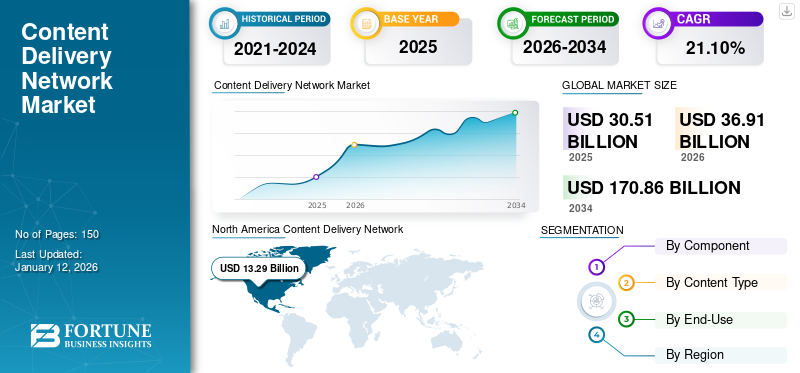

Content Delivery Network (CDN) Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Content Type (Static and Dynamic), By End-Use (Media & Entertainment, Advertising, E-commerce & Retail, BFSI, Healthcare, IT & Telecom, Gaming, and Others), and Regional Forecast, 2026–2034

CDN Market Size

The global Content Delivery Network (CDN) Market was valued at USD 30.51 billion in 2025. The market is projected to be worth USD 36.91 billion in 2026 and reach USD 170.86 billion by 2034, exhibiting a CAGR of 21.10% during the forecast period. North America dominated the market with a share of 43.60% in 2025.

Many organizations around the world have not renewed their subscriptions for on-premises CDN services as they transitioned to remote work due to the pandemic. CDN solutions are widely used in the media and entertainment industry to improve the delivery of video and audio content. The need for high-quality content, continued evolution of content consumption, and real content meet the need for efficient CDN solutions that can improve network performance and improve content delivery. The increasing demand for over-the-top (OTT) and video-on-demand (VOD) services ensures the continuous delivery of content over high-speed data networks and is expected to drive market growth during the forecast period.

On the other hand, the complexity of the delivery structure is a major hurdle for market growth. In a world where bandwidth is controlled, the speed of content delivery is affected by many factors, including page content and the effective routing of web traffic. Additionally, complex delivery procedures increase the operational cost of the process and such factors create major challenges for the market.

This report has considered market players, including Akamai Technologies, Amazon Web Services, Inc., Fastly, Inc., Limelight Networks Inc. (Edgio), and others that offer CDN solutions.

The earlier phases of the pandemic had a direct impact on the market owing to the growing demand for video content. This period also created labor and supply chain challenges. With the imposition of trade restrictions and lockdowns, it became more challenging for the vendors to manage their supply chains, making it difficult for them to plan and produce. These disruptions caused an increase in costs and had a detrimental impact on the business.

Content Delivery Network (CDN) Market Trends

Increasing Demand for Content Distribution Across Mobile and Wireless Devices to Foster Market Growth

The market is experiencing a rapid shift toward mobile-first content distribution owing to the rising use of mobile devices for accessing online content. According to Cisco, traffic from mobile and wireless devices is expected to account for over two-thirds of all IP traffic by 2023. This trend is prompting content delivery network vendors to optimize their infrastructure and delivery strategies for mobile platforms, ensuring seamless and efficient content delivery on smaller devices with varying network conditions. Moreover, vendors are emphasizing on responsive design and adaptive content formats to cater to a wide range of mobile and wireless devices. For instance, in July 2023, Vodafone deployed Cisco and Qwilt’s content delivery network solution to enhance the capacity and quality of Vodafone’s streaming delivery services to its fixed and mobile broadband customers across Africa and Europe.

Thus, the market is driven by the increasing mobile user base and need for better user experience across all devices.

Download Free sample to learn more about this report.

Content Delivery Network (CDN) Market Growth Factors

Growing Need for Low Latency in Real-Time Applications to Drive Market Growth

Several factors, including increased Internet usage, rise in video streaming, growing popularity of e-commerce, gaming & e-sports, security concerns, and others will drive the global content delivery network (CDN) market growth. The pandemic led to a significant surge in the demand for video streaming services, such as Netflix, YouTube, and various live-streaming platforms. This factor increased the need for a robust CDN infrastructure for smooth content delivery. As per the 2022 Global Internet Phenomena Report, video streaming accounted for 53.7% of the internet bandwidth traffic, which was an increase of 4.8% from the previous year.

