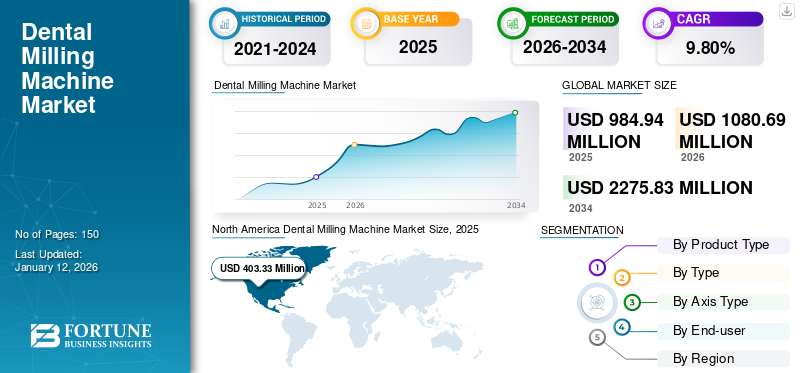

Dental Milling Machine Market Size, Share & Industry Analysis, By Product Type (In-office Milling Machine and In-lab Milling Machine), By Type (Wet Milling and Dry Milling), By Axis Type (5-Axis and 4-Axis), By End-user (Dental Laboratories, Dental Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global dental milling machine market size was valued at USD 984.94 million in 2025. The market is projected to grow from USD 1,080.69 million in 2026 to USD 2,275.83 million by 2034, exhibiting a CAGR of 9.80% during the forecast period. North American dominated the dental milling machine market with a market share of 40.90% in 2025.

Moreover, the U.S. dental machine milling market size is projected to grow significantly, reaching an estimated value of USD 533.0 million by 2032, driven by the adoption of digital dentistry, increasing dental procedures, and a growing geriatric population with a demand for dental care.

A dental milling machine is a precise tool that is used in modern dentistry for the crafting of dental prosthetics, such as crowns, bridges, and veneers. It employs Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) technologies to mill materials, such as ceramics, resins, or metals, into custom dental restorations with utmost accuracy. These machines offer dentists and dental technicians unparalleled control over the shape, size, and intricacy of prosthetics, ensuring a perfect fit and aesthetic appeal for patients. With their automated processes and high-speed operation, dental milling machines have revolutionized the production of dental prosthetics, enabling faster turnaround times and superior quality outcomes in oral healthcare.

The market is primarily driven by the increasing demand for precise and customizable dental prosthetics, including crowns, bridges, and veneers. Moreover, advancements in CAD/CAM technologies have revolutionized the manufacturing process, allowing for greater accuracy and efficiency in milling dental materials, such as resins, ceramics, and metals. Additionally, the aging population worldwide contributes to the market's growth, as older individuals often require more extensive dental work.

The COVID-19 pandemic significantly impacted the dental milling machine market as dental practices faced temporary closures and reduced patient visits due to safety concerns and lockdown measures. This led to a decline in demand for dental prosthetics and milling machines. However, after the pandemic, in 2021, the market recovered as the dental clinics resumed operations and the number of patient visits increased as patients sought to conduct their postponed treatments. Also, there was a decline in the market revenues in 2022, and 2023 as the global market returned to its pre-pandemic growth levels. Furthermore, the pandemic accelerated the adoption of digital dentistry technologies, including CAD/CAM systems, leading to increased investments in advanced milling machines.

Dental Milling Machine Market Overview & Key Metrics

Dental Milling Machine Market Size & Forecast:

- 2025 Market Size: USD 984.94 million

- 2026 Market Size: USD 1,080.69 million

- 2034 Forecast Market Size: USD 2,275.83 million

- CAGR: 9.80% from 2026–2034

Market Share:

- North America dominated the global dental milling machine market in 2025, accounting for USD 403.33 million, representing the largest regional share. This dominance is driven by the adoption of digital dentistry, increased dental procedures, and a rising geriatric population demanding restorative care. Within North America, the U.S. market is projected to reach USD 533.0 million by 2032, supported by a robust healthcare infrastructure and widespread adoption of CAD/CAM technologies.

- By product type, the in-lab milling machine segment held the largest market share in 2024, attributed to its ability to produce a wide range of prosthetics such as crowns, bridges, and implants with high precision. Laboratories also prefer these machines for their advanced features catering to complex dental requirements.

Key Country Highlights:

- Japan: Japan’s dental milling machine market is propelled by its aging population, strict regulatory focus on high-quality healthcare, and demand for precision in dental restorations. The adoption of 5-axis CAD/CAM milling machines in dental labs is a key contributor to market growth.

- United States: The Infrastructure Investment and Jobs Act indirectly supports oral healthcare infrastructure upgrades, while digital dentistry adoption has surged post-COVID. The presence of major players like Dentsply Sirona and Roland DG Corporation and a large elderly demographic have significantly boosted market demand.

