Chlor Alkali Equipment Market Size, Share & COVID-19 Impact Analysis, By Type (Ion Exchange Membrane Method and Diaphragm Method), By Application (Chlor-alkali Industry, Metallurgical Engineering, and Others (Chemical Industry)) and Regional Forecast, 2026-2034

Chlor Alkali Equipment Market Size

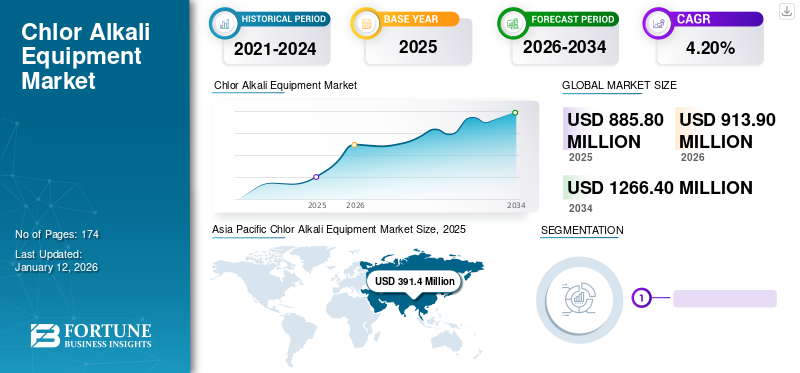

The global chlor alkali equipment market size was valued at USD 885.8 million in 2025 and is projected to grow from USD 913.9 million in 2026 to USD 1,266.40 million by 2034, exhibiting a CAGR of 4.20% during the forecast period. Asia Pacific dominated the global market with a share of 44.20% in 2025.

Chlor alkali equipment produces chemicals such as chlorine, hydrogen, and sodium hydroxide (caustic) solutions by electrolysis. The basic method involves the diaphragm that later on evolves into the current non-toxic ion exchange membrane technology. The end-user applications are majorly in the chlor alkali industry, metallurgical industry, and other industries (paper pulp industry, etc.). The end product of the chlor alkali industry is the essential commodity chemical required in the industry for the various operations of manufacturing, bleaching, and many more which is driving the demand for this equipment.

The global chlor alkali equipment will see a steep, stable growth in the forecast period due to resumed international trade flows and chemical demand. Hydrochloric acid, chlorine, sodium hypochlorite, and hydrogen are used continuously in the various industry verticals such as in the pulp and paper industry, chemical industry, water treatment facilities, and many others, contributing positively to the chlor alkali equipment market growth in the forecast period. Furthermore, rapid urbanization, strict pollution norms, and sustainability concerns in developed and developing countries such as Europe, Asia, and America are significantly helping the ion exchange membrane technology acquire a significant share in the forecast period. Significantly, after the COVID-19 demand for this equipment across the chlor-alkali industry for caustic soda manufacturing is bolstering applications. Additionally, the rise in population and huge consumer demand for cleaning substances in the Asia Pacific region is a major market driving force that is weighing over the regional markets of the Americas, Europe, South America, and the Middle East. Thus, a global rise in the use of surfactants and the soap industry is driving the demand for this equipment globally.

COVID-19 IMPACT

Rising Consumption of End Products Supported the Demand for Equipment During Pandemic

The global chlor-alkali equipment saw a sharp decline after a stopped global chemical supply to the end industry due to strict government regulations and norms. Also, depreciating currencies in major chlor-alkali production countries and market volatility caused the market to behave negatively. Furthermore, high electricity prices have hiked chlorine caustic soda and soda ash production cost, and lower operating rates due to weakening chlorine derivate demand is estimated to boost the expansion projects. However, recovering demand for end products such as surfactants and cleaning chemicals stabilizes market dynamics that help grow stable and progressive demand for most chloro-alkali equipment manufacturers.

- For instance, according to Petrochemical Data Analysis group Tecnon Orbichem, demand for caustic soda which is a crucial raw material for detergents, bleach, and water treatment sectors, and most of the products has declined by around 5% in 2020 across the U.S. region.

