Dental Abutment Market Size, Share & Industry Analysis, By Type (Pre-fabricated and Customized), By Material (Titanium, Zirconium, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

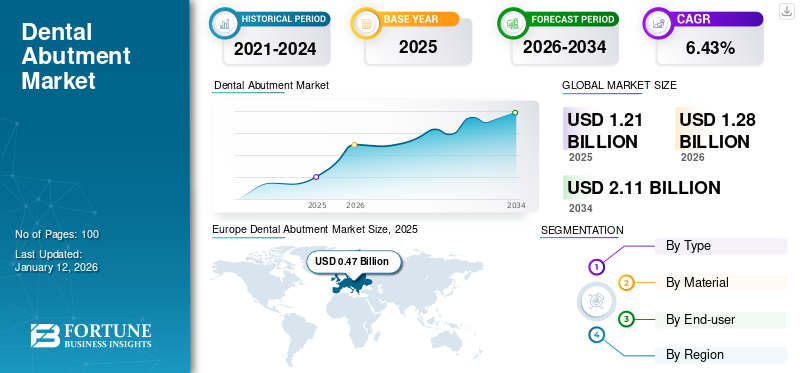

The global dental abutment market size was valued at USD 1.21 billion in 2025. The market is projected to grow from USD 1.28 billion in 2026 to USD 2.11 billion by 2034, exhibiting a CAGR of 6.43% during the forecast period. Europe dominated the dental abutment market with a market share of 38.64% in 2025.

Dental abutments are essential components in implant dentistry, serving as connectors between the dental implants and prosthetic restorations. The product is crafted from materials such as titanium or zirconia and abutments are customized to fit the individual patients' mouths. The abutments provide stability and support for crowns, bridges, or dentures, ensuring proper function and aesthetics. Abutments play a pivotal role in the restoration of the oral health and function, enhancing patients' quality of life with natural-looking and functional dental prosthetics.

The abutments market is primarily driven by advancements in the dental implant technology, increasing prevalence of dental disorders, and growing demand for cosmetic dentistry procedures. Additionally, the rising geriatric population, expanding awareness about oral health, and surge in disposable income levels contributes to the market growth. Moreover, the adoption of CAD/CAM technology for precise abutment design and customization further propels the market forward, along with the availability of innovative materials such as zirconia and titanium alloys.

The COVID-19 pandemic significantly affected the market in 2020 and 2021. The initial phase witnessed a notable decline in the elective dental procedures due to lockdowns and restrictions leading to a decline in market. However, as restrictions eased and healthcare services adapted to safety protocols, the market gradually recovered, driven by the demand for dental procedures and the resumption of elective surgeries.

Global Dental Abutment Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.21 billion

- 2026 Market Size: USD 1.28 billion

- 2034 Forecast Market Size: USD 2.11 billion

- CAGR: 6.43% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 38.64% share in 2026. This is due to the growing incidence of dental disorders like tooth decay, government initiatives to create awareness about dental implants, and strategic partnerships among major players to expand their portfolios in the region.

- By Material: The titanium segment held the largest market share in 2025. Its dominance is credited to the material's benefits, including excellent biocompatibility, corrosion resistance, strength, and durability, which promote successful integration with bone tissue.

Key Country Highlights:

- Japan: As part of the rapidly growing Asia Pacific market, demand in Japan is driven by the increasing penetration of technologically advanced implant tools and a rising patient base for restorative dental procedures.

- United States: The market is driven by a rising patient pool for implant procedures, spurred by the introduction and adoption of 3D and CAD/CAM techniques, and a growing consumer demand for cosmetic surgeries.

- China: Growth is fueled by a significant number of patients diagnosed with cracked, chipped, or broken teeth, creating a large demand for dental restorations and contributing to the strong growth of the Asia Pacific market.

- Europe: The market is propelled by the high prevalence of dental ailments, supportive government initiatives promoting oral health awareness, and strategic activities by key companies to strengthen their product offerings and presence across the region.

