Chiplets Market Size, Share & Industry Analysis, By Packing Technology (2.5D/3D, Flip Chip Chip Scale Package, Flip Chip Ball Grid Array, Fan-Out, System-in-Package, and Wafer-Level Chip Scale Package), By Processor (Central Processing Unit, Graphics Processing Unit, Application Processing Unit, Artificial Intelligence Processor-specific Integrated Circuit Coprocessor, Field Programmable Gate Array), By Application (Enterprise Electronics, Consumer Electronics, Automotive, Industrial Automation) & Regional Forecast, 2025 – 2034

KEY MARKET INSIGHTS

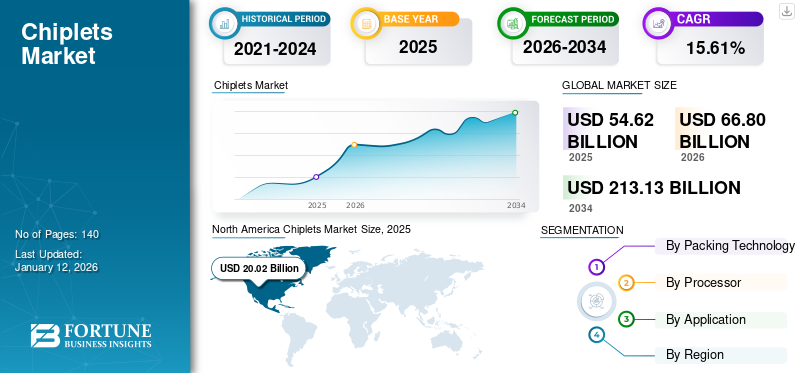

The global chiplets market size was valued at USD 54.62 billion in 2024 and is projected to grow from USD 66.8 billion in 2025 to USD 213.13 billion by 2034, exhibiting a CAGR of 15.61% during the forecast period. North America dominated the global market with a share of 36.66% in 2025.

The chiplet is a tiny, modular chip designed to excel at performing a specific function. They enable a mix-and-match approach by combining various functionalities from different fabricators, unlike the traditional monolithic chip designs where all components are fabricated on a single silicon wafer.

Chiplets Market Overview

Market Size:

- 2025 Value: USD 54.62 billion

- 2026 Value: USD 66.8 billion

- 2034 Forecast Value: USD 213.13 billion

- CAGR (2026–2034): 15.61%

Market Share:

- Regional Leader: North America led the global market with a 36.66% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to exhibit the highest growth rate during the forecast period, propelled by increasing investments in data centers, cloud infrastructure, and virtual desktop solutions.

Industry Trends:

- Remote Work Enablement: The shift towards remote and hybrid work models has increased the demand for secure and efficient computing solutions, boosting the adoption of thin clients.

- Cloud Computing Integration: Organizations are increasingly integrating thin clients with cloud services to enhance scalability, flexibility, and cost-efficiency.

- Energy Efficiency Focus: Thin clients are gaining popularity due to their lower energy consumption compared to traditional desktop PCs, aligning with sustainability initiatives.

- Security Enhancements: Centralized management and data storage in thin client architectures contribute to improved security and easier compliance with data protection regulations.

Driving Factors:

- Cost Reduction: Thin clients offer a cost-effective alternative to traditional desktops by reducing hardware and maintenance expenses.

- Centralized Management: Simplified IT management through centralized control of applications and data enhances operational efficiency.

- Scalability: The ability to easily scale computing resources to meet organizational needs supports business growth.

- Security: Enhanced data security through centralized storage and reduced risk of data breaches at the endpoint level.

Chiplets market growth is expected to be driven by the rising need for high-performance computing in consumer electronics, data centers, and AI. Chiplets modularity enables the creation of more efficient and adaptable designs to meet the specific requirements of advanced technologies. Moreover, standardization efforts and the expansion of data centers are also helping to accelerate market growth.

An industry analyst has emphasized that over 50% of a computer chip's power is utilized for horizontally transferring data across the chip, which is a major issue in terms of power consumption. This emphasizes the importance of developing more efficient chip designs, and chiplet technology is being increasingly considered as a solution.

IMPACT OF GENERATIVE AI

Advanced Capabilities and Accelerated Development of AI Applications for Chiplets Fueled Market Growth

Generative AI is significantly influencing the development and application of chiplet technology, reshaping how semiconductor designs are approached. Chiplets allow for the creation of more powerful AI chips by breaking down complex functionalities into smaller, specialized modules. This modular approach enables manufacturers to optimize performance by selecting the best chiplets for specific tasks, thereby enhancing design flexibility and reducing costs associated with traditional monolithic designs.