- China: China's market growth is fueled by government-backed healthcare reforms, expansion of dental clinics, and increasing investment in digital dental equipment. The country’s focus on affordable prosthetic solutions through dry milling machines is also expanding adoption in both urban and semi-urban areas.

- Europe: Europe remains a significant market led by countries like Germany, the U.K., and France, driven by dental tourism, cosmetic dental treatments, and R&D initiatives. Supportive regulatory frameworks and increased awareness of oral aesthetics and hygiene contribute to steady market expansion.

Dental Milling Machine Market Trends

Adoption of In-Office Milling Machines to Provide Single-Day Dental Restoration Solutions

The adoption of in-office milling machines by dentists represents a significant market trend in the dental milling machine industry. This trend is driven by several factors that highlight the benefits and advantages of in-office milling technology. In-office milling machines offer dentists greater control and flexibility over the fabrication process. By having the milling equipment onsite, dentists can streamline the production workflow, reduce turnaround times, and ensure the timely delivery of custom restorations to patients. This enhances patient satisfaction and also improves practice efficiency.

Furthermore, in-office milling machines empower dentists to provide same-day restorations, eliminating the need for multiple appointments and temporary prosthetics. This saves both time and inconvenience for patients, leading to higher patient retention rates and a competitive edge for dental practices. Moreover, in-office milling technology enables dentists to maintain quality control throughout the fabrication process. Dentists can oversee the entire process, from digital scanning and design to milling and final restoration placement, ensuring precision and accuracy at every step. Such benefits of these machines have stimulated the focus of market players to develop and introduce novel machines to penetrate the dental clinic population.

Download Free sample to learn more about this report.

Dental Milling Machine Market Growth Factors

Adoption of CAD/CAM Technologies to Provide Better Dental Treatment Options to Drive Market Growth

The rising adoption of Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) machines in dentistry is expected to drive the global dental milling machine market growth. The CAD/CAM technology has transformed dental practices by enabling precise and efficient fabrications of dental restorations, such as crowns, bridges, and implants.

Patients are increasingly seeking personalized dental restorations that not only fit better but also mimic the natural aesthetics of their teeth. CAD/CAM technology allows dental professionals to create highly accurate digital impressions of patients' teeth and subsequently design and manufacture tailor-made restorations with unparalleled precision. Dental milling machines play a crucial role in fabricating dental restorations from various materials, such as ceramics, metals, and polymers, with exceptional accuracy and detail.

Moreover, these products streamline the entire dental fabrication process, reducing the time required for traditional methods significantly. This efficiency translates to improved patient experience, as they spend less time in the dental chair and require fewer appointments for restoration procedures. Such benefits associated with these machines are expected to drive the market during the forecast period.

Growing Geriatric Population to Boost Market Growth

The increasing aging population and growing awareness of dental health are significant drivers behind the market expansion.

- For instance, according to the published by the Australian Institute of Health and Welfare, on 30th June 2020, there were an estimated 4.2 million older population (aged 65 and over). The older people comprise 16.0% of the total Australian population.

The geriatric population is more likely to require dental restorations and prosthetics due to factors, such as tooth decay, wear, and loss. Additionally, older adults are increasingly seeking cosmetic dental procedures to maintain or enhance their oral health and appearance. The increasing geriatric population has stimulated the growing need for dental restorations, such as crowns, bridges, and implants, to address the oral health challenges associated with aging. This growing need can be fulfilled by the introduction of milling machines in the market.

Moreover, there has been a significant rise in dental health awareness among people of all age groups. With increased access to information and education about the importance of oral hygiene and preventive dental care, individuals are taking proactive steps to maintain their dental health by using dental restorations.

- For instance, in India, 6th March is celebrated as National Dentist's Day every year to raise awareness about the importance of oral health and hygiene.

As the need for dental restorations continues to grow, milling machines will play an important role in meeting the evolving needs of patients and dental professionals alike. In conclusion, the increasing aging population and dental health awareness are key factors driving market expansion.

RESTRAINING FACTORS

High Cost of Dental Machines Hinders Market Growth

The high cost of dental milling machines has been a significant barrier to their adoption in the market. These machines typically require a substantial initial investment, including the purchase of equipment, software, and ongoing maintenance expenses. In the cases of small dental practices or laboratories with limited financial resources, the upfront costs can be prohibitive, leading to a reluctance in terms of investing in these technologies.

- For instance, the DWX-52D Plus, 5-Axis Dental Milling Machine from Roland DGA Corporation costs around USD 26,995.0, and it also provides the machine for lease, which costs around USD 540.0 for 60 months.