Moreover, there was a greater demand for CDNs in the gaming industry, with online gaming platforms requiring low latency and high-speed content delivery for superior user experiences. However, this scenario led to an increase in cyber threats, which boosted the need for Distributed Denial-of-Service (DDoS) protection and security services, which CDN providers often offer as part of their services.

Furthermore, governments are trying to penetrate untapped areas and facilitate broadband access in such areas. For instance, the Federal Communications Commission (FCC) conducts various programs, such as the Connect America Fund and the Rural Digital Opportunity Fund, which aim to expand broadband access in underserved areas.

These factors will collectively contribute to the continuous growth and evolution of the CDN market.

RESTRAINING FACTORS

Complex Architecture and Data Security Concerns to Impede Market Growth

The CDN market faces challenges that influence the strategies and investments of CDN providers. While CDNs enhance performance, they also create potential security vulnerabilities. For instance, CDNetworks, in its State of Web Security H1 2022 analysis, stated that in the first half (H1) of 2022, the API security attacks multiplied, increasing by nearly 1.7 times than the previous year. Most attacks were concentrated on film/TV & media information, software information services, e-commerce, transportation, and government agencies. Providers need to invest in robust security measures to alleviate these concerns.

Moreover, network congestion and latency are still a concern in areas with limited infrastructure or sudden spikes in traffic. Delays in live video streaming of live matches and video conferencing may highly affect the network quality, thereby decreasing the demand for content delivery networks.

Content Delivery Network (CDN) Market Segmentation Analysis

By Component Analysis

Growing Demand for Better Media Delivery & Web Performance to Bolster Adoption of CDN Solutions

Based on component, the market is segmented into solutions and services. The solutions segment is further segmented into media delivery, app & web performance, and cloud security.

The solutions segment holds the biggest content delivery network (CDN) market share of 51.69% in 2026, owing to the growing applications of CDN in media delivery and web performance optimization. An October 2023 study by Cloudways stated that Walmart experienced a 2% increase in its conversion rate with every 1-second improvement in page load time.

However, the services segment is expected to record the highest CAGR due to the rising demand for professional and consulting CDN services.

By Content Type Analysis

Rising Live Streaming and Online Gaming Services to Drive Demand for Dynamic Content

Based on content type, the market is classified into static and dynamic.

The dynamic content type segment accounts for the largest share of 59.08% in 2026, the market due to the rising demand for real-time interactions, such as live streaming, gaming, and video conferencing. Such applications rely heavily on CDNs to ensure low latency and high performance.

However, the static content type segment is forecasted to register the highest CAGR. Optimizing the delivery of images, JavaScript files, and HTML documents through a content delivery network significantly improves the website load time and overall performance.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Number of Streaming Platforms to Drive CDN Use in the Media & Entertainment Industry

Based on end-use, the market is divided into media & entertainment, advertising, e-commerce & retail, BFSI, healthcare, IT & telecom, gaming, and others.

The media & entertainment segment holds the largest share of 59.08% in 2026. The market is experiencing high demand for streaming platforms for video, music, gaming, OTT, and other services. These platforms require content delivery network solutions to deliver content in real-time. According to the Netflix Open Connect analysis, in 2021, many online entertainment services will invest heavily in content to delight and engage their customers. Netflix invested more than USD 12.5 billion in content alone in 2020.

However, the e-commerce & retail segment is expected to display the fastest CAGR owing to the increasing use of mobile devices for online shopping. CDNs assist retailers in frequently updating their product listings, prices, and availability.

REGIONAL INSIGHTS

The report studies the market across North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

North America Content Delivery Network (CDN) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 13.29 billion in 2025 and USD 15.5 billion in 2026. The region has digitally matured economies due to the early adoption of advanced technologies and frequent investments in research and development. Moreover, the presence of significant content delivery network vendors in the region will contribute to the market growth. Many businesses, including large enterprises and cloud service providers, operate in the region. They utilize CDNs to enhance the performance of their web applications, software downloads, and other digital services. The U.S. market is projected to reach USD 10.83 billion by 2026.