LATEST TRENDS

Technological Advancements for Green Fuel Production to Diversify Offerings Globally

The global trend of achieving sustainable development has shifted the focus on stopping climate change by reducing greenhouse gases emission and achieving carbon neutrality by 2050. Major developing countries have strict policies and demand for sustainability to expand the capabilities of the hydrogen-producing this industry. Also, the trend of upgrading the existing mobility industry to flex-fuel (ethanol) or emission fuel such as hydrogen with the current carbon-emitting fuels is propelling the adoption of green hydrogen. These mentioned factors are the expanding chlor alkali equipment market share globally.

Download Free sample to learn more about this report.

- For instance, In May 2022, DeNora, a global electrode technologies supplier, expanded its electrode technologies to develop and test the platinum metal to produce green hydrogen.

Chlor Alkali Equipment Market Growth Factors

Rising Use of Equipment in Medical and Water Treatment to Thrive the Demand

Globally, the chemical commodity chlorine used for commercial and industrial applications is essential. Chlorine is used in every aspect and application, from water disinfection and bleaching in paper pulp to ethyl and PVC production in production facilities. At the global platform, major chlor-alkali manufacturers use electrolysis of common salt for chlorine production. primary chlorine application in the industry was in the manufacturing sector to produce vinyl and organic chemicals. These chemicals have dominant use in the medical and petrochemical sectors and also use of chlorine in water treatment facilities dominates its application in the chemical sector. Such diverse usage across varied industries to thrive the this product demand.

- For instance, in 2022, U.S. merchant market chlorine demand reached 1039 kMT, contributing to 27.2% of the U.S. total merchant chlorine market, while 50.2 kMT of chlorine demand was from medical devices.

RESTRAINING FACTORS

Increased Handling Challenges and Strict Safety Regulations to Suppress the Market Growth

Globally, chlorine is a critical chemical to operate owing to its hazardous nature and diverse applications. While significant applications are in the form of caustic soda, hydrochloric acid, and sodium hypochlorite. Limitations to setting up a plant outside ecozones and cities and the requirement of large amounts of raw materials such as sodium chloride limit their use in coastal sea regions. Also, transporting this hazardous chlorine compound to the end user across chemical industry is challenging and need to follow strict regulations. Also, global safety concerns for this chemical handling across the industry and strict safety regulations by the government are crucial to prevent from stop loss and incidents in the production domain that are causing hindrance to the market share.

- For instance, according to Eurochlor, the number of caustic soda incidents remained at the same level. Hydrochloric acid transport incidents rose from zero to 1.44 million tonnes, followed by zero to 0.86 million tonnes in sodium hypochlorite transport.

Chlor Alkali Equipment Market Segmentation Analysis

By Type Analysis

Growing Caustic Soda Applications Expanded Membrane Cell Technology’s Market Penetration

Globally, chlor alkali manufacturers use two methods to produce chemicals such as caustic soda from brine solutions: the traditional diaphragm and the latest ion exchange membrane technology.

In the halted market dynamics, soaps, and detergents were majorly used products, contributing about 12-16% of caustic soda applications. Also, using it in the raw form for water treatment facilities across various countries consolidates about 17% worldwide. However, the ion exchange membrane method dominates the market segments with market share of 69.23% in 2026, owing to the increasing demand for chemicals and caustic soda in wastewater treatment facilities, the construction industry, and production facilities across the globe. Such diverse applications of ion exchange membrane cell technology around the globe for crucial health operations and consumer goods expand chlor alkali equipment market size for the forecast period.

- For instance, until 2022, approximately 109,000 municipal wastewater treatment facilities exist across 129 countries for water purification operation supplements for market growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Chemical Treatment Application across Automotive Industry to Dominate the Chlor Alkali Industry

Chlor-alkali equipment for the production of chemicals has diverse applications across industries; chlor-alkali industry, metallurgical industry, and others (chemical industries, etc.)

The Chlor-alkali Industry segment led the market accounting for 56.65% market share in 2026. As per our analysis, chlor-alkali industry revived confidently post-pandemic with increasing demand for chlorine chemicals across various industrial applications such as paper pulp, ferroalloys, metal treatment, and pharmaceuticals to broaden the applications in different regions of globe. However, growth in demand in the automotive sector for paint and metal treatment solutions. Also, the presence of major key players in manufacturing and upgrading production capacity to fulfill the automotive sectors’ demand for chlor alkali chemicals is driving the market growth.