Moreover, the integration of chiplet technology is crucial for accelerating generative AI applications, particularly in edge computing. By facilitating faster data processing and reducing latency, chiplets enable more efficient deployment of AI models in various sectors. This is particularly relevant as the demand for real-time data processing grows. Due to the rising demand for AI chips, experts in the industry are predicting substantial growth in the High-Bandwidth Memory (HBM) sector, with an estimated increase of 331% this year and 124% in 2025, according to an industry analyst.

CHIPLETS MARKET TRENDS

Growing Usage of Modular Design Approaches is Key Trend

Modular chip designs are becoming increasingly popular, with separate chiplets handling different functionalities. This approach enables greater flexibility and scalability in product development. Initiatives, such as DARPA's CHIPS program, aim to standardize chiplet design and manufacturing processes, potentially leading to a robust marketplace for interchangeable components. As per an industry analyst, the CHIPS flow is expected to lead to a 70% reduction in design cost and turn-around times. As the industry continues to innovate, there is widespread adoption across various sectors, including automotive and high-performance computing.

Furthermore, modular design approaches leveraging chiplet technology offer significant benefits while also presenting challenges that need addressing. As standards evolve and interoperability improves, the potential for customized solutions in semiconductor design will expand.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Demand for High-Performance Computing Solutions is Aiding Market Growth

The demand for high-performance computing solutions is driving substantial growth in the chiplet market. With technological advancements, there is an increasing need for more powerful and efficient computing systems to support applications such as AI, big data analytics, and high-speed networking.

Chiplets offer a flexible and scalable solution to address these demands. They enable system designers to customize and optimize computing solutions by mixing and matching different chip functionalities. Chiplets facilitate the development of highly specialized and targeted systems, delivering exceptional performance for specific applications and fueling market demand.

Market Restraints

Technical Complexities in Integration and Interoperability and Heat Management Issues to Hinder Market Expansion

The market encounters specific limitations that require attention. One significant challenge is the complexity of ensuring and integrating interoperability between chiplets due to their diverse origins, specifications, and designs. This integration process presents difficulties in achieving seamless communication and compatibility, necessitating careful planning and standardized protocols and interfaces.

Heat management is another limitation for the chiplets market growth. When multiple chiplets are combined into one system, there are worries about how to dissipate the heat they generate. Keeping the system at the right operating temperatures becomes a difficult task due to the heat generated by each chiplet. To solve this problem, it is necessary to put in place efficient heat management methods, including advanced cooling systems and careful thermal design planning.

Market Opportunities

Rapid Expansion in AI, IoT Applications, and 5G Infrastructure to Create Lucrative Opportunities

The market for chiplets has great growth potential, particularly in the realm of AI and IoT applications. Their modularity and flexibility allow for the integration of specialized AI accelerators and IoT functionalities, resulting in more powerful and efficient processing. This paves the way for the advancement of applications, such as autonomous vehicles, smart homes, and industrial automation.

Furthermore, the rapid expansion of 5G infrastructure creates another opportunity for chiplets. Given the increased connectivity and data processing demands of 5G networks, chiplets can be employed to develop specialized components for base stations, edge computing, and other 5G-related applications. It enables the creation of high-speed, low-latency systems capable of handling the massive data volumes generated by 5G networks, thereby boosting the market demand. According to an industry analyst, by 2025, 5G networks are likely to cover one-third of the world's population.

SEGMENTATION ANALYSIS

By Packing Technology Analysis

Exceptional Properties of 2.5D/3D Packaging Technology Cement its Dominance

Based on packing technology, the market is segmented into 2.5D/3D, Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), Fan-Out (FO), System-in-Package (SiP), and Wafer-Level Chip Scale Package (WLCSP).

In terms of market share, the 2.5D/3D segment dominated the market in 2023. The chiplet landscape is being transformed by the emergence of 2.5D/3D packaging technology, which allows for the vertical stacking of chiplets, ensuring high performance, miniaturization, and bandwidth. 2.5D/3D packaging is a method that facilitates the integration of multiple ICs into a single package. In a 2.5D configuration, more than two active semiconductor chips are placed adjacent to each other on a silicon interposer to achieve a high die-to-die interconnect density. In a 3D configuration, active chips are stacked together to achieve the shortest interconnect and smallest package footprint. The 2.5D/3D segment is expected to lead the market, contributing 33% globally in 2026.

The Fan-Out (FO) segment is anticipated to register the highest CAGR during the forecast period. FO packing technology combined with chiplet architectures represents a transformative shift in semiconductor packaging, enabling higher performance, greater design flexibility, and cost efficiencies essential for modern electronic applications.

