Dental Infection Control Market Size, Share & Industry Analysis, By Product (Equipment {Sterilization Equipment, Cleaning and Disinfection Equipment, and Packaging Equipment} and Consumables {Medical Gloves, Eye and Face Protection Products, Cleaning and Disinfection Products, and Others}), By End-user (Dental Laboratories, Dental Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

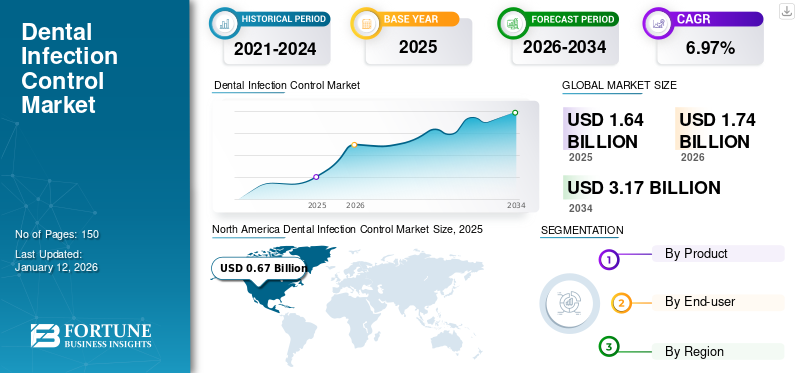

The global dental infection control market size was valued at USD 1.64 billion in 2025 and is projected to grow from USD 1.74 billion in 2026 to USD 3.17 billion by 2034, exhibiting a CAGR of 6.97% during the forecast period. North America dominated the Dental Infection Control Market with a market share of 41.18% in 2025.

Dental infection control refers to the products implemented in dental settings to prevent the transmission of infectious diseases among patients, dental healthcare workers, and the surrounding environment. This is critical due to the high risk of exposure to pathogens through blood and saliva during dental procedures.

The global market growth can be attributed to the increasing demand for various dental infection control products, such as sterilization equipment. This demand is mainly propelled by the rising prevalence of dental disorders, which is increasing the number of visits to dental care facilities for various procedures. This trend is expected to boost the utilization of infection control consumables and equipment, driving the global dental infection control market growth over the forecast period.

- For instance, according to the estimation of the World Health Organization (WHO), around 19.0% or 1.0 billion adults globally are affected by periodontal diseases. This is expected to fuel the demand for dental infection control products, boosting market growth during the projection period.

The global market witnessed positive growth during the COVID-19 pandemic in 2020. This growth was attributed to the increased utilization of infection control products in dental care facilities to avoid the spread of infections among patients and professionals. Moreover, several dental professionals participated in training focused on COVID-19 infection control measures, leading to increased compliance with recommended practices, which propelled the use of consumables such as gloves, masks, and eye protection products. Such increased demand propelled market growth during the pandemic.

Global Dental Infection Control Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.64 billion

- 2026 Market Size: USD 1.74 billion

- 2034 Forecast Market Size: USD 3.17 billion

- CAGR: 6.97% from 2026–2034

Market Share:

- Region: North America dominated the market with a 41.18% share in 2025. This is due to the high penetration of advanced infection control products, driven by a significant number of dental facilities performing a high volume of procedures.

- By Product: The consumables segment held the largest market share in 2024. This dominance is attributed to the rising usage of single-use items like gloves and masks, which are cost-effective, convenient, and crucial for reducing the risk of cross-contamination between patients and healthcare providers.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, demand is driven by a significant aging population with a higher risk of dental problems, leading to increased visits to dental clinics where infection control is paramount.

- United States: Market growth is supported by a very high number of dental offices (over 135,000) and the widespread adoption of stringent infection control protocols. The high volume of dental procedures performed annually fuels the demand for both equipment and consumables.

- China: Growth is propelled by increasing dental tourism and a rising awareness of oral health, which boosts the number of dental procedures and the corresponding need for reliable infection control products.

- Europe: The market is driven by the strong presence of major manufacturers offering a wide range of infection control products and a large number of dental professionals who are increasingly adopting comprehensive infection control measures.