- For instance, according to BASF, the automotive sector in Germany grew by 0.4% in 2021 compared to 2020.

REGIONAL INSIGHTS

The market report covers a detailed scope and in-depth analysis of five main regions: North America, Europe, South America, Asia Pacific, Middle East, and Africa.

Asia Pacific

Asia Pacific Chlor Alkali Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 391.4 billion in 2025 and USD 405.2 billion in 2026. According to our report, the Asia Pacific region dominates the global market with the highest CAGR of 3.9% during the forecast period. Increasing demand for caustic soda derivatives among various industry verticals such as pulp & paper, chemical, textiles, metallurgical engineering, and water treatment facilities. This equipment is used to manufacture caustic soda and other chlor alkali elements, enhancing the demand and contributing positively to expanding chlor alkali equipment market share during the forecast period.

As per our market analysis, China is dominant in the Asia Pacific region due to heavy demand for chemicals in chemicals, metallurgical, and industrial applications. The rising participation of China, India, and Australia-based manufacturers and their efforts for spending on research and development activities can increase the prominence of this region. Additionally, the expanding population, industrialization, urbanization, and increased demand for chlor-alkali equipment, to cater Asia Pacific chlor alkali market growth. The Japan market is projected to reach USD 45.3 million by 2026, the China market is projected to reach USD 254.4 million by 2026, and the India market is projected to reach USD 21.7 million by 2026.

- For instance, in 2022, approximately 65.2% of the total population in China lived in cities. Such increment in the population drives the demand for PVC and caustic soda, which subsequently drives the market growth.

North America

North America chlor-alkali equipment demand is proposed to grow progressively during the forecast period due to the production of essential industrial chemicals through ion exchange membranes. Also, increasing demand for chlorine, soda ash, and caustic soda in the U.S., Canada, and Mexico to propel the demand for this equipment across the chlor alkali industry. In addition, the increasing demand for chlorine and caustic soda from swimming pools and various industry verticals fuels the market growth. The U.S. market is projected to reach USD 173.2 million by 2026.

- For instance, in 2022, according to Fairland (Smart Igarden Solution), in the U.S., 12,236 swimming pool businesses rose by 0.8% compared to 2021, significantly propelling the need for chlorine in water cleaning.

Europe

Europe’s chlor alkali equipment market is forecasted to grow steadily as the government emphasizes on greener equipment solutions owing to rising electricity prices and environmental concerns. Additionally, European countries such as France, Germany, U.K., and others are producing organic chemicals, increasing the demand for equipment such as ion exchange membrane technology. Increasing demand for green fuel hydrogen in the commercial and several industry verticals subsequently boosts the demand for this equipment in the chlor alkali industry in the forecast period. The UK market is projected to reach USD 35.8 million by 2026, while the Germany market is projected to reach USD 93.7 million by 2026.

- For instance, according to Euro Chlor, the use of hydrogen in the chemical industries grew by 10.26% of the total production in 2021 compared to the year 2020.

South America

The South America chlor alkali equipment market will grow substantially over the forecast period owing to the stable demand for water treatment chemicals across the industry. Also, the equipment uses ion exchange methods for chlor alkali production, expanding the market share across the chlor alkali industry. Moreover, substantial demand for caustic soda and sodium hydroxide for manufacturing and chemical operations will substantially grow the demand for equipment.

Middle East and Africa

Middle East and Africa to showcase steady growth owing to the increasing demand for chemical, petrochemical, and agrochemicals from economies such as Qatar, Dubai, Oman, Africa, Saudi Arabia, and others. Also, the growing adoption of ion exchange membranes across various end users such as chemical, manufacturing, automotive, and other sectors is driving the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

- For instance, in January 2023, TA’ZIZ Company based in Abu Dhabi signed an agreement with Proman AG deals in the manufacturing of methanol and other chemicals.

