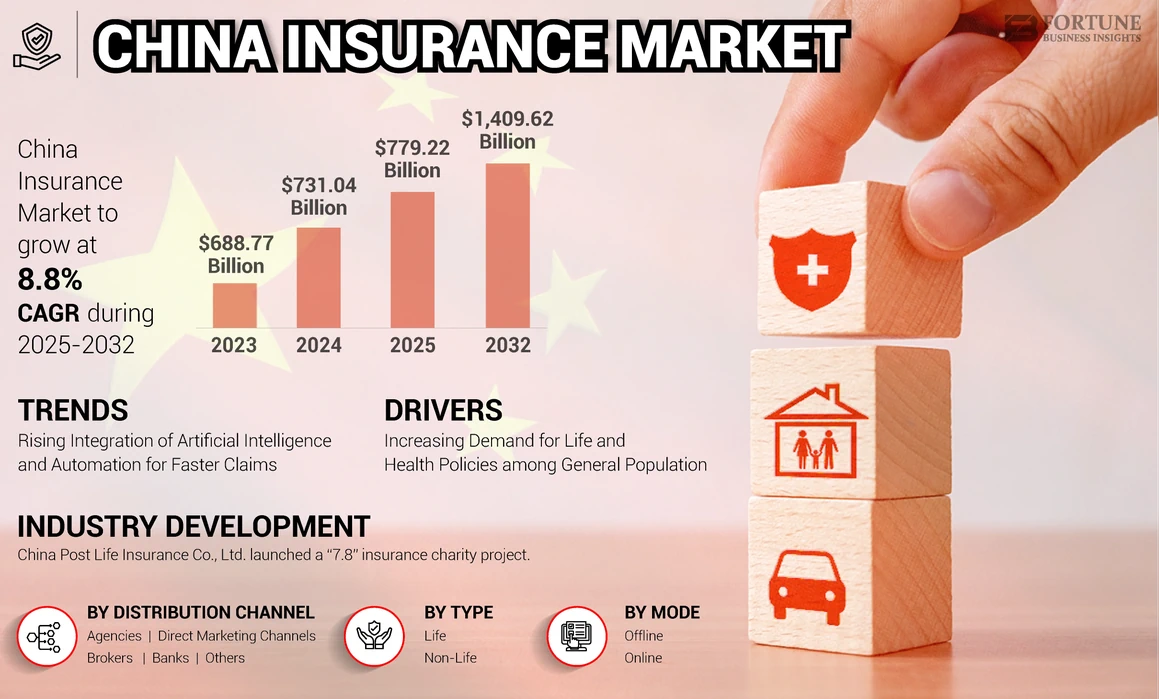

The China insurance market size was valued at USD 731.04 billion in 2024. The market is projected to grow from USD 779.22 billion in 2025 to USD 1,409.62 billion by 2032, exhibiting a CAGR of 8.8% during the forecast period.

Insurance is one of the most important financial products that act as a support system for the insured in case of a loss, and the product can be of various types, including life, auto, motor, property, and health. The increasing geriatric population, income growth, growing financial literacy, and awareness about the benefits of these policies are some of the factors supporting the growing demand for these policies among patients. In addition, the growing focus of key providers to launch innovative products to cater to customized needs among patients, resulting in the rising adoption of these policies.

- According to the 2023 statistics published by the Population Pyramid, the population aged 65 years in China was around 203.4 million in 2023, witnessing a growth of 4% from the previous year. The population accounted for 14.3% of the total population.

Due to the sudden outbreak of the COVID-19 pandemic, the market exhibited slower growth in 2020 as compared to 2019. The overwhelming need for healthcare services for treatment and various therapies resulted in an increased financial burden on individuals amid the pandemic. All these factors resulted in a slight decrease in demand for these policies, especially non-life policies among the population.

China Insurance Market Trends

Rising Integration of Artificial Intelligence and Automation for Faster Claims

The rising preference toward digital methods is continuously transforming the insurance sector toward online mode. There is a rising integration of artificial intelligence tools, including machine learning, and others in the industry that are enhancing the overall services, such as claims management, risk assessment, among others offered by the providers. The rapidly growing digital economy of the country is another factor that contributes to the growing adoption of digital tools in the market.

