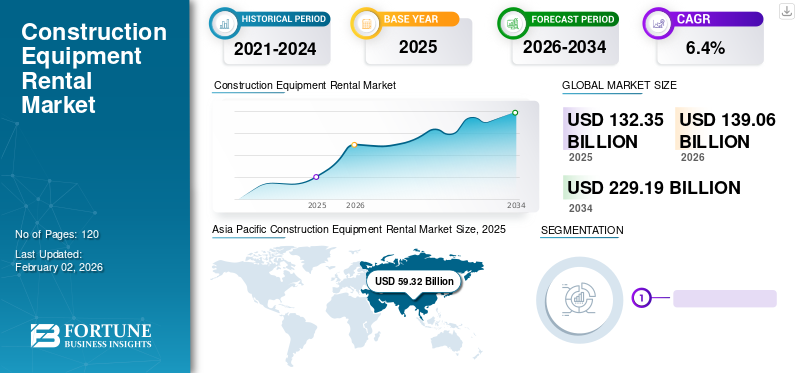

Construction Equipment Rental Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete & Road Building Equipment, and Others), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global construction equipment rental market size was valued at USD 132.35 billion in 2025 and is projected to grow from USD 139.06 billion in 2026 to USD 229.19 billion by 2034, exhibiting a CAGR of 6.4% during the forecast period. Asia Pacific dominated the global market with a share of 44.8% in 2025.

Construction equipment rental is a service that concludes a contract with terms of use and rents construction equipment to the end user for a certain period of time. Construction machinery is mainly used to facilitate heavy labor at mine construction sites. According to the Construction Equipment Rental Association, construction equipment rentals have increased significantly and are expected to foresee a substantial rise in developing countries such as China, India, and Mexico.

The demand from the equipment rental industry was impacted by the COVID-19 pandemic. After the outbreak of COVID -19 pandemic across the key economies, most of the leading market players registered a significant drop in their revenue generation and profit margins. Further, the sudden closure of the manufacturing facility affecting the rate of daily output from the production facilities played a pivotal role in plummeting the sales of these market players.

Download Free sample to learn more about this report.

However, the market witnessed substantial growth in 2021 as many rental businesses have taken advantage of the uncertainty caused by the pandemic. The global construction activity moved at an erratic pace each time a wave of COVID-19 hit, prompting small and medium-sized construction firms to rent rather than buy equipment. The uncertainty in the construction sector is expected to be exacerbated by rising commodity prices, a shortage of skilled labor, and high interest rates for construction companies.

Local and regional small businesses may prefer rental service businesses to achieve flexibility and generate revenue from their local and regional contractor customer base. In addition, markets where these rental services have started to emerge have seen significant growth in the construction equipment rental, with similar results in the U.S. and Italy.

Construction Equipment Rental Market Trends

Technological Progression in Heavy Machinery to Accelerate the Market Growth

Technological advances in the heavy equipment and automotive industries have brought a number of new trends to the market. Construction equipment manufacturers are focused on assimilating cutting-edge safety aspects such as 360-degree camera views, lift assist, and auxiliary work lights to improve the productivity of their operations and reduce the need for maintenance.

Growing technological advances in the automotive and construction machinery sectors are increasing the efficiency and performance of construction machinery. Key players in the equipment market are primarily focused on developing smarter machines through the integration of proprietary technology systems. Telematics systems provide simple information about the location and performance level of construction equipment and vehicles. Data sent through the system includes GPS location, fuel consumption & engine idle time.

However, this system requires a huge investment, making it unaffordable for many small builders and contractors. The equipment rental service has solved the problem by eliminating the total cost and providing rental options. Thus, the aforementioned factors are further increasing the construction equipment market growth across the globe.

Construction Equipment Rental Market Growth Factors

Increasing Adoption of Rental Equipment in Various Industries to Bolster the Market Growth

Hiring construction equipment offers a multitude of advantages, especially in light of the cyclical nature of the construction industry and prevailing economic conditions. Amidst increasing economic uncertainty and forecasts of a potential recession, numerous construction firms, contractors, and industries are increasingly turning to rental options. Notably, platforms such as BigRentz report a significant shift from outright equipment purchases to rental models among contractors and builders. This shift indicates a growing trend toward cost-effective and flexible solutions in response to economic fluctuations.

As concerns regarding economic volatility and cost containment persist, construction companies are becoming more discerning about their expenditures. The necessity to optimize the utility of equipment purchases to maximize value has prompted a surge in interest toward equipment rental as a viable alternative. Consequently, this trend is playing a pivotal role in driving the growth of the construction equipment rental market, as businesses seek to mitigate financial risks and leverage the benefits of a rental model in uncertain economic environments.

