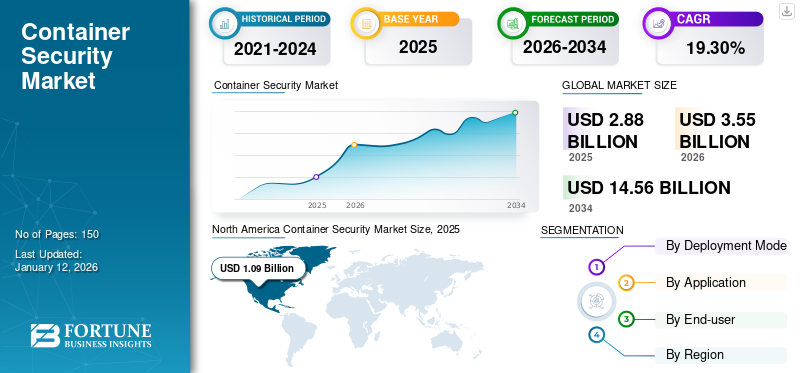

Container Security Market Size, Share, & Industry Analysis, By Deployment Mode (Cloud and On-premise), By Application (Vulnerability Management, Runtime Management, Compliance Management, Authentication Management, Infrastructure Security Management, and Access Management), By End-user (BFSI, Retail & Consumer Goods, Government, Healthcare, IT & Telecom, Manufacturing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global container security market size was valued at USD 2.88 billion in 2025 and is projected to be worth USD 3.55 billion in 2026 and reach USD 14.56 billion by 2034, exhibiting a CAGR of 19.30% during the forecast period. North America dominated the global container security market with a share of 37.73% in 2025.

The report focuses on key players, including Microsoft Corporation, Amazon Web Services, Inc., Alphabet Inc. (Google LLC), IBM Corporation, VMware, Inc., Palo Alto Networks, McAfee Corporation, Cisco Systems, Inc., Tenable, Inc., Trend Micro Incorporated, and many others that provide solutions and services for container security.

Cloud-based systems, such as Salesforce and Zoom are essential for enabling knowledge workers to interact successfully from home, but public cloud hosting suppliers, such as Google Cloud and AWS have had great success. These factors will further support the growth of the container security industry during the forecast period. The dependencies between a virtual machine and its Operating System (OS) have become a critical task for developers in the era of cloud computing and application development tools. Application portability across clouds is a key element in adopting containers and container-related technologies, such as Docker and Kubernetes to accelerate DevOps time to market.

At the beginning of the COVID-19 pandemic, many businesses were required to quickly adopt cloud applications to allow employees to work effectively outside the office, away from traditional network security tools. Although containers offer some degree of isolation between various applications running on an endpoint, they are still vulnerable to attack. To stop malicious software from entering or exiting their containers, DevOps and security teams must comprehend the risks associated with container security solutions.

Container Security Market Trends

Advancement in Security Policy is a Key Trend

The way organizations manage their security policy has changed as a result of updating their containers. "Policy as code" is rapidly becoming achievable, and organizations are witnessing the beginning of a security application revolution at this time. This is due to the fact that security tools are now a part of the DevOps process. Instead of delegating security to a single team, many teams tackled it together. The entire procedure is extremely streamlined as organizations designate security policies for new deployments.

With security policies becoming the industry standard for application deployment, there has been a significant increase in demand for container security services. Although containers are neither more nor less secure than other applications, they have the advantage of being perceived as being more secure than traditional applications.

Download Free sample to learn more about this report.

Container Security Market Growth Factors

Increasing Adoption of Serverless Technologies to Propel Market Growth

Enterprises are realizing that container technology is paving the way for cloud 2.0. They see this opportunity by moving beyond their VM-centric cloud infrastructure and adopting more data-centric and service-centric solutions. Enterprises also want to transform their cloud capabilities by using serverless containerization, cross-cluster, hyper-scale management, and advanced technologies, along with the aforementioned services and safety nets. Cloud 2.0 provides native cloud security, allowing enterprises to use containers securely.

Customers are adopting serverless technologies for IT infrastructures to deal with maintenance costs and security. They are also utilizing this technology to control the processes of their framework. Due to its simplicity and financial benefits, serverless processing is receiving critical consideration in the business world as a convincing worldview to send applications and administrations on the lookout.

The acceleration is shifting the focus on containers and serverless computing, which will allow enterprises to optimize their operations further.