The integration of AI tools can help providers analyze market trends, customer preferences, and branding guidelines and offer tailored products and services through potential customer targets. The growing focus of the regulatory bodies, including the China Banking and Insurance Regulatory Commission (CBIRC), among others, to develop and introduce guidelines and measures to ensure data privacy and avoid data breaches is a crucial factor that further emphasizes the trend in the market.

- In July 2023, the Cybersecurity Administration of China (CAC) published the ‘Interim Measures for the Management of Generative AI Services’ in the Chinese Mainland.

Therefore, the growing demand for innovative plans and products among consumers in China is leading to the rising focus of the providers to integrate AI tools and services further enhancing the entire customer service and experience.

Download Free sample to learn more about this report.

China Insurance Market Growth Factors

Growing Demand for Life and Health Policies among General Population to Drive Market Growth

The growing awareness regarding the importance of health and life policies among the population, especially the youth in China, owing to the rising financial burden of healthcare expenses, is one of the major factors attributing to the growing demand for these products in the country.

The rising economy and disposable income among the population in China, along with improving financial literacy among the Chinese population regarding plans and products, are some of the crucial factors that are expected to fuel the China insurance market growth during the forecast period.

- According to a 2024 article published by the International Monetary Fund, the economic activity of China rebounded in 2023 with an increase in the GDP by around 5%.

Therefore, the growing demand, along with transformational changes in marketing strategies adopted by market players, are projected to drive market growth during the forecast period.

RESTRAINING FACTORS

Rising Concerns Regarding Data Privacy and Cyberattacks to Hamper the Adoption for These Policies

The growing trend of digitalization and integration of AI tools in the industry is enhancing the overall service among insurers. However, one of the significant limitations of big data technology is the cyber threats associated with this technology, which often leads to unauthorized access to the confidential data of the insured.

The data leak of personal information, including biometric, medical, and health-related information, among others, leading to the infringement of human dignity. Cyber threats often damage the reputation of companies, further impacting the business among the insurers.

Therefore, the growing use of big data technology and further increasing cyberattacks are likely to hamper the adoption of these policies among the insured, thereby limiting the growth of the market. Furthermore, limited focus on the establishment of a unified agency against cyber threats, along with a lack of implication of laws and regulations to protect the insured from cyberattacks and security threats, is likely to limit the adoption of these policies among the insured and thereby hampering the growth of the market.

China Insurance Market Segmentation Analysis

By Type Analysis

Growing Awareness about the Adoption of Life Policies Led to the Dominance of the Life Segment

Based on type, the market is segmented into life and non-life. The non-life segment is further bifurcated into property, health, motor, and others.

The life segment dominated the market in 2024 owing to growing financial literacy, awareness about the importance and benefits of life policies, and income growth, among others, resulting in rising demand for these policies among the population. This, along with the integration of artificial intelligence, machine learning, and improvement in regulatory scenarios for these policies, is likely to augment the adoption of life insurance policies among the population, thereby supporting the growth of the segment.

- For instance, according to the 2021 article published by ELSEVIER, it was reported that China accounts for more than 5% of the world’s life insurance premiums volume.

On the other hand, the non-life segment is also expected to grow considerably during the forecast period. The rising number of owned vehicle properties among the population is leading to increased demand for general policies, such as motor, property, and others. This, along with growing household income and rapid urban economic expansion, among others, are some of the factors contributing to the growing penetration of non-life products and plans among the population. This, along with the increasing geriatric population's growing awareness of health policies, among others, are some of the additional factors likely to support the growth of the segment in the market.

To know how our report can help streamline your business, Speak to Analyst

By Mode Analysis

Growing Number of Policies Sold Through Offline Channels Led to the Dominance of Offline Segment

Based on mode, the market is segmented into offline and online.

The offline segment dominated the market in 2024 fueled by personalized guidance regarding these policies and efficient selection of sum-assured, among other factors, resulting in rising demand for these policies through offline mode among the population. This, along with the growing number of providers in the provision of tailored policies among the population, is likely to support the growth of the segment in the market.

The online segment is also expected to grow with a considerable market share during the forecast period due to growing digital transformation, resulting in the rising number of providers offering innovative policies through online mode. Moreover, increased convenience, less time-consuming, ease of comparing policies, and availability of multiple payment modes are some of the factors contributing to the growing penetration of policies through online mode.

- For instance, according to the 2021 statistics published by the Insurance Association of China (IAC), it was reported that these policies are becoming more popular in online mode, with premiums increasing by about 13.6% in 2021 for online mode as compared to the previous year.