Dental Infection Control Market Trends

Integration of IoT and Eco-Friendly Designs of Dental Infection Control Equipment

There is a significant shift toward the use of advanced sterilization methods, including autoclaves and chemical sterilizers. These technologies are crucial for ensuring high standards of infection control, reflecting a commitment to patient safety and compliance with evolving regulatory standards. Some of these advancements in dental infection control equipment are integration with IoT and eco-friendly designs.

The incorporation of digital technologies and the Internet of Things (IoT) is transforming infection control practices. This allows for remote monitoring and management of equipment and provides dental staff with several other benefits.

- For instance, according to the article published by Unicorn Denmart Ltd. in August 2024, several modern sterilizers are presently equipped with IoT. This technology provides dental staff with real-time data on sterilization cycle compliance tracking, all accessible via smart devices and alerts for maintenance needs.

Moreover, the eco-friendly products emphasize environmental sustainability, reducing energy and water consumption during sterilization practices without compromising effectiveness. These designs adhere to stricter environmental regulations and offer cost savings in long-term utility expenses. Adoption of these designs ensures that dental professionals comply with the latest health standards, providing patients with the safest care.

Download Free sample to learn more about this report.

Dental Infection Control Market Growth Factors

Rising Dental Disease Cases to Boost Market Growth

In recent years, there has been a significant rise in the incidence of dental ailments such as gingivitis, dental caries, and periodontal disease, frequently among children globally. Such diseases are significantly driving the demand for infection control products, including consumables and equipment in various dental care procedures. Such products reduce the risk of cross-contamination between healthcare professionals and their patients, which is expected to boost the global dental infection control products market in the forthcoming years.

- For instance, the WHO Global Oral Health Status Report (2022) stated that oral diseases affected nearly 3.5 billion people globally, and an estimated 2.0 billion individuals suffered from caries of permanent teeth. Furthermore, the report also mentioned that approximately 514.0 million children were suffered by caries of primary teeth.

Furthermore, this incidence of oral diseases continues to rise globally due to poor lifestyle conditions, an aging population, and other risk factors. Inadequate exposure to fluoride in oral hygiene products, including toothpaste, and the availability of food with high sugar content are some of the risk factors stimulating the incidence of oral diseases.

- For instance, according to the World Health Organization (WHO) in March 2023, a range of modifiable risk factors such as high sugar consumption, alcohol use, tobacco use, and poor hygiene often cause oral diseases globally, often requiring treatment dental procedures involving infection control products. This trend is anticipated to boost the market growth in the coming years.

Growing Technological Innovations and Increased Awareness to Drive Market Expansion

Over the past few years, the adoption of advanced sterilization technologies such as autoclaves, chemical vapor sterilizers, and smart monitoring devices, has increased in dental practices due to rising awareness of infection in dental control practices. Moreover, digital dentistry is gaining immense popularity as it enhances precision, reduces cost and time, and assures a flexible workflow. This is increasing the overall volume of dental surgeries, requiring the utilization of infection control products.

Moreover, there is increasing awareness of infection control in dentistry, catalyzed by stringent regulations and rising concerns about healthcare-associated infections (HAIs). Regulatory bodies such as the Centers for Disease Control and Prevention (CDC) and healthcare compliance leaders specializing in infection control are mandating education and training programs for dental staff to create awareness about infection prevention. This trend is projected to spur the demand for infection control products, thereby fueling the global dental infection control market expansion in the coming years.

- For instance, in March 2023, American Medical Compliance began offering infection control training for dental healthcare providers. This training covers the importance of infection control in dental settings, the use of personal protective equipment, and equipment considerations.

RESTRAINING FACTORS

Disparities in Training and Awareness of Dental Infection Control to Restrict Market Growth

Despite the significantly growing infrastructure in dental care sector globally, there is often a disparity in training and awareness levels among dental staff regarding infection control protocols. Variability in knowledge and resistance to adopting new practices can lead to lapses in compliance, increasing the risk of infection transmission in dental settings, which may limit market expansion during the forecast timeframe.

- For instance, according to the data published by the International Journal of Dentistry in June 2021 indicated that several hospitals worldwide lack infection control training programs. Additionally, some have reported a lack of awareness among allied health personnel.