RESTRAINING FACTORS

Lack of Governance, Visibility, and Standardization to Restrict Market Growth

Some DevOps groups avoid formal security cycles and compartment checking, which can create basic security weaknesses. Programming misconfiguration and IAM secondary passage linkage can make gigantic holes on the lookout. As per a security priorities study by Foundry,container security incidents account for more than 90% of the current organization's security dangers, a considerable lot of which are huge security threats. Containers make codes run quicker and more productively; however, the action inside the containers is generally undetectable to security groups. Existing security devices don't screen which containers are running, what they are doing, or flag organizational actions.

Container-based security standards have become a challenge as they are based on outdated methods, making it difficult for some organizations to overcome the obstacles. In addition to several security standards, the proliferation of containers, tools, and platforms is creating security issues.

Container Security Market Segmentation Analysis

By Deployment Mode Analysis

Growing Adoption of Cloud to Boost Demand for Container Security Solutions

Based on deployment mode, the market is segmented into cloud and on-premise.

In 2026, the cloud segment accounted for a larger global container security market with a share of 79.06% in 2026 and is projected to record a high CAGR during the forecast period. The growing usage of the cloud deployment model is attributed to an increase in data loss and privacy concerns, which is accelerating the demand for solutions and services.

Additionally, large quantities of sensitive data of various applications are being stored in data containers as a result of the continuous adoption of cloud services. Moreover, businesses recognize the opportunities presented by adopting solutions that are more focused on data and services rather than just virtual machines in cloud infrastructures. This factor may surge the demand for cloud solutions.

By Application Analysis

Robust Use of Vulnerability Management Applications to Tackle Cyberattacks will Fuel Market Progress.

Based on application, the market is segmented into vulnerability management, runtime management, compliance management, authentication management, infrastructure security management, and access management.

The vulnerability management segment is dominating the market due to the significant increase in cyber-attacks and security threats in recent years. If left unchecked, vulnerabilities in security programs and other business applications can pose extreme risks. Enterprises are mitigating the impact of external attacks through proactive vulnerability management, which is expected to increase the demand for this application during the forecast period.

compliance management dominate market with contribution of 24.81% globally in 2026.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

BFSI to Dominate the Market Due to Rise in Use of Digital Technologies

By end-user, the market is divided into BFSI, retail & consumer goods, government, healthcare, IT & telecom, manufacturing, and others. Containers have become an essential tool across banks and financial service firms that have to use digital technologies on a large scale. Organizations using container security solutions and services started gaining the attention of a wider audience, which achieved the same technology benefits of enhanced application delivery and run-time efficiencies.

Thus, container security in BFSI has helped to deliver better applications and services, in turn, leading to a larger market with a share of 28.11% in 2026.

REGIONAL INSIGHTS

The market covers various regions, such as North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America Container Security Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North American market is expected to account for the largest revenue share over the forecast period, maintaining its leading position established in 2025, when the regional market size reached USD 1.09 billion. Market strength is underpinned by consistently high enterprise IT spending, early adoption of cloud-native architectures, and heightened focus on containerized workload security. Regulatory expectations around data protection, critical infrastructure security, and industry compliance standards continue to encourage proactive security investments, particularly among large enterprises. The U.S. remains the primary contributor, with its market projected to reach USD 0.93 billion by 2026, supported by strong demand from BFSI and healthcare sectors where rising cyber threats and a shift from traditional VPN-based models to zero trust network access are accelerating container security adoption.

Europe

Europe represents a steadily expanding market, shaped by a stringent regulatory environment emphasizing data privacy, cybersecurity resilience, and compliance with region-wide frameworks. The UK market is projected to reach USD 0.20 billion by 2026, while Germany is expected to attain USD 0.22 billion by the same year, reflecting robust demand from enterprises modernizing legacy IT systems toward containerized and microservices-based architectures. Growth is further supported by increasing cloud migration across regulated industries, where container security solutions are being deployed to ensure compliance, visibility, and runtime protection without compromising operational efficiency.

Asia Pacific

The Asia Pacific market is characterized by rapid digital transformation and expanding cloud infrastructure investments across both developed and emerging economies. By 2026, the Japan market is projected to reach USD 0.09 billion, China USD 0.14 billion, and India USD 0.13 billion, highlighting broad-based regional momentum. Demand is driven by the increasing adoption of container technologies among enterprises and technology service providers, coupled with rising awareness of cloud-native security risks. The presence and active participation of global technology vendors such as Microsoft, IBM, and VMware, along with sustained investments in R&D and strategic partnerships, are strengthening the regional ecosystem and supporting long-term market growth.