RESTRAINING FACTORS

Economic Downturn in Construction Equipment Rental Industry to Obstruct the Market Growth

The construction industry is renowned for its susceptibility to slumps and recessions, often mirroring fluctuations in broader economic conditions. The construction equipment leasing market, being intricately linked to the construction sector, undergoes multiple business cycles throughout its life cycle, experiencing the ebbs and flows of economies with varying levels of economic activity. During periods of economic downturn, such as recessions, the construction industry can bear the brunt of reduced consumer demand, leading to lower final production levels.

Consequently, this downturn in construction activity inevitably reverberates throughout the equipment rental market, as construction firms scale back their operations and delay investments in new equipment. Furthermore, factors such as fluctuating interest rates, regulatory changes, and shifts in government spending on infrastructure projects can also influence the performance of the construction equipment leasing market. Despite these challenges, the resilience of the construction sector and the adaptability of equipment leasing companies often enable them to navigate through economic downturns and emerge stronger in periods of recovery.

Construction Equipment Rental Market Segmentation Analysis

By Equipment Type Analysis

Earthmoving Equipment Expected to Hold Major Share Owing to Rising Demand

Based on equipment type, the market is classified into earthmoving equipment, material handling equipment, concrete & road equipment, and others.

Earthmoving equipment includes excavators, wheel loaders, bulldozers, and trenchers. This segment is expected to hold the highest share of the market as manufacturers are seeing notable opportunities owing to an increase in bridge, high-rise, and road construction.In 2026, the earthmoving equipments egment is projected to lead the market with a 53.54% share.

Moreover, the concrete & road equipment segment is anticipated to exhibit a progressive growth during the forecast period. As the road connectivity has the potential to define the future economy of the country, an established infrastructure plays an important role in enhancing commercial activities. In November 2021, the U.S. federal government passed a bipartisan infrastructure agreement (Jobs and Infrastructure Investment Act), authorizing a USD 110 billion investment to rebuild roads, bridges, and similar infrastructure for five years.

Furthermore, the material handling equipment segment is projected to experience major growth due to rapid industrialization and increasing demand for construction equipment for industrial applications. With an increased focus on maximizing output, industries are looking to minimize capital expenditures, much of which is spent on purchasing material handling machinery. Taking advantage of the same rental benefit allows major companies to expand their profit margins.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Commercial Segment to Grow Significantly Due to Rising Demand in Infrastructural Activities

Based on application, the market is segregated into residential, commercial, and industrial.

The commercial segment is expected to grow exponentially over the forecast period due to the rising demand for construction equipment. Commercial properties are generating profitable opportunities for equipment manufacturers to enhance their business in terms of rental services and sales of the product. Besides that, with the infrastructure plan incorporated by the governments of various countries in developing economies, the heavy equipment rental market growth would be increasingly stable as governmental schemes will choose rental services.

Moreover, the industrial segment is anticipated to exhibit substantial growth owing to rising investment and rapid industrialization in major economies. For instance, there is an increase in the construction of multi-family homes (with the growing trend of nuclear families) and a rise in investment in the construction of highways, bridges, subways, and smart cities due to population growth and urbanization. Further, the upward trend toward automation is expected to drive the growth of the market.

The residential segment is expected to depict considerable growth during the forecast period. In 2026, the residential segment is projected to lead the market with a 38.47% share.The demand for construction equipment in this sector will increase significantly due to rise in the construction of residential buildings. In addition, macroeconomic factors are also very supportive for homebuyers as they help reduce mortgage rates and create more jobs. This is expected to drive the market growth.

REGIONAL INSIGHTS

The report covers five major regions, North America, Europe, Asia Pacific, the Middle East, and Africa, and Latin America.

Asia Pacific Construction Equipment Rental Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 59.32 billion in 2025 and USD 62.97 billion in 2026. Asia Pacific currently holds the largest share in the market and is expected to expand at the fastest rate throughout the forecast period. The region is one of the largest markets that has seen a boom in infrastructure development and construction as governments increasingly focus on developing infrastructure for a growing economy. The region has seen remarkable growth in the number of Special Economic Zones (SEZs), hydropower projects, dams, construction of highways, subways, and airports to support the high level of industrial activity, increasing energy demand, and better connectivity. As a result, numerous international companies have started to invest and set up distribution centers and production facilities in the region to meet the growing demand and capture the regional market.The Japan market is projected to reach USD 17.22 billion by 2026. The China market is projected to reach USD 27.10 billion by 2026. The India market is projected to reach USD 10.62 billion by 2026.

Furthermore, China is witnessing a phenomenal growth in the construction equipment rental industry. This country is estimated to hold the highest market share as a result of tremendous opportunities for the rental equipment manufacturers as the government is investing significantly in public infrastructures & residential construction projects & developments as the population in China is increasing rapidly. This is also elevating the market share across the globe.

To know how our report can help streamline your business, Speak to Analyst

North America

Following Asia Pacific, the North America market share is expected to exhibit substantial growth in the upcoming years.The strong presence of leading global manufacturers is contributing to the growth of the market. Additionally, construction companies across North America are being observed to be hesitant to invest in new equipment in these economic conditions. Hence, there are significant opportunities for the market to push through during the forecast period. These factors drive North America's growth potential and continue to grow the market share at the global level.The U.S. market is projected to reach USD 17.82 billion by 2026.