By Processor Analysis

CPU Chiplets Lead Due to Their Essential Role in Modern Computing Ecosystem

Based on processor, the market is segmented into Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application Processing Unit (APU), Artificial Intelligence Processor-specific Integrated Circuit (AI ASIC) Coprocessor, and Field Programmable Gate Array (FPGA).

In terms of market share, the CPU segment dominated the market in 2023, which was attributed mainly to the critical role that CPU chiplets play in the modern computing ecosystem. It functions as the main processing unit in a chip, managing a wide range of tasks from simple to intricate computational operations, which are essential in both consumer and enterprise computing devices. The Central Processing Unit (CPU) segment will account for 30.02% market share in 2026.

The AI ASIC coprocessor segment is anticipated to register the highest CAGR during the forecast period. AI ASIC coprocessors are tailored for specific applications, which allows them to provide enhanced performance for particular tasks compared to general-purpose chips. Their use is expanding in areas such as autonomous vehicles, healthcare, and robotics due to their efficiency in processing complex algorithms.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Enterprise Electronics Segment Dominated Market Due to Improved Performance of Advanced Electronic Devices

Based on application, the market is categorized into enterprise electronics, consumer electronics, automotive, industrial automation, military & aerospace, and others.

In terms of market share in 2023, the enterprise electronics segment dominated the market by holding the largest chiplets market share. The segment’s dominance is mainly a result of chiplets playing a crucial role in improving the performance and efficiency of electronic devices such as smartphones, tablets, laptops, and gaming consoles. These devices greatly benefit from the advanced modular chip architecture provided by chiplets, which allows for the incorporation of high-performance components without the expense and intricacy associated with traditional monolithic chip designs. The Enterprise Electronics segment is expected to account for 27.42% of the market in 2026.

The automotive segment is expected to grow at the highest CAGR during the forecast period. The automotive chiplet market represents a significant opportunity for growth as vehicles become increasingly electrified and reliant on advanced electronics. With rising consumer expectations for safety, connectivity, and efficiency, chiplets are set to play a pivotal role in shaping the future of automotive technology. Investments in this sector are expected to yield substantial returns as manufacturers seek innovative solutions to meet evolving market demands.

CHIPLETS MARKET REGIONAL OUTLOOK

Regionally, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Chiplets Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a major market share in 2023. The region’s growth is supported by leading semiconductor firms and a robust environment that fosters technological advancement. The demand for high-performance computing solutions in fields such as cloud computing and advanced electronics is the main catalyst for the utilization of chiplets in North America.

The chiplets industry in the U.S. is poised for remarkable growth due to technological advancements, increasing demand across various sectors, and significant investments in research and development. The U.S. market is estimated to reach USD 17.42 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

South America is poised for significant growth during the forecast period. The region is substantially investing into telecommunications infrastructure, requiring more advanced semiconductor solutions such as chiplets. This need is predicted to grow as the region keeps improving its connectivity and digital transformation efforts.

Europe

Europe is estimated to grow at the highest rate during the forecast period. The market experiences significant growth due to the region's emphasis on automotive and industrial uses. Advancements in chiplet technologies are further driven by the region’s dedication to minimizing electronic waste and enhancing energy efficiency, positioning it as a key supporter of sustainable electronic design. The UK market is expected to reach USD 2.96 billion by 2026. The Germany market is anticipated to reach USD 2.74 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to register a significant growth rate in the market during the forecast period. The early adoption of chiplet technology is currently a focus in this region, with an emphasis on building its technological infrastructure and digital services. As these markets progress, there is an expected increase in the use of advanced semiconductor technologies such as chiplets, which will help drive regional development efforts.

Asia Pacific

Asia Pacific is expected to register the second-highest growth rate in the market during the forecast period. A significant share of the market emphasizes the region's important position in the semiconductor and microelectronics sectors, which is propelled by advanced manufacturing abilities and substantial investments in research and development. The region's concentrated efforts to improve semiconductor technologies, along with robust government backing and partnerships among major tech companies, persist in driving expansion and creativity in the chiplets market. This leadership showcases the region's essential role in the worldwide market and its capability to spearhead future progress in chiplet technology. The Japan market is forecast to reach USD 4.83 billion by 2026. The China market is poised to reach USD 7.52 billion by 2026. The India market is set to reach USD 2.95 billion by 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Their Business Reach

Major industry players operating in the market are offering advanced chiplets by providing advanced packaging, performance, and flexibility in their product portfolio. These companies prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increase in demand for products.