Latin America

Latin America is witnessing gradual but consistent adoption of container security solutions as organizations increase cloud deployment to enhance scalability and cost efficiency. Market growth is supported by improving digital infrastructure and rising awareness of cybersecurity risks associated with containerized applications. While regulatory frameworks are comparatively less uniform across countries, increasing alignment with global data protection and cybersecurity standards is prompting enterprises, particularly in BFSI and telecom sectors, to invest in container security platforms to safeguard workloads and ensure operational continuity.

Middle East & Africa

The Middle East & Africa market is in an emerging growth phase, driven by government-led digital transformation initiatives and expanding cloud adoption across sectors such as banking, energy, and public services. Regulatory emphasis on national cybersecurity strategies and data sovereignty is gradually shaping enterprise security priorities, supporting the adoption of container security solutions. Strategic collaborations between global vendors and regional cloud service providers are enhancing market accessibility. For example, in May 2021, NeuVector announced the availability of its end-to-end container security platform for clients via IBM Cloud, reflecting the growing integration of advanced container security capabilities within regional cloud ecosystems.

Key Industry Players

Strategic Acquisitions to Boost Market Expansion of Key Players

The major players in the global market are focusing on providing advanced solutions and increasing their investments in R&D initiatives to introduce products and update existing solutions to expand their customer base and market presence.

In addition, these players are adopting partnership and acquisition strategies to expand their business in new regions and offer better customer experience.

- October 2022 – SUSE, a company specializing in enterprise-grade open-source solutions, announced that it acquired NeuVector. The acquisition may boost SUSE's value proposition for secure software and ensure an optimized container security program for its customers.

List of Top Container Security Companies:

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Alphabet Inc. (Google LLC) (U.S.)

- IBM Corporation (U.S.)

- VMware, Inc. (U.S.)

- Palo Alto Networks (U.S.)

- McAfee Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Tenable, Inc. (U.S.)

- Trend Micro Incorporated (Japan)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Kaspersky launched Kaspersky Container Security (KCS), a fully featured solution for container environments. This protects container applications at every step of the way, from development to production. The product is ready-to-install, cost-effective, and easy to integrate and deploy into a company's IT infrastructure.

- October 2023 – Net Feasa announced patent-pending security upgrades to its IoTPASS smart container tracking system. This is a shipping container monitoring device that forms a security connection between the container and locking bar, leveraging Net Feasa's context-aware AI to monitor security breaches and anomalies intelligently.

- November 2022 – Cider Security, a leader in software supply chain security and operation security (AppSec), was acquired by Palo Alto Networks in a definitive agreement. The planned acquisition would sustain Palo Alto’s Prisma Cloud solution methodology to safeguard the complete operation security lifecycle.

- June 2022 – The general availability of runtime security for customers driving infrastructure and application modernization with Red Hat OpenShift on IBM Power Systems has been announced by Aqua Security, a pure cloud-native security provider. IBM Power’s customers can now protect their Red Hat OpenShift container workloads throughout their entire lifecycle against cloud-native attacks with the help of Aqua’s runtime technology.

- March 2022 – To assist customers in protecting modern applications at scale, VMware, Inc. introduced new container runtime security capabilities based on a robust end-to-end security offering. The VMware group of security solutions for updated applications draws on the company's extensive knowledge of workloads, security, and Kubernetes to cover the entire application lifecycle.

REPORT COVERAGE

The research report highlights leading regions across the world to offer users a better understanding of the market. Furthermore, the report provides insights into the latest industry trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.30% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment Mode

By Application

By End-user

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 14.56 billion by 2034.

In 2025, the market value stood at USD 2.88 billion.

The market is projected to record a CAGR of 19.30% during the forecast period of 2026-2034.

The vulnerability management segment is likely to lead the market.

Advancements in security policies are driving the market growth.

Microsoft Corporation, Amazon Web Services, Inc, Alphabet Inc. (Google LLC), IBM Corporation, VMware, Inc, Palo Alto Networks, McAfee Corporation, Cisco Systems, Inc., Tenable, Inc, and Trend Micro Incorporated are the top players in the market.

North America is expected to hold the largest market share.

North America is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us