Moreover, several developing countries have a limited range of dental care services, which may limit the use of infection control products in those areas. In addition, distribution networks often fail to reach rural or isolated areas where a significant portion of the population resides. Such limited access to infection control products in low- and middle-income countries is expected to hamper their adoption in these regions, thereby limiting market expansion.

- For instance, the World Health Organization (WHO) mentioned that most of the low- and middle-income countries lack sufficient services available to prevent and treat oral health conditions.

Dental Infection Control Market Segmentation Analysis

By Product Analysis

Growing Usage of Consumables in Dental Practices Boosted Segmental Dominance of Consumables in 2024

Based on product, the market for dental infection control is segmented into equipment and consumables.

Furthermore, the equipment segment is sub-segmented into sterilization equipment, cleaning and disinfection equipment, and packaging equipment. Moreover, the consumables segment is sub-classified into medical gloves, eye and face protection products, cleaning and disinfection products, and others.

Consumables emerged as the largest product sub-segment in 2026, holding a 65.74% market share and is projected to expand at the fastest CAGR during the forecast period. The segment’s growth can be attributed to their rising usage due to their single-use nature, which effectively reduces the risk of infection and cross-contamination between patients and healthcare providers. The convenience, cost-effectiveness, and safety associated with consumables are making them a staple in dental practices, which is expected to boost segment growth during the forecast period. The medical gloves sub-segment is projected to witness substantial growth in the coming years as healthcare professionals increasingly use them to prevent the transfer of microorganisms between patients and themselves. In addition, the mandated use of medical gloves by health regulations and guidelines set by various organizations are also anticipated to drive their expansion.

Equipment accounted held the significant share in the market in 2024. This growth can be attributed to the essential role of infection control equipment in dental practices to maintain a safe and healthy environment. Such equipment is utilized for cleaning, sterilizing, and disinfecting surfaces and dental instruments to prevent the further spread of infectious diseases. Several key players are significantly providing infection control equipment, ensuring its sufficient availability globally, which is expected to fuel the segment's growth. The sterilization equipment sub-segment is experiencing significant growth due to the advancement in its technologies and high availability ensured by key players to support dental care facilities.

- For instance, as of September 2024, Patterson Dental is offering equipment for infection control at dental practices, including aerosol management equipment, instrument washers, and autoclaves.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Dental Clinics Held the Highest Share due to Increasing Patient Visits

By end-user, the market is segmented into dental laboratories, dental clinics, and others.

The dental clinics accounted for the highest share in 2024 due to the rising number of patient visits for several procedures. Moreover, growing awareness of infection risks, strict regulatory compliance, and increasing patient expectations are driving the high usage of infection control products in dental hospitals and clinics. This trend is expected to continue during the forecast period, as the evolving dental industry is prioritizing safety and hygiene in patient care.

The dental laboratories segment held the substantial market share for a 63.01% in 2026. The integration of dental infection control products in laboratories is essential for safeguarding health and ensuring compliance with health regulations. The evolving dental industry is expected to continue effective infection control practices, driven by technological advancements and the need to protect both patients and healthcare providers from infectious diseases. Moreover, there is a significant rise in the number of dental laboratories globally, which is expected to spur the demand for infection control products, thereby driving segment growth.

- For instance, as of September 2024, the European Federation of Dental Laboratory Owners (FEPPD) represents 40,000 dental laboratories and 210,000 dental technicians on the European level. Such rising laboratories may increasingly implement infection control products on a regular basis to avoid further complications, which is expected to spur segment growth.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

North America Dental Infection Control Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a revenue of USD 0.67 billion in 2026. The growth is mainly due to the high penetration rates of advanced infection control products in the region due to a significant number of dental facilities with high procedures performed. This trend is anticipated to encourage key players to introduce new products in the region, thereby supporting expansion.

- For instance, according to the data published by the United States Census Bureau in their 2021 Economic Surveys Business Patterns, the number of offices of dentists in the U.S. was estimated to 135,333.

Europe

Europe held the second-highest share in 2024. This growth can be attributed to the presence of major players offering infection control equipment and consumables to boost product availability in the region. Moreover, the increasing number of dentists adopting infection control products in their clinics is expected to further propel market growth. The UK market reaching USD 0.08 billion by 2026 and the Germany market reaching USD 0.14 billion by 2026.