Dental Abutment Market Trends

Several Technological Advancements to Revolutionize the Dental Abutment Sector

Technological advancements are profoundly reshaping the landscape of the market, offering precision, customization, and efficiency. The adoption of Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) technology allows for the creation of highly accurate digital impressions and the fabrication of customized abutments with exceptional precision, ensuring optimal fit for patients.

Furthermore, digital workflows and virtual treatment planning software have streamlined the entire process of the implant dentistry, from diagnosis to restoration. These innovations facilitate seamless communication between clinicians, dental laboratories, and patients, leading to improved treatment outcomes and patient satisfaction.

Moreover, 3D printing technology has emerged as another advanced technology in the production of dental abutment. It enables the rapid prototyping of abutments with intricate geometries, offering greater design flexibility and reducing manufacturing time. For instance, in February 2022, Desktop Health launched Einstein, a dental 3D printer series to deliver accurate dental implantations.

Additionally, the integration of advanced materials such as zirconia and titanium alloys further enhances the durability and biocompatibility of dental abutment, meeting the evolving demands of patients and practitioners.

Download Free sample to learn more about this report.

Dental Abutment Market Growth Factors

Increasing Prevalence of Dental Ailments Bolster Market Growth

Dental conditions such as tooth decay, periodontal disease, and tooth loss are becoming more prevalent due to factors such as poor oral hygiene, unhealthy dietary habits, and aging populations. Such high risk of oral disorders has increased the demand for these abutments during implant procedures.

- Moreover, according to an article by BioMed Central Ltd., in April 2021, it was reported that developed countries are contributing majorly to the increasing prevalence of dental disorders globally. Several key factors, including sedentary lifestyle, poor oral hygiene, and tobacco consumption are some of the major reasons for the rising prevalence of dental disorders in these regions.

As the number of individuals requiring dental interventions rises, the demand for dental implant systems, which often necessitate the use of abutments, is also increasing. Abutments play a critical role in anchoring dental prostheses to implants, ensuring stability and longevity of the restoration.

As a result, the growing prevalence of dental ailments is driving the adoption of dental implants and, consequently, the demand for these abutments.

Increasing Dental Services to Drive Market Growth

The rise in dental services has driven the increasing penetration and access to care globally. This has increased the patient visits for dental care services which is expected to positively impact the demand for dental products. Furthermore, as dental care becomes more accessible and affordable, there is a rising demand for restorative procedures such as dental implants, which often require the use of abutments.

- For instance, according to the Centers for Disease Control and Prevention (CDC), in 2020, the percentage of adults above 18 that visited dental clinics was 63.0%.

- Moreover, according to the National Health Service (NHS), in England 18.2 million adults visited dentists in 24 months till 30th June 2021.

The continuous increase in dental services and patient visits for the treatment of dental implants is expected to contribute to the dental abutment market growth during the forecast period.

RESTRAINING FACTORS

Risks Associated with Abutments During Implant Procedures Might Hinder Market Growth

The growing prevalence of oral disease, such as tooth decay has increased the adoption of abutments during the implant procedures. However, several risks associated with abutments during implant procedures have the potential to hinder market growth.

An inflammatory condition that affects the soft and hard tissues surrounding the dental implants, is known as peri-implantitis. The inflammation can be occurring due to poorly designed or improperly fitted abutments and can create spaces where bacteria can accumulate, leading to infection and ultimately implant failure.

- Furthermore, according to a study published by BROADCASTMED LLC, in April 2022, peri-implant mucositis and peri-implantitis post-implant insertions among patients ranged from 46% to 63% and 19% to 23%, respectively.

Furthermore, factors such as inadequate torque application during abutment placement or excessive forces exerted on the restoration can contribute to these complications, necessitating additional interventions and increasing treatment costs.

Such complications related to the material degradation or allergic reactions to abutment materials can also pose risks to patient health and implant longevity, hampering the market growth during the forecast period.