LIST OF KEY CHIPLETS COMPANIES PROFILED:

- Intel Corporation (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

- IBM Corporation (U.S.)

- Marvell Packing Technology Group Ltd. (U.S.)

- MediaTek, Inc. (Taiwan)

- Achronix Semiconductor Corporation (U.S.)

- Renesas Electronics Corporation (Japan)

- Global Foundries (U.S.)

- Apple Inc. (U.S.)

- ASE Packing Technology Holding Co., Ltd. (ASE Group) (Taiwan)

- Silicon Box (Singapore)

- Tower Semiconductor Ltd.(Israel)

- NVIDIA Corporation (U.S.)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Ayar Labs, Inc. (U.S.)

- Tachyum (U.S.)

- Si-Five, Incs. (U.S.)

- Synopsys, Inc. (U.S.)

- Ranovus (Canada)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Rapidus Corporation, a producer of cutting-edge logic semiconductors, teamed up with the multinational technology company, IBM, to work on developing mass-production technologies for chiplet packages. As part of the partnership, IBM provides Rapidus with packaging technology for high-performance semiconductors, and the two companies will work together to drive innovation in this field.

- June 2024: Achronix Semiconductor Corporation, a company specializing in embedded FPGA IP and high-performance FPGAs, joined forces with Primemas, a semiconductor company working on an advanced SoC Hub Chiplet platform by means of chiplet technology. Together, they have announced a partnership to integrate FPGA programmability into Primemas' range of products. It has opted to utilize Achronix's Speedcore eFPGA IP in the Primemas Hublet to meet the requirements of organizations in need of testing and programmability capabilities.

- October 2023: Achronix Semiconductor Corporation collaborated with Myrtle.ai and launched a new development. This groundbreaking innovation is an accelerated Automatic Speech Recognition (ASR) solution utilizing the Speedster7t FPGA. The solution is capable of converting spoken language to text in more than 1,000 concurrent real-time streams with exceptional accuracy and rapid response times, and it offers a performance improvement of up to 20 times compared to competing solutions.

- July 2023: Silicon Box, based in Singapore, inaugurated a semiconductor manufacturing foundry worth USD 2 billion. The company aims to expand the utilization of chiplet technology. According to a statement by the company, the 73,000 sq.-meter factory is expected to generate more than 1,000 job opportunities with assistance from Singapore's Economic Development Board.

- November 2022: AMD introduced fresh graphics cards that are based on the next-generation energy-efficient, high-performance AMD RDNA 3 architecture. These graphics cards are called the AMD Radeon RX 7900 XT and Radeon RX 7900 XTX. The new graphics cards continue the trend of the highly positive and advanced AMD "Zen"-based AMD Ryzen chiplet processors.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The chiplets market presents robust growth prospects fueled by technological advancements and business expansions. With the market expected to grow significantly over the next decade, investors should consider focusing on emerging technologies, regional growth dynamics, and the competitive landscape to capitalize on potential returns in this rapidly evolving sector. For Instance,

- In July 2024, DreamBig Semiconductor Inc. secured a USD 75 million equity funding round, with the Samsung Catalyst Fund and the Sutardja Family co-leading the investment. The company is known for its high-performance accelerator platforms that make use of its industry-leading Chiplet Hub with 3D HBM.

- In March 2024, Eliyan secured funding of USD 60 million for its chiplet interconnect technology, which accelerates the processing of AI chips. The funding round was led by Samsung Catalyst Fund and Tiger Global Management, aiming to assist the team in tackling the hurdles associated with developing generative AI chips.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.61% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Packing Technology

By Processor

By Application

By Region

|

|

Companies Profiled in the Report |

Intel Corporation (U.S.) Advanced Micro Devices, Inc. (U.S.) Microchip Packing Technology Inc. (U.S.) IBM Corporation (U.S.) Marvell Packing Technology Group Ltd. (U.S.) MediaTek, Inc. (Taiwan) Achronix Semiconductor Corporation (U.S.) Renesas Electronics Corporation (Japan) Global Foundries (U.S.) Apple Inc. (U.S.) |

Frequently Asked Questions

The market is projected to record a valuation of USD 213.13 billion by 2034.

In 2025, the market was valued at USD 54.62 billion.

The market is projected to grow at a CAGR of 15.61% during the forecast period of 2026-2034.

By packing technology, the 2.5D/3D segment led the market in 2026.

The rising demand for high-performance computing solutions is aiding market growth.

Intel Corporation, Advanced Micro Devices, Inc., Microchip Technology Inc., IBM Corporation, MediaTek, Inc. are the top players in the market.

North America held the highest market with a share of 36.66% in 2025.

By application, the automotive is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us