Asia Pacific is expected to register the highest CAGR during the forecast period. The region’s growth is driven by a surge in smartphone and internet penetration and increasing access to affordable data plans. Asia Pacific has a large mobile-first population, which will foster the demand for CDNs that can optimize the content on mobile devices. Furthermore, governments are striving to offer customers better access to the Internet and related technologies. For instance, the South Korean government has invested in its “Korea 4.0” initiative, which includes measures to enhance the country’s digital infrastructure and support content delivery technologies. The Japan market is anticipated to reach USD 1.54 billion by 2026, the China market is projected to reach USD 2.5 billion by 2026, and the India market is expected to reach USD 1.47 billion by 2026.

Europe accounts for a substantial share of the global market due to the region’s rapid digital transformation, with enterprises across various industries moving their operations online. Also, the consumption of streaming services, online gaming, and other media-rich content is on the rise in Europe. For instance, according to a 2021 study by Netflix, in the U.K., 77% of standard broadband users availed of subscription-based video-on-demand services, such as Netflix, while 86% and 90% of users used superfast broadband and ultrafast broadband, respectively. The UK market is expected to reach USD 2.88 billion by 2026, while the Germany market is projected to reach USD 2.58 billion by 2026.

Similarly, the Middle East & Africa and South America are estimated to showcase great potential in the CDN market owing to many factors, including rapid digital transformation, growing e-commerce & online retail, expansion of the media & entertainment industry, favourable government initiatives, and rising digitalization efforts. For instance, Brazil’s National Broadband Plan aims to expand broadband access across the country, which will support the growth of digital content delivery services.

Key Industry Players

Collaborations & Partnerships among Vendors to Propel Market Growth

Major players in the market are collaborating and partnering with other companies to increase their profit margins. Partnerships can help businesses increase their sales and cut down costs by sharing or combining resources. For instance,

- March 2022: Cloudways and Cloudflare partnered with each other to launch enterprise-level integration to enhance internet connectivity. The collaboration offered Cloudways’ customers enterprise-level performance and security features with Cloudflare’s CDN.

List of Top Content Delivery Network (CDN) Companies:

- Akamai Technologies (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Fastly, Inc. (U.S.)

- Limelight Networks Inc. (Edgio) (U.S.)

- Google LLC. (U.S.)

- CDNetworks Co. Ltd. (Singapore)

- Cloudflare, Inc. (U.S.)

- Tata Communications (India)

- Medianova, LLC (U.S.)

- Imperva (Thales Group) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Vultr launched Vultr CDN (Content Delivery Network). This content delivery service brings content closer to the edge without conceding security. Vultr enables global content and media caching, extending websites and web applications to Vultr's global community of over 225,000 developers.

- January 2024: Leaseweb Global launches Leaseweb Multi-CDN in the Asia Pacific. Multi-CDN technology combines several content delivery network (CDN) providers to expand global customer reach. It allows media, marketing, SaaS, advertising, entertainment, gaming, and iGaming providers to reduce latency and deliver high-bandwidth content.

- October 2023: Edgio launched Perform Applications Bundles and enterprise-level Protect solutions equipped with enterprise-level Security Operations Center (SOC) support services and Tier-1 web performance capabilities. The new offering protects businesses against security threats while improving web application performance at an affordable monthly cost.

- March 2023: CDNetworks partnered with VSTV K+ to deliver seamless and interactive live-streaming user experiences across the Vietnam market. The collaboration enabled CDNetworks to expand its OTT business using the CDNetworks Media Acceleration Live Broadcast solution.

- January 2023: Google LLC made additions to its product offering to improve the security of web content. Google Cloud CDN offered support for private origin authentication for Amazon S3. This feature provided improved and advanced security by permitting only trusted connections to access the content on the user’s private origins.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Content Type

By End-Use

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 170.86 billion by 2034, according to Fortune Business Insights.

In 2025, the market was valued at USD 30.51 billion.

The market is projected to record a CAGR of 21.10% during the forecast period.

E-commerce & retail are expected to lead the market.

Growing need for low latency in real-time applications, such as OTT and video-on-demand services to drive the market growth.

Akamai Technologies, Amazon Web Services, Inc., Fastly, Inc., Limelight Networks Inc. (Edgio), Google LLC., CDNetworks Co. Ltd., Cloudflare, Inc., Tata Communications, Medianova, LLC, and Imperva (Thales Group) are the top players in the market.

North America is expected to hold the highest market share.

By component, the services segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us