Overall, dental abutments play a crucial role in implant dentistry. The risks associated with their use during implant procedures could potentially hinder market growth by increasing the adverse events.

Dental Abutment Market Segmentation Analysis

By Type Analysis

Customized Segment Held the Largest Share Owing to Various Benefits Associated with Dental Abutments

Based on type, the market is segmented into prefabricated and customized.

In 2026, the customized segment held the largest share and is expected to grow at the substantial CAGR during the forecast period. The segment’s growth is attributed to the rising prevalence of oral diseases coupled with an increase in implant procedures, leading the abutments demand during the forecast period. Additionally, advancements in digital dentistry technologies enable efficient and accurate customization of abutments, catering to the increasing demand for tailored dynamic abutment solutions among patients and practitioners.

The prefabricated segment accounted for a significant dental abutment market share in 2024. Prefabricated abutments offer a ready-made solution that eliminates the need for custom fabrication, reducing treatment time and labor costs for dental professionals. Additionally, their standardized design ensures consistency and reliability in dental procedures. Furthermore, advancements in prefabricated abutment materials and designs enhance their aesthetic appeal and functional performance, further fueling the segmental growth during the forecast period.

By Material Analysis

Titanium Segment Held a Major Share Owing to Growing Adoption of these Materials in Implant Procedures

By material, the market is segmented into titanium, zirconium, and others.

In 2026, the titanium segment accounted for the largest market share 76.15% and is projected to register a substantial CAGR during the forecast period. The segmental growth is credited to the benefits associated with it, such as biocompatible, corrosion resistance, strength, durability, and stability. Furthermore, titanium's favorable mechanical properties enable seamless integration with surrounding bone tissue, promoting osseointegration and overall implant success rates, thereby fueling its demand in the market. Additionally, the growing focus of market players to launch titanium abutments is expected to propel the segmental growth during the forecast period.

The zirconium segment accounted for a significant market share in 2024 and is expected to grow at the highest CAGR during the forecast period. The segmental growth is attributed to the increasing number of new players entering the dental implants industry offering novel technology based zirconium abutments. Furthermore, the growing number of zirconium dental implant procedures across developed countries is expected to increase the demand for zirconium abutments, thereby boosting the market growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Held a Major Share due to Increasing Implant Procedures in these Settings

As per end-user, the market is segmented into solo practices, DSO/group practices, and others.

In 2026, the solo practices segment accounted for the highest market share 64.71% and is anticipated to expand at a substantial CAGR during the forecast period. The segment’s growth is fueled by the increasing patient visits coupled with growing government initiatives to increase dental practices across the region. Furthermore, the increasing prevalence of dental ailments across the globe is expected to increase the adoption of abutments in implant procedures. For instance, as per World Health Organization (WHO), nearly half (46%) of all adults aged 30 years or older showcase signs of gum disease.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period, 2025-2032. The growth of the segment is bolstered by the increasing investments by the public and private players for the betterment of dental care industry in developed countries. Additionally, DSOs often invest in advanced technologies and equipment, including digital dentistry solutions, which drives the demand for compatible dental abutment.

The others segment held a significant share of the market. The segment includes hospitals and community health centers. The growth of the segment is attributed to the increasing patient visits for implant procedures, especially in developing countries.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Europe Dental Abutment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a revenue of USD 0.47 billion in 2026 and is expected to continue its dominance during the forecast timeframe. The dominance is due to several factors that comprise the growing incidence of dental disorders such as tooth decay among the general population in the region. Additionally, the growing initiatives by the government to create awareness about dental implants and increasing number of research studies associated with them will support the dental abutment’s demand in the region. The UK market is projected to reach USD 0.03 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Furthermore, the increasing number of strategic partnerships among major players to expand their dentistry portfolio or increase production capabilities are anticipated to boost the segmental growth during the forecast period.