Additionally, the Return on Investment (ROI) period for dental milling machines can be prolonged, further discouraging potential buyers. Dental professionals may hesitate to commit to such a significant financial outlay without a clear understanding of the long-term benefits and profitability of integrating this technology into their practice. Such high cost of these machines is hampering the global dental milling machine market growth.

Dental Milling Machine Market Segmentation Analysis

By Product Type Analysis

In-lab Milling Machine Segment Held the Largest Share owing to Various Benefits

Based on product type, the market is segmented into in-office milling machine and in-lab milling machine.

In 2026, the in-lab milling machine segment held the largest global dental milling machine market share of 90.25% due to its specialization in producing a wide range of prosthetics, including crowns, bridges, and implants. The machine caters to the specific needs of dental professionals and patients. Additionally, these labs offer advanced features and capabilities that cater to the complex demands of dental laboratories, which is expected to propel segmental growth.

The in-office machine segment holds a significant share of the global market. This significant share can be attributed to the growing demand for convenient and efficient dental solutions among patients, who increasingly prefer same-day restorations to minimize multiple visits to the dental office. Furthermore, market players are focusing on introducing these machines to cater to the demand from dental clinic facilities, thereby boosting segmental growth.

- For instance, in March 2023, Planmeca introduced a new chairside milling unit with dry and wet processing capabilities.

By Axis Type Analysis

5-Axis Segment to Dominate the Market Owing to Benefits Associated with the Axis

By axis type, the market is segmented into 5-axis and 4-axis.

In 2026, the 5-axis segment accounted for the largest market share of 92.15% and is projected to register the highest CAGR during the forecast period. These machines offer advanced multi-axis machining capabilities, allowing for the simultaneous milling of intricate geometries from various angles. As a result, 5-axis milling machines can produce highly accurate and detailed dental restorations with exceptional surface finish and fit.

Moreover, the growing demand for customized dental solutions has fueled the introduction of 5-axis milling machines, as they enable dental laboratories and practices to fabricate a wide range of prosthetics.

- For instance, in February 2023, vhf camfacture AG launched an innovative 5-axis dry milling machine E5 digital dental technology, showcasing it at the AEEDC event in Dubai.

The 4-axis segment held a substantial share of the market. The segment’s growth is led by precision engineering, versatility in the handling of various materials, advanced software integration for intricate designs, and efficient production capabilities.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Dry Milling Segment to Hold a Major Share Owing to High Demand for Prosthetic Solutions

By type, the market is segmented into wet milling and dry milling.

In 2026, the dry milling segment dominated the market share of 69.00% and is anticipated to register a substantial CAGR during the forecast period. The primary factor contributing to its dominance is its compatibility with a wide range of dental materials, including ceramics, resins, and certain metals. Dental laboratories and practices prefer dry milling machines for their ability to produce high-quality restorations with excellent surface finish and marginal accuracy. Furthermore, the increase in the introduction of new devices in the market by key players is also contributing to the segmental growth.

- For instance, in September 2022, Roland DGA's DGShape Americas business group introduced the DWX-53DC dry dental mill, a part of the company's DWX Series milling solutions.

The wet milling segment is projected to grow at the highest CAGR during the forecast period. The growth is attributed to the advancements in wet milling technology that have led to the development of more efficient and user-friendly machines with improved speed and precision. Furthermore, the growing cases of implant procedures are expected to increase the adoption of these products.

By End-user Analysis

Dental Laboratories Segment to Hold a Major Share Due to Increasing Demand for Dental Restorative Products

As per end-user, the market is segmented into dental laboratories, dental clinics, and others.

In 2026, the dental laboratories segment held the largest market share of 65.01% and is anticipated to grow at a substantial CAGR during the forecast timeframe, 2025-2032. The segmental growth is attributed to the high demand for a large number of prosthetics by dentists, which these facilities can easily fulfill compared to others. Additionally, the growing number of dental technicians across the globe is further propelling segmental growth.

- For instance, according to the U.S. BUREAU OF LABOR STATISTICS, the U.S. has observed an increase in the number of laboratory technicians in the dental industry. In May 2023, the number of technicians was 34,190, which increased from May 2022, which was 34,150.

Furthermore, the advantages associated with these facilities, such as providing reliable services along with delivering superior quality restorations, have solidified dental laboratories' position as the leading segment in the market.

The dental clinics segment is projected to grow at the highest CAGR during the forecast period. The growth is attributed to the increasing adoption of digital dentistry practices within clinics, driven by advancements in technology, rising patient awareness, and the demand for same-day dental restoration services. Furthermore, the increase in the adoption of in-office milling machines is also expected to boost segmental growth during the forecast period.

The others segment, which includes dental hospitals and milling centers, held a moderate share and is expected to grow at a significant CAGR during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Milling Machine Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a revenue of USD 403.33 million in 2025 and is expected to continue its dominance during the forecast timeframe. The region’s major share is credited to the adoption of digital dentistry, increasing dental procedures, and a growing geriatric population with a demand for dental care. The U.S. market is projected to reach USD 416.9 billion by 2026.