Asia Pacific

The Asia Pacific market is anticipated to rise at the highest CAGR over the projection period. The highest CAGR of the region is attributed to the increasing dental tourism in the region, which may propel the demand for infection control products in several dental care facilities. Furthermore, the aging population, coupled with the higher risk of dental problems, may surge the use of such products due to increased visits to clinics, further fueling regional market expansion. The Japan market reaching USD 0.10 billion by 2026, the China market reaching USD 0.12 billion by 2026, and the India market reaching USD 0.05 billion by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast timeframe. The growth of the region can be attributed to the high burden of dental diseases, rising awareness, and government initiatives supporting dental care, thereby increasing the use of infection control products in these regions.

KEY INDUSTRY PLAYERS

Key Players Hold Significant Market Share Owing to Diversified Portfolio and Strong Customer Base

Market players such as Dentsply Sirona Inc., Young Innovations, Inc., and Crosstex International, Inc. accounted for major market share in 2024. This was attributed to their broad range of products along with the large customer base globally. Moreover, a significant focus on expanding geographical presence and the launch of new infection control products for dental care facilities is anticipated to strengthen their positions in the global market.

Other players, such as Kerr Corporation, COLTENE Group, and GC America Inc., are engaged in implementing various growth strategies, such as signing collaboration and merger agreements and geographic expansions, to gain significant market share in the coming years. Moreover, their focus on commercializing infection control products in various regions is projected to enhance the market share of these companies.

List of Top Dental Infection Control Companies:

- Young Innovations, Inc. (U.S.)

- Kerr Corporation (U.S.)

- 3M (U.S.)

- A-dec Inc. (U.S.)

- Dentsply Sirona Inc (U.S.)

- Henry Schein, Inc. (U.S.)

- COLTENE Group (Switzerland)

- Getinge AB (Sweden)

- Crosstex International, Inc. (U.S.)

- GC America Inc. (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Cranberry Global, launched the Bio Nitrile biodegradable nitrile Powder free examination gloves to meet the rising demand for environmentally sustainable and eco-friendly products to be used in dental and medical settings.

- January 2023: W&H launched novel infection control products, Lexa Plus sterilizer (a pre-vacuum, Class B sterilizer) and Assistina One single port maintenance device, expanding its hygiene portfolio.

- June 2022: Eastwest Medico announced the launch of PROSENSO BIODEGRADABLE disposable gloves to support food industry, and healthcare sector, including dentistry. These gloves were the first biodegradable alternative to a traditional nitrile disposable glove.

- December 2021: Owens & Minor acquired American Contract Systems (ACS), a provider of kitting and sterilization services for gaining accessibility to Custom Procedure Tray (CPT) solutions. This further strengthened their ability to meet and exceed customers’ collective needs in surgical procedure trays, including dentistry.

- June 2021: STERIS plc acquired Cantel Medical Corp, an international provider of infection prevention products for dentistry to strengthen STERIS plc's product & service offerings, global reach, and customer base.

REPORT COVERAGE

The global market report includes a detailed competitive landscape and industry forecast. It covers key aspects such as new product launches and market dynamics. Additionally, it covers key industry developments such as mergers, partnerships, acquisitions, global market statistics, and technological advancements in the market. Moreover, the global market forecast provides an analysis of different segments in various regions, the impact of COVID-19 on the market, and the company profiles of key players. The report also covers quantitative and qualitative analysis contributing to market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.97% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global dental infection control market size was valued at USD 1.64 billion in 2025 and is projected to grow from USD 1.74 billion in 2026 to USD 3.17 billion by 2034, exhibiting a CAGR of 6.97% during the forecast period.

In 2025, the North America market stood at USD 0.67 billion.

The market is expected to exhibit a CAGR of 6.97% during the forecast period.

By product, the equipment captured the dominant market share in 2025.

The rising prevalence of dental disorders, growing awareness, and technological advancements are the key factors driving market growth.

Dentsply Sirona Inc., Young Innovations, Inc., and Crosstex International, Inc. are the top players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us