By Distribution Channel Analysis

Increasing Number of Agencies in the Country Led to Dominance of the Agencies Segment

The market is segmented into agencies, banks, direct marketing channels, brokers, and others, based on distribution channel.

The agencies segment accounted for the largest market share in 2024 due to the growing number of agencies offering innovative policies further resulting in rising demand for these policies from agencies among the population. This, along with the increasing number of plans for life and non-life insurance among these agencies, is likely to augment the growth of the segment in China during the forecast period.

- For instance, according to the 2023 report published by the National Bureau of Economic Research (NBER), it was reported that there are approximately 1,764 professional insurance agencies in China. Thus, a growing number of agencies is further likely to augment the penetration of these policies among the insurers, thereby supporting segmental growth.

The banks segment is also expected to grow considerably during the forecast period. The growth is due to the growing focus of banks on the inclusion of innovative plans in their product portfolio, resulting in rising demand for various policies among the population, thereby contributing to the growth of the segment in the market.

Additionally, direct marketing channels, brokers, and others segment are anticipated to grow with the highest CAGR during the forecast period. The growth is due to a growing focus on digital transformation among the population, resulting in rising demand for these policies from these channels.

KEY INDUSTRY PLAYERS

Robust Focus of the Key Players to Strengthen their Product Portfolio to Favor Market Growth

The market is fragmented with prominent players operating in the market with a wide product portfolio. China Life Insurance Co., Ltd., and Ping An Insurance (Group) Company of China, Ltd., are some of the prominent players in the market, accounting for a significant China insurance market share. The growing focus on innovative product launches, along with recognition awards to strengthen their brand presence, is a significant factor supporting the growing market shares of these companies.

China Pacific Insurance (Group) Co., Ltd. and New China Life Insurance Co., Ltd. are some other major companies operating in the market. The growing focus on the strategic initiatives of the company to increase the penetration of its life products, among other factors, is likely to support the growth of the company in the market. Other prominent players in the market include AIA Group Limited, and Taikang Insurance Group, among others. Rising product launches, collaborations among the other players, and others are some of the factors supporting the growth of these players in the market.

List of Top China Insurance Companies:

- Ping An Insurance (Group) Company of China, Ltd. (China)

- China Life Insurance Company Ltd. (China)

- China Pacific Insurance (Group) Co., Ltd. (China)

- New China Life Insurance Co., Ltd. (China)

- People's Insurance Company of China Co., Ltd. (China)

- AIA Group Limited (Hong Kong)

- Taikang Insurance Group (China)

- China Post Life Insurance Co., Ltd. (China)

- Sino Life Insurance Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 - People's Insurance Company of China Co., Ltd. collaborated with Inspur Group Co., Ltd. with an aim to improve its insurance business in China.

- January 2024 - China Post Life Insurance Co., Ltd. collaborated with General Health and General Health Care - China Post Health Station No. 1 with an aim to improve health and elderly care.

- October 2023 - China Post Life Insurance Co., Ltd. launched a “7.8” insurance charity project with an aim to support students in the village to strengthen the company’s presence in China.

- March 2023 - China Post Life Insurance Co., Ltd. launched “Health Insurance + Service” with an aim to improve the products and services for health insurance.

- February 2023 - Ping An Insurance (Group) Company of China, Ltd. launched the first ocean carbon sink index insurance policy for marine ecosystem protection, with an aim to create sustainable products.

REPORT COVERAGE

The research report provides a detailed market analysis. It focuses on key aspects, such as market size and forecast, segmentation based on type, mode, and distribution channel, and competitive landscape. It also gives an overview of the regulatory scenario, insights on insurance penetration, and analysis for significant companies. Besides, the report offers insights into the latest market trends, statistics, and key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.8% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Mode

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 731.04 billion in 2024.

The market will exhibit a steady CAGR of 8.8% during the forecast period of 2025-2032.

The life segment held the leading position in the market in 2024.

The key driving factors of the market include the rising awareness about the benefits of these policies, growing financial literacy, increasing demand for imaging technologies, and the launch of advanced products.

China Life Insurance Co., Ltd., China Pacific Insurance (Group) Co., Ltd., and Ping An Insurance (Group) Company of China, Ltd., are the leading players in the market.

Integration of technology to launch advanced products among the general population is driving the product’s penetration.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us