- For instance, according to the CDC, in the U.S., periodontal disease increases with age; 70.1% of adults 65 years and older have periodontal disease. Such a large patient population with the disease is expected to increase the demand for dental care, propelling the demand for these machines in the country.

Moreover, the robust infrastructure supporting dental healthcare and the strong presence of key market players contribute to its dominance.

Europe

Europe held the second-highest market share in 2025. The growth is attributed to the high prevalence of dental caries and an aging population driving the demand for dental milling products and services. Moreover, the presence of key market players and robust research and development initiatives has further stimulated market growth in the region. The UK market is projected to reach USD 46.7 billion by 2026, while the Germany market is projected to reach USD 95 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR over the projected period driven by the expanding dental tourism for dental restoration solutions by CAD/CAM technology. Moreover, the rising demand for advanced dental restorations, technological advancements in CAD/CAM systems, growing prevalence of dental disorders, and increasing adoption of digital dentistry further contribute to the region's substantial market share in dental milling. The Japan market is projected to reach USD 51.2 billion by 2026, the China market is projected to reach USD 59.9 billion by 2026, and the India market is projected to reach USD 10.9 billion by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America are expected to grow at a significant CAGR during the forecast period. The growth is due to rising dental expenditure, and the increasing adoption of milling units to contribute to the market's growth. Moreover, the growing demand for digital dentistry further drives demand for dental milling products and services in these regions.

List of Key Companies in Dental Milling Machine Market

Companies with 5-Axis and In-Laboratory Machines in their Product Portfolios to Hold Key Market Share

The market is consolidated with the presence of a few players with significant shares. Amann Girrbach AG, Roland DG Corporation, and vhf camfacture AG held a significant market share in 2024. Roland DG Corporation holds a prominent position in the market due to its strong geographical presence, diversified presence of cad cam dental milling machines, and large global customer base. Additionally, its focus on new product launches is expected to further strengthen its position in the global market. Furthermore, its budget-friendly milling machine is expected to strengthen its presence in emerging countries during the forecast period.

Other key players in this market include 3M, ARUM DENTISTRY Co., Ltd, along with several small and medium-sized companies. These competitors engage in strategic activities, such as consistently introducing advanced solutions to meet the changing needs of practitioners and patients, thereby maintaining their prominence in the industry.

LIST OF KEY COMPANIES PROFILED:

- Ivoclar Vivadent (Liechtenstein)

- Dentsply Sirona (U.S.)

- vhf camfacture AG (Germany)

- Kelkar Dynamics LLP (India)

- Roland DG Corporation (Japan)

- 3M (U.S.)

- Amann Girrbach AG (Germany)

- ARUM DENTISTRY Co., Ltd. (South Korea)

- YENADENT (Turkey)

- UP3D Tech (China)

- imes-icore (Germany)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – UP3D Tech, a digital dentistry company, launched its latest innovation, the P55D high-end dry milling machine, with the aim of making dry milling more efficient.

- November 2023 – Ardian announced plans to sell its stake in the imes-icore Holding GmbH to EMZ Partners, a leading European investment firm. imes-icore currently offers the world's most comprehensive portfolio of milling and grinding machines for the automated production of dental prosthetics.

- December 2022 – Planmeca announced a new in-lab milling unit, PlanMill 60 S, in its portfolio of CAD/CAM technology.

- December 2022 – DOF Inc. introduced the Craft 5x-milling machine in the dental industry, which is designed to provide a one-step milling solution for the dentists.

- October 2021 – ARUM DENTISTRY Co., Ltd. recently enhanced its ARUM 5X-500L milling machine by incorporating intelligent interface features. These advancements facilitate automatic material replacement, particularly designed for processing metals.

REPORT COVERAGE

The market research report provides a detailed competitive landscape. It focuses on key aspects such as key industry developments such as mergers, partnerships, and acquisitions. Furthermore, the reports provide an exhaustive product mapping of key companies. The report also includes insights related to the product launches in the market. Moreover, it provides an analysis of different segments in various regions, profiles of key companies, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.80% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By Axis Type

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1,080.69 million in 2026 and is projected to reach USD 2,275.83 million by 2034.

In 2025, the North American market stood at USD 403.33 million.

The market is expected to exhibit a CAGR of 9.80% during the forecast period.

The dry milling segment is set to lead the market.

Increasing adoption of CAD/CAM equipment, such as milling machines, and growing demand for customized dental restorative solutions are the key factors driving market growth.

Amann Girrbach AG, Roland DG Corporation, and vhf camfacture AG are the top players in the market.

North American dominated the dental milling machine market with a market share of 40.90% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us