Europe

The Europe market is projected to record considerable growth during the forecast period. This is mainly due to the increase in demand for new residential buildings. Additionally, Germany has a huge number of manufacturing plants, specifically in the automotive sector and the best performing machinery & equipment in the whole of Europe, which is further accelerating the market growth.The UK market is projected to reach USD 10.22 billion by 2026. The Germany market is projected to reach USD 13.30 billion by 2026.

According to the European Rental Association (ERA), sustainability of companies can be improved by services rather than buying them. In addition, the expansion of the fleet in these countries also underpins the growth of the European market.

Middle East & Africa

The Middle East & Africa region is predicted to exhibit steady growth during the forecast period. The Gulf Cooperation Council (GCC) holds the highest market share in the Middle East and Africa region, owing to the heavy application of automation and modernized techniques in manufacturing in the developed Gulf countries.

Latin America

Latin America is likely to grow at a modest rate due to niche opportunities for the development of manufacturing industries and the limited presence of global market players. Additional factor dictating the sluggish growth of the region is the underdeveloped distribution channel for the market.

KEY INDUSTRY PLAYERS

Manufacturers Concentrating on Technological Advancements in their Renting Technique to Strengthen Industry Position

The market for construction equipment rental is identified as highly competitive with presence of multiple players operating in certain regions as well as at the global level. Fleet development is the major trend observed in the construction rental market. Many leading companies such as Herc, Sunbelt & United Rentals are focusing on expanding their fleets and investing in the same direction. This is mainly due to the increasing demand for a wide range of construction equipment in the residential, commercial, and industrial sectors. Furthermore, these companies are now extending their services beyond their conventional setup to provide value to consumers throughout their product lifecycle by providing digital solutions.

LIST OF TOP CONSTRUCTION EQUIPMENT RENTAL COMPANIES:

- United Rentals, Inc. (U.S.)

- Loxam (France)

- Sunbelt (U.S.)

- Taiyokenki Rental Co., Ltd. (Japan)

- AKTIO Corporation (Japan)

- Herc Rentals Inc. (U.S.)

- Ahern Rentals. (U.S.)

- H&E Equipment Services, Inc. (U.S.)

- Nikken Corporation (Japan)

- Nishio Rent All Co. Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: H&E Equipment Services Inc. (H&E) inaugurated its 22nd rental location in Texas with the opening of a new branch in Houston South, catering to various construction and general industrial equipment needs.

- April 2023: Boels Rental acquired BAS Maskinutleie, a Norwegian company, thereby expanding its Nordic subsidiary Cramo and extending its rental services across the Nordic region.

- December 2022: United Mobility Technology AG (UMT), a German technology firm, launched Smart Rental, an online rental marketplace accessible via a mobile phone app. This platform allows customers to rent construction equipment such as excavators, vibratory plates, and loaders using the 'Car-2-Go' concept, providing proximity to their sites, anytime availability, and contactless transactions.

- October 2022: H&E Equipment Services Inc. finalized the acquisition of One Source Equipment Rentals Inc., enabling it to broaden its rental services to the Midwest and reinforce its presence in the southern U.S., facilitating increased involvement in non-residential construction and industrial end-markets.

- June 2022 - Sunbelt Rentals announced its partnership with Britishvolt, to support the development of Britishvolt’s first full-scale Cambois-based battery Gigaplant. This long-term deal will also see the companies work closely together to favor the development of battery solutions for power plants and heavy equipment to help decarbonize the construction and equipment rental sector.

- March 2022: Herc Holdings acquired Cloverdale Equipment Company to enhance its offerings of general and specialty equipment rental solutions and associated services.

REPORT COVERAGE

The global construction equipment rental market research report provides a detailed analysis of the type and application of the product. It provides information about leading companies and their business overview, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, current market trends, and highlights key drivers and restraints. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.4% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 132.35 billion in 2025.

By 2034, the market is expected to be valued at USD 229.19 billion.

The global market is estimated to record a noteworthy CAGR of 6.4% during the forecast period (2026-2034).

Asia Pacific stood at USD 59.32 billion in 2025 and is expected to hold a major share in the market.

Based on equipment type, earthmoving equipment is expected to be the leading segment in the market during the forecast period.

The market is majorly being driven by the increasing adoption of rental equipment in various industries.

United Rentals, Inc., Loxam, Sunbelt, Taiyokenki Rental Co., Ltd., AKTIO Corporation, Herc Rentals Inc., Ahern Rentals., H&E Equipment Services, Inc. Nikken Corporation, and Nishio Rent All Co. Ltd. are some of the leading players in the market.

Based on application, the commercial segment is expected to drive the market.

The major players constitute approximately 45%-50% of the overall market share, which is majorly owed to their brand image and presence in multiple regions.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us