- For instance, in February 2022, Envista Holdings Corporation renewed its partnership agreement with the leading Spanish Dental Service Organisation, Vitaldent Group. This helped the company become the preferred supplier of implant related products in Europe.

North America held the second highest share in 2024. This can be attributed to the rising patient pool for implant procedures in the U.S. due to the introduction of 3D and CAD/CAM techniques. Thus, growing awareness about oral hygiene and improved adoption of cosmetic surgeries is expected to surge the market growth across the forecast period.The U.S. market is projected to reach USD 0.36 billion by 2026.The Japan market is projected to reach USD 0.02 billion by 2026, the China market is projected to reach USD 0.06 billion by 2026, and the India market is projected to reach USD 0.02 billion by 2026.

Asia Pacific is expected to grow at the highest CAGR over the projected years. The growth is attributed to the rising number of partnerships among major players in the region to launch their titanium based dental abutments in the untrodden economies of the region. Furthermore, a relatively significant number of patients are diagnosed with cracked, chipped, or broken teeth in countries such as India and China. Additionally, penetration of technologically advanced implant tools are the key factors for the estimated growth of this region during the forecast period.

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is attributed to factors such as increasing healthcare expenditure, growing awareness about oral health, and the rising demand for cosmetic dentistry procedures.

List of Key Companies in Dental Abutment Market

Companies with Technologically Advanced Product Portfolios to Hold Key Market Share

The market is partially consolidated with the presence of leading players, such as Institut Straumann AG, Dentsply Sirona, and ZimVie Inc. These companies held a substantial market share in 2024. These are some companies at prominent positions due to their comprehensive range of high-quality products, innovative technologies, and established brand presence in the market. These players are consistently investing in advanced technologies, such as zirconium, while their global distribution networks enable their positions as leaders in the dental abutment industry.

Other companies operating in this market include BioHorizons, Cortex, Zest Dental Solutions, and other small & medium-sized players. These companies are engaged in various strategic activities such as the introduction of advanced customized dental abutments and expansion of their presence to gain market share during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- ZimVie Inc. (Zimmer Biomet) (U.S.)

- BioHorizons (U.S.)

- Cortex (Israel)

- Dentium (South Korea)

- Zest Dental Solutions (U.S.)

- ALLIANCE GLOBAL TECHNOLOGY (U.S.)

- Ziacom (Spain)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - Neoss Group launched a new multi-unit abutment for its Neoss4 treatment solution, a cutting-edge system designed to transform the way dental professionals approach full arch restorations.

- June 2022 - ZimVie Inc announced the joint launch of the new, FDA-cleared Encode Emergence Healing Abutment in the U.S. The Encode Emergence Healing Abutment builds upon ZimVie’s 3-in-1 Encode Impression System to provide clear intraoral scans and aesthetics and is designed for patient healing and comfort.

- January 2021 - Nobel Biocare introduced the Xeal and TiUltra surfaces in the U.S. These new surfaces are applied to abutments and implant, which optimizes tissue integration at every level.

REPORT COVERAGE

The dental abutment market research report provides a detailed analysis of the industry. It focuses on key aspects such as key industry developments - mergers, acquisitions, partnerships, and the impact of COVID-19 on the market. Besides this, it offers insights into the market trends and highlights key market drivers and restraints. In addition to the aforementioned factors, the market analysis encompasses several factors that have contributed to the growth of the global market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.43% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global dental abutment market size is projected to grow from $1.28 billion in 2026 to $2.11 billion by 2034, at a CAGR of 6.43% during the forecast period.

In 2025, the Europe market stood at USD 0.47 billion.

The market is expected to exhibit a CAGR of 6.43% during the forecast period.

By type, the customized segment leads the market.

The increasing prevalence of periodontal disease, growing launches of advanced custom abutment systems, and growing adoption of digital dentistry drive market growth.

Institut Straumann AG, Dentsply Sirona, ZimVie Inc are the top players in the market.

Europe dominated the market in 2025 by holding the highest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us