KEY INDUSTRY PLAYERS

Diverse Product Offerings and Expanding Services Helped in the Acquisition of a Significant Market Share

Key industry players have addressed growth in the service business fueled by new product launches due to the demand for the most climate-friendly technological solutions and service adoptions. Although the demand has trekked up by the end of 2021 owing to the business growth opportunities outside their geographic zones, have helped the manufacturer to expand their consumer base to the new locations. Furthermore, manufacturers observed a rise in demand for maintenance and upgradation orders in the pandemic had held revenue growth in the volatile market dynamics.

- July 2022: Alfa Laval, a leading chlor alkali equipment manufacturer, established four new service centers in Monza, Europe. These centers will be a hub for cleaning, maintenance, and upgradation of the consumer’s equipment.

- May 2021: DeNora acquired ISIA S.p.A, a water disinfection and chlorine dioxide solution leader that will enhance the technology portfolio and improvise its operations in the Middle East.

LIST OF TOP CHLOR ALKALI EQUIPMENT COMPANIES:

- Alfa Laval AB (Sweden)

- Asahi Kasei Corporation (Japan)

- Azienda Chimica Genovese S.R.L. (Italy)

- Bluestar (Beijing) Chemical Machinery Co., Ltd. (China)

- Hitachi Zosen Corporation (Japan)

- Evoqua Water Technologies Corp (U.S.)

- Industrie De Nora S.p.A (Italy)

- INEOS Limited (U.K.)

- Mitsubishi Heavy Industries Group (Japan)

- ThyssenKrupp AG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: Mitsubishi heavy industries Engineering is integrated into Mitsubishi Heavy Industries Group. The agreement is made under the absorption-type split agreement to accelerate the MHI’s energy transition segment, which is the group’s central growth factor.

- November 2022: Asahi Kasei, a Japanese multinational, initiated the construction of a hydrogen production pilot plant that works on alkaline water electrolysis and was funded by the green innovation fund.

- November 2022: Asahi Kasei has initiated constructing its new alkaline water electrolysis pilot plant for hydrogen production at its Kawasaki works.

- October 2022: Green Energy Storage S.r.l partnered with Industrie De Nora S.p.A, a specialized Italian manufacturer of electrochemistry and sustainability solutions leader to develop, test, and optimize a platform for patented hydrogen technology.

- January 2022: INEOS, a U.K.-based chemical company, has welcomed its new state-of-the-art manufacturing facility. The manufacturing facility was a milestone facility project opened in partnership with Alpha manufacturing, a long-term sheet metal manufacturer.

REPORT COVERAGE

An Infographic Representation of Chlor Alkali Equipment Market

To get information on various segments, share your queries with us

The global market research report covers a detailed depth analysis of the mode of operation, product type, lubrication type, and application. It provides information about leading players in the Chlor alkali equipment market and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.20% from 2026 to 2034 |

|

Unit |

Value (USD Million), Volume (Thousand Units) |

|

Segmentation |

By Type, By Application, By Region |

|

By Type |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

The market size was valued at USD 885.8 million in 2025.

The market is expected to be valued at USD 1,266.40 million in 2034.

The global market is estimated to have a remarkable CAGR of 4.20%

Asia Pacific is expected to hold a major market share in the market. The region stood at USD 391.4 million in 2025.

Within the Application segment, Chlor alkali Industry is expected to be the leading segment in the market during the forecast period.

Rising Use in Medical and Water Treatment to Thrive Chlor Alkali Equipment Market Demand.

Alfa Laval AB (Sweden), Asahi Kasei Corporation (Japan), Azienda Chimica Genovese S.R.L. (Italy), Bluestar (Beijing) Chemical Machinery Co., Ltd. (China), Hitachi Zosen Corporation (Japan), Evoqua Water Technologies Corp (U.S.), Industrie De Nora S.p.A (Italy), INEOS Limited (U.K.), Mitsubishi Heavy Industries Group (Japan), ThyssenKrupp AG (Germany)

Chlor alkali Industry applications are expected to drive the market.

The major players in the market constitute approximately 40%-45% of the market due to their presence in multiple regions and diverse product portfolios.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic