Dental Intraoral Photostimulable Phosphor Systems Market Size, Share & Industry Analysis, By Type (Scanner and Accessories), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

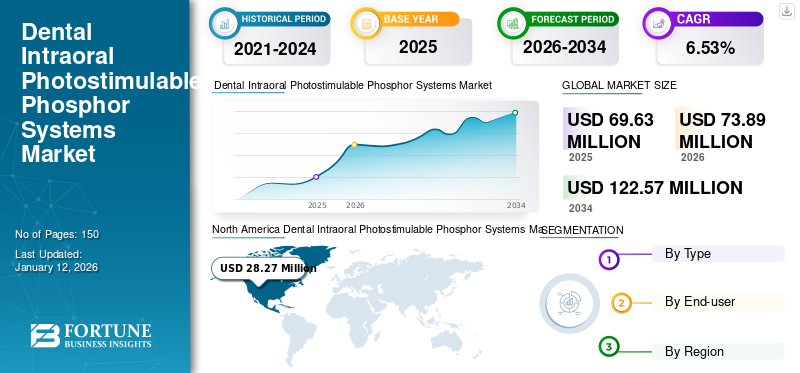

The global dental intraoral photostimulable phosphor systems market size was valued at USD 69.63 million in 2025 and is projected to grow from USD 73.89 million in 2026 to USD 122.57 million by 2034, exhibiting a CAGR of 6.53% during the forecast period. North America dominated the dental intraoral photostimulable phosphor systems market with a market share of 40.60% in 2025.

Dental intraoral photostimulable phosphor systems refer to advanced imaging technologies that are used in dentistry. These systems utilize phosphor-coated plates to capture X-ray images, which are then scanned and digitized for their detailed examination. They offer significant advantages over traditional film by providing faster image acquisition, enhanced image quality, and reduced radiation exposure. Additionally, these systems are reusable and easily integrated into dental practices, thereby improving diagnostic capabilities and patient care efficiency.

The increasing prevalence of dental diseases and the growing demand for advanced diagnostic equipment primarily drive the dental intraoral photostimulable phosphor systems market. Moreover, the shift toward digital dentistry and the need for more efficient and accurate imaging solutions also contribute to the market growth. Additionally, the benefits of these systems, such as reduced radiation exposure, high image quality, and quick image processing, enhance their adoption. Rising awareness about oral health and the expanding use of these systems in dental clinics further propel market expansion.

The COVID-19 pandemic negatively impacted the dental intraoral photostimulable phosphor systems market as dental clinics faced temporary closures and reduced patient visits, leading to a decline in demand for new equipment. Furthermore, supply chain disruptions hindered the production and distribution of these equipment during this period. However, post-pandemic, with the resumption of routine dental care, there's an increased demand for advanced digital imaging solutions to enhance diagnostic accuracy and efficiency. Furthermore, the emphasis on reducing patient contact and improving infection control measures has driven the adoption of these systems during the forecast period.

Global Dental Intraoral Photostimulable Phosphor Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 69.63 million

- 2026 Market Size: USD 73.89 million

- 2034 Forecast Market Size: USD 122.57 million

- CAGR: 6.53 % from 2026–2034

Market Share:

- North America dominated the dental intraoral photostimulable phosphor systems market with a 40.60% share in 2025, driven by the rising awareness of oral health, early diagnosis initiatives, and widespread adoption of advanced dental imaging systems across dental practices.

- By type, the scanner segment is expected to maintain its leading market share owing to its crucial role in digitalizing images from PSP plates and the increasing demand for high-quality, efficient diagnostic imaging in dental clinics.

Key Country Highlights:

- United States: The rising prevalence of gum diseases and the increasing emphasis on advanced diagnostic imaging technologies among dental professionals are driving the demand for intraoral photostimulable phosphor systems.

- Europe: The region’s well-established healthcare infrastructure, combined with the strong presence of leading dental equipment manufacturers, is facilitating the widespread adoption of these imaging systems in dental practices.

- China: Rapid urbanization, growing dental disease burden, and government initiatives to enhance healthcare infrastructure are supporting the increasing adoption of advanced dental imaging technologies.

- Japan: Technological advancements in dental imaging, coupled with a strong focus on precision diagnostics and an aging population requiring enhanced dental care, are contributing to market growth.

Dental Intraoral Photostimulable Phosphor Systems Market Trends

Technological Advancement in Photostimulable Phosphor Systems to Provide Broader Treatment Options

Technological advancements in dental intraoral Photostimulable Phosphor Systems (PSP) have enhanced functionality, efficiency, and accuracy, making them increasingly attractive to dental professionals. The advancements in software associated with these systems have improved image processing capabilities. Modern software solutions provide advanced features such as image enhancement, noise reduction, and digital zoom, allowing better analysis and interpretation of dental images. These software improvements streamline workflows and enhance diagnostic accuracy, making these systems more efficient and user-friendly.

- For instance, Carestream Dental CS 7600 from Carestream Dental LLC features advanced image processing software, wireless functionality, and cloud storage, which together enhance diagnostic accuracy and workflow efficiency. Its durable PSP plates ensure long-term use and cost savings, making it a reliable choice for dental professionals.

Furthermore, cloud storage enables seamless access to images from multiple devices and locations, facilitating better collaboration among dental professionals and more efficient patient management. The development of more durable and reusable PSP plates further contributes to the cost-effectiveness and sustainability of these systems. Enhanced durability ensures that plates can withstand repeated use without compromising image quality, reducing the need for frequent replacements and lowering overall costs.

Download Free sample to learn more about this report.

Dental Intraoral Photostimulable Phosphor Systems Market Growth Factors

Growing Demand for Advanced Diagnostic Equipment in Dentistry to Drive Market Expansion

Modern dentistry increasingly relies on precise and efficient diagnostic technologies to enhance patient care and treatment outcomes. In recent years, dental professionals have sought to improve diagnostic accuracy and the adoption of advanced imaging systems, such as intraoral PSP systems, is expected to increase during the forecast timeframe. Dental intraoral photostimulable phosphor systems offer superior image quality compared to traditional film-based methods, providing clearer and more detailed images. This high-resolution imaging is essential for accurately diagnosing various dental conditions, including cavities, periodontal disease, and other oral health issues. The ability to detect these problems early allows for timely intervention and more effective treatment plans, which is a significant advantage in dental care. Furthermore, companies collaborating with hospitals to introduce dental imaging equipment are expected to boost the adoption of such systems in the market.

- For instance, in May 2024, VATECH announced the launch of a project to improve dental healthcare in South Africa. The company partnered with Tygerberg Hospital in Cape Town, South Africa, to donate medical equipment for dental care and provide training for dental professionals.

Additionally, these systems facilitate quicker image acquisition and processing, reducing the time patients spend in the dental chair and improving workflow efficiency for dental practitioners. This efficiency is increasingly important in dental practices, where the demand for diagnostic processes is high. The convenience and speed of these systems enhance patient experience and satisfaction, further driving their adoption. These advanced imaging solutions meet the demands of modern dental practices, contributing to better patient care and more efficient practice management.

Growing Cases of Dental Disorders to Boost Market Development

Dental disorders, including cavities, periodontal disease, and oral cancer, are becoming more common globally due to aging populations, unhealthy diets, and poor oral hygiene. As these conditions increase, the need for timely diagnosis has driven the demand for advanced imaging solutions, such as dental intraoral photostimulable phosphor systems.

- For instance, according to WHO, in India, the prevalence of severe periodontal disease in people older than 15 years of age was 21.8% in 2019.

These systems offer high-quality imaging, which is crucial for detecting and diagnosing dental issues effectively. They provide detailed and precise images that help dentists identify problems early, plan appropriate treatments, and monitor progress. As a result, the demand for these systems is rising in response to the need for improved diagnostic capabilities.

Furthermore, the rise in dental disorders underscores the importance of regular dental check-ups, further increasing the use of diagnostic imaging. As awareness of oral health grows and more individuals seek dental care, the demand for effective and efficient imaging technologies, such as these systems is likely to rise. Additionally, the benefits associated with these systems, such as quick image acquisition and reduced radiation exposure, are expected to increase their adoption among dentists. Such growing cases of dental disorders and the benefits associated with the equipment are expected to increase the demand for this equipment during the forecast period.

RESTRAINING FACTORS

Growing Adoption of Intraoral Sensors May Hamper Market Progression

The presence of intraoral sensors as an alternative product is hindering the adoption of dental intraoral photostimulable phosphor systems. Intraoral sensors offer several advantages that make them appealing to dental professionals, thereby impacting the growth of the market.

Intraoral sensors provide immediate image acquisition and display, significantly reducing the time required for diagnosis and treatment planning. This instant feedback is highly beneficial in fast-paced dental practices, where efficiency and quick turnaround times are critical. In contrast, these systems involve an additional step of scanning the phosphor plates to digitize the images, which can be more time-consuming. Such advancements in these intraoral sensors have led companies to launch new and advanced sensors, which is expected to surge the adoption of sensors among dentists and potentially hamper the adoption of intraoral photostimulable phosphor systems.

- For instance, in November 2019, VATECH introduced the EzSensor Wave in North America and Europe. The sensor offers superior imaging accuracy and usability. Furthermore, its design is to fit itself smoothly along the patient’s oral cavity, providing greater comfort for both patients and doctors.

Additionally, high costs of equipment and lack of reimbursements for dental care in emerging countries further hinder their adoption, limiting dental intraoral photostimulable phosphor systems market growth.

Dental Intraoral Photostimulable Phosphor Systems Market Segmentation Analysis

By Type Analysis

Scanners Holds Leading Position Owing to Growing Installed Base in Dental Clinics

Based on type, the market is split into scanner and accessories.

The scanner segment is projected to dominate the market with a share of 77.62% in 2026 due to its crucial role in converting images captured on PSP plates into digital format. The growing adoption of digital dental imaging systems, the need for efficient and quick image processing, and the widespread availability of advanced scanner models further enhance the segment’s growth.

The accessories segment holds a significant dental intraoral photostimulable phosphor systems market share due to their essential role in imaging processes. Furthermore, the advancement in plate technology, offering better image quality and durability, contributes to their market dominance. The indispensability of these accessories in every imaging procedure underscores their significant market share.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Dominates with Rise in Patient Visits in These Settings

As per end-user, the market is segmented into solo practices, DSO/group practices, and others.

The solo practices segment is expected to lead the market, accounting for 52.22% of the total market share in 2026 and is projected to grow at a substantial CAGR during the forecast timeframe of 2026 to 2034. Solo dental practices often prioritize cost-effective, high-quality imaging solutions that offer strong performance and affordability. Dental intraoral photostimulable phosphor systems are ideal for these practices as they are generally more affordable compared to digital sensors, while still offering high image quality with reduced radiation exposure.

The segment of DSO/group practices is anticipated to record the highest CAGR over the analysis period. These practices manage higher patient volumes and multiple locations, making efficient and cost-effective imaging solutions crucial. These systems provide a compelling blend of high-quality imaging and lower overall costs compared to other digital imaging technologies, making them beneficial for large-scale operations. Furthermore, the introduction of dental groups and DSOs in developed and developing countries is expected to increase the installed base of these systems.

- For instance, in January 2024, Dental Associates of Connecticut (DACT) launched a new multi-specialty dental platform, Archway Dental Partners. Such introduction of new dental platforms is expected to increase the demand for these systems.

The other segments are research and academic institutes and dental hospitals, which is expected to grow at a moderate CAGR during the forecast period. The segment’s growth is attributed to the growing demand for advanced intraoral equipment to provide better diagnosis options for patients.

REGIONAL INSIGHTS

Regionally, the market is studied across Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

North America Dental Intraoral Photostimulable Phosphor Systems Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America’s market valuation touched USD 26.7 million in 2024 making it a dominant region and is expected to sustain during the forecast timeframe. The leading position is due to high awareness of oral health and the importance of early diagnosis, which drives demand for advanced diagnostic tools, such as these systems. Moreover, the growing number of dental disorders cases and the availability of advanced diagnostics options are further boosting the market growth in the region.

- For instance, according to the Centers for Disease Control and Prevention (CDC), in the U.S., approximately half of adults aged 30 years and above are suffering from some form of gum disease. Such a large population of patients is expected to increase the demand for these devices in the near future.

Europe held the second-highest share in 2024 attributable to several factors, such as well-established healthcare infrastructure that supports the widespread adoption of advanced dental technologies. Furthermore, the presence of leading dental equipment manufacturers and distributors in Europe also facilitates the availability and accessibility of these systems.

Asia Pacific is expected to grow at the highest CAGR over the projected years due to the increasing cases of dental diseases and the presence of the large number of dentists in the region. Urbanization and improvements in healthcare infrastructure in China and India are also accelerating the adoption of modern dental equipment.

- For instance, according to the WHO, in India, the prevalence of edentulism in people older than 20 years was 4.0% in 2019.

The Middle East & Africa and Latin America are anticipated to grow at a steady CAGR over the coming years. Growth in these regions is due to the increasing number of dental practices and enhancements in dental education. Furthermore, the growing population suffering from tooth decay and dental caries is expected to increase the adoption of these devices for better examination.

KEY INDUSTRY PLAYERS

Companies with Strong Geographical Presence to Hold Crucial Share of the Market

The competitive landscape of the market reflects a consolidated structure, with a few market players holding a significant market share. PLANMECA OY, VATECH, Dentsply Sirona, and Carestream Dental LLC held a significant market share in 2024. Carestream Dental LLC is in a prominent position due to its strong geographical presence, advanced imaging technologies, and digital solutions, which includes the company’s PSP systems and large customer base across the globe. Furthermore, focus on research and development initiatives ensures the innovation of cutting-edge technologies and superior image quality, which are expected to strengthen its position in the global market.

Some other players engaged in the market include Trident, Acteon, and DIGIRAY.Corp and other small and medium-sized players. These organizations are engaged in technological innovations, improvements in the product quality, creation of extensive distribution networks, and strong customer support.

LIST OF TOP DENTAL INTRAORAL PHOTOSTIMULABLE PHOSPHOR SYSTEMS COMPANIES:

- Dentsply Sirona (U.S.)

- Carestream Dental LLC (Germany)

- VATECH (South Korea)

- PLANMECA OY (Finland)

- Acteon (U.K.)

- DIGIRAY.Corp (South Korea)

- Trident (Italy)

- NEWTOM (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Acteon, a manufacturer of phosphor systems, was acquired by private equity investors Buckthorn Partners and One Equity Partners (OEP) to improve its customer base.

- December 2021 – Carestream Dental LLC announced that it had entered into an agreement to sell its Scanning Technology business to Envista Holding Corporation. This move was aimed at allowing Carestream Dental to focus on its existing products, including photostimulable phosphor systems.

- June 2021 – Carestream Dental LLC partnered with SLOWDENTISTRY to promote the use of digital dental technology, including the photostimulable phosphor systems, and ensure these technologies are used to their fullest potential.

- April 2022 – ClearChoice Dental Implant Centers announced a collaboration with PLANMECA OY and Henry Schein, Inc. to enhance its digital imaging technology services, including photostimulable phosphor systems and have more than 75 centers.

REPORT COVERAGE

The research report provides a detailed competitive landscape and focuses on aspects such as key industry developments, mergers, partnerships, and acquisitions. Moreover, it provides analysis of different segments in various regions, profiles of key companies, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.53% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 69.63 million in 2025.

In 2025, North America’s market stood at USD 28.27 million.

The market is expected to exhibit a CAGR of 6.53% during the forecast period.

By type, the scanners segment led the market in 2025.

Key factors, such as the growing popularity of digital dentistry among dentists, rising prevalence of dental diseases, and increasing dental expenditures are key factors driving market growth.

PLANMECA OY, VATECH, Dentsply Sirona, and Carestream Dental LLC are the key players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us